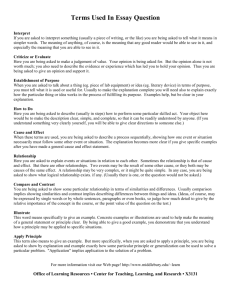

A Neoclassical Optimal Growth Model

advertisement

A Neoclassical (Ramsey-Kass-Koopmans) Optimal Growth Model Skills learned or practiced: Macroeconomic modeling, differentiation, posing a dynamic optimization problem, transforming a dynamic optimization problem into either an optimal control problem or a calculus of variations problem, solving an optimal control problem, solving a calculus of variations problem, analyzing a system of two differential equations using a two dimensional phase diagram Economic ideas: Macroeconomic implications of consumers adjusting their savings rate in an optimal way over time, in particular the implications for the path for the real interest rate level. An Aggregated Macro Model (1) Y F ( K , AL) , FK 0 , FAL 0 , FKK 0 , FALAL 0 , Y F (K , AL) (2) A A(0)e gt (3) L L(0)e nt The production level Y depends upon the level of capital K and the “effective” labor level AL . The effective labor level AL is the product of the labor level L and the productivity level A of one unit of labor. Labor grows at rate n , while its effectiveness grows at rate g . Production increases when either capital or effective labor increase, and production exhibits decreasing returns to both capital and effective labor. Production exhibits constant returns to scale. (4) Y C I (5) I K ' (t ) Production generates income Y that is either spent on consumption goods C or saved as S . Two types of goods are produced, consumption goods C and investment goods I . Investment is accumulated capital K ' (t ) , (and remember K ' (t ) is another way of writing dK / dt ). Converting an Aggregated Model into an Intensive Form or Per Capita Form This model, with variables presented in economy-wide aggregates, can be transformed into “intensive form” or “per capita form” by introducing the variables c C /[ AL] , k K /[ AL] , and y Y /[ AL] . Substituting (5) into (4) we have Y C K ' , which becomes Y /[ AL] C /[ AL] K ' /[ AL] . Recognizing k / K 1 /[ AL] , we can using the newly created per capita variables to rewrite this last condition as y c [ K ' / K ]k . 1 We want to find a way to replace K ' / K in this last condition with per capita variables. Applying the natural log to both sides of the equation k K /[ AL] , and the differentiating with respect to time, we find k ' / k K ' / K A' / A L' / L . Similarly, applying the natural log to equations (2) and (3) and differentiating with respect to time, we find A / A g and L / L n . Thus, we can rewrite k ' / k K ' / K A' / A L' / L as k ' / k K ' / K [ g n] . Using this last condition to replace K ' / K in the condition y c [ K ' / K ]k , we obtain (7) k ' y c [ g n]k . Condition is the intensive form equivalent to equations (4) and (5), a condition that indicates investment is what is left over from production after consumption. To put the production function in per capita form, replace with 1 /[ AL] , so the constant returns to scale assumption Y F (K , AL) becomes Y /[ AL] F ( K /[ AL],1) . Using k K /[ AL] and y Y /[ AL] , we obtain y F (k ,1) . Defining a new function f (k ) F (k ,1) , we find (8) y f (k ) , f ' (k ) 0 , f ' ' (k ) 0 , lim f ' (k ) , k 0 lim f ' (k ) 0 k The restriction f ' (k ) 0 is derived as follows. We know f (k ) F (k ,1) , which implies f ( K /[ AL]) F ( K /[ AL],1) . Differentiating this last condition with respect to K , we obtain f ' (k ) /[ AL] FK ( K /[ AL],1) / AL , which implies f ' (k ) FK ( K / AL,1) . From (1), we know FK 0 by assumption, for all values in its arguments, so it follows that f ' (k ) 0 . To obtain the restriction f ' ' (k ) 0 , note that f ' ( K / AL) FK ( K / AL,1) . Differentiating with respect to K , we obtain f ' ' /[ AL] FKK /[ AL] , which implies f ' ' FKK . Consequently the restriction in (1) that FKK 0 implies f ' ' 0 always holds. As will be shown below, the “Inada conditions” lim f ' (k ) and lim f ' (k ) 0 are added restrictions needed to draw a definite conclusion k 0 k about the existence of a steady state for the model, and are needed to draw a definite conclusion about the behavior of the system when it is not in the steady state. Together, the two equations (7) and (8) capture in intensive form the aggregate flows captured by equations (1)-(5). Formulating a Dynamic Optimization Problem Consumption yields utility. The problem for a consumer is the more consumption in the present implies less investment in the present, which implies less production and consequently less production in the future. This tradeoff suggests there