Part three-Biotech Sector

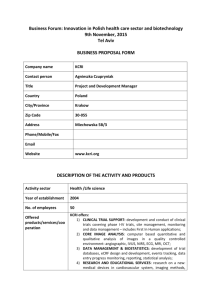

advertisement

DRAFT Case studies of Israeli Biotechnology Companies IFISE Project Dan Kaufmann Chen Levin The Jerusalem Institute for Israel Studies Table of Contents Biotechnology Global Overview .................... 3 Drug Development Process and Value Creation .............................................................. 5 Israeli Biotechnology Industry – Overview .... 7 Research Summary ....................................... 11 The Sample ................................................... 13 Entrepreneurs Background .......................................................................................... 16 Work Experience: ................................................................................................... 16 Team work ............................................................................................................. 17 Triggers and reasons for Foundation ......................................................................... 18 The importance of the cluster....................................................................................... 18 Technology Transfer ................................................................................................... 19 Sources of Finance...................................................................................................... 20 Incubators: ................................................................................................................. 21 VCs ........................................................................................................................... 22 Office of Chief Scientist (Ministry of Industry and Trade) ......................................... 24 Business Models ......................................................................................................... 24 Human Resources ....................................................................................................... 26 Policy Recommendation ............................... 28 2 Biotechnology Global Overview The biotechnology market is expected to grow by 12% annually and to generate over $40Bn revenues in 2004 (potentially $100M by 2010). Market capitalization of US companies reached over $250Bn in 2000 (more than 25% growth per year since 1996) with revenues above $22Bn1. Among European countries (Fig 1) Germany is leading with the 350 companies. In the UK about 300 companies exist. Israel, with 160 biotechnology is in the 5th place. This market is mostly dominated by bio-therapeutic and platform technologies (80% of the market) with the development of new age therapeutic products. Post-genomic technologies are laying the foundation for a new era of therapeutic products with many of the conventional drug therapies being replaced by safer and more effective ones over the next decade. Fig 1: European biotechnology companies per country Source: Earnst and Young 1 Source: Ernst & Young and Recombinant Capital 3 Worldwide bio-therapeutic drug sales are expected to be around $28Bn in 2004, growing by 10% annually (i.e., sales projection of existing drugs). An aging population in the developed world, the existence of large markets with sub-optimal treatments and incurable conditions, and the emergence of new protein-based drugs is driving this growth. The three key therapeutics areas are cancer, autoimmune and Central Nervous System (CNS), with cancer being the most significant. In 1999, the NIH allocated 19% (or $3.3Bn) of its grants to cancer research. Cancer therapies account for 47% (175 drugs) of all the compounds currently in clinical trials. There are at least 49 biotech cancer products on the market, which together generated sales of $2.7Bn in 1998 (already 15% of the entire market for cancer therapeutics). These sales are expected to reach $8.8Bn in 2005, growing by 18% annually. At the same time, the total cancer therapeutic market is expected to be around $34Bn in 2002 (17% annual growth). Auto-immune diseases cover a wide spectrum of illnesses including diabetes which is the most prominent one. There are currently 16 biotech products on the market for auto-immune disorders with an additional 19 in clinical trials. Their expected sales for 2005 are around $5.5Bn, a 12% compound annual growth rate. Central nervous system (CNS) disorders include a number of common old-age conditions like stroke, Alzheimer and Parkinson diseases. CNS is the third largest therapeutic market with total sales of $31Bn in 1999. The sales of biotech products were still limited to $672M in 1998 but they should be over $1.6Bn by 2005 (13% compound annual growth). Infectious diseases, especially viral diseases, are still the subject of intense scientific investigation. Modern medicine still lack effective cures for many viral infections, from simple flu to the most deadly infections such as AIDS. The market for proteinbased drugs in infectious diseases is expected to reach $1.2Bn by 2005, a growth of 17% annually. Currently there are over 50 biotech drugs in clinical trials. Cardiovascular diseases are still one of the main cause of death in the modern world. However, the market is fairly mature and should remain stable. By 2005, the market for cardiovascular products is estimated to be $1.3Bn, enjoying an annual growth of only 4%. Currently, there are 19 biotech drugs in clinical trials. 4 Drug Development Process and Value Creation The process of drug development has few phases, which are derivate from the regulation procedure. Drug development companies increase their value by successfully passing each phase. In general the drug development process consists of the following phases: 1. Preclinical Testing: this phase includes test of pharmacology; toxilogy; preformulation; formulation; analytical; and pharmacokinetics. 