adverse impact of global financial crisis on employment

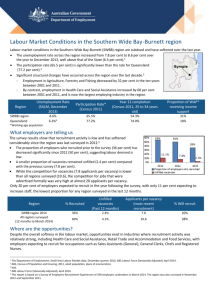

advertisement