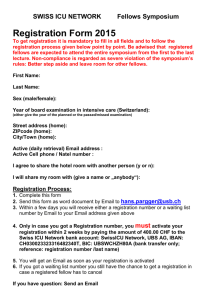

Bio for Rowland Fellows

advertisement

Executive Resume Rowland Fellows 1234 My Way Yourtown, NY 99999 Phone: (999) 999-9999 Email: rfellows@myhometown.com Leadership Profile Sales and Marketing Leadership, General Management, Business Development, Customer Satisfaction, Enterprise Transformation, Strategic Planning, High-Tech Startups, Cross-Functional Team Building Visionary, results-driven sales manager with a demonstrated record of success in creating marketing initiatives to penetrate new markets, strengthen existing market presence, and drive sales to new heights within the information technology industry. An accomplished general manager and sales executive, with a proven ability to build new business operations, lead turnaround efforts and significantly grow existing operations. Expertise in strategic business planning and cross-functional quality initiatives. Excellent ability to drive revenue through account development, long-term client relationships and powerful closing skills. Well-developed interpersonal skills with documented success in leading, motivating and inspiring teams to meet and surpass corporate objectives. Professional Experience Software Ventures International Manila, Philippines Vice President, Worldwide Sales and Marketing 2003 to present Software Ventures International is a Philippines-based outsourcing firm focused on three markets: information technology outsourcing, business process outsourcing, and customer contact center outsourcing. Key geographic market segments for the company include the US, Europe and Japan. Direct all aspects of sales, account management and marketing. Key initiatives implemented include: standard sales processes, implementation of a sales pipeline tracking and collaboration tool, comprehensive account management methods, metrics-based sales activity tracking, re-engineered website and Web strategysupporting sales initiatives, and enhanced marketing support functions. Electronic Data Systems Structural Dynamics Research (acquired by EDS in 2001) Santa Clara, California Vice President & General Manager, Western Region 1999 to 2002 Managed and provided leadership for a sales organization of 46 and a services staff of 68. Restructured sales and services organization to an account-focused team, eliminating separate product-focused sales and services groups. Integrated staff of two formerly competitive companies in a single, high-performing regional team. Implemented innovative sales programs to improve sales focus, sales activity levels, and improved competitive selling. Implemented sales campaigns to penetrate high tech marketplace in the Bay Area, such as Bechtel, Boeing, Lockheed Martin Space Systems, Northrop Grumman, Raytheon and Seagate. Sold the company’s largest software and services transactions at Boeing ($12 million), Goodrich Aerospace ($8 million), Lockheed Martin Space Systems ($6 million) and Thiokol Propulsion ($3 million). Organized and led western region cross-selling initiatives with other EDS lines of business at Bechtel, Storage Technology and Weyerhaeuser. Results included several multi-year, multi-million dollar contracts for software, services and outsourcing services. In year 2000, achieved revenues of $32 million against a $24 million goal. Continued this growth the following year, reaching $42 million in revenues. Rowland Fellows Page 2 Complete Business Solutions, Inc. (CBSI) Claremont Technology Group (acquired by CBSI in 1998) Sacramento, California Vice President 1995 to 1999 Led startup operations in California and grew operation into the company’s largest business unit. Projects included the replacement of mainframe systems with large-scale servers and networks, development of new object-oriented, n-tier, distributed client server business applications and selection and implementation of new application solutions from various software vendors. Procured and implemented complex enterprise systems for investment accounting and actuarial valuations. Landed significant contracts with the State of California Sacramento offices, Pacific Bell’s San Ramon locations and Providian Bank in San Francisco. Built CBSI's Southern California operation from a one-project operation to a multi-branch, multi-account region. Implemented account planning processes, sales training programs, and regional sales programs for the utilities, health care and manufacturing industry vertical markets. Integrated an acquisition into the western region, creating significant sales and delivery capability in Denver. Implemented a business development program for CBSI's e-business service offerings. Built the Claremont California consulting organization from zero to 100+ staff and over $15 million in annual revenue in two years. Profitability was consistently above company averages. Led a management team that successfully completed a 120,000-hour development project at the California Public Employees Retirement System (CalPERS) in ten months to increase fiduciary reporting accuracy. Managed and provided leadership for CBSI's western region consulting services organization that included approximately 800 people and generated approximately $40 million in annual revenue. Closed a $6 million multi-year, multi-service offering contract at CB Richard Ellis (a global real estate brokerage and services company based in El Segundo) for a combination of on-site and offshore services in the ERP (Peoplesoft) and CRM (Vantive) application