Taglich Brothers

advertisement

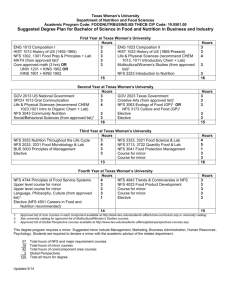

Research Report – Update Investors should consider this report as only a single factor in making their investment decision. NetSol Technologies, Inc. Rating: Speculative Buy Howard Halpern February 22, 2016 NTWK $6.54 — (NasdaqCM) Fiscal year net sales (in millions) Earnings per share 52-Week range Shares outstanding a/o 11/10/15 Approximate float Market Capitalization Tangible Book value/shr Price/Book 2013 A $49.8 $1.16 2014 A $36.4 ($1.38) $9.50 – $4.20 10.5 million 9.1 million $68 million $2.81 2.2X 2015 A $51.0 ($0.57) Fiscal year ends: Revenue/shares (ttm) Price/Sales (ttm) Price/Sales (2017) E Price/Earnings (ttm) Price/Earnings (2017) E 2016 E $62.5 $0.23 2017 E $72.5 $0.68 June $5.66 1.2X 1.0X NMF 9.6X NetSol Technologies, Inc., headquartered in Calabasas, CA, is a global provider of information technology and enterprise application solutions geared to credit and finance portfolio management systems. Key Investment Considerations: Maintaining Speculative Buy rating and increasing our 12-month price target to $10.20 per share from $7.75 due primarily to a sharp increase in our FY17 earnings forecast. With an estimated 8,300 potential customers, growth potential for the company’s 2nd generation platform NFS Ascent is substantial. Globally, the company has captured less than 1% of total potential customers (180+). We estimate 3% of the potential auto-finance customers in Asia are NetSol customers. In December 2015 NTWK announced it signed a contract valued in excess of $100 million in revenue with an existing customer to upgrade its current NFS platform to the Ascent platform in Australia, China, Hong Kong, India, Japan, New Zealand, Singapore, South Korea, Taiwan, Thailand, and Malaysia, and South Africa, a new market for NetSol. Under the contract, the customer will upgrade to the NFS Ascent platform from its NFS legacy system over five years with maintenance and support revenue during the following five years. Sales in 2Q16 (reported on 2/11/16) accelerated 31.1% to $16.2 million due to a 76.4% increase in service fees, partly offset by a 66.2% reduction in license fees. We projected sales of $13.5 million and a loss of ($0.01) per share. Net income for 2Q16 was $0.08 per share from a year-earlier loss of ($0.14). We increased our FY16 projection by $0.27 per share to a profit of $0.23 on 22.3% sales growth to $62.5 million (prior was $59.2 million). Our forecast reflects 1H16 results (service revenue growth 66.3% and gross margin of 45.6%). We project gross margin expansion to 47.6% from 35.3% stemming from increased service revenue without the need to hire additional personnel. We increased our FY17 net income projection to $7.2 million or $0.68 per share (previous was $2.1 million or $0.20 on sales of $68.7 million) on sales growth of 16.1% to $72.5 million. Our net income projection reflects gross margin expansion to 50.5% from 47.6% in FY16 due to support service revenue growth of 12.9% and license revenue nearly doubling to $7.6 million with no new hiring required. Please view our Disclosures pages 15 - 17 790 New York Ave, Huntington, New York, N.Y. 11743 (800) 383-8464 • Fax (631) 757-1333 NetSol Technologies, Inc. Appreciation Potential Maintaining Speculative Buy rating based on long-term growth potential of the NFS Ascent platform. In October 2013 NFS Ascent was launched (a $16 million customer contract was signed in 1Q15 and a $100 million customer contract was signed in 2Q16), offering clients multiple deployment and procurement options. Customers can opt for the traditional on-site implementation or as a software-as-a-service deployment. NFS Ascent is designed for the global financing, leasing, and lending industries, especially for the North and South American markets. We are increasing our 12-month price target to $10.20 per share from $7.75. Our price target implies yearahead stock price appreciation potential in excess of 50%. We have updated our valuation metric to a price-toearnings multiple (prior was price-to-sales multiple) due to a December 2015 contract that should enable the company to generate significant profits in FY17 and beyond. FY13 was the last time the company generated significant profits. In April 2013 the company’s share price was $14.01 with a price-to-earnings multiple of 14.7X on an EPS estimate of $0.95 per share. NTWK is trading at 9.8X our FY17 earnings per share forecast compared to a price-to-earnings multiple of 17X for its peer group (prior was 16.8X). With a return to significant profitability in FY17, we applied a price-to-earnings multiple of 15X (slightly above the multiple high in FY13) to our FY17 EPS forecast of $0.68 per share, to obtain a year-ahead value of $10.20 per share. Source: Taglich Brothers estimates, Yahoo Finance, and Thompson One The downside risk to NTWK’s current valuation should be limited due to existing customers embracing its NFS Ascent platform in the second year after its launch. We anticipate the valuation gap with the company peers could narrow due to the profits NTWK should generate in year four of NFS Ascent’s lifecycle compared its processor product NFS legacy, which did not generate significant profits until year eight. The peak year for NFS legacy was in FY13, which yielded a price-to-earnings multiple of 14.7X compared to a peer group multiple of 15.5X. We forecast annual revenue growth in FY16 and