2. Investigation New Dru (IND) Application: After completing preclinical testing, a company files an IND with the U.S. Food and Drug Administration (FDA) to begin to test the drug on people. The IND enables a sponsor to ship an unapproved drug in interstate commerce. Clinical trials may proceed 30 days after filing unless the FDA places a hold on the proposal. 3. Clinical trials: this consists of the following: Table 1: Phases of Clinical Trials Number of Patients Length Mainly safety Some shortUpto Several term safety, Phase 2 several months to but mainly hundred 2 years effectiveness Several Safety, hundred 1-4 Phase 3 effectiveness to several years , dosage thousand Phase 1 20 - 100 Several months Purpose Percent of Drugs Successfully Tested 70 percent 33 percent 25 - 30 percent For example, of 100 drugs for which Investigational New Drug applications are submitted to the FDA, about 70 percent will successfully complete Phase I and go on to Phase II; about 33 percent of the original 100 will complete Phase II and go to Phase III; and 25 to 30 of the original 100 will clear Phase III (and, on average, about 20 of the original 100 will ultimately be approved for marketing). 4. New Drug Application: Following the completion of all three phases of clinical trials, a company analyzes all of the data and files an NDA with the FDA if the data successfully demonstrates both safety and 5 effectiveness. The NDA contains all of the scientific information that the company has gathered. NDAs typically run 100,000 pages or more. By law, FDA is allowed six months to review an NDA. 5. Approval: Once the FDA approves an NDA, the new medicine becomes available for physicians to prescribe. A company must continue to submit periodic reports to the FDA, including any cases of adverse reactions and appropriate quality-control records. The following chart provide graphical presentation of this process. Chart 1: Drug Development Process Source:FDA 6 As a general rule it is possible to say that companies increase their value by passing each phase as follows: Table 2: Value Creation During Drug Development Process Phase value Basic idea/technology 1 Animal testing X2 Pre clinical tests X2 Phase 1 X2 Phase 2 X3-4 Phase 3 X2 As will be presented, startup companies are commonly performing the drug development process up until phase II. As such companies are limited in their financial resources they need to either sell\license the knowledge to “big pharma” companies or to join a strategic partner in order to continue in the development process. Israeli Biotechnology Industry – Overview The biotechnology cluster in Israel consist of 220 companies of which 160 are “pure” biotech and the rest are service providers, private labs, and private incubators. The Biotech sector in Israel is located in four main areas around the major universities: Jerusalem (23%), Rehovot (25%), Tel-Aviv (14%) and Haifa (14%). The rest of the industry is located in different areas with some concentration in the North and in the center, mainly as a result of strong and dedicated incubators. The industry employs about 4000 employees in pure biotech companies and about twice as many in the whole cluster. 7 Biotechnology Companies in Israel by Location Other % MigdalHa'Emek % Haifa % Tel-Aviv % Rehovot % Jerusalem % Most of the companies are small startups with less than 20 employees (75% of the companies), while a dozen companies represent 80% of the total market value of the industry, they generate 2/3 of the sales and employ about 50% of the industry’s human resources2. In the last decade, the number of companies increased by an average of 17% per annum, while the sales generated by the sector grew 27% per annum over the same period3. However, over the last 5 years the annual growth in the number of companies slowed to 13% with only 14% annual growth in sales. In 1990, Israel boasted only 30 biotechnology companies employing just 600 employees, but by 2000 there were 160 companies employing more than 4,000 staff. The rate of growth accelerated markedly toward the end of the decade: during 2000, 25 new companies were registered, $238 million was invested privately in biotechnology-based business, and three companies raised $140 million on foreign stock exchanges (data from Ernst & Young). Even the recently renewed hostilities between Israel and the Palestinians have not dampened enthusiasm for biotechnology in the region. During the first quarter of this year, new companies were being registered at the same rate as that during the biotechnology "boom" of 2000. According to Ernst & Young, the rate of investment has slowed just 10-20%-far less than the dramatic slowdown seen in the high-tech industry globally. 2 Include BTG, Compugen, D-Pharm, Interpharm, Keryx, Omrix, Peptor, Pharmos, QBI and three companies with limited biotech activities (Abic, Hazera, Sigma Israel) but still significant player in their biotech specialty; Estimated market value as per August 31, 2000 3 In 1990, there were 30 companies with 600 employees and $50M sales 8 However, despite having one of the highest rates of startup creation globally, revenue from Israel's biotechnology sector is not keeping apace. Business Data Israel recently announced that in 1999 revenue grew only 10-15% compared with a 40-50% seen in Europe and the United States. The lion's share of Israeli biotechnology companies are still at an early stage of development, and the country's combined sales of biotechnology-derived products generated $600 million in 1999, and about $790 million in 2000. This is still just a small fraction of Israel's gross domestic product of $93 billion (1999 figures). Fig 2: Israel Biotechnology Sector The estimated market valuation of the entire biotech industry in Israel is about $3.5Bn in 2000, including 7 public biotech companies capitalizing $2.1Bn4. The vast majority of the valuation is driven by bio-therapeutic and bioinformatics companies (80% of total market cap) following worldwide market trends. These sectors are expected to generate higher returns than any others, as indicated by their ratio of market valuation per employee, which is 5 times higher than that for other industry sectors, such as agrobiotech. 