R-13-1995 - Northern Ireland Court Service Online

advertisement

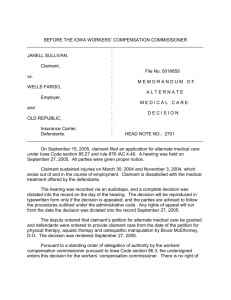

LANDS TRIBUNAL FOR NORTHERN IRELAND LANDS TRIBUNAL AND COMPENSATION ACT (NORTHERN IRELAND) 1964 IN THE MATTER OF A REFERENCE R/13/1995 BETWEEN GRAINNE NEILSON - APPLICANT AND NORTHERN IRELAND HOUSING EXECUTIVE - RESPONDENT PREMISES: 25 DUNMORE STREET, BELFAST Lands Tribunal - Mr Michael R Curry FRICS FSVA IRRV ACI.Arb Belfast - 21st December 1995 The dispute concerned a purchase by agreement in advance of vesting by the Northern Ireland Housing Executive, the acquiring authority for the Clonard Redevelopment Area, of an improved and extended pre-war kitchen terrace house at 25 Dunmore Street. Following completion of the disposal of this property to the Northern Ireland Housing Executive in September 1994 the Claimant relocated at a post war semi-detached house at 27 Floral Park. For convenience only the Tribunal refers to the former as the "old" house and the latter as the "new" house. The Claimant had purchased the old house in 1990 and had funded the purchase by a 100% endowment mortgage of £17,500 through the National & Provincial Building Society. At that time, the Society had required a single premium Mortgage Insurance Guarantee, also known as a Mortgage Indemnity Policy, of £302, which was added to the loan and not refundable on early redemption. The market value agreed for the old house was £18,500 and the mortgage redemption amount, which included some fees was £17,650.20. The purchase price of the new house was £32,500 which was funded by a loan of £30,850 from the Ulster Bank Ltd which required a mortgage indemnity policy premium of £243.75 as the loan to value ratio was greater than 80%. About 1991/2 the old house had been redecorated; the Tribunal was told the cost, at prices ruling at the acquisition date, would have been about £900. -1- Two matters had been referred to the Tribunal for determination. Both were put forward as Disturbance claims. The first was for the £243.75 incurred by the Claimant in obtaining a mortgage indemnity policy for the new house, and the second was for a proportion of the decoration costs at the old house, of £300. Appearances Mark Orr instructed by McCann & McCann appeared for the Claimant and called Mr Joseph Allen, an experienced Chartered Surveyor, to give expert evidence. Ms Heather Gibson instructed by Northern Ireland Housing Executive Legal Department, appeared for the Claimant and called Ms Deborah Tracey Rice, an experienced Chartered Surveyor, to give expert evidence. Matters Agreed between the experts The expert witnesses, without admission of the relevance, importance or otherwise of these matters to the issues in question, agreed that: the consideration for the old house represented and was understood by both parties to represent the estimated market value of the property in its actual state at that time, assessed in accordance with the compulsory purchase code, the old house was in good decorative order at the date of sale, and there was nothing extravagant or of peculiar taste in its decoration, the new house was in need of immediate redecoration at the date of purchase and costings put forward for its redecoration were not extravagant. The Applicable Principles So far as is relevant to this case, the principles of disturbance payments are as follows. The rules for assessing compensation are set out in the Land Compensation (Northern Ireland) Order 1982. The relevant rules are rules (2) and (6): "(2) The value of land shall, subject to rules 3 to 6, be taken to be the amount which the land if sold in the open market by a willing seller might be expected to realise;" -2- and "(6) The provisions of rule (2) shall not affect the assessment of compensation for disturbance or any other matter not directly based on the value of land." Rule (6) does not create the right to a disturbance payment (the origin is in the cases probably beginning with Jubb v Hull Dock Co (1846) 9 QB 443), instead it makes clear that the basis for assessing the 'personal loss of disturbance' is not restricted to open market value. Although the underlying principles of disturbance payments are well settled and illustrations may be found in the cases and in many of the textbooks, the application of these principles often causes problems both because it must reflect the continuously changing realities of contemporary social circumstances and because it raises questions of causation. "Questions of causation are particularly difficult and have vexed the best of human intellects for 2,400 years" Arnott v O'Keefe [1977] IR19. Disturbance is to be treated separately. In Munton v Newham London Borough Council (1976) 32 P&CR 269, Lord Denning endorsed that view: "The second point of law is whether, in order to be binding, there has to be one entire sum agreed that comprises not only the value of the property itself but also the compensation for disturbance. Under the Act of 1845 the inquiry was only as to the 'value of the land', and it was held that in that sum there was to be included the compensation for disturbance. So only one sum was to be awarded. That seems to be the effect of Inland Revenue Commissioners v Glasgow & South Western Railway Co (1887) 12 App Cas 315 and Horn v Sunderland Corporation [1941] 2 KB 26. But, although only one sum is awarded, it is very proper, in assessing it, to divide it into two