Bops methodology, BPM6

advertisement

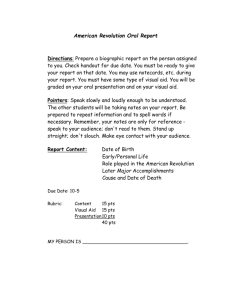

Balance of Payments Statistics Methodology Table of Contents: A. A. Introduction B. Individual Country Data C. World and Regional Tables D. Methodological Notes Introduction The BOPS (Balance of Payments Statistics) CD-ROM is consistent with the Balance of Payments Statistics Yearbook (BOPSY). It contains balance of payments and international investment position (IIP) data of individual countries, jurisdictions, and other reporting entities, and regional and world totals for major components of the balance of payments. In addition, it contains descriptions of methodologies, compilation practices, and data sources used by selected reporting countries. The BOPS CD-ROM contains data as reported by the balance of payments correspondents to the Fund, in addition to containing the corresponding series and tables within BOPSY denominated in U.S. dollars. The reported data are typically denominated in national currency. Conversion is performed on the basis of average U.S. dollar/national currency exchange rates for balance of payments data and on end-of-period exchange rates for IIP data. Both balance of payments and IIP data are presented on the BOPS CD-ROM in accordance with the standard components of the sixth edition of the Balance of Payments and International Investment Position Manual, BPM6. The BPM6, published by the Fund in 2009, introduced a number of methodological changes in the compilation of balance of payments and IIP data. These changes are summarized in Appendix 8 of the BPM6. Data conversion work undertaken -2by Fund staff has made possible the presentation in the BPM6 format of data staring with 2005 for both member countries that reported data in BPM6 format and member countries who are still compiling their data in the format of the fifth edition of the Balance of Payments Manual (BPM5). In 2010, the Fund staff developed formulas to convert reported balance of payments and IIP data for each country in the Fund’s database to approximate the BPM6 methodology and presentation. The main rules applied in the conversion are presented in Box 1 below. Member countries could opt (i) to accept the generic conversion without adjustment; (ii) to customize the conversion by adjusting the results from the generic conversion; or (iii) to implement the BPM6 standards. Table 1 presents the basis in which data were reported to the IMF by country and year. Also, the disclosure of the option selected by countries in reporting the most recent balance of payments and IIP data is included at the top of individual country tables. The notes about the methodologies, compiling practices, and data sources of reporting countries are based on information provided to the Fund by these countries for the publication in Balance of Payments Statistics Yearbook 2011, which was on a BPM5 basis. The updated methodological notes will be disseminated on BOPS CD-ROM in December 2012 release. The current notes can be retrieved after a Country Table selection from the directory tree within the Browser and can also be found in the Print_Me directory in the BOPCTYNOTES.rtf file. The descriptions are intended to enhance users’ understanding of the coverage, as well as the limitations, of individual country data published on this CD-ROM. They are also designed to inform compilers of data sources and practices used by their counterparts in other countries. -3Box 1. Selected Main Rules Used for The Conversion of BPM5 data to BPM6 The balances on Current account, Capital account, Financial account, Reserve assets, and Net errors and omissions were not changed; “Merchanting” was reclassified from Services to Goods; “Manufacturing services on physical inputs owned by others” (“Goods for processing” in BPM5) was reclassified from Goods to Services. The gross values of goods that physically move across borders for processing but for which there was no change in ownership are excluded from goods trade and from the IIP accounts. “Repairs on goods” was reclassified from goods to services (called “Maintenance and repair services n.i.e.” in BPM6); “Goods procured in ports by carriers” was included in “General merchandise on a balance of payments basis”; “Communication services” and “Computer and information services” from BPM5 were reclassified to “Telecommunications, computer, and information services” in BPM6; “Postal and courier services” was included in “Transport”; “Migrants transfers” was included in “Other capital transfers – financial corporation, nonfinancial corporations, households, and NPISHs”. (Although migrants transfers should not be included in the balance of payments accounts under BPM6, the elimination of this account was not possible without impacting net errors and omissions, which was avoided); “Reverse investment” in “Direct investment” was reclassified according to the asset/liability basis; The data for “Monetary authorities” in BPM5 were mapped to “Central bank.” In some instances, the data were mapped (in full or in part) to “General government” or other institutional units in consultation with countries; The use of signs in the BPM6 presentation was changed as follows: (i) in current and capital accounts, both credits and debits, were registered with positive signs; (ii) in financial account, increases in assets and liabilities were registered with positive signs, and decreases in assets and liabilities with negative sign; For the IMF dissemination of data, consistent with long-time IMF practices, data provided by the Finance Department of the IMF on SDR holdings, SDR allocations, and Reserve position in the IMF were substituted for reported data, if different. -4B. Individual