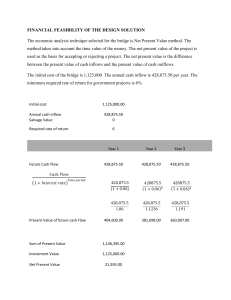

CHAPTER 4 The investment decision Introduction • What should financial managers do to maximise shareholders’ wealth? • Make wise investment, financing and dividend decisions • Which activities will the enterprise get involved in ? • Building new factory • New machine in production process • Development of new product • Take-over of another company • Identify and evaluate all profitable investment projects • Only accept those that add to creation of shareholder wealth Investment decisions • It is expensive • LT survival depends on the ability to invest in financially feasible projects • Negative ST effects • Wrong decisions can lead to failure of business • It is difficult and expensive to correct a mistake • It has a LT impact on competitiveness and profitability • Need to maintain competitive advantage: • Technological developments • New product development • Changing market trends Introduction: Capital vs Financial Investment • Capital investment: • Productive utilisation of capital to purchase productive assets • Financial investment: • Transfer of surplus funds to financial intermediaries, who transfer it to 3rd parties Introduction: Steps in the investment decision 1. Identification 2. Evaluation of alternatives 3. Decision-making 4. Implementation 5. Follow-up evaluation Introduction: Steps in the investment decision • Incremental Cash Flow • Only the additional cash flow that the acceptance of the project will contribute to the existing cash flow • Differs in regard to expansion and replacement projects • Expansion project – only the cash flows of the project • Replacement project – difference between existing cash flows and expected cash flows from project INVESTMENT CONCEPTS: Incremental cash flow Definitions Expansion VS What is the impact of a new/extra project? Company Replacement What is the impact of replacing an existing asset? Company Asset Replace with a new asset Example – incremental cash flow (Pg 55) A printing company intends to double their current production. Two alternatives are considered. First option: an existing printing press will be sold, and replaced with a newer model. It is expected that the enterprise’s annual cash inflow will increase from R400 000 to R600 000 as a result of the transaction. Second option: The purchase of an additional printing press that will be used in conjunction with the existing one. The expected annual cash inflow associated with the new printing press amounts to R150 000. Incremental cash in flow option 1 = (600 000 - 400 000) = 200 0000 Incremental cash in flow option 2 = 150 000 Definitions • Sunk Costs • Cash flows that occurred in the past • Cash flows have no influence on the cash flow of current project • Examples : • Feasibility studies • Environmental impact assessments • NOT included in investment calculations Definitions • Opportunity Costs • Cost associated with the acceptance of one alternative over another • The cost of an opportunity forgone • Include in investment decision • See example on page 56 Types of projects • Independent • The selection of one project does not exclude the selection of others • Has no effect on cash flows of other project • Mutually exclusive • Acceptance of one project will result in rejection of all others • Complimentary – positive effect on cash flows from existing projects • Substitute – negative effect on cash flows from existing projects Example Page 57 Assume that an enterprise needs to make a decision between the following two investment options: Option A: entails the manufacturing of a new product range, and will result in an annual cash inflow of R500 000. The new products, however, will compete with the enterprise’s existing products, and it is expected that the existing cash inflow will decrease by R150 000. Relevant cash inflow associated with Option A amounts to: = 500 000 - 150 000 = R350 000 Option B: entails the extension of the enterprise’s activities to another branch of industry. The expected cash inflow due to the extension amounts to R300 000. Since some of the enterprise’s existing products will also be used in the new branch of industry, it is also expected that the existing cash inflow will increase by R100 000. Relevant cash inflow associated with Option B amounts to: = 300 000 + 100 000 = R400 000 Cash Flow Diagram Terminal cash inflow Initial investment - 200 000 0 25 000 25 000 25 000 25 000 1 2 3 4 50 000 25 000 5 Annual cash inflows Types of cash flow streams Conventional cash stream: Unconventional cash stream: Annuity: Mixed cash stream Cash flow calculations • Initial investment • Periodic cash flows from operations • Terminal cash flow Periodic cash flows Terminal flow Initial investment Terminal cash cashflow Initial investment • All cash flows at beginning of project – positive and negative Components : • Opportunity cost • Any other relevant costs • Installed cost of new asset (All costs to ensure that the new asset is operational) • Purchase price (- discount if applicable) PLUS transport, preparation of plant, installation cost, VAT (if not included) Initial investment • Net working capital requirement • Required to support operating activities • Increase or decrease in working capital components • Inventory, trade receivables and trade payables might increase /decrease • Focus on impact on cash flow Example Page 59: Beauty Box Ltd Example Page 59: Beauty Box Ltd - answers Periodic cash flows Cash flows during the lifespan of a project/asset 1. After-tax operating cash flow • Profit vs Cash flow • After-tax cash flow • Finance cost – leave out of calculation (included in WACC) • Depreciation – not a cash flow item - add back to profit 2. Changes in net working capital – any annual changes in net working capital requirement 3. Additional investments (e.g. upgrades) 4. Any cash flows as a result of complimentary / substitute projects Example Page 61 Terminal cash flows • Final cash flow at the end of a project lifetime • Both positive and negative • Two components: • After-tax sales proceeds of the asset • Selling price minus relevant costs • Tax implications – capital gains and accounting profit/loss • Reversal of changes in working capital • Cumulative working capital investment over project lifetime must be reversed Rand value Net proceeds Carrying value Total profit If Net proceeds is less than the initial installed cost of the asset Initial cost Net proceeds R 100 000 R 80 000 Carrying value R 40 000 Total profit = Accounting profit 23 Tax on accounting profit = Accounting profit x tax rate (28%) Rand value Net proceeds Carrying value Total profit If Net proceeds is more than the initial installed cost of the asset Net proceeds R 120 000 Carrying value R 40 000 Initial cost R 100 000 Total profit 24 Capital gain Accounting profit • Capital gain x 80% x 28% Inclusion rate Tax rate Example: ABC Ltd Page 62/63 27 Example: ABC Ltd Page 62/63 After-tax cash flow Beauty Box ANSWER After-tax cash flow Beauty Box ANSWER After-tax cash flow Beauty Box ANSWER SUMMARY of cash flow diagram for Beauty Box -1 550 000 549 000 549 000 549 000 549 000 461 000 549 000 0 1 2 3 4 5 32