4 By August 31, 2000 9 Israeli Biotech Companies Statistics Companies Employees 1999 Sales $M 2000 Market value $M Therapeutics 43 1,280 166 2,222 Diagnostics 27 471 28 138 Agrobiotech 30 830 114 286 24 191 39 93 Biologicals 14 492 79 149 Bioinformatics 6 231 3 472 144 3,495 429 3,360 144 3,276 376 3,238 Segment Industrial 7 Total Adjusted Total 7 Source: Monitor Report The sales of the biotech sector in Israel, reached $376M5 in 1999 (close to $600M including Copaxone sales by Teva) of which 92% was generated by less than 10% of the companies. This low revenue stems from the fact that most biotech companies’ products are still in the R&D phase. An estimated 21 therapeutic products are currently in clinical trials phase I, II and III with at least 51 products still in preclinical development. In the therapeutic sector, it may take 10 to15 years before a company can enjoy any revenue. Even in the sectors of diagnostics and agrobiotech it can take over 5 years. In 1999, venture capital funds invested $28M in biotech firms and are becoming increasingly interested in this sector. Since the beginning of 1999 four additional Israeli biotech companies have gone public, increasing the total to seven. This provides more exit opportunities for VC funds. The biotech industry in Israel is still emerging with no backing from large ethical pharmaceutical companies. Therefore, the companies lack the appropriate experience to fully develop a therapeutic drug. On the other hand, Israel has a comparative advantage and synergy opportunities with its strong related industries in computers & physics to develop platform technologies, bioinformatics and diagnostic tools. 5 Adjusted for Hazera biotech activities which are estimated to represent only 20% of their total activity; Industrial includes food, cosmetics, environment and chemical industry 10 Research Summary 1. The study has pointed to the growing importance of technology transfer agencies (TTA) in the process of startup creation in the field of biotechnology. Most startup companies in the field are based on ideas which were generated in the academia. TTA are required to be pro-active in their search for both financial resources as well as for experienced entrepreneurs who can take a lead. In addition, research staff employment policy needs to be more flexible in order to encourage researchers to initiate startups. 2. Two main financial resources for early stage startups have been identified: Incubators and Venture Capital. Regarding incubators the study found inadequacies in the current structure of the incubator program. Incubators are lacking the required basic infrastructure such as common research facilities, clean rooms, water supply etc. As result, a few VCs started to create their own private incubators. In addition the time frame as well as the available resources made available by the incubators program are too limited for startup companies in this field. 3. The shortening of the drug development process, the reduction of drug development costs as a result of utilizing biotechnology techniques and bio-informatics, and the existence of exit opportunities have increased the interest of VCs in the field. Most companies in our study raised money from VCs. The study also showed that all public companies have performed IPO in a period of less than 6 years. 4. The number of Israeli VCs active in the field is rather small and stands at about 15. The number of specialized VCs is even smaller. This causes imperfections, which sometimes result in “flock behavior”. On the other hand this increases the dependency of startups on foreign VCs. 5. The growth model of most companies in our study was similar and based on completing phase II of drug development. After phase II two strategies have been identified: selling\licensing the knowledge or continued development with a strategic partner who took responsibility on operating 11 phase III. In each case after completing phase II the company started developing another new drug. This process was also true for companies that raised substantial amounts of money from IPO. Only after creating stable cash flow as an outcome of successfully developing new drugs with a strategic partner, did the companies allow themselves to conduct phase III alone. 6. Israel has a very strong basis of academic research in human science. Each year more than 850 students graduate M.Sc. and Ph.D programs. As a result, there is not yet a shortage in workforce. On the other hand, as the sector is still in its developing phase, there is a critical shortage of experienced managers. In the current situation companies are required to recruit managers abroad. In some cases companies succeed in attracting Israelis who gained experience in “big pharmas” or VCs abroad. 