Country Data “Country” in the BOPS CD-ROM does not always refer to a territorial entity that is a state as understood by international law and practice; the term also covers some nonsovereign territorial entities for which statistical data are provided internationally on a separate basis. For most countries, balance of payments data are presented in both analytic and standard presentations. As its name implies, the analytic presentation is an analytical summary of the more detailed data contained in the standard presentation. Balance of payments components in the analytic presentation are arrayed to highlight the financing items (the reserves and related items). The standard presentation shows data displayed in the standard components described in the BPM6. For countries for which IIP statistics are available, the data are presented in the IIP section. B.1 Analytic Presentation In the analytic presentation, balance of payments components are classified into five major data categories (groups A through E) that the Fund regards as useful for analyzing balance of payments developments uniformly. The selected groups, however, should not be considered to reflect the Fund’s recommendations about the analytic approach appropriate for every country. Other analytic presentations could be arrayed by regrouping the standard components in other ways to take into account the special circumstances of a specific country or to serve particular analytical requirements. Note that the figures shown in the analytic and standard presentations differ for balances of the current account, the capital account, and the financial account for some countries. This is because in the analytic presentation, certain transactions under these accounts are reclassified as “exceptional financing.” The reclassified transactions are grouped under “reserves and related items”. “Exceptional financing” refers to transactions undertaken by the authorities to finance balance of payments needs, including such items as external borrowing, accumulation and payment of arrears, and debt forgiveness. Exceptional financing does not include reserve assets. -5B.2 Standard Presentation The standard components of BPM6, shown in the standard presentation are summarized under goods and services, primary income, and secondary income in current account, and also under the main standard components in the capital account. Under the financial account, components are classified by type of investment (i.e., direct investment; portfolio investment; financial derivatives (other than reserves) and ESOs; other investment; and reserve assets), separately for assets and liabilities. Most of these financial account categories are futher classified by domestic sector (central bank; deposit taking corporations, except the central bank; general government; and other sectors (with the latter containing and “of which: other financial corporations and nonfinancial corporations”). The standard presentation of balance of payments includes as memorandum, detailed information on exceptional financing transactions by functional category, financial instrument, and domestic sector. Also included are some supplementary items related to arrears not in exceptional financing and remittances measures. B.3 International Investment Position IIP data are arrayed in accordance with the standard components for IIP, as set forth in the BPM6. Although the classification of the IIP components is consistent with that of the financial account of the balance of payments, a number of differences exist between the two. As mentioned earlier, IIP data reflect a country’s external financial assets and liabilities at a specific point in time. Therefore, the basic presentation of the IIP components is provided under two general categories, namely, assets and liabilities, as opposed to categories for debits and credits in the current and capital accounts, to categories for the net acquisition of financial assets, and net incurrence of liabilities, in the financial account, of the balance of payments. Also, IIP data reflect a country’s position at the end of the reporting period, as opposed to transactions during the period shown in the balance of payments. Furthermore, unlike the balance of payments, which shows the value of financial transactions over a period, the valuation of a country’s IIP reflects the accumulated value of financial transactions, revaluations, and other changes in volume as of the end of a reporting period. The net IIP is derived by taking the difference between the value of reported external financial assets and that of reported external financial liabilities. -6IIP data also include supplementary data on arrears by functional category and domestic sector. External debt is not a separate component of the IIP but can be derived by summing the liability positions other than financial derivatives, equity and investment fund shares, and other equity (these are not debt instruments according to international statistical standards). B.4 Credits and Debits In both the analytic and standard presentations, the transactions data are shown as gross credit or gross debit entries in the current and capital accounts, and as net acquision of financial assets or net inccurence of liabilities (to reflect net changes in liabilities and net changes in assets) in the financial account. In current and capital accounts, both credit and debit entries, gross or net, are positive (but without a plus sign). In financial account, increases in assets and liabilities are shown as positive amounts (without a plus sign) and decreases in assets and liabilities are shown as negative amounts. B.5 Nil or Unavailable Entries It is frequently difficult to discern