FY17 reflecting customer acceptance of its NFS Ascent offering resulting in improved expense leverage and profitability in FY16 of $3 million, which we forecast growing to $8 million in FY17. Our growth forecast should be supported by increased work on the $100 million contract signed in 2Q16. Due to risks associated with global economic uncertainty and implementation of a new software platform (NFS Ascent) that disrupted FY14 sales growth, we believe NetSol shares are suitable primarily for risk tolerant investors seeking exposure to a potentially high growth microcap company. Overview NetSol Technologies, Inc., founded in 1997, is headquartered in Calabasas, CA. The company operates nine owned and five minority-owned subsidiaries. The company’s information and enterprise technology customers include organizations in the financial, leasing, insurance, energy, and technology industries. Taglich Brothers, Inc. 2 NetSol Technologies, Inc. NetSol’s clients include auto manufacturers such as Daimler, Toyota, and Nissan through their financing arms, and regional banks primarily in Asia. The company also provides offshore development and testing services to Innovation Group Plc and their insurance client such as Allstate and Cendent. Regional offices are located in San Francisco and corporate headquarters in Calabasas, California for North America, London for Europe, and Bangkok, Thailand and Lahore, Pakistan for Asia Pacific. Additional locations include Australia, China, and Japan. Growth Platforms NFS Ascent. In October 2013, NetSol Technologies launched the platform with Nissan Leasing Thailand. This reference customer has been completely operational for nearly two years in five of the seven markets Nissan Leasing has finance operations. For Toyota Thailand the implementation of NFS Ascent was completed in 1Q15. In August 2014 the company announced a $16 million agreement to implement the NFS Ascent platform for a finance group in Asia. The implementation will automate all finance front and back office operations, while managing a portfolio of nearly two million contracts, serving more than 5,000 concurrent users. In April 2015 the first phase of the implementation commenced with completion expected within 12 to 18 months. In December 2015 NTWK announced it signed a five-year contract valued in excess of $100 million in revenue with an existing customer to upgrade its current NFS platform to the Ascent platform in Australia, China, Hong Kong, India, Japan, New Zealand, Singapore, South Korea, Taiwan, Thailand, and Malaysia, as well as an installation in South Africa, a new market for NetSol. Maintenance and support revenue will be over a five-year period, after the five-years needed to complete the deployments across twelve countries. The implementation (starting in 3Q16) encompasses the full end-to-end finance and leasing lifecycle, covering NFS Ascent’s loan origination system, contract management system, wholesale financing system, and its dealer/auditor access system. Each country will decide on how much of the platform will be deployed. Once complete, the system will provide a single regional platform that improves business visibility and assists with strategic planning. While the implementation process is underway, the company will be marketing NFS Ascent platform to existing legacy NFS platform customers and new multi-million/billion dollar customers in North America, South America, Europe, and Asia. NFS Mobility. The company has developed the first of many new mobile technology applications for use by its NFS customers. The first application for the IOS platform commenced with Mercedes Benz Finance China focusing on iPads at the initial point of sales. Mercedes Benz Finance China will have their dealerships use this application on the origination portion of the lending lifecycle. Netsol plans to provide Android and Microsoft platforms to existing and new customers. Additional mobile applications under development include account–enabling customers to view their credit/lease contracts, field investigator–enabling teams to perform application details and verification on the go, and collections-designed to seemly interface with the existing NFS and NFS Ascent customers. The company is seeing strong demand for this offering from its existing customers once they upgrade to NFS Ascent. The December 2015 $100 million contract includes mobility accounts (mAccounts) to give customers visibility into their autofinancing contract. Technology campus. The company added two floors and over 250 new technology employees at its campus in Lahore, Pakistan in order to leverage future NFS Ascent platform licensing implementations anticipated through FY2016. The $10 million investment added 90,000 square-feet to its Lahore technology campus in FY14. At September 30, 2015 the company had 1,550 employees worldwide. Projections Basis of Forecast Revenue recognition for NFS Ascent customers will differ from the company’s legacy NFS product. NetSol will recognize license fees over the product’s implementation period rather than at contract signing. For NFS Ascent we estimate license fees will account for approximately 20% of a deal excluding maintenance fees. Our NFS Ascent Taglich Brothers, Inc. 3 NetSol Technologies, Inc. forecasting model is best illustrated using the August 2014 contract signing that is approximately 70% complete. The contribution to license fees from this customer