CHAPTER 13

advertisement

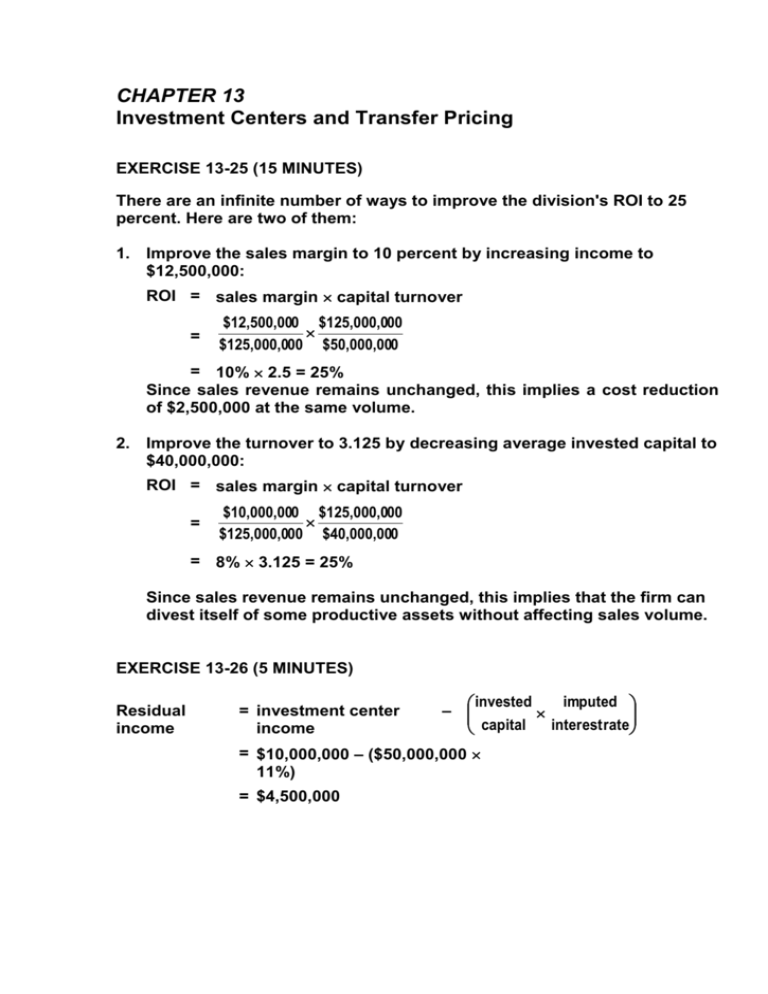

CHAPTER 13 Investment Centers and Transfer Pricing EXERCISE 13-25 (15 MINUTES) There are an infinite number of ways to improve the division's ROI to 25 percent. Here are two of them: 1. Improve the sales margin to 10 percent by increasing income to $12,500,000: ROI = sales margin capital turnover = $12,500,000 $125,000,000 $125,000,000 $50,000,000 = 10% 2.5 = 25% Since sales revenue remains unchanged, this implies a cost reduction of $2,500,000 at the same volume. 2. Improve the turnover to 3.125 by decreasing average invested capital to $40,000,000: ROI = sales margin capital turnover = $10,000,000 $125,000,000 $125,000,000 $40,000,000 = 8% 3.125 = 25% Since sales revenue remains unchanged, this implies that the firm can divest itself of some productive assets without affecting sales volume. EXERCISE 13-26 (5 MINUTES) Residual income = investment center income imputed invested – capital interest rate = $10,000,000 – ($50,000,000 11%) = $4,500,000 EXERCISE 13-34 (10 MINUTES) 1. Transfer price = outlay opportuni + cost ty cost = $450* + $120† = $570 *Outlay cost = unit variable production cost † Opportunity cost = forgone contribution margin = $570 – $450 = $120 2. If the Fabrication Division has excess capacity, there is no opportunity cost associated with a transfer. Therefore: Transfer price = outla opportunit + y y cost cost = $450 + 0 = $450 EXERCISE 13-35 (25 MINUTES) 1. The Assembly Division's manager is likely to reject the special offer because the Assembly Division's incremental cost on the special order exceeds the division's incremental revenue: Incremental revenue per unit in special order ..... $1,000 Incremental cost to Assembly Division per unit in special order: Transfer price ..................................................... $770 Additional variable cost..................................... 300 Total incremental cost ............................................ 1,070 Loss per unit in special order ................................ $ (70) 2. The Assembly Division manager's likely decision to reject the special order is not in the best interests of the company as a whole, since the company's incremental revenue on the special order exceeds the company's incremental cost: Incremental revenue per unit in special order ... $1,000 Incremental cost to company per unit in special order: Unit variable cost incurred in Fabrication $590 Division .................................................................. Unit variable cost incurred in Assembly 300 Division .................................................................. Total unit variable cost ......................................... 890 Profit per unit in special order ............................. $ 110 3. The transfer price could be set in accordance with the general rule, as follows: Transfer price = outlay opportuni + cost ty cost = $590 + 0* = $590 *Opportunity cost is zero, since the Fabrication Division has excess capacity. Now the Assembly Division manager will have an incentive to accept the special order since the Assembly Division's incremental revenue on the special order exceeds the incremental cost. The incremental revenue is still $1,000 per unit, but the incremental cost drops to $890 per unit ($590 transfer price + $300 variable cost incurred in the Assembly Division). PROBLEM 13-37 (45 MINUTES) Division I Sales revenue .......................................... $2,000,000 Income ...................................................... $ 400,000 Average investment ................................ $1,000,000 Sales margin ............................................ 20%a Capital turnover ....................................... 2b ROI ............................................................ 