12 The Sample During the course of the project 10 bio-pharmaceutical companies, 1 technology transfer organization, 2 incubators and 2 specialized VCs were studied by conducting in-depth interviews and using public information. The sample consisted of 2 incubator companies, 3 small startup companies (up to 30 employees), 1 medium company (up to 70 employees) who plans IPO within a period of a year and 4 companies which have already gone public. The selection of this sample enabled us to focus on different development stages of companies within the bio-pharmaceutical sector. The study of the technology transfer company as well as the specialized VC and the incubator was made in order to obtain a complete view on the process of entrepreneurship in this sector. The selected companies are: Gamida-Cell: is an early stage company engaged in the dynamic field of cell therapy. Using a proprietary platform technology for the ex-vivo modulation of cell proliferation and differentiation, the company is developing a kit for the expansion of stem cells derived from umbilical cord blood as a first product. This kit will provide a crucial and revolutionary tool for stem cell transplantation in patients with leukemia or lymphoma. Clinical trials are expected to start in 2001. The company is collaborating with luminary cord blood banks and transplantation centers in Europe and the US. Gamida Cell is developing relationships with strategic partners to develop additional applications in non-hemopoietic stem cells and in gene therapy. The company was established in 1998 and has applied for broad worldwide patent protection of its core technology. Gamida Cell is based in Jerusalem, Israel. Keryx: is a post-genomics, drug discovery and development company that uses bioinformatics to build a pipeline of product candidates and actual drugs. The Company employs applied genomics platform, a novel, kinase-based approach to identify drug leads rapidly. Keryx Biopharmaceuticals was established in 1997 as a US-based company with R&D and manufacturing facilities in Israel. The Company is traded on Nasdaq and on AIM since 2000. 13 BTG: develops, manufactures and markets pharmaceuticals and devices for human health care, which are manufactured by genetic engineering and other biotechnological methods: 1. Recombinant human therapeutics (hGH, SOD, Imagex, Factorex). 2. Recombinant vaccines (HBsAg -in mammalian cells). 3. Viscoelastic devices for ophthalmology and orthopedics (based on hyaluronic acid. The company was established in Israel in 19980 and has currently 6 registered products, which are marketed all over the world, Six other products in various development stages and various research products all related to human health-care. The company is traded on NASDAQ since 1984. XTL Biopharmaceuticals: develops novel therapeutics to treat life-threatening infectious diseases based on fully human monoclonal antibodies (hMAbs) and small molecule drugs. The Company's pipeline of therapies, designed to combat chronic viral infections, drug-resistant bacteria and serious systemic fungal infections, comprises internally developed products as well as those being co-developed with a number of biopharmaceutical partners. The Company was incorporated in Israel in March 1993 and commenced operations in November 1993. The company was established to commercialize technology originally developed at the Weizmann Institute of Science in Rehovot. XTL has exclusive rights to 14 patents and 17 patent applications world-wide which protect its proprietary technology. The Company employed 65 people - the vast majority of whom are scientists. The company is traded in the London Stock Exchange since 2000. Pharmos: The company uses advanced methods of drug design, combinatorial chemistry and screening tools to invent new and to improve existing therapeutic compounds. Pharmos' proprietary technologies have resulted in products that have increased efficacy and/or reduced side effects relative to their precursors and to competing products. Pharmos was established in 1990 and has developed proprietary and novel lipid-based Drug Delivery Systems (with a wide range of therapeutic 14 applications for a variety of drugs that are delivered by parenteral, dermal or oral routes of administration. Pharmos is traded on NASDAQ since the 1993. MINDSET: develops biotechnological and pharmaceutical methods for the prevention and treatment of brain disorders, for example Alzheimer's disease, Parkinson's disease, schizophrenia, depression and brain tumors and Platform technologies include CNS gene therapy and anti-oxidants/anti-amyloids. Mindset was established in 1997 Idgene Pharmaceuticals: is a population genomics company focused on identifying the genetic basis of common diseases. Founded in 1999, the company has developed a focused scientific strategy, which is applied to one of the most informative population resources in the world. IDGENE relies on population-wide association analysis for gene identification. Association analysis has the advantage of great statistical power and precise localization of the genes, once detected. Atena-Cardionet: The company develops drugs based on binding heavy metals and free radicals for treating neuro-degenerative diseases such as Alzheimer and Parkinson, as well as cancer and cardio diseases. Natural Compounds: The company was established in 1994 in an incubator. It engaged in the development of a new line of anti diabetic, Anti lipidemic and antioxidants, based on natural sources. In addition MC succeeded in preparing several synthetic compounds exhibiting hypoglycemic and anti oxidant effects. CellStain Technologies: The company is engaged in the development of drugs and tools for the treatment of cancer. CellStain has developed a technique capable of marking cancer cells of all types differentially from other cells and tissue, based on a newly discovered common denominator of all cancer cells. Based on the this technique the company is developing three clusters of products: drug-screening architecture aimed at whole-cell assaying of anti-cancer drug molecules and carcinogenesis; tools for functional genomics and pharmacogenomics, and a cellular diagnostics solutions. In addition, the NAIOT incubator specialized in biotechnology and the incubator of the Technion institute and Clal-Biotechnology venture capital were interviewed. 