Simple and Compound Interest Solutions

advertisement

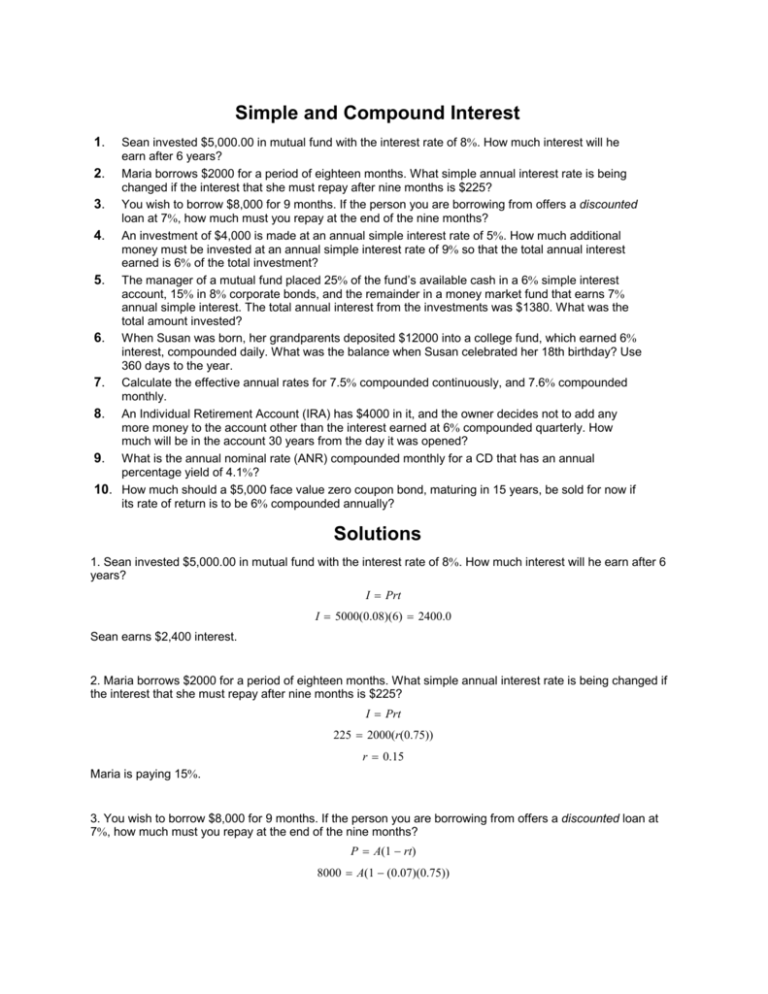

Simple and Compound Interest Sean invested $5,000.00 in mutual fund with the interest rate of 8%. How much interest will he earn after 6 years? 2. Maria borrows $2000 for a period of eighteen months. What simple annual interest rate is being changed if the interest that she must repay after nine months is $225? 3. You wish to borrow $8,000 for 9 months. If the person you are borrowing from offers a discounted loan at 7%, how much must you repay at the end of the nine months? 4. An investment of $4,000 is made at an annual simple interest rate of 5%. How much additional money must be invested at an annual simple interest rate of 9% so that the total annual interest earned is 6% of the total investment? 5. The manager of a mutual fund placed 25% of the fund’s available cash in a 6% simple interest account, 15% in 8% corporate bonds, and the remainder in a money market fund that earns 7% annual simple interest. The total annual interest from the investments was $1380. What was the total amount invested? 6. When Susan was born, her grandparents deposited $12000 into a college fund, which earned 6% interest, compounded daily. What was the balance when Susan celebrated her 18th birthday? Use 360 days to the year. 7. Calculate the effective annual rates for 7.5% compounded continuously, and 7.6% compounded monthly. 8. An Individual Retirement Account (IRA) has $4000 in it, and the owner decides not to add any more money to the account other than the interest earned at 6% compounded quarterly. How much will be in the account 30 years from the day it was opened? 9. What is the annual nominal rate (ANR) compounded monthly for a CD that has an annual percentage yield of 4.1%? 10. How much should a $5,000 face value zero coupon bond, maturing in 15 years, be sold for now if its rate of return is to be 6% compounded annually? 1. Solutions 1. Sean invested $5,000.00 in mutual fund with the interest rate of 8%. How much interest will he earn after 6 years? I = Prt I = 5000(0.08)(6) = 2400.0 Sean earns $2,400 interest. 2. Maria borrows $2000 for a period of eighteen months. What simple annual interest rate is being changed if the interest that she must repay after nine months is $225? I = Prt 225 = 2000(r(0.75)) r = 0.15 Maria is paying 15%. 3. You wish to borrow $8,000 for 9 months. If the person you are borrowing from offers a discounted loan at 7%, how much must you repay at the end of the nine months? P = A(1 − rt) 8000 = A(1 − (0.07)(0.75)) A = 8443.30 You must repay $8,443.30. 4. An investment of $4,000 is made at an annual simple interest rate of 5%. How much additional money must be invested at an annual simple interest rate of 9% so that the total annual interest earned is 6% of the total investment? Let x be the additional amount of money. P I = rP r 4000 x 0.05 (4000)(0.05) = 200.0 0.09 4000 + x 0.06 0.09x 0.06(4000 + x) 0.06(4000 + x) = 200 + 0.09x x = 1333.30 The extra amount required is $1333.30. 5. The manager of a mutual fund placed 25% of the fund’s available cash in a 6% simple interest account, 15% in 8% corporate bonds, and the remainder in a money market fund that earns 7% annual simple interest. The total annual interest from the investments was $1380. What was the total amount invested? Let x be the total amount invested P r I = rP 0.25x 0.06 (0.06)(0.25x) = .0 15x 0.15x 0.08 (0.08)(0.15x) = .0 12x 0.6x 0.07 (0.07)(0.6x) = .0 42x .0 15x + .0 12x + .0 42x = 1380 x = 20000 The fund manager has $20, 000 to place. 6. When Susan was born, her grandparents deposited $12000 into a college fund, which earned 6% interest, compounded daily. What was the balance when Susan celebrated her 18th birthday? Use 360 days to the year. r ) mt A = P( 1 + m A = 12000(1 + 0.06 ) (360)(18) = 35333.0 360 Susan will have $35, 333 for her college fund. . 7. Calculate the effective annual rates for 7.5% compounded continuously, and 7.6% compounded monthly. r eff = e r − 1 r eff = e 0.075 − 1 = .07788 4 The effective annual rate for 7.5% compounded continuously is 7.788 4%. r )m − 1 r eff = (1 + m r eff = (1 + 0.076 ) 12 − 1 = .07870 4 12 The effective annual rate for 7.6% compounded monthly is 7.870 4%. 8. An Individual Retirement Account (IRA) has $4000 in it, and the owner decides not to add any more money to the account other than the interest earned at 6% compounded quarterly. How much will be in the account 30 years from the day it was opened? r ) mt A = P( 1 + m A = 4000(1 + 0.06 ) (4)(30) = 23877.0 4 There will be $23,877 in the account. 9. What is the annual nominal rate (ANR) compounded monthly for a CD that has an annual percentage yield of 4.1%? r )m − 1 APY = (1 + m 0.041 = (1 + r ) 12 − 1 12 r = .04024 9 The annual nominal rate is 4.0249%. 10. How much should a $5,000 face value zero coupon bond, maturing in 15 years, be sold for now if its rate of return is to be 6% compounded annually? A = P(1 + r) n 5000 = P(1 + 0.06) 15 P = 2086. 3 The price of the bond should be $2086.3.