was $900,000 in FY15. In FY16 we estimate approximately $500,000 in license fees will be recognized, as well as at least $3.1 million in service fees. After the implementation the company will record annual maintenance fees during the following four years. We estimate the December 2015 $100 million contract will add at least $7 million to annual service revenue, and that licensing fees will be recorded as the twelve countries deploy the NFS Ascent platform over a five-year period. Maintenance and service support fees should be earned in the five years after deployment is completed. The new NFS Ascent software platform had disrupted some of the company’s legacy NFS platform sales. Since new and existing customers have had over a year to vet the capabilities of the new NFS Ascent platform, choices by customers are being made as to which platform best suits their needs. In the prior two fiscal years ended June 30, 2015 the company hired and trained 420 additional employees to support implementations of NFS Ascent in FY16 and beyond. Since additional hiring is unlikely the company’s gross margin should expand as labor costs are leveraged. Projected sales consist of fees from licensing, maintenance, and services. We forecast services and maintenance revenue (software consulting and implementation services) contributing over 85%+ due to expanding use of the NFS platforms and revenue recognition changes. A longer sales and implementation cycle could result in uneven quarterly licensing sales and gross margins. In FY16 we project license fees will decrease by $2.4 million to $3.9 million due to diminished legacy NFS product sales (small NFS Ascent contracts and at least a dozen NFS legacy contracts), and waning recognition from the August 2014 $16 million contract, partly offset in 4Q16 as license fees start to be recognized from the December 2015 NFS Ascent contract. In 2Q15 NetSol signed two agreements in Europe, one with a US auto captive finance company and the other with a large UK asset finance company. In 2Q16 an existing customer signed a contract valued in excess of $100 million with a majority of the service and license revenue to be recognized over five years (in 12 countries) with maintenance revenue to be recognized over a five year period after the installation is complete. The table on the right tracks the rebound in service revenue due to the 1Q15 and 2Q16 NFS Ascent contracts. We project maintenance fees will increase, reflecting the implementation of contracts signed in prior years (see table above). We anticipate FY16 and FY17 gross and operating margins of 47.6% and 9.6%, and 50.5% and 14.6%, respectively. The FY14 transition led to diminished results, but FY15 results rebounded due to higher services and maintenance fees. As NFS Ascent gains customer acceptance and implementations occur, gross margins should improve. The table at right provides transparency to our overall gross margin forecast by estimates for each of the three primary revenue sources. We project gross margin for services above 50% due to quarterly revenue exceeding $10 million without the need to hire additional professionals. Our projections do not include any future potential foreign currency exchange gains or losses. Economic Forecasts We believe that economic growth in the US and in Asia-Pacific countries provide an environment that is conducive to the company’s current NFS legacy customers to upgrade their systems to NTWK’s new NFS Ascent platform. In 2015 real GDP growth was 2.4%, unchanged from 2014. While economic forecasts vary it is likely 2016 US GDP will exceed 2% but remain below 2.5%. Steady economic growth in the US could Taglich Brothers, Inc. 4 NetSol Technologies, Inc. In its December 2015 (latest) outlook report, the Asian Development Bank (ADB) projects 2016 GDP growth rates for Asian countries (see chart right). Growth rates were primarily unchanged from its September 2015 outlook. In January 2016, the International Monetary Fund decreased its 2016 and 2017 US GDP forecasts by 0.2% each, to 2.6% for both periods, from its October 2015 forecast. The IMF decreased its US forecasts due primarily to the tightening of monetary policy. In January 2016, the International Monetary Fund reduced by 0.2% its 2016 and 2017 global GDP forecasts to 3.4% and 3.6%, respectively. Operations In FY16 we project 22.9% sales growth to $62.5 million (prior forecast was $59.2 million). Our sales forecast reflects the $16 million NFS Ascent contract signed in 1Q15, the NFS Ascent contract signed in December 2015 ($100 million in revenue), and smaller customers purchasing at least a dozen NFS legacy systems. We project service revenue to grow by 41.4% to $45.4 million, and an increase in maintenance revenue by 4.4% to $13.1 million, gains that will be offset in part by a 38.6% decrease in license fees to $3.9 million. We project a 64.8% increase in gross profit to $29.7 million, driven by gross margin improvement to 47.6% from 35.3% in FY15. Gross margin gains reflect a 41.4% increase in service fees (see first two charts on page 4). With projected revenue growth of 22.3% and gross margin improvement, we anticipate an operating profit of $6 million, up from an operating loss of $5.2 million, as operating expense margin improves to 37.9% from 45.4% in FY15. We anticipate operating expense to increase 2.1% to $23.7 million due to marketing and selling expenses increasing by 28.2% to $7.8 