in data reported by countries whether missing numbers are not available or are zero or insignificant. In the BOPS CD-ROM, “....” indicates either unreported data or estimated data (in world and regional tables). B.6 A Note on the Components of Primary Income, Portfolio Investment, and Other Investment In the standard presentation, the data reported by certain countries under “primary income” in the current account, and “portfolio investment” and “other investment” in the financial account are at a level of aggregation that does not allow all of the individual components within this category to be separately identified. In these cases, therefore, the aggregate data for certain subcategories cannot be derived by summing the components for these subcategories. The same principle applies to “other investment” shown in the IIP. -7B.7 Rounding of Figures Most data in the tables are expressed in units of one million; it should not be assumed that any table showing smaller units necessarily contains more accurate figures. The unit is chosen to present the figures conveniently. Because of the calculation routines used, rounding differences may occur between an aggregate and the sum of its components. B.8 Currency Conversion The balance of payments and IIP data reported to the Fund are expressed in national currencies, in U.S. dollars, or in another currency. To facilitate comparisons among countries, all balance of payments and IIP statements published in the BOPSY and in the BOPS CD-ROM are expressed in U.S. dollars. As mentioned previously, the BOPS CD-ROM also contains data in national currency as reported by member countries. In addition, all countries’ reported data on transactions with the Fund and transactions in SDRs are replaced with data obtained from the Fund records, which are kept in SDRs. This information is, in turn, converted to U.S. dollars. For countries that do not report in U.S. dollars, data are converted using the country conversion rates shown at the bottom of the analytic presentation table in the BOPS CD-ROM and in Table 1 in BOPSY. These rates are normally the average exchange rates for a country for the relevant period taken from the International Financial Statistics (IFS). For example, the IFS pages for Australia contain line “rf” giving average rates for Australian dollars per U.S. dollar. Conversions of transactions data from SDRs into U.S. dollars are made at the rates shown in line “sb” of the IFS pages for the United States. For countries reporting quarterly data in national currencies, annual U.S. dollar totals are obtained by aggregating the quarterly U.S. dollar figures. For countries that do not report IIP data in U.S. dollars, data are converted using the line “ae.” These rates are the end-of-period exchange rates for a country for the relevant period, taken from the IFS. More information on the exchange rates used may be found in the introduction to IFS, Section 1, or on the IFS CD-ROM in the file entitled INT.rtf. C. World and Regional Tables This section aggregates country data by major balance of payments components, based on BPM5 (with BOPSY2012, the data will be presented on a BPM6 basis). The user should note that this aggregation is done only once a year and that the aggregates included in the BOPS CD-ROM correspond to the most recent -8issue of BOPSY (i.e., BOPSY2011). For each component, data for countries, country groups, and the world are provided. In addition to data reported by countries as shown in the analytic and standard presentations, the tables in this section also include data for international organizations. Missing data have been estimated for countries by Fund staff to the extent possible. For the balance of payments, the estimation procedure is based largely on the use of the World Economic Outlook (WEO) database. Data published in BOPSY may differ from balance of payments data published in the WEO mainly due to timing and coverage differences (for example: BOPSY Part 2 includes data on international organizations). For the IIP, the estimates for nonreporting economies are derived from the Research Department’s External Wealth of Nations (EWN) database, which includes data for some 180 economies. Data from this database are used extensively by IMF staff for multilateral surveillance and for research, and these data are also in the public domain. They are updated and validated by the Research Department on a continuing basis. External assets and liabilities in EWN are estimated from a variety of sources. Typically official IIP data are used for countries that report such estimates. For countries and years for which IIP data are not reported, the data are estimated using alternative sources. These include, for example: (i) Bank for International Settlements(BIS)reported data and partner-country BIS data (for foreign assets), (ii) IFS data on banks’ and nonbank financial institutions’ foreign assets, (iii) IFS data for official reserves, (iv) Joint External Debt Hub, the World Bank’s Global Development Finance, and the WEO databases for external debt liabilities, (v) cumulative financial flows (adjusted for valuation changes)—financial flows are taken from the Statistics Department (STA) published data as well as WEO (when STA data are not available), (vi) United Nations Conference on Trade and Development (UNCTAD) data on foreign direct investment (FDI), (vii) Coordinated Portfolio Investment Survey data for portfolio investment, and (viii) partner-country data from national sources for both FDI and portfolio equity assets and liabilities. The following outlines the methodology used to gap-fill balance of payments data. With regard to goods and services transactions, where data gaps exist