Tourism in Ireland - Plattsburgh State Faculty and Research Web Sites

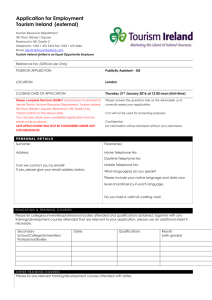

advertisement

ASAC 2001 London, Ontario Karen E. Volkman Ray M. Guydosh School of Business and Economics Plattsburgh State University of New York TOURISM IN IRELAND: OBSERVATIONS ON THE IMPACT OF EUROPEAN UNION FUNDING AND MARKETING STRATEGIES The tourism industry in Ireland has undergone substantial changes between the years 1980 to 1999. These changes are analyzed in the context of the EU structural funds, employment factors, and types of tourism markets. The paper concludes with an examination of the potential for increasing Canadian tourism to Ireland. The images of the Ireland of the late 1990s are a stark contrast to the Ireland of the late 1980s. When one imagines Ireland today, one is likely to think of large computer companies, such as Dell and Gateway, an educated workforce, and one of the lowest unemployment rates in Europe. However, the “Celtic Tiger", as Ireland is now referred to, was nowhere to be found during the 1980s. The European Union grouped Ireland with other agricultural “Objective One” countries such as Greece, Portugal, and Spain, who were in need of extensive financial assistance to bring them into the single monetary currency of the European Union. Economists are asking the question, how did Ireland successfully transform its economy to become the Celtic Tiger. As mentioned above, there is a tendency to attribute its success to the expansion of the high tech industries. While the expansion of foreign information technology companies into the Irish economy should not be underestimated, the authors contend that the primarily locally-owned tourism industry also had an important role in the turnaround of the Irish economy. Perhaps this overlooking of tourism can be explained by the very recent (1980s) acknowledgment of the significance of tourism as an industry in the entire European Union. The paper will focus on the following areas in its analysis of tourism research in the Republic of Ireland: objectives and funding from the European Regional Development Fund (ERDF), labor market sector employment and areas for growth, emphasis on tourism sectors; specifically heritage tourism, and an analysis of expansion of overseas markets with a focus on Canada. Observations The authors visited Ireland (primarily the Republic) during the summer of 2000, following a traditional tourist route via Kilkenny, Waterford, Cork, Kinsale, Killarney, the Ring of Kerry, and the Dingle Penninsula. They traveled North to the Cliffs of Mohr through Galway and Sligo to Donegal and spent a short amount of time in Northern Ireland to Portrush and the Giant’s Causeway before returning South to Dublin. They were struck by the preponderance of signs alerting us that many a project, from road building to heritage centers, had been funded by the European Union. Shortly after hiring a car at the Dublin airport the authors observed their first EU structural funding sign on the Dublin ringroad. Some other observations included the newly renovated visitor’s center at the privately owned Waterford crystal factory sporting the familiar EU funding logo. No trip to Ireland would be complete without learning about whiskey, which led them to the Middleton distillery, part of the Irish Distillers consortium of five brands of Irish whiskey. They observed the familiar EU logo on this heritage center, which is a combination of distilling history and the working plant site for whiskey manufacture for the Middleton brand. Yet another observation of EU funding was at one of the most popular attractions in Dublin, the “Guinness Hopstore”, the visitor center for the Guinness brewery at St. James Gate. The “Hopstore” is a multi-level visitor center with exhibits ranging from Guinness advertising through the years, a life size replica of the brewing process, to the sampling bar. The authors later investigated the subject of EU funding signage and found that for such projects, EU structural funding must be acknowledged and that the EU logo must even comprise 25% of the sign. These observations led to an interest in tracking the funding and marketing initiatives of tourism in the Republic of Ireland. Objectives and ERDF Funding One finds comparatively few scholarly articles on the subject of the Irish tourism industry during the past 20 