Literature Study: implementation of micro credit programs in Vietnam

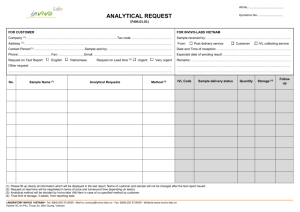

advertisement

‘Operational and Institutional Obstacles for the Efficacy of Micro Credit Programs for Poverty Reduction in Vietnam’ - Promotor: Prof. J. F. M. Swinnen, K,U.Leuven, F.E.T.E.W., Onderzoeksgroep Ontwikkelingseconomie Research Associates : Hannelore Beerlandt en Miet Maertens, K.U.Leuven Objectives of Research The key issue of the proposed research is the efficacy of micro credits in Vietnam for poverty reduction viewed within the transition environment of Vietnam. Even though the tremendous economic growth that Vietnam has known in the nineties, poverty is still deep and especially in some of the rural areas. Multiple aid programs involve micro credits targeted at the poorest segments of society. Although these programs have succeeded in attracting international attention to rural poverty in Vietnam, they have not always reached the intended impact on poor households, mainly because of lack of viability of the programs. Also more institutional reasons for failure of micro credit programs have been studied. Many studies have focused on institutional and juridical aspects of micro credits 1 in Vietnam, on implementation schemes for micro credits2, on economic transition and land reform issues3 and on vulnerability of the targeted households4. Our research will 1 Asian Development Bank, (2002), DFID and State Bank of Vietnam (2001) 2 DFID and State Bank of Vietnam (2001) 3 - - Ravaillon M. and D. van de Walle, 2001, “Breaking up the Collective Farm: Welfare Outcomes of Vietnam’s Massive Land Privatisation”, Policy Research Papers, World Bank Development Research Group, Washington D.C. Deiniger K. and J. Songquing, “Land Sales and Rental Markets in Tranistion, Evidence from Rural Vietnam”, Mimeo, Jan 2003. Quy-Toqn D. and I. Lakshmi, “Land Rights and Eocnomic Development: Evidence from Vietnam”, mimeo July 2002 4 - - - Glewwe, P., Gragnolati M. and H. Zaman, “Who Gained from Vietnam’s Boom in the 1990’s?”, Economic development and Cultural Change, Vol. 50, no4, July 2002. Worldbank and DFID, 1999, Vietnam, Voices of the Poor, Synthesis of Participatory Poverty Assessments, Washington D.C.. Minot, N. and B. Baulch, 2002, The Spatial Distribution of Poverty in Vietnam and the Potential for Targeting, Markets and Structural Studies Division, International Food Policy Research Institute, Washington. Dollar, D., Glewwe, P. and J. Litvack, Household Welfare and Vietnam’s Transition, Worldbank Regional and Sectoral Studies, Washington D.C.. Dwayne B., and L. Brandt, 2001, “Agriculture and Income Distribution in Rural Vietnam under Economic Reforms: A Tale of Two Regions”, Working Paper Department of Economics, University of Toronto, Ontario, M5S 3 G7, Canada. Baulch, B., Chuyen, T. T. K. Haughton, D. and J. Haughton, 2001, Ethnic Minority Development in Vietnam: A Socio-Economic Perspective, Beacon Hill University. try and focus on the interlinkages between these themes: namely the relation between micro credits, land markets and vulnerability (rice-price fluctuations) and how these linkages affect poverty and inequality. The interlinkage between land and credit markets can be simply explained. (1) Credit opportunities can be the financial source to purchase land; (2) land can function as a collateral for financial loans. In fact micro credits are linked with vulnerability of land-loss in two ways. Firstly, households that cannot pay back their loans and loose their land as collateral and therefore loose part of there productive capital. Secondly, lack of access to consumption credits unables households to smooth their consumption when shocks occur and therefore are forced to sell their land. Different sources5 mention that households indeed loose their land (sell or stop lease) when shocks happen in the household or when credits are not paid back in time (often credits for investments in agriculture). Both these coping strategies can be very harmful in the light of increasing inequality. None of the sources in literature have yet mentioned the shocks that households experience because of price fluctuations although this is illustrated in qualitative surveys (mainly remote rice growing areas in Vietnam). When prices fluctuate households get quickly