15 As a general rule we preferred to include in the sample more mature companies in order to get a wider and more complete perspective on the long process of drug development. Entrepreneurs Background Common to all entrepreneurs in this field is their strong academic background. All entrepreneurs have a Ph.D. in biology or other fields of the life sciences with 1 being a M.D. The need for substantial education usually results in relatively more mature entrepreneurs aged 40-55. All entrepreneurs gained academic experience both in Israel and abroad while most of them developed the idea for their company while abroad. Work Experience Beside the fact that all entrepreneurs had academic work experience both in Israel and abroad 3 companies were set-up by people with former entrepreneurial experience namely: Keryx, Pharmos and Gamida-Cell. In the case of Keryx the entrepreneur gained experience as Vice President of Medical Venture Capital with Paramount Capital Investments LLC., a merchant and investment bank. After finalizing his medicine studies he came to Israel and was involved in the creation of XTL. In 1999 he set-up Keryx which went public by September 2000. The creator of Pharmos gained his experience from setting-up BTG 10 years before. By the end of 1993 the company started to be traded in NASDAQ. In the case of Gamida-Cell the entrepreneur gained his experience while managing the technology transfer agency of Haddash: one of the biggest academic hospitals in Israel. The other entrepreneurs were well into their academic careers after post-doc work while creating their companies. 16 Team work In most cases of the sample (6 out of 10) the companies were created by a team and not by a single entrepreneur. The basic team usually consisted of a scientist who came up with the idea and another person experienced in entrepreneurship. Very often the other person was also from the field of life sciences. Interestingly, in about half of the cases the entrepreneur was the one to find the scientist and not vice versa. The case of Cell-Stain represents in some aspects the general case of an entrepreneur joining a scientist. When Lev Goltsman emigrated from Russia to Israel in 1991, he took with him several skills, as a pathologist, a natural scientist and an acupuncturist. After working in an Israeli hospital, he was persuaded by Dan Gelvan, a business economist, to join him in establishing CellStain as an incubator company in the Weizmann Institute of Science. CellStain found it could differentiate between normal and malignant cells in a relatively fast 15 minutes process. Normal cells were stained green; malignant ones red. CellStain believes malignant cells can be distinguished more easily by this method, and decided to use it for detecting cervical cancer. CellStain belives its method could increase the detection of pre-malignancies and malignancies. Moreover, labour-intensive manual screening could be replaced by a computer-integrated imageanalyst system capable of screening Pap smears. Similar cases where companies were founded by a team were Keryx, Gamida-Cell, Pharmos, ID-gene and XTL. Our study shows clear advantages for startups created by teams. From the 3 companies initiated by single entrepreneur only one is successful. The benefits of team-entrepreneurship stem from the fact that a newly-founded biotech company engages in, from very early stages, intensive activity in many different fields such as IPR, regulation as well as R&D. Moreover, in order to attract financial sources any biotech startup is required to set-up a strong advisory board consisting of reputed scientists and experts in the field. 17 Company Team 1 2 Gamida-Cell Keryx E+S E+S Work experience A + SU (I) A + VC (A) 3 Biotechnology General (BTG) XTL Mindset Idgene Pharmos Atena Cardionet Natural Compounds Cell-Stain S+S A S+E S S+E E+S S S E+S A + I (A) A A + I (I) A +SU (I) A A A + SU (I) 4 5 6 7 8 9 10 IPO Nasdaq London Nasdaq London Nasdaq Development Phase Phase II Phase III Location Approved Drugs Rehovot Phase II Phase I Proof of concept Approved Drugs Rehovot Jerusalem Jerusalem Rehovot Jerusalem Haifa Rehovot Not Relevant Phase II Jerusalem Rehovot Team: E = Entrepreneur; S = Scientist Work experience: A = Academic; SU = Startup (Israel/Abroad); I = Industry (Israel/Abroad) Triggers and reasons for Foundation As mentioned in 4 cases, the driving force behind initiating the companies were entrepreneurs who were seeking good scientific ideas. Two out of these entrepreneurs had prior experience in establishing at least one biotechnology startup. The rest of the companies were the result of promising ideas that emerged during the scientists’ academic careers or as part of their Post-Doc work. However, good ideas were usually not the only driving force. Strong entrepreneurial character was also needed. In most cases (8 out of 10) the decision to found a company was followed by giving-up on a stable academic career, as rules regarding additional employment for academic staff in Israel creates substantial difficulties for entrepreneurs to keep their academic position. This fact increases the personal risks for entrepreneurs. Policies towards the development of the biotechnology industry should pay attention to this point. The importance of the cluster In all of the cases in our sample companies have stressed the importance of being located near a leading academic institute in order to exchange information, to be close 18 to students and in some cases to use research