may be some consumption path that is best, or optimal. Clearly, the best choice for how much to invest in the present will depend upon how long the future is expected to last. Here, we present the consumer’s problem assuming the consumer expects the future to last indefinitely, or to infinity. Under this assumption, we can present the optimization problem as 2 (9) max c (t ) t t 0 e tU (c(t )) dt , U ' 0 , U ' ' 0 subject to k ' (t ) f (k (t )) c(t ) [ g n]k (t ) and k (0) k 0 Here it is assumed the consumer obtains utility from time t consumption, that utility increases with consumption at a decreasing rate, and that the consumer discounts future consumption at the constant rate . A solution to problem (9) is a pair of functions c (t ) and k (t ) that satisfy the constraints and maximize the discounted lifetime utility integral. This problem can be solved using an “optimal control” approach or a “calculus of variations” approach. A Dynamic Optimization Problem as an Optimal Control Problem The problem (9) is presented in an optimal control form. To use the optimal control approach, one must identify both a “state variable” and a “control variable.” Letting x(t ) denote the state variable and letting u (t ) denote the control variable, an optimal control presentation for a general problem like problem (9) is (10) max u (t ) t t 0 f (t , x(t ), u (t )) dt subject to x' (t ) g ( x(t ), u (t )) and x(0) x0 Comparing our problem (9) to problem (10), we see our problem is of the form of problem (10) if we consider c (t ) as the control variable u (t ) and k (t ) as the state variable x(t ) . In our problem, both the control variable and state variable appear in the constraint, as in the general problem. Our problem is slightly different in that only the control variable appears in the objective function, not the state variable. To solve a problem with the form of problem (10) using the optimal control approach, one first constructs a “Hamiltonian” function. For problem (10), the appropriate Hamiltonian is (11) H f (t , x(t ), u (t )) g ( x(t ), u (t )) , The equations that describe the solution must satisfy are (12) H u 0 or (13) H x ' or f u g u 0 , f x g x ' , and the constraint 3 (14) H x' x' g or Together, equations (12)-(14) implicitly determine the variables x(t ) , u (t ) , and as functions of the model’s parameters. For our problem, the Hamiltonian (11) becomes (15) H e tU (c(t )) f (k (t )) c(t ) [ g n]k (t ) Calculating the Hamiltonian derivatives, our constraints analogous to (12)-(14) become e tU ' 0 (16) Hc 0 (17) H k ' or (18) H k' or or [ f '' [ g n]] ' k ' (t ) f (k (t )) c(t ) [ g n]k (t ) From equations (16)-(18), we seek two differential equations in that will describe the paths of c (t ) and k (t ) . So, we must seek to eliminate and ' . To do so, first differentiate (16) with respect to time to obtain ' e tU ' e tU ' ' c' . Then, use this result and the fact that e tU ' to eliminate and ' from (18). The result is that (18) becomes (19) U '' c ' [ g n] f ' . U' Conditions (18) and (19) are the two differential equations we seek. Before examining the implications of these equations, we will show that the same two equations can be obtained using the calculus of variations approach. A Dynamic Optimization Problem as a Calculus of Variations Problem The calculus of variations approach involves formulating the problem so that it fits the following form (20) max x (t ) t t 0 F (t , x(t ), x' (t )) dt subject to x(0) x0 Notice there is no control variable, but rather one sees both the state variable x(t ) and its time derivative x' (t ) . The solution x(t ) must satisfy the initial condition and the “Euler Equation:” 4 (21) Fx d Fx ' dt or Fx Fx 't Fx ' x x' Fx ' x ' x' ' We can put our problem in the calculus of variations form by eliminating c (t ) from the utility function using the constraint k ' (t ) f (k (t )) c(t ) [ g n]k (t ) . Doing so, our problem becomes (22) max k (t ) t t 0 e tU ( f (k (t )) [ g n]k (t ) k ' (t )) dt subject to k (0) k 0 . To obtain the Euler equation for our problem, we first find the derivatives Fk e tU '[ f '[ g n]] and Fk ' e tU ' . Then, we take the derivative of Fk ' e tU ' respect to t , k and k ' to obtain the derivatives Fk 't e tU 'e tU ' '[ g n]k ' , Fk 'k e tU ' ' f ' and Fk 'k ' e tU ' ' . Then, we can construct the Euler equation as (23) e tU '[ f '[ g n]] e tU 'e tU ' '[ g n]k 'e tU ' ' f ' k 'e tU ' ' k ' ' , This reduces to U ' f ' [ g n] U ' ' k ' '[ g n]k ' f ' k ' . Differentiating (18) with respect to time, we know