guideline on better asset management

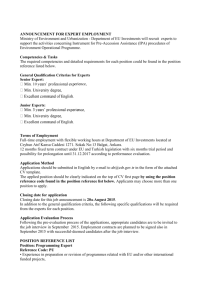

advertisement