areas. Led an effort to define and implement a new set of service offerings. Implemented an ERP/CRM development and support center in Bangalore, India. Consistently exceeded profitability goals. PRODATA, Inc. Sacramento, California General Manager 1992 to 1995 Provided leadership for PRODATA's Sacramento and Northern Nevada operations, directing all consulting services operations. Defined and implemented new services offerings, creating competitive differentiators for the company in a very competitive market. Expanded into new geographies in Nevada and Northern California. Developed the Reno office into a full branch office, and built the office to profitability. Accomplished rapid business recovery within weeks after the cancellation of a significant State of California contract. Sold significant services contracts at various State of California departments including: Employment Development Department, Department of Justice and the State Legislature. Won major new development and services contracts with the State of Nevada. Landed significant services contracts with Baxter Healthcare, Hewlett Packard, Mercy Healthcare and NEC. Achieved revenue growth and profitability targets in 1993 and 1994. Rowland Fellows Page 3 Prime Computer, Inc. Mountain View, California Sales Management 1984 to 1992 Held various positions with increasing responsibility in Prime’s western region. Significant accomplishments included: Successfully repaired damaged customer relationships with the State of California. Sold of over $20 million (in two years) to multiple State agencies. Completed a $2 million dollar sale of leading edge, open-systems hardware and software to Aerojet Corporation. Transformed the Portland branch in to an office that consistently over-achieved its targets. Won major new contracts at Tektronix, Standard Insurance, Northwest Natural Gas, Mount Hood Community College, Clark County, Columbia Machines, Department of Energy/Hanford and Gonzaga University. Achieved four “Pro Club” awards. International Business Machines San Francisco, California Sales and Sales Management 1973 to 1984 Held various positions with increasing responsibility in the San Francisco Bay Area. Significant accomplishments included: Sold major new data center contracts to the State of California. Built a reputation as an aggressive new-account sales person by selling expensive, large mainframe systems to competitive accounts at a time where very few new accounts were being won. Became known as the key competitive “fire fighter” and led all competitive sales campaigns in Northern California and the Pacific Northwest with an outstanding competitive win record. Managed several major new product announcements for the region. Devised a sales strategy, organizational approach and tactical plan for winning new accounts in the San Francisco Bay Area. Implemented the strategy and plan resulting in the sales of 27 new accounts ($1+ million) within one year. Managed a major reorganization in the San Francisco Bay Area that combined three product-oriented divisions in to a single customer-focused sales organization. Consistently achieved the largest managers' sales quota in the region. Achieved one “Golden Circle” and four “100 Percent Club” awards. Education Bachelor of Science, University of California at Davis Environmental Biology, Economics, Mathematics Trained in all major selling methodologies, including Miller Heiman (Large Account Management Program), Wilson Learning, Holden's Power-Base Selling and Solutions Selling. Key Accomplishment Summary Rowland Fellows Catapulted Company to $55 Million in Annual Revenue Situation: Claremont Technology Group was a small, privately held professional services company with locations in Beaverton, Oregon; Columbus, Ohio; and Basking Ridge, New Jersey. With ambitious growth goals, Claremont was anxious to enter the California market. It was necessary to formulate a strategy and provide leadership for the effort to start and grow a consulting business in California. Action Plan: Defined a general plan focused primarily on the industry segments of the company's expertise instead of its technology expertise. This allowed for more flexibility in using the company's credentials and deploying other company resources to new engagements in California. Hired three senior-level professionals who all had the unique ability to start a consulting engagement as an individual contributor and transition to project/engagement management roles as our clients requested additional services to be performed. This ensured excellent client satisfaction with the work being performed. Each of these managers had expertise in a key industry vertical. Acquired a few small engagements in our selected verticals. Excellent service resulted in high client confidence and within six months the office had a total staff of ten consultants. With the business profitably underway, created a technology differentiator in order to make it very difficult for other services firms to compete with us. The combination of business expertise, technology expertise and our delivery track record resulted in a high demand for our services. Results: The California practice grew to approximately 200 employees and $20 million in annual revenue in within 2.5 years. The parent company had grown during that same time period from 180 to 600 employees and from $15 million to $55 million in revenue. My consulting and professional services operations accounted for