after the latest year of reporting to the Fund, estimates are made by -9applying the growth rates derived from the WEO for the missing year(s) to the latest reported annual data (debits and credits). When the data gaps are in respect of years prior to the latest reported data to STA, the WEO data are inserted to complete the series. Net WEO data series are used to estimate income, current transfers, and the capital account. The estimation procedure for income and current transfers carries forward the latest reported values for the balance of payments series, compares WEO and balance of payments net figures, and then adjusts balance of payments credit and debit figures so that both balance of payments and WEO net figures are the same. Where there are gaps in the data prior to the latest reported data, the net credit or the net debit figures from WEO are inserted directly. To estimate the capital account, the net WEO series is inserted directly, to credits if WEO shows a net credit and to debits if WEO shows a net debit. With regard to most recent financial account transactions, derived growth rates based on WEO data are used when there are gaps after the latest year of reported data to the Fund. When the data gaps are in years prior to the latest reported data to STA, and for missing reserves data, the WEO data are inserted to complete the series. There are no estimations for financial derivatives. Data on Fund transactions—for example, transactions in SDRs and of the Fund's General Resources Account—are obtained from Fund sources. For the IIP, in some cases, neither reported data nor EWN data were available for one or more years in the time series. In these cases, estimates were derived using a relevant growth rate (example: a regional growth rate). A small number of economies that have no data available from STA or the IMF’s Research Department for the entire period are not included in the published regional and global tables. Estimates for missing data, which are included in regional and world totals, are not shown for the individual countries concerned. All tables of aggregates appearing in the section on world and regional data are shown in the concept tree of the BOPS CD-ROM (except for the Tables E-1 and E-2). Table A-1 provides a summary of international transactions, showing world totals of the major components of the balance of payments. Tables A-2 through A-5 present balances, by country, for the current, capital, and financial accounts, as well as for errors and omissions. Each of these tables - 10 includes a breakdown by regional group, by country, and for international organizations. Tables B-1 through B-39 present world and regional totals, by country, of major components of the balance of payments accounts. Table C-1 presents "global discrepancies" in balance of payments statistics by major components. Global discrepancies shown in the table refer to the discrepancies between the sum of the debit and credit entries for the current and capital accounts and between the sum of assets and liabilities for the financial account of corresponding components reported by countries and estimated by the Fund staff. For example, the global discrepancy shown for the trade balance represents the difference between the global aggregate of trade surpluses for goods and that of trade deficits reported on goods. In principle, under the balance of payments convention, global aggregates for exports should equal global aggregates for imports, and global trade surpluses should mirror global trade deficits, with the global trade balance equal to zero. The same principle applies to other balance of payments components shown in Table C-1. For a variety of reasons, however, countries generally do not correctly record all transactions, or they classify corresponding transactions differently. Under these circumstances, errors and omissions in the national data and asymmetries (discrepancies) in the global statistics arise. Also, some coverage gaps exist at the global level, such as financial flows for some small offshore centers that do not report balance of payments data to the Fund. Figures presented in C-1 reflect such net global asymmetries for the different balances. The net errors and omissions shown in the table represent the difference between the global discrepancy figure for the current account and that for the combined capital and financial accounts. Within the current account, a negative global imbalance indicates a net excess of recorded debits, which may reflect an under-recording of credits, an overstatement of debits, or both. A positive imbalance in the financial account suggests a net understatement of capital outflows (increase in assets or decrease in liabilities) and/or a net overstatement of recorded inflows (decrease in assets or increase in liabilities). - 11 The memorandum items of Table C-1 show the global discrepancies of certain major components of the balance of payments as a proportion of the sum of credits and debits of the category. Tables D-1, D-2, and D-3 present exports and imports of goods and services and the current account balance, respectively, as a percentage of gross domestic product (GDP), information that is of general interest to data users. Table E-1 presents the Net IIP while E-2 shows Total Assets and Total Liabilities. D. Methodological Notes The BOPS CD-ROM contains notes for countries for which the Fund staff have received information. The notes, which can be viewed from the analytic presentation, standard presentation, and IIP country tables in the BOPS CDROM, present descriptions of methodologies, compilation practices, and data sources used by individual member countries in compiling their balance of