million. The increase will be partly offset by 3.6% decrease in G&A expense to $14.3 million, which reflects a reduction in legal and professional services, partly offset by salary increases from the 400 technology employees hired in FY14/FY15. We project an operating margin improvement to 9.6% from (10.1%) in FY15, due to sales growth, expanded gross margin, partly restrained by an increase in operating expenses. We project non-operating expense of $235,000 from income of $330,000. The swing from income to an expense is due to higher interest expense, lower interest income and a reduction in other income. In FY16 we project net income of $2.4 million or $0.23 per share (prior was $376,000 or ($0.04) per share), after deducting income tax expense of $868,000 and non-controlling interest reduction of $2.5 million. In FY17 we project 16.3% sales growth to $72.5 million (prior was $68.7 million) due primarily to service and license revenue from the $100 million December 2015 contract signed by a customer to upgrade to the NFS Ascent platform in 12 Asia-Pacific countries. We anticipate least a dozen smaller legacy NFS contracts and NFS Mobility deals, as well as increased service revenue for customization projects from existing customer and additional upgrades from existing customer to the NFS Ascent platform. We project maintenance fees increasing at 4.2% to $13.7 million and service fee growth of 12.9% to $51.3 million. We project license fees increasing by 94.6% to $7.6 million. We project a 31.3% increase in gross profit to $36.6 million, driven by gross margin improvement to 50.5% from our FY16 forecast of 47.5% reflecting a 94.6% increase in license fees, as well as a 12.9% increase in service revenue (see second chart on page 4). We anticipate operating income increasing 75.6% to $10.6 million driven by operating expense margin improving to 35.9% from 37.9% due to leveraging of expenses. We anticipate operating expense to increase 10% to $26.1 million. We project increases in G&A and marketing and selling expenses of 8.7% and 13.6%, respectively. We project an operating margin improvement to 14.6% from 9.6% in FY16, due to sales growth and expanded gross margin, partly offset by an increase in operating expenses. We project non-operating expense of $170,000 compared to our FY16 projection of $235,000. Taglich Brothers, Inc. 5 NetSol Technologies, Inc. With the company’s largest contract signed in 2Q16 and implementation commencing in 4Q16, we increased our FY17 income projection to $7.2 million or $0.68 per share from our prior forecast of $2.1 million or $0.20 per share, after deducting income tax expense of $1.6 million and a non-controlling interest reduction of $1.6 million. Finances For FY16, we project cash earnings of $13.1 million and an increase in working capital of $5.1 million due to increases in receivables and decreases in accruals and payables, partly offset by an increase in deferred revenue. Cash from operations of $8 million will not cover capital expenditures, capital lease payments, and repayment of debt, reducing cash by $164,000 to $14 million at June 30, 2016. For FY17, we project cash earnings of $17.8 million and an increase in working capital of $3.8 million due to increases in receivables and decreases in accruals and payables, partly offset by an increase in deferred revenue. Cash from operations of $14 million should cover capital expenditures, capital lease payments, and repayment of debt, increasing cash by $8.6 million to $22.8 million at June 30, 2017. 2Q16 and 1H16 Results Sales in 2Q16 increased 31.1% to $16.2 million due primarily to higher service fees, which increased 76.4% to $12.2 million, partly offset by 66.2% decrease in license fees. Services and services from related parties increased $5.3 million to $12.2 million due to new customer implementations of legacy NFS and NFS Ascent systems, as well as customization and enhancement service requests for existing customers. Maintenance fees decreased by $57,360 to $3.3 million due to exchange rate differences, partly offset by the start of new maintenance agreements from customers who activated NFS legacy products at the end of FY15 and 1H16. Partly offsetting the increase in total sales was a 66.2% decrease in license fees to $710,000. The decrease in license fees was due to recognition (percentage of completion accounting method) of a certain portion of license revenue from the NFS Ascent project signed in FY15during the last fiscal year. License revenue also included the implementation of the company’s legacy product at a customer site in China. Cost of sales increased 11% to $8.2 million due to higher salaries and wages, travel, and other. The increase in cost of sales was partly offset by an 18.8% decrease in depreciation and amortization to $1.5 million reflecting products becoming fully amortized. The increase in cost of sales was due primarily to hiring and training of technical employees at key locations including Pakistan, Thailand, China, Europe and North America in anticipation of new projects associated with NFS Ascent. Gross profit increased 60.5% to $8 million due to gross margin improvement to 49.6% from 40.5% in the year-earlier period. In 2Q16, operating expenses decreased $61,943 to $5.9 million as lower general and administrative costs and depreciation and amortization expenses, were partly offset by higher selling, marketing, and research and development