years in English language journals. Indeed, a recent Queens University Belfast, Centre for Cross Border Studies (CCBS) Mapping Study notes that the tourist industry: “…is vastly under-resourced in terms of research. It is difficult to conceive of any other industry with an annual turnover in excess of £ 2bn functioning with so little research and development backup in the universities. We have tried to draw published and unpublished research for this study but our impression is that very little academic work is being done, especially on North-South matters.” This phenomenon is reflected in the wider scale lack of recognition of tourism by the European Union before the early 1980s. Pearce (1992) has traced the evolution of tourism in the EU and points out that it was not until 1980 that the EU even designated a commissioner for tourism. The influential policy document “The Role of the Union in the Field of Tourism”, a Commission Green Paper was not released until 1995. The European Union has four main categories of Structural Funds to address economic and social inequities within the Union: European Regional Development Fund (ERDF), European Social Fund (ESF), European Agricultural Guidance and Guarantee Fund (EAGGF), and the Financial Instrument for Fisheries Guidance (FIFG). Tourism receives direct funding under the ERDF, thus this particular structural fund is the focus of this paper. The ERDF was created in 1975 and the scope of its funding programmes is arranged in the following time periods: 1975-88, 1989-93, 1994-99, and 2000-06. Ireland is classified along with Greece, Portugal, and Spain as an Objective One region, “Promoting the development and structural adjustment of regions whose development is lagging behind.” These regions are eligible if their GDP based on data for the three years prior to 1993 was less than 75% of the EU average. EU contributions are matched by their respective country recipients; in the case of Ireland, EU funded projects can be funded at the 75% EU to 25% Ireland levels. (IBB, Ch.1) As one might infer from the relative downplaying of tourism in the EU mentioned previously, tourism during the 1975-88 period received a small proportion of ERDF funding. The ERDF funding for tourism during the 1975-88 period has been studied most extensively by Pearce (1992). He found that tourism funding accounted for only 1.9% of all ERDF funding of 22,723 million euros (MECU). Out of this small amount, Ireland received only 2.4 % of the total tourism funding grants. Indeed, Ireland didn’t receive any tourism grants until 1984, with 80% of the 2.4% being allocated during 1988. Interestingly, the UK (54.1%) and Italy (19%) took the greatest advantage of the tourism funds. All of the Objective One regions took little advantage of the ERDF structural funds. The 1989-93 period begins to show the benefits of a greater emphasis on the tourist industry. Pearce (1992) mentions that the change in official government policy accounts for increased tourist targets and investment plans. There is also recognition of a specific Irish tourist product to sell to the market The Operational Programme for 1989-93 created very specific target goals acknowledging the role of tourism in the Irish economy. In fact, tourism’s share of the GNP increased from 5.8% to 7% in 1993. This was aided by 220 MECU of funding from the ERDF programme. (IBB) This is also significant in that that Irish tourism industry is primarily a local one with little foreign ownership. (Hurley 1994) Thus, while GNP receipts are affected by foreign ownership of the information-technology infrastructure, receipts for tourism stay mainly within the Irish economy. This program included doubling the number of overseas visitors, a goal which the Irish tourism industry was successful in accomplishing. (IBB) The 1994-99 Operational Programme, which coincides with Ireland’s increasing economic power, is its most comprehensive ERDF request. ERDF 1994-99 Funding for Tourism in Ireland Financial Information by sub-programme: Sub-programmes/Measures Natural and cultural heritage Development of new products Marketing Training Technical assistance Total Total cost EC contribution (in € millions) (in € millions) 155.000 116.000 355.000 171.000 154.000 63.000 136.000 102.000 6.000 4.000 806.000 456.000 Source: Ireland Tourism Outline of Programme-Inforegio As with the