c' f ' k '[ g n]k 'k ' ' . This allows us to replace k ' '[ g n]k ' f ' k ' with c' and more conveniently write the Euler equation as (24) U ' ' (c(t )) c' (t ) g n f ' (k (t )) U ' (c(t )) Notice that condition (24), obtained using the calculus of variations technique, is the same as condition (19) obtained using the optimal control technique. Together, the Euler equation (24) and the capital accumulation constraint (18) are a system of two differential equations that describe the paths of the optimal consumption and capital paths c (t ) and k (t ) . Using a Phase Diagram to Characterize the Two Dimensional Differential Equation System We now characterize the path followed by c (t ) and k (t ) diagrammatically in a “phase diagram.” The first step in constructing the phase diagram is to plot the “nullclines” associated with the steady state conditions c' (t ) 0 and k ' (t ) 0 . From (24), we can see that c' (t ) 0 implies [ g n] f ' . The restrictions on the production function f given in (2) imply there is a unique value k such that [ g n] f ' (k ) . (Notice that we need the Inada conditions lim f ' (k ) and lim f ' (k ) 0 to conclude this. The restrictions f ' (k ) 0 and f ' ' (k ) 0 k 0 k alone are not enough.) When k k , the assumption f ' ' 0 implies f ' (k ) f ' (k ) , so f ' (k ) [ g n] which implies the right side of (24) is negative. Because U ' ' 0 and U ' 0 by assumption, we know c' (t ) must be positive for the left side of (24) to be negative. Thus, 5 when k k , c' (t ) 0 . Using analogous reasoning, when k k , c' (t ) 0 . the arrows in Figure 1. This is shown by We obtain the k ' (t ) 0 nullcline by setting k ' (t ) 0 in condition (18), which implies c(t ) f (k (t )) [ g n]k (t ) . Because f (0) 0 , we know c(t ) 0 when k (t ) 0 . The Inada conditions lim f ' (k ) and lim f ' (k ) 0 allow us to draw conclusions about the shape of k k 0 this nullcline consumption level c (t ) . The assumption lim f ' (k ) ensures k 0 that f (k (t )) [ g n]k (t ) when k (t ) is near zero, which implies c(t ) 0 when k (t ) is near zero. Moreover, lim f (k ) ensures f (k (t )) increases faster than [ g n]k (t ) as k (t ) increases k 0 from a number near zero, which implies c (t ) is increasing as k (t ) increases from zero. The assumption lim f ' (k ) 0 ensures that, when k (t ) is large enough, [ g n]k (t ) increases faster k than f (k (t )) as k (t ) increases. This implies that, as k (t ) increases, c (t ) must reach a peak and then decline thereafter. This k ' (t ) 0 nullcline separates the region where k ' (t ) is increasing from where it is decreasing. Condition (18) indicates that, when c (t ) is greater than its nullcline value for a given level k (t ) , then k ' (t ) 0 . Conversely, when c (t ) is less than its nullcline value for a given level k (t ) , then k ' (t ) 0 . This is shown by the arrows in Figure 1. Figure 1: Dynamics implied by the Euler Equation and Capital Accumulation Contraint for the Neoclassical Model of Optimal Growth c (t ) c' (t ) 0 c(t ) f (k (t )) [ g n]k (t ) k k (t ) k ' (t ) 0 Starting at any point in the (k , c) of Figure 1, the arrows tell us the direction of movement. This allows us to trace the path from any starting point (k 0 , c0 ) . The starting point for k 0 is given to us in the problem. The starting point for c0 is a choice. Without additional 6 restrictions, we cannot determine which value of c0 will occur. However, proceeding with some analysis can provide an indication of what those restrictions might be. Figure 2 is drawn under the assumption that k 0 k . it should be apparent how to present the case for k 0 k .) (After understanding this analysis, Path 1 is associated with a relatively high initial consumption choice c0 . Because (k 0 , c0 ) is in the upper left quadrant of the phase diagram, the direction of movement must be up and to the left ( c increasing and k decreasing). k 0 k . Path 2 is still associated with a relatively high initial consumption choice c0 , but one where (k 0 , c0 ) falls in the lower left quadrant. Initially, the direction of movement must be up and to the right ( c increasing and k increasing). However, the k ' (t ) 0 nullcline is eventually reached, and the direction of movement of k is reversed. Thus, the paths of type 2 eventually become like those of type 1. For all paths of type 1 and type 2, k (t ) 0 must eventually occur. To rule out such paths as equilibrium paths, we need only add the reasonable condition k (t ) 0 to the problem. Figure 2: Phase Diagram for the Neoclassical Model of Optimal Growth