Lucas, American Economist, Wins Nobel --

advertisement

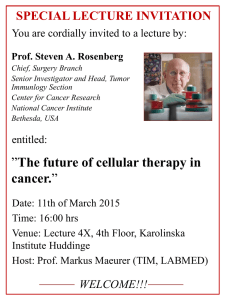

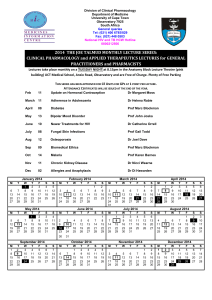

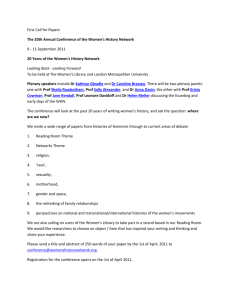

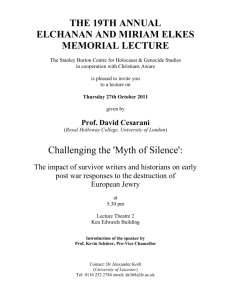

Lucas, American Economist, Wins Nobel --`Rational Expectations' Idea Focuses on Consumers Over Central Planners By Richard Gibson 10/11/1995 The Wall Street Journal Page A2 (Copyright (c) 1995, Dow Jones & Company, Inc.) Robert E. Lucas Jr., a professor at the University of Chicago whose economic theories give the common man much more influence on economic policy than central planners once had, won this year's Nobel Memorial Prize in Economic Science. The Royal Swedish Academy of Sciences said yesterday that they awarded the prize to the 58-year-old economist for his "insights into the difficulties of using economic policy to control the economy." The Academy called Prof. Lucas "the economist who has had the greatest influence on macroeconomic research since 1970." Macroeconomics is the study of the economy as a whole. Building on ideas first developed by another economist in the 1960s, Prof. Lucas formed what came to be called a theory of "rational expectations." Today, his theories underlie economic and business planning throughout much of the modern world. In essence, the "rational expectations" theory shows how expectations about the future influence the economic decisions made by individuals, households and companies. Using complex mathematical models, Prof. Lucas showed statistically that the average individual would anticipate -and thus could easily undermine -- the impact of a government's economic policy. For example, temporarily cutting taxes to spur consumption might prove a flawed policy because individual purchasing power depends more on the amount of money consumers expect to have in the future than it does on short-term policy changes. Before Prof. Lucas's work was widely accepted, traditional economic theory discounted the impact of individuals in formulating policy. In a 1972 study, Prof. Lucas upset the economic establishment when he took on the "Phillips Curve," which implied that there was a positive relationship between inflation and employment. Government officials seeking to create jobs should pursue an expansionary inflation policy, the theory ran. But Prof. Lucas showed that while such policies would work in the short term, they wouldn't work in the long term. Prof. Lucas's selection by the academy extends a remarkable winning streak for his alma mater and current employer, the University of Chicago. He is the fifth Nobel economics prize winner for the school this decade and the eighth overall. Among the earliest was Milton Friedman, looked on as the godfather of the school's prominence as an economic powerhouse. Other early winners from the University of Chicago include Theodore W. Schultz in 1979 and George J. Stigler in 1982. Some economists consider the choice of Prof. Lucas somewhat controversial considering he has argued in recent years against attempts by central banks to finetune economies and intervene in foreign-exchange markets -activities in which many countries, including the U.S., participate. The U.S. Treasury, backed by the Federal Reserve, believes in the efficacy of well-timed, unexpected and publicized intervention in foreign-exchange markets as a way to signal the government's views on the dollar. The Clinton Treasury has intervened less often than the Bush Treasury, and appears less confident that it can keep the dollar trading in a given range. Still, Prof. Lucas considers such actions "a mistake," adding that central bankers and Treasury officials "haven't learned anything in 200 years." While Prof. Lucas professed surprise at his victory, colleagues said he was an odds-on favorite. "He's been a leading candidate for years," said David Romer, a University of California economist who runs a pool for macroeconomists on who will win the prize each year. Indeed, many of the $1 bets this year were on Prof. Lucas, Prof. Romer said. Why? "Because he's revolutionized macroeconomics." Anil Kashyap, a colleague of Prof. Lucas at Chicago, said this year's prize winner has "forced everybody to be much more precise about exactly what assumptions they were making, particularly regarding forward-looking behavior. "It was quite common 20 years ago to write down a model and say this is the way the economy works, and if I fiddled with this tax rate I could give people more money and they would then go off and spend it," Prof. Kashyap said. But that approach, he said, ignored "that if government spending didn't change they might eventually have to pay more taxes. That doesn't make any sense," he said, giving credit to Prof. Lucas for changing the way economists view policymaking. For his part, Prof. Lucas said yesterday he is generally pleased with current economic policymaking in this country. "The U.S. is a low-inflation country without major unemployment. We're doing great, and have been for a long time." Prof. Lucas lately has turned his attention to issues of economic growth and development, he said. Specifically, he is studying "the connection between trade and growth. We need to figure it out, and we haven't." The Nobel prize in economics, which carries a $1 million award, was endowed in 1968 and is the only Nobel prize that wasn't created by industrialist Alfred Nobel in 1901. Nobel prizes in chemistry and physics are due out today followed by the most famous Nobel prize, the peace price, which will be announced in Oslo on Friday. --- University of Chicago Wins Again University of Chicago economists have won Nobel prizes in five of the past six years 1990 Merton M. Miller, for "work in the theory of financial economics." 1991 Ronald H. Coase, for "discovery and clarification of the significance of transaction costs and property rights for the institutional structure and functioning of the economy." 1992 Gary S. Becker, for "having extended the domain of microeconomic analysis to a wide range of human behavior and interaction, including non-market behavior." 1993 Robert W. Fogel, for "having renewed research in economic history by applying economic theory and quantitative methods in order to explain economic and institutional change." 1995 Robert E. Lucas Jr. for "having developed and applied the hypothesis of rational expectations." Source: Associated Press