DEBT COLLECTION - Donna Brown, PC

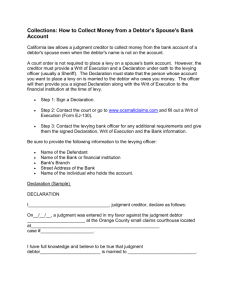

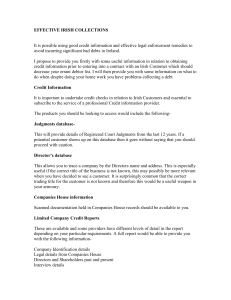

advertisement