approximately 50 percent of the company's growth. Key Accomplishment Summary Rowland Fellows Revamped Western Region to Promote Growth and Increase Customer Satisfaction Situation: Structural Dynamics Research Corporation (SDRC) was a software and services company offering a wide range of solutions for product development. Its multiple sales and services organizations were product-oriented and operated in the same geographies with the same customers. This resulted in high field operation costs and a sub-optimal situation with regard to customer satisfaction. The optimal goal was to transition the western region to a single, customer-oriented sales and services organization. Action Plan: Consolidated all sales, business consulting and implementation services personnel in to a single organizational structure in the western region. Expanded the sales organization by 50 percent and organized sales units around customers and market segments. All sales units sold all products within their assigned customers and market segments. Major account teams were instituted for the region's two largest accounts, Boeing and Lockheed Martin. A region-wide large account team was created to market to the region's large, complex sales prospects. Two geographically-based sales units were created to sell SDRC's products and services to the remainder of the customers in the region. Increased training for business consulting team, enabling them to be more responsive to customers and less dependent on resources from outside the region. Created a single organization and measurement system for the implementation services organization. Created a matrix organization that accounted for customer relationships and product expertise. Business area managers were assigned. These managers were responsible for customer relationships as well as personnel management. They had the traditional business measurements of revenue, margin attainment, and project performance. Practice leaders were created with the responsibility for the product and technical performance of the organization. These managers had responsibility for training, professional development, and shared the project performance measurements with the business managers. Performance-based measurements for all customer-facing personnel (including personnel that had previously been on salary-only compensation plans) resulted in increased participation and accountability. This included sales, business consulting and services staff. Performance metrics were established and evaluated throughout the entire customer interaction life cycle, including the sales cycle, system development projects and application deployment processes. Results: The company enjoyed a sustained revenue growth of 33 percent per year. In year 2000, achieved revenues of $32 million against a $24 million goal. Continued this growth the following year, reaching $42 million in revenues. Profit margins were significantly improved for the region. Customer satisfaction reached new levels and customer relationships grew with several of the company's largest accounts. Key Accomplishment Summary Rowland Fellows Maximizing Reporting Accuracy by Implementing Improved Financial Controls Situation: The California Public Employees' Retirement System (CalPERS) is one of the country's largest investment funds, managing over $136 billion in investments. In the management of a fund this large, there are thousands of individual transactions each day, creating a record keeping nightmare. While CalPERS outsources most of the financial record keeping to a master custodian, it is still held accountable for the accuracy of the custodian's records. Small, unnoticed errors in the financial records can amount to millions of dollars in losses. In order to effectively execute its fiduciary responsibility, CalPERS needed an effective, accurate method to certify the accuracy of the custodian's records. Action Plan: A series of planning meetings were held with CalPERS executives to identify the objectives and critical success factors for the project. Project strategies were proposed, negotiated and agreed to by the executive team. An overall project plan was built that encompassed business issues, technical initiatives, personnel requirements, executive sponsorship and project commitments necessary to ensure success. Assembled a team to investigate the requirements for State of California public bid processes and prepare a proposal. An investment accounting system supplier was selected for implementation. A combined vendor, systems integrator, CalPERS team was assembled for the implementation project. Provided project management oversight for the implementation team. Results: The CalPERS investment accounting reconciliation system was installed successfully and made operational on time and within budget. CalPERS now has the tools in place to certify the accuracy of their custodian's financial records and carry out its fiduciary responsibility. Industry Insights Rowland Fellows Making a Difference in Today’s Market Offering Solutions, Not Products In the technology sector, the competition is tough and it is a buyer’s market. Competitors will always be willing to “buy the business” by offering a lower price on products or services. Success in a highly competitive, recessionary market will be assured for those who focus on assisting customers with their challenges--finding solutions instead of merely offering products. There are myriad products/services