ChangeWave Research: Cosmetic Medicine

April 15, 2005

ChangeWave Research Report:

Cosmetic Medicine

Cosmetic Procedures Market Still Skyrocketing

Overview

This report presents the latest ChangeWave Alliance survey on Cosmetic Medicine. Our

previous survey (May 2004) showed escalating interest in cosmetic procedures and a

growing perception that they are becoming routine.

To follow-up, we went back to our healthcare members to examine how the healthcare

industry and patients are dealing with cosmetic surgery issues – including those

procedures that have the most momentum. The survey was completed March 21, 2005,

and a total of 116 Alliance members participated, including 58 doctors.

Key Findings:

Surging Interest in Cosmetic Procedures. More than a third of responding doctors

(38%) report a “Significant Increase” in patient inquiries/requests for cosmetic

procedures over the past 12 months – a 14-point surge since our May 2004 survey.

Another 38% say they have seen a “Small Increase.”

Cosmetic Procedure Growth Rates. More than two-thirds of doctor respondents

(69%) say the growth rate for cosmetic procedures is faster than the average growth

rate for medical services generally, 14-points more than our May 2004 survey.

Consumers Increasingly Considering Cosmetic Procedures at Younger Ages.

Fifty-six percent (56%) of responding doctors say the average age of patients making

inquiries or requests about cosmetic procedures has decreased over the past year,

compared with 41% in May 2004.

More Patients are Viewing Cosmetic Procedures as Routine. Nearly nine-in-ten

doctors (89%) report that patients in their work locales increasingly view cosmetic

procedures as something routine, compared with 82% previously.

Procedures With Most Momentum – Last 12 Months. Doctors chose Botox

Procedures (Net Difference Score = +64) and Gastric Surgical Procedures to Limit

Eating (+39) as the cosmetic procedures that have increased most over the past 12

months, followed by ‘Surgical Procedures to Treat the Face’ (+35) and ‘Collagen and

other Dermal Filler Procedures to Treat the Face’ (+26).

Dysport Sticking it to Botox? Better than one-in-four doctors (28%) see Dysport – if

approved – capturing more than 25% of the Botox market in the first year it becomes

available. This is an 8-point increase over our May 2004 survey results.

Copyright ©2005 ChangeWave Research

All rights reserved.

ChangeWave Research: Cosmetic Medicine

The Isolagen Process. If approved, one-third of responding doctors (34%) believe

that between 1 and 10% of patients that currently use Dermal Fillers/Botox treatments

would migrate to Isolagen. ChangeWave Research Director Michael Shulman finds

the projected market acceptance rate to be higher than current company estimates.

Hyaluronic Acid-Based Dermal Fillers. The survey results also suggest that

Hyaluronic Acid (HA) based dermal fillers could eventually be a competitive product. A

third of doctors (34%) believe that more than 20% of patients currently using Dermal

Fillers/Botox treatments will migrate to HA when it becomes available.

Bottom Line: The survey results show a continuing surge in patient interest and in the

overall growth rates for cosmetic procedures. Moreover, consumers are increasingly

considering cosmetic procedures at younger ages and viewing it as something routine.

Botox and Gastric Surgery are the cosmetic procedures that appear to have increased

most over the past 12 months. Dysport looks to be a serious competitor to Botox once it

becomes available. Hyaluronic Acid Based dermal fillers also could eventually become a

competitive product. Isolagen, if approved, looks to capture only a small percentage of

the current Botox market, but the Alliance findings suggest its market acceptance rate

could be higher than the Street currently estimates.

The ChangeWave Alliance is a group of 5,000 highly qualified business, technology, and medical professionals in

leading companies of select industries—credentialed professionals who spend their everyday lives working on the

frontline of technological change. ChangeWave surveys its Alliance members on a range of business and investment

research and intelligence topics, collects feedback from them electronically, and converts the information into

proprietary quantitative and qualitative reports.

Helping You Profit From A Rapidly Changing World ™

www.ChangeWave.com

Copyright ©2005 ChangeWave Research

All rights reserved.

2

ChangeWave Research: Cosmetic Medicine

Table of Contents

Summary of Key Findings ............................................................................................ 4

The Findings .................................................................................................................. 5

ChangeWave Research Methodology ....................................................................... 13

About ChangeWave Research ................................................................................... 14

Copyright ©2005 ChangeWave Research

All rights reserved.

