Key Players in Corporate Governance of Islamic Financial Institutions

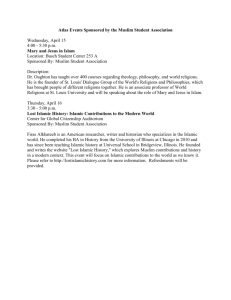

advertisement