prior initiatives, the EU funding is matched: 57% from EU and the rest from the Irish government and private sector. It should be noted that, while the bulk of the EU funding is from the ERDF (77.63%), 22.37% is from the European Social Fund, another structural fund. This initiative continues support for cultural heritage and visitor centers and adds marketing support, particularly for off-season international travel. Interestingly, little research covers this funding period. While not exactly following the ERDF funding period, Henry and Deane (1995) have completed input-output modeling methods to compare the impact of tourism on the Irish economy during 1990 and 1995. They observe that the impact of foreign tourism on the GNP in 1990 was IR £1337 million and increased to IR £2032 million, an increase of 52%. They conclude “that tourism has played an important role in the rapid expansion of the Irish economy during the period and has, in fact, performed above the average for the economy as a whole.” The year 1995 was also a watershed year in terms of EU issuance of policy. The Commission of the European Communities published the “Role of the Union in the Field of Tourism”, a document which analyzes the growth of tourism in the EU and examines how tourism adds value to the ideals of establishing a European “Community”, both in terms of economic and social structure. It is important to remember that the ERDF funds are intended to promote “social cohesion” for a unified Europe. Specifically this "Green Paper" outlines three areas for action: - supporting improvement in the quality of tourism by taking greater account of trends in tourism demand; - encouraging diversification of tourist activities and products by improving the competitiveness and profitability of the tourism industry; - incorporating the concept of sustainable and balanced growth into tourism by taking greater account of the cultural environmental dimensions of tourism. Clearly, the 1994-99 plan accommodates these goals by seeking to expand the traditional tourist season in Ireland. Ideas concerning sustainable growth are discussed in the context of employment, later in the paper. The chart below demonstrates the Irish tourist market has been growing at a steady rate since 1988, when the government changed its policies toward investment in the tourism plant. The 1990s show a clear growth of doubling the overseas visitors to Ireland at the same time period that Ireland is escaping economic obscurity to emerge as the Celtic Tiger. Number of Overseas Visitors to Ireland Unit=thousands 1988 2,345 1989 1990 1991 1992 1993 2,732 3,069 2,997 3,128 3,333 Ireland Central Statistics Office (CSO) 1994 3,681 1995 4,256 1996 4,739 1997 5,164 1998 5,716 1999 6,068 Labor Market Sectors in Tourism In analyzing the growth of the Irish economy, much reference is made to the staggering increase in GDP. The Irish GDP has increased from 60.8 (PPS) in 1986 to 96.5 (PPS) in 1996. This increase is significantly more than any of the other regions identified as economically disadvantaged by the Objective One structural funds status. Indeed, the overall EU GDP has remained constant from the 1986 figures of 107.7 (PPS) to the 1996 figures of 104.8 (PPS). Thus Ireland’s change in GDP from 1986-1996 is 6.2% while the overall EU lags behind with a 2.0% change. ( Statistical Annex, ERDF Sixth Periodic Report) How can one explain these changes in relation to tourism? It is important to note that unemployment has dropped significantly in Ireland from 1985 when unemployment rates were 18% to 1997 when unemployment rates decreased to 10.1%. (Statistical Annex, ERDF Sixth, p215) One must factor into this effect the labor force needed to run an industry dominated by small guest house/B&B type establishments. The Irish Hotels Federation (IHF) estimates that 78% of rooming premises have less than 40 rooms, thus the majority of the industry is dependent on the more local and labor-intensive small hotels and guesthouses as shown in the chart below. Categorization of Percentage of Hotels and Guesthouse Size by Number of Rooms Hotels and Guesthouses by Number of Rooms 151-300 2% 41-50 5% 51-70 6% 71-100 6% 101-150 3% +300 0% 0-10 24% 31-40 5% 21-30 12% 11-20 37% Source: Irish Hotels Federations The State Tourism Training Agency (CERT) predicts a future staffing shortage if the current tourism