3

ChangeWave Research: Cosmetic Medicine

I. Summary of Key Findings

Cosmetic Procedure Procedures with

Market Skyrocketing Most Momentum –

Last 12 Months

38% of doctors see a

“Significant Increase” in

patient inquiries for

cosmetic procedures over

past 12 months – a 14point surge since May ’04

Another 38% see a “Small

Increase”

Cosmetic Procedure

Growth Rates

69% of doctors say the

growth rate for cosmetic

procedures is faster than

the average growth rate

for medical services

generally

56% say the average age

of patients making

cosmetic procedure

inquiries has decreased

over the past year – a

15-pt increase since May

Botox Procedures (+64)

Gastric Surgical

Procedures to Limit

Eating (+39)

Surgical Procedures to

Treat Face (+35)

Collagen and other

Dermal Filler Procedures

to Treat Face (+26)

Least Momentum

Varicose Vein

Procedures (+4)

Bottom Line:

Continuing Surge in

Cosmetic Procedures

The survey results show a

continuing surge in patient

interest and in the overall

growth rates for cosmetic

procedures. Moreover,

consumers are

increasingly considering

cosmetic procedures at

younger ages and viewing

it as something routine.

Botox and Gastric

Surgery are the

procedures that appear to

have increased most over

the past 12 months.

Dysport looks to be a

serious competitor to

Botox once available.

Hyaluronic Acid Based

dermal fillers may also

eventually become a

competitive product.

Introduction

This report presents the latest ChangeWave Alliance survey on Cosmetic Medicine. Our

previous survey (May 2004) showed escalating interest in cosmetic procedures and a

growing perception that they are becoming routine.

To follow-up, we went back to our healthcare members to examine how the healthcare

industry and patients are dealing with cosmetic surgery issues – including those

procedures that have the most momentum. The survey was completed March 21, 2005,

and a total of 116 Alliance members participated, including 58 doctors.

Copyright ©2005 ChangeWave Research

All rights reserved.

4

ChangeWave Research: Cosmetic Medicine

II. The Findings

Total Respondents (n = 116)

Doctor Respondents (n = 58)

All Other Respondents (n = 58)

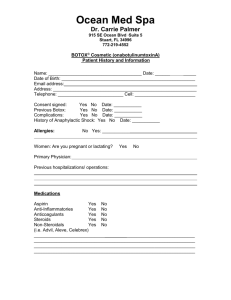

(1) Question Asked: Based upon what you are seeing in your work locale, has

there been an increase, decrease, or no change over the past 12 months in patient

inquiries or requests for cosmetic procedures?

A Significant Increase Over Past 12 Months (10% or More)

A Small Increase Over Past 12 Months (Less Than 10%)

No Change Over Past 12 Months*

A Decrease Over Past 12 Months

Don't Know

Other

Doctors

Current

Survey

Mar ‘05

38%

38%

22%

0%

2%

0%

Doctors

Previous

Survey

May ‘04

24%

51%

20%

0%

4%

0%

*Note that in the previous May 2004 survey this choice was “No Increase Over Past 12 Months”, whereas

in the current survey it is “No Change Over Past 12 Months”.

Surging Interest in Cosmetic Procedures. More than a third of responding doctors

(38%) report a “Significant Increase” in patient inquiries/requests for cosmetic procedures

over the past 12 months – a 14-point surge since our May 2004 survey. Another 38% say

they have seen a “Small Increase.”

(1A) Question Asked: Year over year consumption of medical services in general

is increasing by double digits. How would you characterize the growth rate for

cosmetic procedures?

Growth rate for cosmetic procedures is faster than the

average growth rate for medical services generally

Growth rate for cosmetic procedures is similar to the average

growth rate for medical services generally

Growth rate for cosmetic procedures is slower than the

average growth rate for medical services generally

Don't Know

Doctors

Current

Survey

Mar ‘05

69%

Doctors

Previous

Survey

May ‘04

55%

22%

37%

7%

2%

2%

6%

Cosmetic Procedure Growth Rates. More than two-thirds of doctor respondents (69%)

say the growth rate for cosmetic procedures is faster than the average growth rate for

medical services generally, 14-points more than our May 2004 survey. Another 7% say

the growth rate for cosmetic procedures is slower, and 22% say the rates are similar.

Copyright ©2005 ChangeWave Research

All rights reserved.

5

ChangeWave Research: Cosmetic Medicine

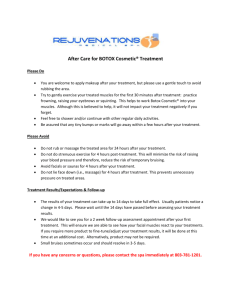

(2) Question Asked: Which of the following statements best reflects what you have

personally observed in your work locale over the past year?