expenses. Lower general and administrative costs reflect reductions in legal and professional services. The increase in selling and marketing expenses was due to hiring additional employees and increasing marketing efforts for the company’s NFS Ascent platform. The company earned an operating profit of $2.1 million, up from a loss of $1 million in the year-ago period as net operating expense margin decreasing to 36.7% from 48.6% due to better alignment of expenses with sales. Operating margin improved to 12.9% from (8.1%). Non-operating expense was $53,033 compared to an expense of $413,650. The improvement from the year-ago period was due primarily to foreign currency exchange losses of $134,527 in 2Q16 from losses of $421,082 in 2Q15the year-ago period. Net income attributable to NetSol in 2Q16 was $875,065 or $0.08 per share, compared to a loss of $1.4 million or ($0.14) per share. In 2Q16 income was reduced by minority interest in earnings of $883,396 compared to a reduction of $138,764 in 2Q15. We projected a loss of $145,000 or ($0.01) per share on sales of $13.5 million. Taglich Brothers, Inc. 6 NetSol Technologies, Inc. Sales in the 1H16 increased 30.6% to $29.5 million due primarily to higher service and maintenance revenue, partly offset by lower licensing fees. Services and services from related parties increased 66.3% to $21.2 million due to new customer implementations of legacy NFS and NFS Ascent systems, as well as customization and enhancement service requests for existing customers. Maintenance fees increased 4.2% to $6.4 million due to the start of new maintenance agreements from customers going live with the company’s NFS legacy product, as well as its NFS Ascent platform during the latter stages of FY15 and 1H16, partly diminished by foreign exchange differences. Licensing fees decreased 48.4% to $1.9 million due to recognition (percentage of completion accounting method) of a certain portion of license revenue from the NFS Ascent project signed in FY15during the last fiscal year. License revenue also included the implementation of the company’s legacy product at a customer site in China, compared to two in the year-ago period. Cost of sales increased 11.8% to $16.1 million due to higher salaries and wages, travel, and other, due primarily to salary increases in 2015. The increase in cost of sales was partly offset by an 18.5% decrease in depreciation and amortization to $2.9 million reflecting products becoming fully amortized. Gross profit increased 63.6% to $13.5 million due to higher sales and gross margin improving to 45.6% vs. 36.4% in the year-ago period. 1H16 was positively impacted by 49.6% gross margin in 2Q16 compared to 40.5% in 2Q15. In the 1H16, operating expenses decreased by $49,404 to $11.4 million due primarily to lower general and administrative costs and depreciation and amortization expenses that were partly offset by higher selling, marketing, and research and development expenses. Operating expense margin decreased to 38.7% from 50.8% due to the company’s ability to leverage expenses as the NFS Ascent platform gains customer acceptance. The company generated an operating profit of $2 million compared to an operating loss of $3.2 million in the year-ago period. Non-operating expense decreased to $140,372 from $360,280 due primarily to foreign currency exchange losses narrowing to $248,246 from $341,860, as well as other income of $174,998 from $18,539 in the year-ago period. 1H16 net income was $464,037 or $0.04 per share compared to a net loss of $3.2 million or ($0.34) per share. In the 1H16 the loss was reduced by minority interest in earnings of $1.1 million compared to an increase of $529,961 in the 1H15. Finances In the 1H16 cash earnings of $5.6 million were offset by a $3.5 million increase in working capital stemming from increases in receivables and other assets, partly offset by a reduction in deferred revenue. Cash from operations of $2 million did not cover capital expenditures and repayment of debt, reducing cash by $182,000 to $14 million at December 31, 2015. In the 2Q16 cash earnings of $3.9 million was enhanced by a $1.3 million decrease in working capital due to a decrease in receivables and increases in payables and accruals. Cash from operations of $5.2 million covered exchange rate loss, capital expenditures and repayment of debt increasing cash by $3.9 million to $14 million at December 31, 2015. Taglich Brothers, Inc. 7 NetSol Technologies, Inc. Capital Structure The company has total outstanding debt of $3.3 million all of which is short-term. As of December 31, 2015, the company was in compliance with all loan covenants. In October 2011, the company’s NTE subsidiary obtained a loan from HSBC Bank to finance the acquisition of a 51% interest in Virtual Leasing Services Limited. HSBC Bank guaranteed availability of up to $1.6 million for five years at an interest rate of 4%. At December 31, 2015, the subsidiary had $264,135 outstanding in borrowings under the loan. The company has an overdraft facility with HSBC Bank, which was zero at December 31, 2015. A subsidiary (NetSol PK) entered into two different term finance facilities from Askari Bank to finance the construction of a new building. The aggregate amount was $1.1 million that is secured by land, building and equipment. The subsidiary also had a revolving export refinance facility with Askari Bank Limited for $2.9 million at an interest rate