c (t ) c' (t ) 0 1 2 c 4 c 0* 3 k0 k k (t ) k ' (t ) 0 Path 3 is associated with a relatively low initial consumption choice c0 . Because (k 0 , c0 ) is in the lower left quadrant of the phase diagram, the direction of movement must initially be up and to the right ( c increasing and k increasing). However, on this path, the c' (t ) 0 nullcline is reached, and the direction of movement of c is reversed. Eventually, such a path must involve a negative consumption level. One way to rule out such a path is to recognize that, at any given point in time t , when the capital-consumption combination is (k (t ), c(t )) , the consumer can discontinuously increase or decrease the consumption level, for such an action is equivalent to the choosing c0 when t 0 . On path 3, by choosing to jump paths by discontinuously increase c (t ) , (by choosing to reduce the saving level k ' (t ) ), the consumer can 7 move to a new path that will provide a higher consumption level in every period, for all time, which is clearly preferable. Thus, it is not optimal to choose a consumption level c0 that generates a path of type 3. Having ruled out paths of types 1 and 2 because they are not feasible, and paths of type 3 because they are clearly not optimal, we can conclude that the unique optimal choice for c0 , given the initial capital level k 0 is the level for c0 that generates path 4, or the level c 0* shown in Figure 2. One this path, consumption and capital each increase en route to the steady state (k , c ) , never crossing a nullcline. It is worth noting that, if the consumer believes that the economy would end at a particular point in time T , rather than assuming the economy will never end, then it would be rational to choose a consumption path such that k (T ) 0 . That is, the consumer should choose the consumption path where capital is just used up when the economy terminates. (The Euler equation and capital accumulation equation would be the same; only the “boundary condition” condition would change to k (T ) 0 .) This implies, rather than choosing path 4 in Figure 2, the consumer would choose a path either of Type 1 or Type 2, so that vertical axis where k (t ) 0 is eventually reached. Which path is chosen would depend upon the length of time T. The optimal initial consumption level becomes lower as the length of time T becomes longer. Implications for the Economy’s Real Interest Rate Level If producers maximize profit with respect to capital employed, then the real interest rate level r (t ) will equal the marginal product of capital f ' (k (t )) . In the case where consumers believe the economy has an infinite horizon, the level of capital k (t ) converges to the level k . This implies the real interest rate level would converge to r f ' (k ) . As the steady state is approached, k (t ) and c (t ) converge to k and c . In the steady state, condition (24) becomes 0 g n f ' (k ) . Rearranging terms we have f ' (k ) g n [U ' ' (c ) / U ' (c )]c , so r f ' (k ) implies (25) r g n . Condition (25) indicates that the steady state real interest rate level, the level to which the economy converges when consumers optimize with an infinite time horizon, depends upon the impatience parameter , the rate of technological improvement g , and the population growth rate n . A higher real interest rate level is expected when people are less willing to delay gratification (i.e., higher), when labor augmenting technological improvements arise at a faster rate (i.e., g higher), and when the population grows more quickly (i.e., n higher). En route to the steady state, the economy would be following a path like path 4, where the capital k (t ) increases at a decreasing rate. This implies the marginal product of capital f ' (k (t )) will decrease at a decreasing rate. That is, the model predicts the real interest rate level will decrease, converging to the level r over time. 8 The economy’s interest rate level would not converge to r if consumers expect the economy to end. Rather, a path like path 2 in Figure 2 would be followed, and the capital level k (t ) will eventually decrease to zero. This implies the marginal product of capital f ' (k (t )) will increase at an increasing rate, approaching infinity as time t approaches T . Thus, in this case, the prediction is that, while the real interest rate may decrease for some length of time while capital is accumulating along path 2, the real interest rate would eventually increase at an increasing rate as the economy heads toward the expected termination date. 9