(a) Patient Age

The average age of patients making inquiries or requests about

cosmetic procedures is increasing

The average age of patients making inquiries or requests about

cosmetic procedures is decreasing

The average age of patients making inquiries or requests about

cosmetic procedures has not changed

Don't Know

Doctors

Current

Survey

Mar ‘05

27%

Doctors

Previous

Survey

May ‘04

27%

56%

41%

16%

24%

2%

8%

Consumers Increasingly Considering Cosmetic Procedures at Younger Ages. Fiftysix percent (56%) of responding doctors say the average age of patients making inquiries

or requests about cosmetic procedures has decreased over the past year, compared with

41% in May 2004.

(b) Patient Attitudes

Patients are increasingly viewing cosmetic procedures as

something routine

Patients are increasingly becoming more reluctant to undergo

cosmetic procedures

Patients attitudes have not changed about the use of cosmetic

procedures

Don't Know

Doctors

Current

Survey

Mar ‘05

89%

Doctors

Previous

Survey

May ‘04

82%

0%

2%

7%

12%

4%

4%

More Patients are Viewing Cosmetic Procedures as Routine. Nearly nine-in-ten

doctors (89%) report that patients in their work locales increasingly view cosmetic

procedures as something routine, compared with 82% previously.

Copyright ©2005 ChangeWave Research

All rights reserved.

6

ChangeWave Research: Cosmetic Medicine

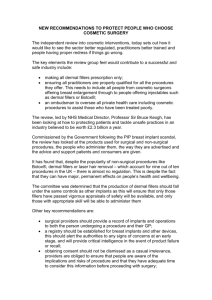

(3A) Question Asked: Based upon the number of patient requests or inquiries you

are seeing in your work locale, which of the following cosmetic procedures would

you say have increased the most over the past 12 months? (Check All That Apply)

Botox Procedures to Treat the Face/Facial Area*

Gastric Surgical Procedures to Limit Eating**

Collagen and other Dermal Filler procedures to Treat the

Face/Facial Area

Surgical Procedures to Treat the Face/Facial Area***

Liposuction Procedures to Reduce Body Fat****

Hair Removal Procedures

Breast Cosmetic Surgical Procedures*****

Varicose Vein Procedures******

Procedures to Eliminate Scars/Tattoos/Blemishes

None of the Above

Don't Know

Other

Doctors

Current

Survey

Mar ‘05

71%

53%

40%

Doctors

Previous

Survey

May ‘04

67%

39%

NA

40%

36%

31%

31%

28%

26%

0%

3%

7%

47%

41%

NA

33%

39%

37%

NA

6%

4%

(3B) Question Asked: And which cosmetic procedures would you say have

increased the least over the past 12 months? (Check All That Apply)

Varicose Vein Procedures******

Liposuction Procedures to Reduce Body Fat****

Procedures to Eliminate Scars/Tattoos/Blemishes

Hair Removal Procedures

Collagen and other Dermal Filler procedures to Treat the

Face/Facial Area

Gastric Surgical Procedures to Limit Eating**

Breast Cosmetic Surgical Procedures*****

Botox Procedures to Treat the Face/Facial Area*

Surgical Procedures to Treat the Face/Facial Area***

None of the Above

Don't Know

Other

Doctors

Current

Survey

Mar ‘05

24%

19%

19%

17%

14%

Doctors

Previous

Survey

May ‘04

24%

22%

20%

NA

NA

14%

14%

7%

5%

2%

26%

2%

27%

22%

10%

8%

NA

20%

0%

* In the previous survey, the response was “Procedures to treat aging of the face/facial area through

injections/implants.”

** In the previous survey, the response was “Procedures to limit the ability of the body to eat (e.g. gastric

bypass). “

*** In the previous survey, the response was “Procedures to treat aging of the face/facial area through

surgery.”

**** In the previous survey, the response was “Procedures to reduce body fat (i.e. liposuction). “

***** In the previous survey, the response was “Procedures to increase breast size.”

****** In the previous survey, the response was “Procedures to eliminate/reduce varicose veins. “

Copyright ©2005 ChangeWave Research

All rights reserved.

7

ChangeWave Research: Cosmetic Medicine

Net Difference Score – Doctors

Botox Procedures to Treat the Face/Facial Area

Gastric Surgical Procedures to Limit Eating

Surgical Procedures to Treat the Face/Facial Area

Collagen and other Dermal Filler Procedures to Treat

the Face/Facial Area

Liposuction Procedures to Reduce Body Fat

Breast Cosmetic Surgical Procedures

Hair Removal Procedures

Procedures to Eliminate Scars/Tattoos/Blemishes

Varicose Vein Procedures

Increased

the Most

71%

53%

40%

40%

Increased

the Least

7%

14%

5%

14%

36%

31%

31%

26%

28%

19%

14%

17%

19%

24%

Net

Difference

+64

+39

+35

+26

+17

+17

+14

+7

+4

Procedures With Most Momentum – Last 12 Months. Doctors chose Botox

Procedures (Net Difference Score = +64) and Gastric Surgical Procedures to Limit Eating

(+39) as the cosmetic procedures that have increased most over the past 12 months,

followed by Surgical Procedures to Treat the Face (+35) and Collagen and other Dermal

Filler Procedures to Treat the Face (+26).