growth rate continues. CERT estimates an additional 105,000 employees will be needed over the next five years. The IHF in their submission “Investing in People, Not Rooms” also points to the disparity between the employment rates of women in Ireland versus their counterparts in other EU countries. The IHF data demonstrates that there is a significant underutilization of the women’s labor force aged 25-54 with only 58.4% employment. This is significantly lower than the 75% in the UK or 73.7% in Germany. Employment of these women in the tourism industry would make great strides in alleviating the shortage. Thus the IHF is lobbying for legislative reform including the “Homemakers Tax Free Allowance” of IR£ 2,000 for the first three years of people returning to the workforce. Creative government strategies could bring more people into the tourism workforce to alleviate the shortage problem. Irish Tourism Sectors The World Tourism Organization calculates the aggregate European annual tourism growth rate at 4.6% between the years 1988-97. (WTO, 11) As we have seen, the EU has made significant policy changes since 1988 to recognize the fiscal contribution of tourism to EU countries’ economies and enhance social cohesion. In fact, tourism is now estimated to account for 14% of the total EU GDP and 14.6% of the total EU workforce. (Barnard) Within this expanding market, it is even more crucial that Ireland now finds and markets its tourism niche to the traveling international public. Indeed, given the immanent single European currency, Ireland must find marketing methods to distinguish itself amongst its European neighbors and to compete against the traditional European “sun holiday” during the winter or summer months with such destinations as Majorca, Tenerife, or Southern Spain. However, it does have a number of very specific sells to European and North American markets that make it very distinctive. Hurley, Archer, and Fletcher (1994) have identified the following: 1) cultural and ethnic links with over 70 million people of Irish extraction world-wide, 2) one of the cleanest environments in Europe with extensive areas of outstanding natural beauty, (3) richness in archaeological and cultural attractions, (4) its people’s reputation for friendliness and hospitality, (5) the experience and professionalism of Bord Failte, and (6) its large stock of tourist facilities and amenities. There has been a revival in some history departments in recent years to include the history of migration; it is not uncommon to find a migration specialist in the history departments of U.S. and Canadian universities. In addition to the labeling of the African Diaspora, many of these migration specialists now also refer to a global Irish Diaspora. While it is difficult to calculate precise estimates, the figure of 70 million people of Irish extraction is commonly cited as in the above reference. Although the majority of Irish went to North America and Britain, Irish migrated worldwide in response to such events as the potato famine of the 1840s and the poor economy, particularly the 1960s and 1970s. In one of the new studies, The Irish Diaspora, Einri comments: The 1980s and 1990s saw a new and remarkable emphasis on the ties between the Irish at home and those around the world. In part this was cultural- the new wave of Irish singers, musicians and cultural artists, from within the country but also from within the Diaspora, who put Irish identity on the map and even made it cool. The Irish government changed its policy toward Irish progeny, particularly during the President Mary Robinson administration of 1990-1997, and is now eager to recognize people of Irish descent throughout the world. In fact, the Department of Justice, Equality and Law Reform has published a pamphlet concerning Irish Citizenship. A quick review of the pamphlet shows the influences of the Robinson policy reforms: clearly anyone whose grandmother or grandfather was born in Ireland may now register for Irish citizenship. In some cases this would even apply to great-grandchildren. North America is Ireland’s third largest travel market, behind the UK and Europe. Clearly migration/genealogy tourism has large prospective markets and both Canadians and “Yanks” are made to feel very welcome. It is not uncommon for many establishments to fly the U.S. flag alongside that of the