Mysteries of Zakat - al

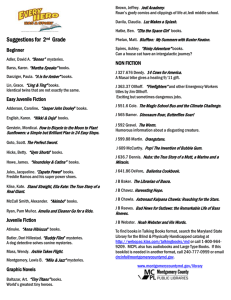

advertisement