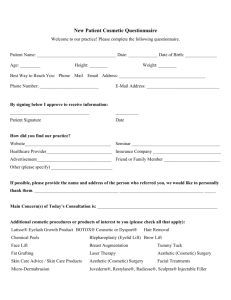

(4) Question Asked: Historically, insurers/payors have not reimbursed for cosmetic

procedures other than those directly related to a patient's health (e.g., gastric

bypass) or to correct a major disfigurement (e.g., repair of cleft palate). Are

insurers/payors exhibiting an increased willingness or a decreased willingness to

pay for cosmetic procedures?

Insurers/payors exhibit an increased willingness to pay for

what was previously considered elective cosmetic procedures

Insurers/payors exhibit a decreased willingness to pay for

what was previously considered elective cosmetic procedures

No change in insurer/payor willingness to pay for what was

previously considered elective cosmetic procedures

Don't Know

Doctors

Current

Survey

Mar ‘05

7%

Doctors

Previous

Survey

May ‘04

2%

19%

22%

71%

67%

3%

8%

Slight Increase in Cosmetic Procedure Reimbursement. Seven percent (7%) of

doctors now say Insurers/payors exhibit an increased willingness to pay for elective

cosmetic procedures compared to 2% in May 2004. Also, fewer doctors in the current

survey report seeing a decreased willingness to pay for these procedures than in May

(19% currently vs. 22% previously).

Copyright ©2005 ChangeWave Research

All rights reserved.

8

ChangeWave Research: Cosmetic Medicine

(5) Question Asked: A Botox competitor called Dysport, manufactured by Inamed,

is currently in trial. Dysport requires fewer injections for the same results as

Botox. If approved, what percent of the Botox market do you think it would

command in its first year on the market?

0-5%

5-10%

11-25%

26-50%

Over 50%

Don't Know

Doctors

Current

Survey

Mar ‘05

3%

19%

17%

21%

7%

33%

Doctors

Previous

Survey

May ‘04

2%

12%

35%

10%

10%

31%

Dysport Sticking it to Botox? Better than one-in-four doctors (28%) see Dysport – if

approved – capturing more than 25% of the Botox market in the first year it becomes

available. This is an 8-point increase over our May 2004 survey results.

(6) Question Asked: Which of the following vendors do you think will gain the most

traction in the marketplace over the next 12 months and why? (n = 15)

Candela

Laserscope

Syneron

Palomar Medical

Cutera

47%

33%

13%

13%

0%

Candela (47%) is the top choice of respondents for vendors likely to gain the most

traction in the marketplace over the next 12 months, followed by Laserscope (33%).

Sample of Alliance Member Responses:

(a) Candela

Doctor DRM7263 writes, "Candela. Strong market presence & state-of-the-art

technology."

JOH9038 writes, "Candela. Largest player in cosmetic lasers. Margins tight and

others may not survive."

Doctor GUT8640 writes, “Candela and Laserscope have a very good marketing

plan.”

Copyright ©2005 ChangeWave Research

All rights reserved.

9

ChangeWave Research: Cosmetic Medicine

(b) Laserscope

Doctor DRJ5952 writes, "Laserscope innovative technology."

Doctor STE3218 writes, "Laserscope, very aggressive sales staff."

HHA9729 writes, “Laserscope.”

(c) Palomar Medical

Doctor HER4689 writes, "Palomar. New products."

BJA2582 writes, “Palomar - Breadth of offerings.”

(d) Syneron

Doctor MIN9289 writes, "Syneron-non-invasive, few side effects."

(7) Question Asked: Are you familiar with the company Isolagen or the Isolagen

process?

Yes

No

Doctors

21%

79%

(7A) Question Asked: Isolagen has pioneered a process, available in England, that

extracts fibroblast cells from a patient and manufactures large quantities of them.

The duplicated cells are then re-injected into the patient. The treatment could last

up to a year and could cost between $7,000 and $10,000. The Isolagen process is

currently awaiting FDA approval in the US. Do you see a market for this cosmetic

procedure?

