Direction - Department of Treasury and Finance

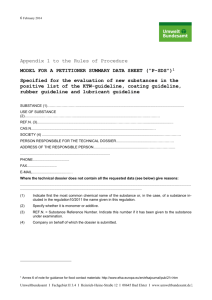

advertisement