of 4.5% at December 31, 2015. Lease Financing Leasing companies buys assets chosen by a lessee, who has the option to own the assets in the future. US Metrics The Equipment Leasing and Finance Association's monthly leasing and finance index showed overall new business volume for December 2015 increased 105% to $12.5 billion from $6.5 million in November 2015. The association reported its confidence index for January 2016 at 54, down from 60.2 in December 2015. The association continues to observe cautious optimism even with turbulent world markets and declining commodity prices, which has made companies carefully consider investment in large-scale expansion projects. They also observed that the equipment finance industry's willingness to lend and continued low interest rate environment could sway companies that are expanding more likely to consider debt or lease financing, as opposed to using cash for their capital acquisitions. Asia-Pacific Growth Financial leasing growth in Asia-Pacific region is due to the evolution of the Chinese financial system. In 2014 financial leasing industry growth accelerated due to a change in rules and regulations made by China’s three regulatory authorities. Government statistics from China stated that the balance of financing leasing contracts increased in 2014 (latest available) by 52.4% to RMB3.2 trillion from RMB2.1 trillion in 2013, up by 52.4 percent. In 2014 financial leasing contracts grew 51.2% to RMB1.3 trillion with domestic capital leasing contracts up by 44.9% to RMB1 trillion. In September 2015, the Chinese government initiated a series of policy incentives in order to shore up the country’s financial leasing business with the goal being to better serve the broader economy and increase competitiveness overseas. The government will encourage leasing firms to explore new industries, including waste water and sewage treatment, telecommunications, agricultural infrastructure and green vehicles, as well as speed up innovation by coordinating with internet companies, banks, insurance, funds and other financial firms, so as to differentiate their services and improve risk control. Financial leasing growth in China is lending support for NTWK’s enterprise financial platform, as financial companies are seeking to make the lending and leasing process more productive, reduce costs, and improve audit trail capabilities. Chinese Leasing Metrics In October 2015 (latest available), the China Leasing Alliance and Tianjing Binhai Financial Leasing Research Institute reported that China’s financial leasing industry maintained accelerated growth in 3Q15 to RMB 4 trillion leasing contracts from RMB780 billion at January 1, 2015. Also, the number of domestic enterprises increased by 1,540 to 3,742 in 3Q15 and total registered capital grew RMB 555.6 billion to RMB 1.2167 trillion. Taglich Brothers, Inc. 8 NetSol Technologies, Inc. Information Technology Market In January 2016 (latest available), consulting firm Gartner found that worldwide 2015 enterprise software spending was $310 billion or a 1.4% decrease from 2014. For 2016, Gartner forecasts 5.3% growth to $326 billion as the worsening economic environment in emerging markets should have no effect on the global enterprise softwarespending forecast. Competition The information technology market is very diversified with many companies having overlapping services that compete with NetSol. Smaller companies such as NetSol face competition from larger organizations such as computer manufacturers and consulting firms that have greater financial resources, as well as the capacity to perform enterprise implementation services. The company’s financial-based product offering competes with private companies Fimasys, International Decision Systems, Data Scan, CHP Consulting, and two overseas public companies 3i Infotech and Nucleus Software. Competition in consulting-based business services is from publicly traded companies such as Wipro Ltd, InfoSys Ltd, and Satyam Infoway, and privately held Tata Consulting. Many of the company’s competitors have significant operations in high cost locations such as the US, UK and Europe, but others are based in India: Wipro, Tata Consulting, InfoSys, and Satyam Infoway. Revenue Sources NetSol Financial Suite (NFS), NTWK’s primary revenue center, targets the global financing, leasing and lending industry, portfolio management services, including customized development, integration, and SAP consulting and services, and business process engineering. The next generation platform NFS Ascent was released in October 2013. NetSol Financial Suite (NFS) NFS is a modular contract management system for asset finance companies. When implemented, the system fully automates a customer’s entire leasing and financing cycle, and interfaces with external legacy systems. The platform consists of seven primary modules. NetSol Financial Suite Ascent (NFS Ascent) NFS Ascent advances the NFS platform, allowing captive-auto lease/financing companies and asset lease/finance companies to rapidly transform legacy dependent information technology into a state-of-the-art information technology and business process environment. The platform’s core are lease accounting and contract processing engine, enabling customers an array of interest calculation methods, and accounting for multi-billion dollar lease portfolios under various types of generally accepted accounting principles, and international