trapped in debt cycles via formal and informal micro credits (often from businessmen who buy agricultural produce and sell inputs on credit). Eventually many of the poorest rural households fail to pay back and loose their land. In fact, the existing trading and credit mechanisms become a vulnerability trap themselves, given the characteristics of the land market. Our research would like to specify the exact causes of this increased vulnerability (relation between price fluctuations, vertical integration in remote areas6, shortcomings in credit schemes, characteristics of land markets). - Worldbank, 2002, Country Assistance Strategy Progress Report, Vietnam. Dercon, S., 2002, Income Risk, Coping Strategies and Safety Nets, The World Bank Research Observer, Vol. 17, No 2, pp. 131-166. 5 - - Reuters, 2002, Vietnam Villagers Invade Neighbors, Dig Up Graves, Reuters, Wed Apr. 17. Worldbank and DFID, 1999, Vietnam, Voices of the Poor, Synthesis of Participatory Poverty Assessments, Washington D.C.. Minot, N. and B. Baulch, 2002, The Spatial Distribution of Poverty in Vietnam and the Potential for Targeting, Markets and Structural Studies Division, International Food Policy Research Institute, Washington. Deiniger K. and J. Songquing, Land Sales and Rental Markets in Tranistion, Evidence from Rural Vietnam, Mimeo, Jan 2003. Asian Development Bank, Indigenous Peoples, Ethnic Monnorities and Poverty Reduction Viet Nam, July 2002. 6 - Dawe, D., “How Far Down the Path to Free trade? The Importance of Rice Price Stabilisation in Developing Asia”, Food Policy, Vol. 26, No 2, April 2001, pp. 163-175. Minot, M. and G. Francesco, 2000, “Rice Market Liberalisation and Poverty in Viet Nam”, Research Report, No 114, International Food Policy Research Institute, Washington, D. C. Hakkala, K. Kang and A. Kokko, 2001, “Step by Step; Economic Reform and Renovation in Vietnam, Beofre the 9th Party Congress” , EIJS The European Institute of Japanese Studies, Working Paper, No 114, 40 p. As micro credit programs are, justly, a priority of the bilateral cooperation between Belgium and Vietnam, the project is expected to specifically advise on credit markets in this context. E.g.: can more refined implementation forms of micro credits prevent increased vulnerability, or in combination with what other basic reforms (land, vertical integration, …) can micro credits lead to sustainable results, should credit policy make a difference in remote areas or when dealing with ethnic minorities, etc. Scientific interest The project would like to make a study on the relation between credit markets, liberalization and loss of land. The implications for rural households, their income and food security and the distribution of land will be the central focus. The project wants to suggest practical solutions about this theme. In recent literature is cited that market structure (and remoteness), history of landmarkets and informal insurance opportunities can play an important role in the relation between credit markets and land loss. Thus: Chance to loose land = F ( - social cohesion and informal insurance systems/institutions - initial wealth and endownments - access to formal credit schemes - access to micro credit schemes - off-farm opportunities - agriculture ability - price fluctuations rice - illness present and past - risk for natural disaster - market structure - remoteness (price for transport to urban centre)) - region (covering history of landrights) Chance to arrive in debt cycle = F ( What do we add? Literature Study: implementation of micro credit programs in Vietnam - Synthesis of existing studies regarding micro credit and operational problems and successes. - Literature study about credit markets in Vietnam and their relation with other reform programs (land, market, insurance…) Analysis - Litvakc, J. and D. Rondinelli, 1999, Market Reform in Vietnam, Building Instituions for Development, Quorum Books, London, 203 p. - Link between credit markets and land loss in Vietnam (and the role of micro credits and debt cycles in this matter). Influence of price fluctuations (liberalisation) on the vulnerability to loose land. Relation between vertical integration and price fluctuations and credit markets Influence of remoteness (via vertical integration). Influence of social cohesion (ethnic fragmentation!) on