parts, (i) the land itself, and (ii) disturbance. Starting with the Acquisition of Land Act 1919, and repeated in the Land Compensation Act 1961, Parliament itself has made a division between the two. In s5(6) of the Act it says: 'The provisions of rule (2)' - that is, about the value of the land - 'shall not affect the assessment of compensation for disturbance or any other matter not directly based on the value of land.' Since those Acts, the practice always has been for the compensation for disturbance to be assessed separately from the value of the land. That is as it should be. The value of the land can be assessed while the owner is still in occupation. The compensation for disturbance cannot be properly assessed until he goes out. It is only then that he can tell how much it has cost him to move, such as to get extra premises or to move his furniture. The practice is warranted by two cases in this court: Harvey v Crawley Development Corporation [1957] 1 QB 485 and Lee v Minister of Transport [1966] 1 QB 111. In my -3- opinion it is quite proper for the acquiring authority to agree in the first place with the owner on the value of the house itself, and to leave till later the compensation for disturbance. That can be assessed later when the acquiring authority go into occupation and the house owner moves." A dispossessed owner is entitled to be compensated for his disturbance loss due to the acquisition, provided, as Romer LJ said, in Harvey v Crawley Development Corporation 1957 1 All ER 504 "First that it is not too remote and secondly that it is the natural and reasonable consequence of the dispossession of the owner." In Bailey v Derby Corporation [1965] 1 WLR 213; 16 P&CR 192 the Court of Appeal considered the effect on compensation of the claimant's personal circumstances, which would include financial impecuniosity. Lord Denning MR, approved the principles laid down by Romer LJ in Harvey (above) and asked the question: "what is the loss which is 'the natural and reasonable consequence' of the acquisition?" His answer was: "only that loss immediately and directly consequent on his having to move". The extinguishment of the claimant's business was not the natural and reasonable consequence of the acquisition, it was due to the claimant's ill-health, an extraneous and independent cause. He said: "In so far as any loss in due, not to the acquisition, but to the state of health of the claimant, that seems to me an extraneous and independent matter which must be put on one side. It should not be taken into account in assessing the compensation. It is comparable to the impecuniosity mentioned in Liesbosch Dredger v Edison (Owners) [1933] A C 449 case. It is very different from what have been called the 'thin skull' cases, which, as Lord Wright said, are concerned with the actual physical damage." The loss must be foreseeable. See, for instance, Hoddom & Kinmount Estates v Secretary of State for Scotland [1992] 1 EGLR 252. There is a duty on a Claimant to take reasonable steps to mitigate loss but the onus is on the acquiring authority to show failure to mitigate, the standard of reasonableness is not high and a Claimant will not be prejudiced by his financial inability to take such steps. See, for instance, Lindon Print Ltd v West Midlands CC [1987] 2 EGLR 200. There is a rebuttable presumption that in expenditure on new premises the claimant receives value for money. See, for instance, Smith v Birmingham Corporation (1975) 29 P&CR 265 and Bibby & Sons Ltd v Merseyside County Council (1979) 251 EG 757 -4- The Mortgage Indemnity Premium (MIP) Usual Practice Correspondence from the Council of Mortgage Lenders was produced at the hearing and was accepted to set out the usual position. "If a borrower wishes to take out a mortgage above 70-75% of the value of the property they are buying, they will usually be charged a "high lending fee" by their mortgage lender. Although the lender may use this fee to buy a mortgage indemnity policy (MIP), this does not mean that the borrower has bought the insurance. Rather, payment of the fee simply enables a borrower to borrow more than the lender would otherwise be willing to lend, as it requires some form of additional security over and above the security offered by the property being bought and the borrower's personal "covenant" to repay all of the mortgage loan. An MIP is an insurance policy which a lender may take out for itself in case at some future stage a borrower falls behind with their mortgage payments and the lender has to repossess the property and sell it. The MIP protects the lender from incurring too much of a loss if the price it can obtain for the property is less than the amount which is still owed on the mortgage. It is not usual for the "high lending fee" to be refunded, either in full or in part, on early redemption of a mortgage." Mr Allen gave evidence that the practice was a relatively recent innovation adopted as a result of the domestic property crash in 1980's. The Amount of the Claim The amount claimed was the full premium which was based upon the purchase price of the replacement house. At the hearing the Tribunal indicated that if it was minded to approve the claim in principle it would consider that the amount must be restricted to an amount proportionate to the mortgage at the old house. The parties indicated that in that event they were confident they could agree what