Valuation Review - it

advertisement

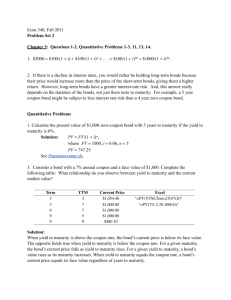

Valuation Review Professor P. Peterson, FIN3403 Time valuation review problems 1. David Matthews put $1,500 into a mutual fund. By the end of six years he had $3,470 in the account. What was DM’s average annual return? PV = $1,500 FV = $3,470 n=6 Solve for i Solution: 15% 2. V. Shephard plans to save $100 a month out of her paycheck (with the first deposit in one month). How much will she have after three years if the bank pays 12% interest, compounded monthly? PMT = CF = $100 n = 36 i = 1% Solve for FV Solution: $4,307.69 3. If you deposit $2,000 into an account that pays 8% interest per year, compounded semiannually, how long will it take you to double your money? PV = $2,000 FV = $4,000 i = 4% Solve for n n = 18 periods (a period is 6 months long) Solution: 9 years Bond and stock valuation review problems 4. The HiLo common stock has a current dividend of $1.00 per share. If you require a 20% return on your investment and you expect HiLo dividends to grow at a constant rate of 6% per year, indefinitely, what is the maximum price you should pay for this stock? D0 = $1.00 re = 20% g = 6% Solve for D1 and then P0 D1 = $1.00 (1.06) = $1.06 Solution: P0 = [$1.06 / (0.20 – 0.06)] = $7.57 Valuation Review Solutions 1 of 1 5. The Happy Company has an issue of bonds that pay a 13% coupon and have a $1,000 face value. The bonds mature in four years. Similar risk investments have yield to maturity of 16%. Interest is paid semiannually. What is the value of a Happy bond? PMT = C = $130/2 = $65 FV = M = $1,000 n=4x2=8 i = 16% / 2 = 8% Solution: PV = Value of bond = $913.80 common sense check: the bond should be selling at a discount from face value Multiple Choice Questions 6. If a a. b. c. bond is trading at a discount from its face value, its coupon rate must be less than its yield to maturity. its coupon rate must be greater than its yield to maturity. its coupon rate must be equal to its yield to maturity. a. The coupon must be less than the market rate -- no investor will pay face value for a bond whose coupon rate is less than the going market rate. 7. Ferry Corporation has coupon bonds with a face value of $1,000 and five years remaining to maturity. If these bonds have a value quoted as 90 and are priced to yield 10 percent to maturity, what is the annual coupon rate if the interest is paid semiannually? a. -3.2% b. 3.2% c. 5.0% d. 7.4% e. 10% FV = $1,000 N = 10 PV = $900 i = 5% Solve for PMT. Pmt = $37.05 Therefore, the coupon rate is ($37.05 x 2) / $1,000 = 7.41% d. 8. Suppose you buy a bond today for $1,000, its par value. If the yield on this bond changes from 10 percent to 12 percent tomorrow, what will happen to the value of your bond? (assume all other factors held constant) a. The bond's value will increase. b. The bond's value will decrease. c. The bond's value will remain the same. Valuation Review Solutions 2 of 2 b. The value of the bond will fall. There is an inverse relation between yield and value. 9. Electronic Products has a $1,000 face value bond outstanding with 5 years remaining to maturity and a coupon rate of 8% paid semi-annually. If the current price is 90, what is the annual yield to maturity (YTM)? a. YTM < _ 8% b. 8% < YTM < _ 9% c. 9% < YTM < _ 10% d. 10% < YTM FV = $1,000 N = 10 PMT = $40 PV = $900 Solve for i i = 5.315% yield to maturity = i x 2 = 10.63% d. 10. Internet.com has a $1,000 face value bond outstanding with 5 years remaining to maturity and a coupon rate of 8% paid semi-annually. If the current price of 70, the bond's yield to maturity (YTM) is closest to: a. 5.3% b. 8.6% c. 10.0% d. 17.2% FV = $1,000 N = 10 PMT = $40 PV = $700 Solve for i i = 8.59% yield to maturity = i x 2 = 17.18% d. 11. Lifeboat Products issued 10-year, $1,000 face value bond on January 1, 1995 with a coupon rate of 8%, paid semi-annually. If the market price on January 1, 2000 is 95, what is the annual yield to maturity (YTM) at this date? a. YTM < _ 8% b. 8% < YTM < _ 9% c. 9% < YTM < _ 10% d. 10% < YTM FV = $1,000 N = 10 (5 years remaining, so therefore there are 10 6-month periods remaining) PMT = $40 PV = $950 i = 4.636% yield to maturity = i x 2 = 9.27% Valuation Review Solutions 3 of 3 c. 12. Consider a bond with a coupon rate of 10% that is currently trading to yield 5%. If the yield remains at 5%, the price of the bond, as the bond approaches maturity, will: a. increase. b. decrease. c. remain unchanged. The bond will be trading at a premium. As it approaches maturity, the value of the bond will approach the face value; hence, the value of the bond will decrease. b. 13. Consider a bond with a coupon rate of 5% that is currently trading to yield 10%. If the yield remains at 10%, the price of the bond, as the bond approaches maturity, will: a. increase. b. decrease. c. remain unchanged. The bond will be trading at a discount. As it approaches maturity, the value of the bond will approach the face value; hence the value of the bond will increase. a. 14. The value of a zero coupon bond that has five years to maturity, a face value of $1,000, and is priced to yield 8% is closest to: a. $676 b. $723 c. $1,000 d. $1,469 FV = $1,000 i = 4% N = 10 PV = $675.56 a. 15. A $1,000 face value zero coupon bond that has four years remaining to maturity and is currently trading for $650, is priced to yield: a. 5% b. 11% c. 13% d. 39% FV = $1,000 PV = $650 N =8 Solve for i i = 5.532% yield to maturity = i x 2 = 11.06% b. Valuation Review Solutions 4 of 4