facilities. In most cases entrepreneurs choose to locate their companies in proximity to the university from which they graduated. The reason for this is twofold: first the personal relationships of the entrepreneur with the university staff and especially with of specific department that has been established during the long period he was studying/working there. Secondly, as has already mentioned, entrepreneurs in the field are usually around the age of 4055 already with families and with less readiness to relocate. In addition, unlike other sectors, all entrepreneurs mentioned the importance of being located in proximity to other biotech companies and to suppliers. The tendency of entrepreneurs to locate their companies near leading academic institutions and in proximity to other biotechnology companies, creates geographical clusters of biotechnology companies. This fact should be considered while designing policies oriented towards developing biotechnology industry. Technology Transfer The process of technology transfer suffers from a number of problems impeding the development of the biotechnology industry in Israel: 1. Problems regarding to the ownership of IPR. Whereas universities require that all patents will belong to the university, investors tend to insist the IPR will belong to the companies. In some cases this gap leads to a “dead end”. 2. Different models of technology transfer in different academic institutions as well as a lack of one clear T.T path increase the transaction costs associated with the process. 3. Differences in business culture between universities and private investors create difficulties in company valuation. In addition, in many cases the demand of Universities to receive royalties before the company creates any type of cash flow is rejected by investors. Moreover, university rules in Israel limit the possibilities of a scientist to hold another job. In general, scientists are obliged to teach and are allowed to work only one day outside the university. This reality forces scientists to take a leave of absence from their university post while increasing personal risks. In order to avoid the need to leave the university 19 we found that in some cases, scientists work in their company on a part time basis while impeding the development of their strat-up. In order to maximize commercialization of academic research and to minimize cases of excellent ideas remaining unutilized, technology transfer agencies are required to be proactive in their search for either financial resources or an experienced entrepreneur who can take a lead. Sources of Finance Drug development processes have been shortened dramatically in the last two decades as a result of employing techniques based on biotechnology, the genomic database and the use of bio-informatics tools based on super-computers. However, conducting phase III tests on thousands of people is still an extremely expensive procedure, which is beyond the financial capabilities of most startups. In most cases phase III trials were conducted in cooperation with one of the leading pharmaceutical companies under different types of licensing/commercial agreements. In all the public companies in our sample we found that IPO occured before Phase III. However, interestingly, none of these companies used the raised capital for performing phase III alone. Alternatively, the money from the IPO was used as a means to improve their negotiation conditions as well as for future development of other new drugs. Early stage capital was obtained from two sources: VCs and Incubators. Only one company started its operation on the basis of self-financing of the entrepreneur. None of the companies had any investments made by strategic partners in the seed phase. It seems that the reduction of risks involved in drug development process besides the fact that “exit” opportunities appears within a period of less then 7 years cause biotechnology companies to be more attractive for VCs. Companies such as Keryx, BTG and Pharmos in our sample succeeded to perform IPO in a period of less than 3 years and XTL in a period of less than 6 years. In our sample we have identified a number of strategies companies used in order to shorten the drug development process and to become more attractive for VCs: 20 a) Shortening the process of drug development using sophisticated genome-based technologies. Companies such as Keryx, Idgene and Gamida-Cell belong to this group. b) Concentrating on improvement of drugs (such as reducing side effects, increase efficiency etc.) of generic drugs rather on developing ethic drugs. Companies such as Pharmos and BTG belongs to this group. c) Developing drugs based on natural compounds and do not require FDA approval. Companies such as Natural Compounds belong to this group. However, the relatively difficult process of screening and evaluation, which requires experienced personnel with relevant background still limit the number of VCs capable of entering the field and creates significant value for specialization. Incubators Incubators have been found as a relatively simple funding mechanism, which shorten the “ignition” period of the startup. Furthermore, entrepreneurs in the incubators mentioned that the incubator was a good “school” regarding the management of a company in terms of book keeping, legislation etc. In the non financial contribution differences have been found between different incubators. Entrepreneurs attributed these differences to the quality of the incubator staff and especially to its manager. However, despite these advantages a number of barriers, which limit the use of this system by entrepreneurs, have been raised: 1. Most government incubators are not suitable for biotechnology projects, because the units are not equipped with the necessary facilities such as clean rooms, refrigerators, centrifuges etc. Except one 2. Incubation period of biotechnology startups is usually longer than 2 years – the maximum time companies can currently benefit from the incubator services. 