financial reporting standards. Deployments can either be distributed or clustered across parallel application using high volume servers. NFS Mobility The first mobility solution is focused on an IOS platform. The first project is underway with Mercedes Benz Finance China focusing on iPads. The initial application permits the customer to use the point of sale functionality focusing currently on the origination portion of the lending lifecycle by enabling sales users at the dealerships. Consulting and Implementation Services Consulting, development and integration services include business intelligence, independent system review, information security, outsourced services, process improvement consulting, project management, and maintenance and support of existing systems. Risks In our view, these are the principal risks underlying the stock: Taglich Brothers, Inc. 9 NetSol Technologies, Inc. Economy Slowing global economic growth could reduce customer demand and confidence in technology investments. Foreign Exchange In FY15, 87.4% of the company’s sales were from Europe/Asia. Currency fluctuations in the 1H16 cost the company $248,246 compared to a cost of $341,862 in the year-earlier period. Adverse currency fluctuations could result in losses. Interest rates US interest rates remain low but are forecast to increase before the end of 2015 due to economic growth. In Pakistan interest rates are forecast to increase from 7% to 7.5% in 2016. Any rise in interest rates will increase the cost to borrow capital thus increasing losses or reducing profits. Legal In July 2014, a Federal securities class action lawsuit entitled Rand-Heart of New York, Inc. v. NetSol Technologies, Inc., Najeeb Ghauri, Naeem Ghauri, and Salim Ghauri was filed in Central District of California for damages of $1 million. After several successful motions by the NTWK, the court granted the plaintiff a final opportunity to amend the complaint on a narrowed basis, which contained a much narrowed class period from October 2013 to November 8, 2013, eliminated all but one of the individual defendants from the suit, and limited the scope of the alleged claims. The company has filed an answer to this final amended complaint. In October 2015, a purported shareholder derivative lawsuit was filed in the Los Angeles Superior Court entitled Caleb McArthur v Najeeb U. Ghauri, et al., naming current and former members of NTWK’s board of directors as defendants. The complaint alleges that the defendants breached fiduciary duties by failing to implement internal corporate controls and is based on the same alleged factual premise as the pending federal securities class action described above. The company is named as a nominal defendant only and no damages are sought from it. In January 2016, the parties agreed in principle to settle the class actions. The settlement is in the process of being documented and is subject to the court’s approval. NTWK expects the cost to be fully covered by its insurers. Shareholder Control Officers and directors collectively own 14% of the outstanding voting stock (as of the SEC filing in September 2015). This group could potentially greatly influence the outcome of matters requiring stockholder approval. These decisions may or may not be in the best interests of the other shareholders. Geopolitical Global Unrest The company’s largest subsidiary is located in Lahore, Pakistan. Current relationships between the US and Iran and the US and Pakistan, and the conflict in Afghanistan, may negatively affect the perception of NetSol’s ability to have its 1,350+ employees, a majority of which are in Pakistan, operate effectively in other Asia-Pacific countries (such as China, and Australia). Thailand is another area the company operates in and that country has just had a military coup. The reports from Thailand are that consumer confidence rose after the coup after declining for the last 13 months. To mitigate this potential, the company has accelerated the growth of additional delivery centers in the US. Miscellaneous Risk The company’s financial results and equity values are subject to other risks and uncertainties, including competition, operations, financial markets, regulatory risk, and/or other events. These risks may cause actual results to differ from expected results. Trading Volume Based on our calculations, the average daily-volume in 2014 was 89,535 shares traded a day, which decreased to 58,646 in 2015. During the last three months to February 19, 2016 volume increased to 116,685. The company has a float of 9.1 million shares and shares outstanding of 10.5 million. Taglich Brothers, Inc. 10 NetSol Technologies, Inc. Consolidated Balance Sheets FY2013 – FY2017E (in thousands) Source: Company reports and Taglich Brothers estimates Taglich Brothers, Inc. 11 NetSol Technologies, Inc. Annual Income Statement – Ending June 30, FY2013 – FY2017E (in thousands) Source: Company reports and Taglich Brothers estimates Taglich Brothers, Inc. 13 NetSol Technologies, Inc. Income Statement Model Quarters FY2015A – 2017E (in thousands) Source: Company reports and Taglich Brothers estimates Taglich Brothers, Inc. 14 NetSol Technologies, Inc. Cash Flow Statement, Ending September 30, FY2013 – FY2017E (in thousands) Source: Company reports and Taglich Brothers estimates Taglich Brothers, Inc. 15 NetSol Technologies, Inc. Price Chart Taglich Brothers Current Ratings Distribution Investment Banking