Republic. Indeed, as official tourist agency, Bord Failte’s own data shows, there has been a growth in North American tourism from 419,000 visitors in 1988 to 858,000 visitors in 1998. In addition, anyone who has been to such common destinations as Blarney Castle or Temple Bar, Dublin, is clearly made aware of the North American presence. Indeed, given the number of American tourists that the authors observed themselves, they were surprised to find in the statistics that North America wasn’t indeed the primary tourist market for Ireland. The Irish “image” is a second crucial sector of its tourist marketing. Bord Failte, the official Republic of Ireland tourism agency, is responsible for creating Ireland's image in the international markets. When one thinks of Ireland, one typically imagines traveling through green pastoral scenes to relax at the pub in the evening with some good “craic” and a pint of Guinness. This image is certainly crucial in Europe, Ireland’s number-two travel market, with 1,255,000 visitors in 1998 according to Bord Failte. A quick look at European population figures tells a part of the story. Aside from the Nordic countries, Ireland has the lowest population density in Europe. With German population density at nearly four times that of Ireland, it is no wonder that the Germans would want to vacation in the idyllic green pastures of Ireland. The efforts of Bord Failte and the NITB (the Northern Ireland Tourist Board), through the Tourism Brand Ireland initiative launched in 1996, help to tell another part of the story. The Tourism Brand Ireland campaign was launched with various forms of advertising, including the web, to create the image of Ireland as “a green and pleasant land.” (O’Maolain ) While the success of TBI is controversial enough to be the subject of a paper in its own right, suffice it to say that TBI was the launch of many web-based advertising initiatives aimed in particular at English speaking markets. Heritage tourism has been an important component of the funding for Irish tourism physical plant since at least 1975. The concept of heritage tourism is distinct from that of migration/genealogy tourism. Heritage tourism has been characterized by Brown and Stevens: -heritage attractions are indigenous and unique in their representation of an area’s history -heritage attractions enliven, enrich and animate those naturally occurring themes and storylines upon which contemporary tourism marketing is based -heritage attractions provide a relatively stable base of visitor activity -heritage attractions have innate appeal for overseas markets Pearce (1992) has done the most comprehensive analysis of distribution of ERDF funding by types of tourism projects for the time period 1975-1988. He characterizes projects by such factors as: infrastructure, accommodation, leisure complexes, marina facilities, sports facilities, museums and historic centers, cultural and visitor centers, conference facilities, and other. Pearce’s study shows several interesting comparative factors in regards to heritage tourism funding by the ERDF in the countries of the European Union. Funding to Ireland for “museums, historic centers, and restoration” was at the level of 24% for the time period 1975-1988. France was the only other EU country that was near distribution in this range with a 23.9% allocation. Other EU countries ranged from no funding in this area at all to a funding level of around 10% of their ERDF tourism funds. Another interesting item in his study is the allocation to “cultural and visitor centers”. Again, Ireland is the highest with an ERDF allocation of 34.8%. The next highest allocation was that of the Netherlands with an allocation of 17.1%. Other EU countries ranged from none to 6%. This level of funding for heritage and cultural centers continues to the EU funding period of 1994-1999. As shown in the “Financial Information by sub-programme” (above), the EU structural funding for “Natural and cultural heritage” is € 116 million out of the total EU contribution of € 456 million. This represents approximately 25% of the total tourism funding for this period again going toward the heritage tourism model. Unfortunately no comparable studies exist for EU-wide heritage funding for this time period; the authors could suggest this topic as an area for further investigation. While it would be difficult to