3. The amount of money available to entrepreneurs during the 2 years of incubation is usually too small for founding a biotechnology startup especially when it is required to equip itself with the basic equipment as well. 21 4. Discrepancies between the rules set by the universities regarding the ability of their staff to carry out commercial research, and those governing scientists' participation in the incubator program may cause considerable difficulties. The universities retain intellectual property rights (IPR) for inventions, whereas companies retain IPR within the incubators. There are also differences where ownership rights are concerned: academic scientists sometimes get less than 50% of the ownership rights in the company, whereas incubators demand that the scientist owns at least a half of the company. It is important to note that a recent study, conducted by Monitor group has suggested some policy recommendation in order to overcome some of the above mentioned barriers. Among the recommendations are setting up two dedicated incubators equipped with the necessary research facilities and expanding the incubation period. VCs The most common means for financing the seed phase of biotechnology companies is raising money from VCs. The average amount of seed funding in our sample is $2 million, which is similar to the general average investment of VCs in biotechnology companies in Israel. Investments of VCs in the biotechnology sector increased by 124% during 2000, attracting 11% of investments (compared with 15% during 1999). Israeli venture capital funds invested $124.4 million (compared to $64 million in 1999) in 115 deals, and the average amount invested showed an increase of 71% to $1.2 million from $0.7 million in 1999. Investment in the sector climbed in each quarter of 2000, including the fourth quarter, which increased by 11%. The total amount raised by Israeli biotechnology companies increased by 76% from $135 million in 1999 to $ 238 million in 2000. Two of the specialized VCs (Clal Biotech and BioEagerGroup) have set-up private incubators in order to support their portfolio companies. In the case of BioEager, the incubator includes common basic facilities. In the case of Clal their incubator aims at providing their companies with GLP (good laboratory practices) conditions which will include clean rooms and other services to support production such as cell 22 cultures, clean water, treatment of contamination etc. Both initiatives are, to some certain extent, a response to the lack of such facilities in Israel. VCs play an important role in the development of the biotechnology industry. Besides providing capital we found a number of areas where their contribution was significant: 1. Recruitment of managers, especially from abroad 2. Setting-up strong advisory boards consisting of “no.1” experts. 3. Introducing the company to strategic partners 4. Exposing the company to other potential investors and managing capital raising rounds and private placements. 5. Active participation in board meetings The important role of VCs to companies’ development is linked to the fact that in the whole field of biotechnology in Israel is still young. In many cases VCs are required to fill the gap created by lack of experienced managers in the field. Tale 4: Capital raising by round (in $million) Company Total till Name IPO First Second Third Gamida-Cell 25.5 2.5 8 15 Keryx 24.5 5 2.5 9 4 3 1 XTL 46 6 2 Idgene 8.5 0.5 8 Natural 0.5 0.5 Biotechnology IPO Valuation 45 52 110 10 500 50 180 General (BTG) 30+8 35 1.5 Compounds 23 Cell-Stain 2 0.4 1.5 5 However, despite the increase of VC funds available to the sector, our study identifies a shortage of capital, especially for seed or early stage investments. As a result a number of companies were required to raise money from foreign VCs. This gap received, as mentioned, only partial solution from the incubator system. Office of Chief Scientist (Ministry of Industry and Trade) Most companies in our sample are using OCS grants. These grants vary between a few hundred thousands to a few million dollars annually. Only two companies have stated that they ignore OCS grants because of the restrictions they impose on the companies. In general, companies use two types of OCS grants: a grant for applied research, which is provided for a company to carry out its R&D activity. This grant covers 50% of the total research costs; and MAGNET grants, which are provided to long term precompetitive R&D conducted by a number of companies and research institutes. This grant covers 66% of the total R&D costs. Business Models Most Israeli biotechnology companies do not perform phase III by themselves. This stems both from the high cost of performing phase III as well as the strong managerial capabilities this phase requires. In order to overcome the “phase III barrier” companies can adopt one of two strategies: 1. entering into agreement with a strategic partner who in turn receives some degree of exclusivity in marketing the new drug 2. selling/licensing the knowledge to a third party (usually on of the big pharmaceutical company). Keryx for example, has 40 drugs in its pipeline waiting for strategic partners or selling. Although the company raised substantial amounts of money by IPO it is not considering entering phase III. 24 In addition, most companies do not have self production capabilities, again, as result of the high costs associated with drug production under