Services for Companies Covered in the Past 12 Months Rating Buy Hold Sell Not Rated # % 2 8 Taglich Brothers, Inc. 16 NetSol Technologies, Inc. Important Disclosures As of the date of this report, we, our affiliates, any officer, director or stockholder, or any member of their families do not have a position in the stock of the company mentioned in this report. Taglich Brothers, Inc. does not currently have an Investment Banking relationship with the company mentioned in this report and was not a manager or co-manager of any offering for the company with in the last three years. All research issued by Taglich Brothers, Inc. is based on public information. In March 2012, the company paid Taglich Brothers a monetary fee of $5,250 (USD) representing payment for the creation and dissemination of research reports for three months. In August 2012, the company began paying Taglich Brothers a monthly monetary fee of $1,750 (USD) for the creation and dissemination of research reports. General Disclosures The information and statistical data contained herein have been obtained from sources, which we believe to be reliable but in no way are warranted by us as to accuracy or completeness. We do not undertake to advise you as to changes in figures or our views. This is not a solicitation of any order to buy or sell. Taglich Brothers, Inc. is fully disclosed with its clearing firm, Pershing, LLC, is not a market maker and does not sell to or buy from customers on a principal basis. The above statement is the opinion of Taglich Brothers, Inc. and is not a guarantee that the target price for the stock will be met or that predicted business results for the company will occur. There may be instances when fundamental, technical and quantitative opinions contained in this report are not in concert. We, our affiliates, any officer, director or stockholder or any member of their families may from time to time purchase or sell any of the above-mentioned or related securities. Analysts and members of the Research Department are prohibited from buying or selling securities issued by the companies that Taglich Brothers, Inc. has a research relationship with, except if ownership of such securities was prior to the start of such relationship, then an Analyst or member of the Research Department may sell such securities after obtaining expressed written permission from Compliance. Analyst Certification I, Howard Halpern, the research analyst of this report, hereby certify that the views expressed in this report accurately reflect my personal views about the subject securities and issuers; and that no part of my compensation was, is, or will be directly or indirectly related to the specific recommendations or views contained in this report. American Software, Inc ClickSoftware Technologies Deltek, Inc. Infosys Ltd. Innodata Isogen Magic Software Enterprises Open Text Corp. Sapiens International Satyam Infoway Wipro Ltd. Public Companies mentioned in this report: (NASDAQ: AMSWA) (NASDAQ: CKSW) (NASDAQ: PROJ) (NASDAQ: INFY) (NASDAQ: INOD) (NASDAQ: MGIC) (NASDAQ: OTEX) (NASDAQ: SPNS) (NASDAQ: SIFY) (NYSE: WIT) Taglich Brothers, Inc. 17 NetSol Technologies, Inc. Meaning of Ratings Buy – The growth prospects, degree of investment risk, and valuation make the stock attractive relative to the general market or comparable stocks. Speculative Buy – Long-term prospects of the company are promising but investment risk is significantly higher than it is in our BUY-rated stocks. Risk-reward considerations justify purchase mainly by high risk-tolerant accounts. In the short run, the stock may be subject to high volatility and could continue to trade at a discount to its market. Neutral – Based on our outlook the stock is adequately valued. If investment risks are within acceptable parameters, this equity could remain a holding if already owned. Sell – Based on our outlook the stock is significantly overvalued. A weak company or sector outlook and a high degree of investment risk make it likely that the stock will underperform relative to the general market. Dropping Coverage – Research coverage discontinued due to the acquisition of the company, termination of research services, non-payment for such services, diminished investor interest, or departure of the analyst. Some notable Risks within the Microcap Market Stocks in the Microcap segment of the market have many risks that are not as prevalent in Large-cap, Blue Chips or even Small-cap stocks. Often it is these risks that cause Microcap stocks to trade at discounts to their peers. The most common of these risks is liquidity risk, which is typically caused by small trading floats and very low trading volume which can lead to large spreads and high volatility in stock price. In addition, Microcaps tend to have significant company-specific risks that contribute to lower valuations. Investors need to be aware of the higher probability of financial default and higher degree of financial distress inherent in the microcap segment of the market. From time to time our analysts may choose to withhold or suspend a rating on a company. We continue to publish informational reports on such companies; however, they have no ratings or price targets. In general, we will not rate any company that has too much business or financial uncertainty for our analysts to form an investment conclusion, or that is currently in the process of being acquired. Taglich Brothers, Inc. 18