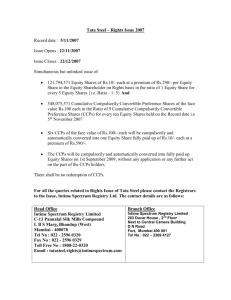

i PRICE BAND: RS. [•] TO RS. [•] PER EQUITY SHARE OF FACE

advertisement

![i PRICE BAND: RS. [•] TO RS. [•] PER EQUITY SHARE OF FACE](http://s3.studylib.net/store/data/007910512_1-a588ea26f8d3ea50947cf1e78b79d507-768x994.png)