GMP (Good Manufacturing Practices). As a result, it comes out that biotechnology companies function more as an R&D companies rather than “big pharmas”. The opportunity to break the “phase III barrier” and become an independent drug producer may come only after securing stable income based on past developments. Pharmos, for example, has only recently decided to perform phase III with its dexanabinol for the treatment of traumatic brain injury side effects. This became possible as the company already has two drugs in the market. This reality creates advantages for companies who have platform technologies, enabling them to enter new drug development using capabilities which already exist in the company. Another factor affecting the ability of the biotechnology startup to grow relates to the competency of its entrepreneurs and it core management team. This factor is of substantial importance in this field, as leading a biotech startup requires, from very early stage, different management skills. In our sample we found very strong relation between the success of the company and its core entrepreneurial team. All three companies that started with single entrepreneurs are the less successful companies. Another important factor is, of course, the originality of the idea and the extent to which it provides a real breakthrough. One common problem of researchers/entrepreneurs in this field is the fact that many of them are not aware of similar ideas/technologies that are being developed in parallel in other places. The following chart present a typical growth profile of Israeli pharmaceutical startup company: 25 Chart 2: Growth Profile of Israeli pharmaceutical Startup Company Strong Team of entrepreneurs Significant Innovative Idea Pre-Clinical Tests Royalties Royalties After 2-3 successful drugs Phase I + II Strategic Partner Licensing/Selling of IPR Phase III Phase III NDA+Marketing Human Resources The seven Universities and research centers involved in biotech in Israel host over 800 research projects in the field, with additional research projects conducted in hospitals. Two thirds of the academic research is related to therapeutic drugs (of which 75% are in a basic research phase), one quarter to agrobiotech, and a further 10% to bioinformatics. The last two are by their nature considered applied research. When comparing the sectoral focus of the academia and industry there appears to be considerable alignment. For example, both show limited activity in genomics and post-genomics reflecting Israel’s relative absence from the original genome research project. 26 Number of Graduates by Faculty in Sciences Related* to Biotechnology (1998) 2000 Ph.D. M.Sc. B.A. 1600 130 1,747 286 393 1200 938 Number of graduates 800 400 0 Biology Agriculture Pharma. & Medical Research Total Biotech Engineering There is a large reservoir of science-skilled human resources in the academia. There are about 900 senior faculty members in the biotech-related departments in the Universities, including biology, biotechnology engineering, agriculture, pharmaceutical & medical research. In the 1998/1999 academic year, a third of all Ph.D. graduates were in biotech related programs (210 graduated), and there were about 650 graduates with a biotech related M.Sc. (10% of all Master’s graduates)6. The level of research conducted in Israel is of a high quality, as measured by the number of publications in leading professional periodicals. When corrected for the population, Israel’s publication level is very similar to the UK, while the US is holding the lead in research intensity and quality worldwide. As the industry is still in its early development stage there is no shortage of personnel. However, and for the same reason, there is a shortage of managers almost in all levels. In some companies such as XTL some of the management was recruited abroad. In addition, other support services mainly in the fields of IPR and regulation specialized in biotechnology are not yet developed in Israel and companies are dependent on services from abroad. 6 Source: VATAT (Council for Higher Education - Planning and Budgeting Committee) 27 Policy Recommendations Policy recommendations are made on several levels: 1. The Government should act to simplify the process of technology transfer. This should include a unification of procedures between different academic institutes. This objective can be reached by setting up joint committees consisting of representatives from universities’ transfer technology agencies, investors, companies and public policy makers. 2. University employment policy of research staff should become more flexible if more entrepreneurial activity is expected. The present reality forces researchers to chose between business and academic careers while increasing their personal risks in case they choose to initiate a startup. 3. The incubator system should be adjusted to support biotechnology startups. This may include extension of the incubation period, an increase in the funds available to startups and supplying some necessary joint equipment. 4. The Government should act in order to encourage early stage and seed investments in the sector. This objective can be achieved by establishing coinvestment funds and by allocating financial assistance, in the form of the R&D grants, to startup companies 5. Encouraging international support services to initiate cooperation with Israeli offices and branches in Israel (like Yozma did for VCs). This should include IPR and regulation. 6. Adopting a cluster oriented policy that encourages cluster dynamics. This may include both financial incentives and activities toward increasing the level of cooperation between companies and between companies and academic institutes. 28