determine without EU-wide comparative data whether or not other countries have adopted this heritage strategy, it is clear that Ireland was the only country with this tourist strategy during the 1975-1988 period. As increases in the Irish tourism figures demonstrate, clearly this strategy has assisted in tripling the number of tourists visiting Ireland between 1988 and 1999. Expansion of North American Markets Bord Failte’s web site indicates that the UK is Ireland's largest tourism market with 3,199,000 visitors in 1998, followed by mainland Europe in second place with 1,255,000 visitors in 1998. The authors have not identified any unequivocal reason why Britain is Ireland’s largest tourist market, however it is most likely because of the proximity of Ireland to Britain and the large numbers of people in the UK of Irish heritage. The Irish image campaign noted above would explain the interest of mainland Europeans in visiting comparatively under-populated and green Ireland. Can Irish tourism expand in North America? We believe that the area of greatest possible development for Irish tourism marketing may in fact be tourism market ranking third, North America, with 858,000 visitors in 1998. Vast numbers of people of Irish descent live in North America. For example, Canada’s 1991 census shows that 3,780,000 Canadians identified themselves as being of Irish heritage. The Irish are the fourth largest ethnic group in Canada. (Canada’s Peoples) Image tourism should be no less effective when aimed at North American markets. Heritage tourism is not a strong influence towards tourism destinations in North America, as it could be for destinations in Ireland. Have these influences been effective? The authors conducted an analysis of Canadian visitors to Ireland between 1979 to 1999 using the Statistics Canada serial publication International Travel: Travel between Canada and Other Countries. (Guydosh and Volkman) They examined specifically “Visits, Expenditures and Length of Stay of Canadian Residents in Selected Countries” and in particular Canadian visits to Ireland for the years 1979-1999. They also noted visits to UK and Europe to use as bases for comparison. As a similar English-speaking country, the UK is typically used for statistical comparison to Ireland. The authors also wanted to compare with EU-wide trends. Tables below report Canadian visits and expenditures to Ireland for the period 1979-1999. Data was indexed using a percentage of respective 1979-1999 averages – 100 equals the country's average for the period. The patterns for number of Canadian visitors and for expenditures by Canadian visitors to Ireland do appear different from both patterns for number of visits and for expenditures to either the UK or the entire European region. Although Canadian visits to Ireland follow the approximately the same trends as visits to the UK and Europe in the period from 1979 to 1993, beginning around 1994 there is a definite increase in Canadian travel to Ireland in comparison to that to the UK or Europe as a whole. This increase relative to other travel continues through 1999. There is a similar change in the trend for Canadian expenditures on trips to Ireland. As visits (and expenditures) to the UK and to the European region continue a single trend throughout the 1979-1999 period, while the trend line for visits (and expenditures) to Ireland changes in mid-period, the authors conclude that the trend-line change represents an effect based on tourism to Ireland rather than on Canadian tourism in general. Clearly Canadian travel is increasing, but increasing greater in travel to Ireland. Canadian Tourist Visits 1979-1999 200 180 160 140 IE-Vis/Ave UK-Vis/Ave EUR-Vis/Ave 120 100 80 60 40 20 19 99 19 97 19 95 19 93 19 91 19 89 19 87 19 85 19 83 19 81 19 79 0 Canadian Tourist Average Expenditure 1979-1999 300 250 200 IE-Spnd/Ave UK-Spnd/Ave EUR-Spnd/Ave 150 100 50 19 99 19 97 19 95 19 93 19 91 19 89 19 87 19 85 19 83 19 81 19 79 0 Source: Guydosh/Volkman -- Changing Trends Why has Canadian travel to Ireland increased significantly in comparison to the base European and UK travel? The authors cannot determine the answer to this question with certainty. However, they can point to the pool of Canadians of Irish heritage that might have potential interest in migration/genealogy visits to Ireland. They can also point to the improvements