the vulnerability to loose land via price fluctuations and debt cycles, and influence of social cohesion of implementation of micro credit programs. Proposed Approach of Research Many of the aspects that we would like to include in our study have been studied, be it separately. As we would like to study the interlinkage between several of these aspects, we will firstly source extensively from existing knowledge, data and studies about the different subjects in Vietnam (credit markets, landmarkets, vertical integration and liberalization, vulnerability). Besides this secondary information we propose to go ahead in two ways: 1) 1 or 2 in depth case studies regarding the interlinkage between micro credits, land markets, price fluctuations. The case studies are regarded as in depth studies and would involve qualitative data collection in the first stage and a (specific) quantitative survey in the second stage. Scientifically7 it would be most interesting to study one case in the Red River Delta and one case in the Mekong Delta. The feasibility of this approach still has to be discussed aswell as the conformity with existing credit programs and other ongoing studies. We suggest to study 3 villages in every place. The initial stage of research would visit the places for qualitative data (credit market, land market, poverty, land loss, debt cycles, organization of rice markets, ethnic minorities etc.). This would involve two local assistants in the North and in the South everytime for about 2.5 weeks. For the survey we plan a sample of about 180 households per place (North-South). Seen our time table this implies about 12 surveys a day. This means we would employ 4 survey assistants for 4 weeks in the North and for four weeks in the South. 7 Variation in remoteness and market structure, history of land rights and thus development of credit markets, social cohesion (ethnic fragmentation) and thus informal institutions and informal insurance. Similarities: sector (rice), market liberalization and presence of micro credit programs. 2) We were asked to join a nationwide Worldbank household survey8 (autumn 2003) on poverty. This means specifically that we can add questions to the Worldbank survey, related to our subject. This dual approach (nation wide and 2 case studies) should allow to get a general picture of the interlinkage between the different aspects and the mechanisms through which they affect poverty on household level. These findings can contribute to elaboration of sustainable and diversified credit programs. Planned Research Stages - Networking with existing credit programs and with organizations/institutes that are implementing studies on micro credits and related issues (land markets, market structures) in Vietnam - Establishing contacts with local partners in Vietnam for research and for implementation of case study(ies) - Determining case study(ies) - Collection and processing of secondary data - Case study(ies): Qualitative household surveys (and report) - Case study(ies): Quantitative household survey (and report) - Nation wide household survey; integration of questions in Worldbank survey (and report) - Data analysis and policy implications Output - 8 Synthesis of existing micro credit programs and related operational problems Summary of Secondary data regarding important findings in recent studies on credit markets in Vietnam (especially in relations with other reforms) Report on results of in depth case studies and analysis (PRA’s and quantitative survey) studies regarding the link between micro credit, land loss, debt cycle and price fluctuations, and social cohesion Workshops and feedback on findings Final report, including policy advice Scientific publications (not in first year) K. Deiniger, Worldbank Planned Missions Mission 1 Timing June-July Mission 2 Oct-Nov Mission 3 Jan-March Objective Duration -Prospection and contact 10 days partners in Hanoi -Secondary information -Secondary information 6,5 weeks and PRA’s in two case studies (each about 2,5 weeks) -Feedback Hanoi en lokaal… -Quantitative survey two 9,5 weeks case studies (each about 4,5 –5 weeks) -Assist in ‘pretest’ survey Worldbank? -Feedback Hanoi (en O’mon ) and workshop

![vietnam[1].](http://s2.studylib.net/store/data/005329784_1-42b2e9fc4f7c73463c31fd4de82c4fa3-300x300.png)