the appropriate figure should be. Applying the principles The Tribunal concludes that an appropriate proportion of the mortgage guarantee premium paid in respect of the new house is properly recoverable as disturbance for the following reasons: -5- The expense was actually incurred and there was nothing to suggest that it would have been incurred but for the dispossession. The expense was directly related to the acquisition, by the owner/occupier as claimant, of the new house which was a replacement for the old house. There can be no suggestion that she was not entitled to replace her house and she funded the purchase of the new in a similar fashion to the old house. The expense was a natural and foreseeable consequence of the dispossession. It was not suggested that the requirement for the expense was due to any impecuniosity on the part of the Claimant. Although the requirement flowed from the contract with the Lenders, and it would appear the effect was to protect the Lenders, the practicalities were that as a condition of lending in these circumstances, a mortgage guarantee premium was usually required. The Tribunal does not accept that the effect of the requirement being part of a separate contract was sufficient to break the causal chain between the dispossession and the expense. Many of the losses approved in the leading cases were obviously incurred as a result of separate contracts and the Tribunal does not accept that to be a useful test. The letter from the Council of Mortgage Lenders made plain that the requirement for a mortgage guarantee premium and the absence of a refund were only the usual position and some Lenders may have different requirements. But the Claimant had obtained a similar guarantee a few years earlier at the old house, and the requirement was a usual requirement. Although the expenditure on the premium was to an extent the Claimant's choice, the Tribunal accepts that it was both reasonable by the Claimant and foreseeable by an acquiring authority. There was no suggestion that the Claimant had failed to mitigate her loss. The Tribunal does not find that the claimant has obtained value for money in the sense of being in an improved position at the new house as a result of the expenditure. The Tribunal accepts that there are differences between the application of these principles to issues which would be relevant to either bridging loans or interest as part of the construction costs of replacement premises, and to the issue in this reference. -6- A parallel was suggested relating to contemporary rates of interest, but the Tribunal cannot accept that a claim might fail because interest rates were high at the relevant time and, in any event does not find that to be a useful analogy. The Decoration Costs In Mr Allen's view an owner seldom fully recovered the cost of decoration when selling their house and he distinguished between the normal sales circumstances and compulsory dispossession: in the latter the timing was not by choice. His approach was to estimate the total cost of decoration in the old house at the removal date and deduct an amount to allow for use and enjoyment up to then, to give the "existing worth to the Claimant at the date of sale". That figure was then apportioned between a figure that he estimated was added to the market value as a result of the decorations to give a measure of shortfall in the value of the decorations in situ to the applicant. This was claimed as a loss under the heading of Disturbance. The Tribunal does not accept Mr Allen's approach. Land acquired and disturbance must be separately assessed. The decorations at the old house were part and parcel of the land acquired. In so far as those decorations give rise to a claim they must be, and have been in this case, claimed and compensated under rule (2) ie market value and not "worth to the Claimant". Cost does not always equal value but value is the statutory basis upon which the Claimant is entitled to compensation. The legislative intention behind Rule (2) was to replace "worth to the Claimant" by "the amount which the land if sold in the open market by a willing seller might be expected to realise" as the measure of compensation and the evidence is that, on that basis, the claimant was fully compensated for all her decoration expense at the old house by the compensation price paid for her interest in accordance with Rule (2). There is no need to consider the application of the principles of assessing the claim as a disturbance claim as it is not a proper matter to consider as disturbance. Indeed, to do so would only confuse. Conclusions For the reasons outlined above, the Tribunal finds that the Claimant partially succeeds in her claim for the expense incurred in obtaining a mortgage indemnity policy, the part recoverable being an amount proportionate to the mortgage outstanding at the old house. In default of agreement on the amount, the parties have liberty to apply. -7- For the reasons outlined above, the Tribunal finds that the Claimant does not succeed in her claim for decoration costs at the old house, as disturbance. ORDERS ACCORDINGLY 1st February 1996 Mr M R Curry FRICS FSVA IRRV ACI.Arb LANDS TRIBUNAL FOR NORTHERN IRELAND Appearances: Mr Mark Orr of Counsel instructed by Messrs McCann & McCann, Solicitors, for the Claimant. Ms Heather Gibson of Counsel instructed by the NIHE Legal Department for the Respondent. -8-