in Ireland’s tourism structural plant brought about by the ERDF structural funding and Irish government policy favoring tourism. By 1990 tourism became recognized as an important contribution to the GDP and GNP of the economy throughout the EU. Ireland’s early recognition of the importance of migration/genealogical tourism, image tourism, and heritage tourism led to increased funding of the local tourism plant. One can note also that the 1994-1999 corresponds to the ERDF funding period which saw € 116,000 million allocated from the ERDF to “Natural and cultural heritage” with and additional € 39,000million matched from the Irish government. Overall the 1994-99 period saw € 806,000 million infused into the Irish tourism infrastructure. One can surely conclude that the European Regional Development Funds have had an important impact on the Irish tourism industry. A comparative increase in trends in Canadian tourism points to the need for increased attention to the success of marketing of Irish tourism abroad. References Barnard, Bruce (1999), “Business is Booming in the World’s Biggest Tourist Market,” Europe, 22 (3),22-25. Bielenberg, Andy (Ed.), (2000) The Irish Diaspora. New York: Longman. Bord Failte. “Tourism Numbers.” [web page] http://www.ireland.travel.ie/aboutus/facts_numbers.asp [Accessed 11 Jan 2001]. Brown, Sean, and Stevens,Terry (1996), “The Role of Heritage Attractions in Sustainable Tourism Strategies: The Experience in Ireland,” Visions in Leisure and Business, 15 (1), 43-64. Culture, Tourism, and the Centre for Education Statistics, International Travel Section. (years 1979-1999) International Travel: Travel between Canada and Other Countries. CS 66-201-XPB. Ontario: Statistics Canada. Central Statistics Office. “Tourism and Travel Number of Overseas Visitors to Ireland.” [web page] http://www.cso.ie/econseries/distribution/trdq103.htm. [Accessed 14 Jan 2001]. Commission of the European Communities. (1995) The Role of the Union in the Field of Tourism Commission Green Paper, Office for Official Publication of the European Communities. Department of Justice, Equality, and Law Reform. “Irish Citizenship.” [web page] http://www.irlgov.ie:80/justice/Publications/Citizenship/IrishCitizens.htm. [Accessed 11 Jan 2001]. ERDF. “Compulsory Elements for Inclusion on Billboards.” [web page] http://www.inforegio.cec.eu.int/wbdoc/graph/panneau_en.htm. [Accessed 11 Jan 2001]. ERDF. “Ireland Tourism Outline of Programme-Shet No 94.04.09.003.” [web page] http://inforegio.cec.eu.int/wbpro/prord/reg_prog/po/prog_22.htm. [Accessed 11 Jan 2001]. ERDF. Sixth Periodic Report on the Social and Economic Situation and Development of Regions in the European Union. [web page] http://inforegio.cec.eu.int/wbdoc/docoffic/official/radi/toc%5Fen.htm. [Accessed 11 Jan 2001]. Guydosh, R and Volkman, K. “Changing Trends in Canadian Tourism to Ireland”, Unpublished Working Paper, 2000. Henry, E.W., and Deane, B. (1997), “The Contribution of tourism to the economy of Ireland in 1990 and 1995,” Tourism Management, 18 (8), 535-553. Hurley, Angelo, Archer, Brian, and Fletcher, John. (1994), “The Economic impact of European Community Grants for tourism in the Republic of Ireland,” Tourism Management, 15 (3), 203211. Irish Business Bureau. “EU Structural Funds a Practical Guide,” [web page] June 1995; http://www.ibb.be/briefing_notes/stucfundsguide/StrFundsGuide.html. [Accessed 22 Nov 2000]. Irish Hotels Federation. “Investing in People, Not Rooms.” [web page] Oct. 1999 http://www.ihf.ie/ihfpag/tourpeop.htm. [Accessed 21 Nov 2000]. Magocsi, Paul (ed.) Encyclopedia of Canada’s Peoples. Buffalo: University of Toronto Press. O’Maolain, Ciaran. “North-South Co-operation on Tourism a Mapping Study,” Centre for Cross Border Studies [web page] June 14, 2000; http://www.qub.ac.uk/ccbs/maptour.html. [Accessed 11 Jan 2001]. Pearce, Douglas. (1992), “Tourism and European Regional Development Fund: The First Fourteen Years,” Journal of Travel Research, 30 (Winter, 1992), 44-51. TOURISM IN IRELAND: OBSERVATIONS ON THE IMPACT OF EUROPEAN UNION FUNDING AND MARKETING STRATEGIES Track: Tourism and Hospitality Management Karen E. Volkman Ray M. Guydosh School of Business and Economics Plattsburgh State University 101 Broad Street Plattsburgh, New York 12901 U.S.A. ray.guydosh@plattsburgh.edu karen.volkman@plattsburgh.edu Phone: 518 564-4189 Fax: 518 564-3183