cost accounting project

advertisement

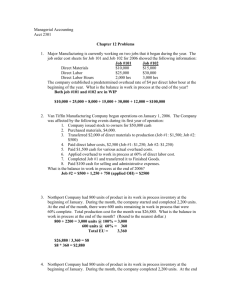

ACKNOWLEDGEMENT This project is a pure effort, I thank ALLAH ALMIGHTY that he gave us strength and ability to perform our duties in a proper manner. We dedicate this effort to my extremely dedicating teacher SIR ADNAN TABLE OF CONTENTS i. ii. INTRODUCTION History Company details Cost of goods sold statement i. ii. Formula Calculations Trends analysis i. ii. iii. iv. WIP FOH Raw materials Finished goods inventory INTRODUCTION Kohinoor textile mills Kohinoor Textile Mills was established in 1953, initially with 25,000 spindles and 600 looms with further expansion in 1954. The company embarked upon a program of modernization and in the last decade, replacement and refurbishment has seen the installation of high technology processing, printing and finishing facilities. Commercial processing for customers, which was not originally envisioned, has also begun. Presently the unit comprises Appx.150,000 spindles along with complete processing capabilities for scouring and bleaching, mercerizing, dying printing and stitching. Weaving no longer exists at the plant which has since been relocated to Kohinoor Raiwind Mills (A Division of Kohinoor Textile Mills Limited). Company Detail Plant is located at Peshawar Road Rawalpindi. The Spinning plant has equipment from Cresol U.K. and Toyota Japan. The company's products are sold in both local and export markets. Regular exports sales to South East Asia UK / Europe U.S.A, Hong Kong, Japan and Australia is a testimony to an ever growing list of satisfied customers who perceive KTML as a manufacturer of quality textile. In 1992 the Company participated in the acquisition of Maple Leaf Cement Factory Limited from Privatization Commission, Government of Pakistan. Kohinoor Textile Mills Limited was initially certified to ISO 9001 by Lipoids Register Quality Assurance, UK on December 16, 1998. Now Kohinoor Textile Mills Limited is certified under the revised ISO standards ISO 2000 from June 2003. Cost of Goods Sold Statement of Manufacturing Companies: Cost of goods sold of a manufacturing company is normally divided into five sections: 1. Direct Materials Section: This section comprises of beginning inventory, purchases, and any purchases returns or allowances, and ending inventory 2. Direct Labor Section: This section indicates the cost of those employees whose work can identified directly with the product manufactured. 3. Factory Overhead Section: Factory overhead section comprises of all those costs that assist in an indirect manner in the manufacturing of the product, e.g., factory supplies and depreciation of machinery. The factory overhead section does not indicate the amount of fixed and variable factory overhead. It must be assumed that the items are stated at actually experienced costs. 4. Work in process inventories section: This section represents costs in process at the beginning and costs still in process at the end of the fiscal period. 5. Finished Goods Inventories: This section represents the finished goods inventory at the beginning and at the end of the period. FORMULA Formula for calculating COGS is given below: Cost of goods sold (COGS) = Cost of goods manufactured + Opening finished goods inventory Ending finished goods inventory Or Cost of goods sold = Direct materials cost + Direct labor cost + Factory overhead cost + Opening work in process inventory - Ending work in process inventory + Opening finished goods inventory - Ending finished goods inventory Data & calculations + Direct Material + Direct Labor + Factory Overhead Total Manufacturing Cost + WIP (Beginning Inventory) + WIP (Ending Inventory) Cost of goods manufactured + Beginning finished goods inventory Cost of goods available for sale - Ending Finished goods inventory Cost of goods sold COGS Manufactured Finished Goods Opening Finished Goods Ending WIP Opening WIP Closing Raw materials FOH 2009 7191015 622,747 614,769 471,943 546,792 3192060 1824883 Cost of goods sold of year 2009 = 7198993 Cost of goods sold of year 2008 = 6395622 2008 6,437,011 581,358 622,747 458,329 471,943 2852417 1759089 TRENDS: Work in process years WIP 2009 741849 2008 13614 80000 60000 Column3 40000 Column2 Column1 20000 0 2009 2008 As the graph shows for the year 2009 the WIP which is Units of product that are only partially complete and will require further work before they are ready for sale to a customer is more as compared to year 2008 .this shows a lot of number of items were unfinished in 2009 as compared to 2008 Finished goods: Years Finished goods 2009 7978 2008 41389 50000 40000 Series 3 30000 Series 2 20000 Series 1 10000 0 2009 2008 A reflection of the amount of manufactured product in stock that is available for customer purchase. On an income statement, the finished goods inventory is considered an asset to the company. So considering that for the year 2009 its value has a marked decrease as compared to 2008 which shows that their purchase has been increased. Raw material Year Raw material 2009 3192060 2008 2852417 3300000 3200000 3100000 3000000 Series 3 2900000 Series 2 2800000 Series 1 2700000 2600000 2009 2008 It is the total cost of all component parts currently in stock that have not yet been used in workin-process or finished goods production. For year 2009 they are not properly utilized as compared to raw material utilization in 2008 Factory over heads: Years FOH 2009 1824883 2008 1759089 1840000 1820000 1800000 Series 3 1780000 Series 2 1760000 Series 1 1740000 1720000 2009 2008 The rise in graph for the year 2009 as compared to 2008 is due to increase in inflation Manufacturing overhead includes such things as the electricity used to operate the factory equipment, depreciation on the factory equipment and building, factory supplies and factory personnel (other than direct labor). Because of rising inflation its value is increased in 2009. Cost of Production Report Quantity Scheduling Units applied + Completed Units + WIP Units + Loss Units Cost Charge to production + Direct Material + Direct Labor + FOH Total Cost A B C A+B+C=M Cost Accounted for as fallow Cost transferred Completed Units*K= N Direct Material WIP*H=O Direct Labor WIP*I=P FOH WIP*J=Q Additional Computations Equivalent production: Materials, Labor, FOH = Completed + WIP Unit Cost: Materials (H) = A/Equivalent Production of Material Labor (I) = B/Equivalent Production of Labor FOH (J) = C/Equivalent Production of FOH Cost per Unit H I J H+I+J=K