40%c Residual income ...................................... $ 300,000d Explanatory notes: Division II Division III $320,000e $1,600,000l $ 80,000 $ 480,000k $160,000f $2,000,000j 25% 30% 2 .8i 50%g 24% $ 64,000h $ 280,000 income $400,000 = = 20% sales revenue $2,000,000 sales revenue $2,000,000 b Capital turnover = = =2 invested capital $1,000,000 a Sales margin = c ROI = sales margin capital turnover = 20% 2 = 40% d Residual income capital) e Sales margin = income – (imputed interest rate)(invested = $400,000 – (10%)($1,000,000) = $300,000 income = sales revenue $80,000 sales revenue Therefore, sales revenue = $320,000 25% = f Capital turnover = sales revenue invested capital = $320,000 invested capital Therefore, invested capital = $160,000 = sales margin capital turnover g ROI ROI = 25% 2 = 50% Residual = income – (imputed interest rate)(invested capital) income h = $80,000 – (10%)($160,000) = $64,000 ROI = sales margin capital turnover 24% = 30% capital turnover i Therefore, capital turnover = .8 j ROI = income = 24% invested capital Therefore, income = (24%)(invested capital) = income – (imputed interest rate)(invested capital) Residual income = $280,000 Substituting from above for income: (24%)(invested capital) – (10%)(invested capital) = $280,000 Therefore, (14%)(invested capital) = $280,000 So, invested capital = $2,000,000 income k ROI = 24% = invested capital income $2,000,000 Therefore, income = $480,000 l Sales = margin income sales revenue 30% = $480,000 sales revenue Therefore, sales revenue = $1,600,000 PROBLEM 13-40 (35 MINUTES) 1. Current ROI of the Western Division: Sales revenue……………… Less: Variable costs ($500,000 x $375,000 75%) Fixed costs 100,000 Income…………………………………… ROI = Income ÷ invested capital = $25,000 ÷ $100,000 = 25% Western Division’s ROI if competitor is acquired: Sales revenue ($500,000 + $200,000) Less: Variable costs [$375,000 + ($200,000 x $495,000 60%)]………………..………… Fixed costs ($100,000 + 170,000 $70,000) Income…………………………………… $500,000 475,000 $ 25,000 $700,000 665,000 $ 35,000 ROI = Income ÷ invested capital = $35,000 ÷ [$100,000 + ($50,000 + $30,000)] = 19.40% 2. Divisional management will likely be against the acquisition because ROI will be lowered from 25% to 19.40%. Since bonuses are awarded on the basis of ROI, the acquisition will result in less compensation. 3. An examination of the competitor’s financial statistics reveals the following: Sales revenue………………………………… Less: Variable costs ($200,000 x $120,000 60%) Fixed costs 70,000 Income…………………………………… ROI = Income ÷ invested capital = $10,000 ÷ $50,000 $200,000 190,000 $ 10,000 = 20% Corporate management would probably favor the acquisition. Megatronics has been earning a 13% return, and the competitor’s ROI of 20% will help the organization as a whole. Even if the $30,000 upgrade is made, the competitor’s ROI would be 15% if past earnings trends continue [$10,000 ÷ ($50,000 + $30,000) = 12.5%]. 4. Yes, the divisional ROI would increase to 23.30%. However, the absence of the upgrade could lead to long-run problems, with customers being confused (and perhaps turned-off) by two different retail environments—the retail environment they have come to expect with other Megatronics outlets and that of the newly acquired, non-upgraded competitor. Sales revenue ($500,000 + $200,000) Less: Variable costs [$375,000 + ($200,000 x $495,000 60%)]………………………… Fixed costs ($100,000 + 170,000 $70,000)......... Income…………………………………… ROI = Income ÷ invested capital = $35,000 ÷ ($100,000 + $50,000) = 23.30% 5. Current residual income of the Western Division: Divisional profit………………………… Less: Imputed interest charge ($100,000 x 15%) Residual income……………………… $700,000 665,000 $ 35,000 $25,000 15,000 $10,000 Residual income if competitor is acquired: Divisional profit ($25,000 + $35,000 $10,000)……………........ Less: Imputed interest charge [($100,000 + ($50,000 + $30,000)) x 10%] 18,000 Residual income………………… $17,000 Yes, management most likely will change its attitude. Residual income will increase by $7,000 ($17,000 - $10,000) as a result of the acquisition.