payments and IIP statements on BPM5 basis. These notes are designed to facilitate readers’ use of the data presented in the BOPS CD-ROM to enhance their understanding of the data coverage, as well as the data limitations. They are also intended to inform national balance of payments compilers of the data sources and compilation practices used by their counterparts in other countries; in this way, the reviews should help foster cooperation and the exchange of ideas among national compilers, as well as encourage them to improve their data. For those countries that report data on BPM6 basis, the notes will be updated to reflect the BPM6 compilation basis with the release of BOPSY2012. The disclosure of the option selected by country in reporting the most recent balance of payments and IIP data is included at the top of the notes for each country. For most countries, the reviews are organized in two sections: a general section and a specific one on balance of payments components. For countries that also compile IIP data, an additional specific section on IIP data is included. - 12 - Table 1. Method of Developing BPM6 Basis Estimates Economy 2005 2006 2007 2008 2009 2010 2011 Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Q1 2012 Albania Balance of payments International investment position Algeria Balance of payments Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Balance of payments BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 International investment position BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 Balance of payments Cust Cust Cust Cust Cust Cust Cust International investment position Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Angola Anguilla Balance of payments Antigua and Barbuda Balance of payments Argentina Armenia, Republic of Aruba Australia Austria Azerbaijan, Republic of Bahamas, The Balance of payments Bahrain, Kingdom of Bangladesh Barbados Gen - 13 Economy Balance of payments 2005 2006 2007 2008 2009 2010 Gen Gen Gen Gen Gen Gen Gen Gen Gen International investment position 2011 Q1 2012 Belarus Balance of payments BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 International investment position BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Belgium Belize Balance of payments Gen Benin Bermuda Balance of payments Bhutan Balance of payments International investment position Bolivia Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Balance of payments Cust Cust Cust Cust Cust Cust Cust International investment position Gen Gen Gen Gen Gen Gen Bosnia and Herzegovina Botswana Brazil Brunei Darussalam Balance of payments Bulgaria Burkina Faso Burundi Cambodia Gen - 14 Economy 2005 2006 2007 2008 2009 2010 Balance of payments Gen Gen Gen Gen Gen Gen 2011 Q1 2012 International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen BPM6 BPM6 BPM6 BPM6 International investment position Gen Gen Gen Gen BPM6 BPM6 BPM6 BPM6 Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Cust Cust Cust Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen1 Gen Gen1 Gen Cameroon Balance of payments Canada Cape Verde Chile China, P.R.: Hong Kong China, P.R.: Mainland China,P.R.:Macao Balance of payments Colombia Congo, Republic of Balance of payments Costa Rica Côte d'Ivoire Croatia Curaçao Balance of payments Curaçao and Sint Maarten Balance of payments Cyprus Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen - 15 Economy 2005 2006 2007 2008 2009 2010 2011 Q1 2012 Balance of payments Cust Cust Cust Cust Cust Cust Cust Cust International investment position Cust Cust Cust Cust Cust Cust Cust Cust Balance of payments Gen Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Balance of payments BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 International investment position BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 Balance of payments BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 International investment position BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 Czech Republic Denmark Djibouti Dominica Balance of payments Dominican Republic Gen ECCB-ECCU Balance of payments Ecuador Egypt El Salvador Estonia Ethiopia Balance of payments Euro Area Faeroe Islands Balance of payments Fiji Finland France Gen - 16 Economy 2005 2006 2007 2008 2009 2010 2011 Q1 2012 Balance of payments Gen Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Balance of payments BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 International investment position BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 Balance of payments Gen Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen French Polynesia Balance of payments Gabon Balance of payments Gen Gambia, The Balance of payments Georgia Germany Ghana Balance of payments International investment position Greece Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Grenada Balance of payments Guatemala Guinea Balance of payments International investment position Guinea-Bissau Balance of payments Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Guyana Balance of payments Haiti Honduras Hungary - 17 Economy 2005 2006 2007 2008 2009 2010 2011 Q1 2012 Balance of payments Gen Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen BPM62 BPM6 BPM6 International investment position Gen Gen Gen Gen Gen Gen Gen Balance of payments Cust Cust Cust Cust Cust Cust Cust International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Iceland India Indonesia Iraq Balance of payments International investment position Ireland Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Balance of payments Cust Cust Cust Cust Cust Cust Cust International investment position Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Balance of payments Cust