Question (formulation with logical variables): An investor has

advertisement

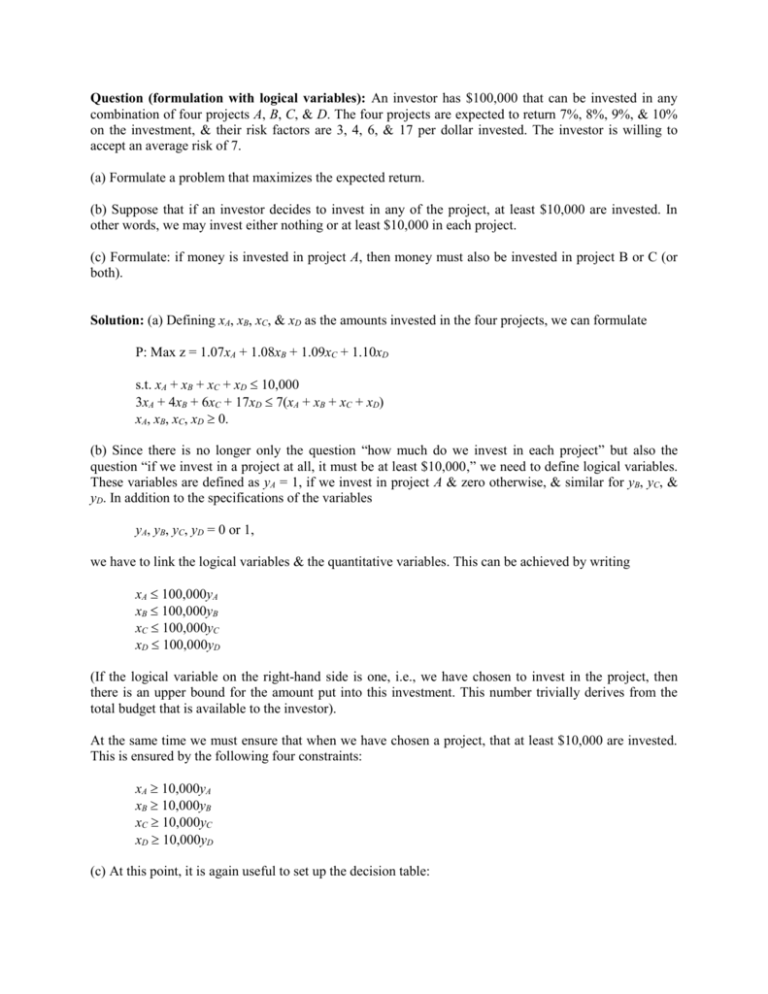

Question (formulation with logical variables): An investor has $100,000 that can be invested in any combination of four projects A, B, C, & D. The four projects are expected to return 7%, 8%, 9%, & 10% on the investment, & their risk factors are 3, 4, 6, & 17 per dollar invested. The investor is willing to accept an average risk of 7. (a) Formulate a problem that maximizes the expected return. (b) Suppose that if an investor decides to invest in any of the project, at least $10,000 are invested. In other words, we may invest either nothing or at least $10,000 in each project. (c) Formulate: if money is invested in project A, then money must also be invested in project B or C (or both). Solution: (a) Defining xA, xB, xC, & xD as the amounts invested in the four projects, we can formulate P: Max z = 1.07xA + 1.08xB + 1.09xC + 1.10xD s.t. xA + xB + xC + xD 10,000 3xA + 4xB + 6xC + 17xD 7(xA + xB + xC + xD) xA, xB, xC, xD 0. (b) Since there is no longer only the question “how much do we invest in each project” but also the question “if we invest in a project at all, it must be at least $10,000,” we need to define logical variables. These variables are defined as yA = 1, if we invest in project A & zero otherwise, & similar for yB, yC, & yD. In addition to the specifications of the variables yA, yB, yC, yD = 0 or 1, we have to link the logical variables & the quantitative variables. This can be achieved by writing xA 100,000yA xB 100,000yB xC 100,000yC xD 100,000yD (If the logical variable on the right-hand side is one, i.e., we have chosen to invest in the project, then there is an upper bound for the amount put into this investment. This number trivially derives from the total budget that is available to the investor). At the same time we must ensure that when we have chosen a project, that at least $10,000 are invested. This is ensured by the following four constraints: xA 10,000yA xB 10,000yB xC 10,000yC xD 10,000yD (c) At this point, it is again useful to set up the decision table: A 0 0 0 1 0 1 1 1 B 0 0 1 0 1 0 1 1 C 0 1 0 0 1 1 0 1 OK? NO A formulation that excludes the solution yA = 1, yB = yC = 0 but allows all other solutions is yA yB + yC . If the requirement would be changed to “if money is invested in project A, then money must also be invested in project B or C, but not both (as opposed to “or both”), . A 0 0 0 1 0 1 1 1 B 0 0 1 0 1 0 1 1 C 0 1 0 0 1 1 0 1 OK? NO NO As is clear from the decision table, the bottom row is now also undesirable. It can be excluded by the additional constraint yA + yB + yC 2. If this problem were solved, its optimal solution is y = (0, 1, 1, 1), & x = (0, 10,000, 79,090.91, 10,909.09) for a total return of $109,009.10 (i.e., a gain of about 9%). This solution is optimal for both version of this constraint.