that can accomplish the same task. Providing strategies for solving customers’ daily problems will foster growth and the forming of solid business partnerships while other companies falter. Stand Out from the Crowd Sales strategies that feature products and services “similar to IBM” or “just like EDS” are destined to fail. After all, customers might as well just buy from IBM or EDS. Customers are seeking differentiators (tangible or intangible) that will fit their needs in the most effective way. If these differentiators are too esoteric or difficult to explain and understand, they will not be meaningful. Realistic Expectations Almost everyone has been burned before on a technology investment. In these less-than-favorable economic conditions, most organizations are hesitant or unwilling to make additional investments without the confidence of tangible returns. Attempts to oversimplify the complexity or providing lip service to the risks of a proposal will destroy a company’s credibility. The most crucial aspect of customer relationships is their assessment of a vendor’s commitment and ability to make them successful. Shorter Time-to-Value A long wait for a return is not acceptable in today's market. A wise investment decision that delivers immediate cost savings can make the difference between a profitable quarter and an unprofitable one. A vendor’s focus should be on creating immediate returns for customers. Additional enhancements or improvements can be implemented along the way that will foster customer satisfaction and loyalty. Benefits should not be held up waiting for your offering to be “perfect.” Organizational Readiness Many enterprise solutions require a high degree of organizational cooperation. Despite a product’s excellence, the customer’s organization may be dysfunctional, impeding a successful implementation. Proactive involvement may be necessary to see to it that a customer’s organization is able to use the product successfully and see its value early on. Failure to do so restricts customer confidence and an ongoing relationship. Filling the Pipeline Most sales problems begin with an inadequate pipeline. The key is volume--new prospects should be cultivated proactively. The likelihood of closing sales increases geometrically when the pipeline is continually fed. Without an adequate pipeline, your sales team is likely to spend time spent focusing on poorly qualified opportunities. Industry Insights Rowland Fellows The Business Case for Open Source Software Open Source Defined The idea behind open source software is simple. When programmers can read, redistribute, and modify the source code for a piece of software, the software evolves. People improve it, adapt it, and fix bugs. Open source software promotes rapid evolution of source code. To be certified by the Open Source Initiative (a non-profit corporation), the software must be distributed under a license that guarantees the right to read, redistribute, modify, and use the software freely. Applications of Open Source Software Open source software is extensively used for production systems and applications today. Much of the Internet is run on open source software and many of the industry-standard communications protocols are open source. Examples of these systems and technologies include the Linux operating system, the Apache web server, DNS, TCP/IP, sendmail, PERL, etc. Many more open source solutions are becoming available all the time. Compared to the pace of conventional, proprietary software development cycles, the speed at which open source developments occur seems amazing. Open source development has resulted in a rapid evolutionary process that produces improved software compared to the traditional model. Information Technology Costs The financial benefits of open source can be astonishing. For example, an organization considering a major proprietary software purchase or upgrade for $1,000,000 will typically pay another 18 percent of the license fees per year in maintenance and another 15 percent per year in support costs. These add-on costs effectively double the cost of a software acquisition over a three-year period. An equivalent open source solution can be 75 percent less expensive over the same time period. Proprietary vs. Open Source--3-year cost of ownership $1,000,000 $800,000 Software Manitenance Services $600,000 $400,000 $200,000 $0 Proprietary Open Source Open Source Myths There are several misconceptions on the part of many CIOs and technical managers regarding open source software. A few of the common ones include: “Open source software is not secure.” In actuality, the open source model results in increased security. The code is in the public view and it is exposed to extreme scrutiny. Problems are identified and corrected quickly rather than kept secret until someone discovers them in a crisis. “Open source software is not reliable.” Open-source software is peer-reviewed. Under such public scrutiny, it tends to be more reliable than proprietary software. Business users will find that mature, open source products are far more reliable than their proprietary counterparts. “Open source software is poorly supported.” Developed and maintained in the public domain, there is typically a speedy resolution of problems and fast implementation of enhancements. Linux users in a business environment have found that the support they were able to receive is far more impressive than what they were used to with commercial software.