Cust Cust Cust Cust Cust Cust International investment position Cust Cust Cust Cust Cust Cust Cust Gen Gen Gen Gen Gen Gen Balance of payments Cust Cust Cust Cust Cust Cust Cust Cust International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Israel Italy Gen Jamaica Japan Jordan Kazakhstan Kenya Balance of payments Korea, Republic of Kosovo Balance of payments International investment position Kuwait - 18 Economy 2005 2006 2007 2008 2009 2010 Balance of payments Gen Gen Gen Gen Gen Gen 2011 Q1 2012 International investment position Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Kyrgyz Republic Lao People's DR Balance of payments Latvia Lebanon Balance of payments Lesotho Liberia Balance of payments Libya Balance of payments Lithuania Luxembourg Macedonia, FYR Madagascar Balance of payments Gen Malawi Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Malaysia Maldives Mali - 19 Economy 2005 2006 2007 2008 2009 2010 2011 Q1 2012 Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Malta Mauritius Gen Mexico Moldova Mongolia Balance of payments International investment position Montenegro Balance of payments Gen Gen Gen Gen Gen Montserrat Balance of payments Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen International investment position Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen3 Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Morocco Mozambique Myanmar Namibia Nepal Balance of payments Netherlands Netherlands Antilles Balance of payments New Caledonia Balance of payments New Zealand Balance of payments Gen - 20 Economy 2005 2006 2007 2008 2009 2010 2011 International investment position Gen Gen Gen Gen Gen Gen Gen Q1 2012 Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Balance of payments Cust Cust Cust Cust Cust Cust Cust International investment position Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Nicaragua Niger Nigeria Norway Oman Balance of payments Pakistan Gen Panama Papua New Guinea Balance of payments Paraguay Peru Philippines Gen Gen Poland Portugal Qatar Balance of payments Romania Balance of payments Cust Cust Cust Cust Cust Cust Cust - 21 Economy 2005 2006 2007 2008 2009 2010 2011 International investment position Cust Cust Cust Cust Cust Cust Cust Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Q1 2012 Russian Federation Rwanda Samoa Balance of payments BPM6 São Tomé and Príncipe Balance of payments Saudi Arabia Balance of payments International investment position Gen Senegal Balance of payments Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Serbia Balance of payments International investment position Seychelles Balance of payments Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Balance of payments BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 International investment position BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 Gen1 Gen Sierra Leone Singapore BPM6 Sint Maarten Balance of payments Slovak Republic Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Slovenia Solomon Islands Balance of payments International investment position South Africa Balance of payments Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen - 22 Economy 2005 2006 2007 2008 2009 2010 2011 Q1 2012 Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Spain Sri Lanka Balance of payments St. Kitts and Nevis Balance of payments St. Lucia Balance of payments St. Vincent and the Grenadines Balance of payments Sudan Suriname Balance of payments Gen Swaziland Sweden Switzerland Syrian Arab Republic Balance of payments International investment position Tajikistan Balance of payments Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Balance of payments BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 International investment position BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 Gen Gen Gen Gen Gen Tanzania Thailand Timor-Leste Balance of payments Togo Balance of payments Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Tonga - 23 Economy 2005 2006 2007 2008 2009 BPM6 BPM6 BPM6 BPM6 BPM6 2011 Q1 2012 Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Balance of payments Cust Cust Cust Cust Cust Cust Cust Cust International investment position Cust Cust Cust Cust Cust Cust Cust Cust Balance of payments Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Balance of payments BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 International investment position BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 Balance of payments International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 BPM6 Cust Cust Cust Cust Cust Cust Balance of payments Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Gen Balance of payments Gen Gen Gen Gen Gen Gen Gen International investment position Gen Gen Gen Zambia Balance of payments Gen Gen Gen Gen Gen Gen Gen Balance of payments 2010 Trinidad and Tobago Balance of payments Tunisia Turkey Uganda Ukraine United Kingdom United States Balance of payments International investment position Uruguay Gen Vanuatu Venezuela Vietnam Balance of payments West Bank and Gaza Balance of payments Yemen, Republic of Gen - 24 1 The data series begins in Q4 2010, when the Netherlands Antilles was dissolved. At this time, Curacao and Sint Maarten became autonomous countries, and also formed a currency union. 2 For Q1 2009, data were submitted in BPM5 format and generic conversion was applied. 3 The data series ends in Q3 2010. In Q4 2010, the Netherlands Antilles was dissolved, and Curacao and Sint Maarten became autonomous countries and also formed a currency union. Note: Gen – data submitted in BPM5 format; generic conversion applied; Cust – data submitted in BPM5 format; customized conversion; BPM6 – data submitted in BPM6 format.