Yes, 1-5% of patients currently using Dermal Fillers/Botox

treatments would migrate to Isolagen

Yes, 6-10% of patients currently using Dermal Fillers/Botox

treatments would migrate to Isolagen

Yes, 11%-20% of patients currently using Dermal

Fillers/Botox treatments would migrate to Isolagen

More than 20% of patients currently using Dermal

Fillers/Botox treatments would migrate to Isolagen

Do not see a market for the Isolagen process

Don't Know

Copyright ©2005 ChangeWave Research

All rights reserved.

Doctors

24%

10%

9%

0%

10%

47%

10

ChangeWave Research: Cosmetic Medicine

The Isolagen Process. If approved, one-third of responding doctors (34%) believe that

between 1 and 10% of patients that currently use Dermal Fillers/Botox treatments would

migrate to Isolagen. We note that ChangeWave Research Director Michael Shulman

finds “this projected market acceptance rate is much higher than company estimates.”

(8) Question Asked: Several companies are working on HA (Hyaluronic Acid)

based dermal fillers and will eventually market them as a "natural alternative" to

animal based collagen fillers. If competitively priced (within 10% of current dermal

fillers) do you see a market for this product?

Yes, 1-5% of patients currently using dermal fillers/Botox treatments would

migrate to HA (Hyaluronic Acid) based dermal fillers

Yes, 6-10% of patients currently using dermal fillers/Botox treatments would

migrate to HA (Hyaluronic Acid) based dermal fillers

Yes, 11%-20% of patients currently using dermal fillers/Botox treatments

would migrate to HA (Hyaluronic Acid) based dermal fillers

More than 20% of patients currently using dermal fillers/Botox treatments

would migrate to HA (Hyaluronic Acid) based dermal fillers

Do not see a market for HA (Hyaluronic Acid) based dermal fillers

Don't Know

Doctors

7%

14%

16%

34%

2%

28%

Hyaluronic Acid-Based Dermal Fillers. The survey results also suggest that Hyaluronic

Acid (HA) based dermal fillers could eventually be a competitive product. A third of

doctors (34%) believe that more than 20% of patients currently using Dermal

Fillers/Botox treatments will migrate to HA when it becomes available.

(9) Question Asked: What would you say is the hottest new cosmetic procedure

that has not yet generated much discussion in the general media?

Doctor 8486810 writes, “Botox is still the hottie.”

Doctor DRJ5952 writes, “Dermal fillers for wrinkles.”

CRA1451 writes, “Men, men, men. Implants, chin tucks, eyes, etc.”

Doctor GUT8640 writes, “Mesotherapy.”

Doctor KJA2163 writes, “Mesotherapy for the reduction of fat and cellulite.”

Doctor MTA6607 writes, “Gastric banding; Gastric bypass.”

Doctor 799519 writes, “Laparoscopic gastric bending is more and more replaced by

laparoscopic gastric sleeve operation that costs less, requires no adaptation

afterwards, and less complications. Laparoscopic gastric bypass for severe obesity is

still rising in favor of open ga.”

Copyright ©2005 ChangeWave Research

All rights reserved.

11

ChangeWave Research: Cosmetic Medicine

WPB8388 writes, “Neurostimulators that replace gastric by-pass.”

Doctor MIM3324 writes, “Laser therapy of all types especially for hair removal.”

Doctor FER6743 writes, “Neither hot nor new but micro-dermabrasion seems to me

capable of increasing use.”

Doctor SKR3776 writes, “Dermabrasion.”

Doctor RAV1272 writes, “Non Ablative Laser Resurfacing (Fraxel).”

Doctor WLU8236 writes, “Spray-on tanning - micro-powered devices for delivery of

skin care products.”

Doctor DON7620 writes, “Breast reduction surgery.”

AGI1147 writes, “Cosmetic acupuncture. Not much potential for huge new product

sales, but the procedures are becoming increasingly common. The risks are much

lower than other cosmetic procedures, so many patients may start here rather than

more aggressive treatment.”

Doctor HER4689 writes, “Non-surgical face lifts.”

WIL6687 writes, “LED Lights for acne and other facial blemishes and fine lines.”

Doctor ELB6765 writes, “I don't think any haven't reached the media.”

Copyright ©2005 ChangeWave Research

All rights reserved.

12

ChangeWave Research: Cosmetic Medicine

III. ChangeWave Research Methodology

This report presents the findings of the latest ChangeWave Alliance survey on Cosmetic

Medicine. The survey was conducted between March 16 - March 21, 2005. A total of 116

Alliance members participated, including 58 doctors.

The Alliance’s proprietary research and business intelligence gathering system is based

upon the systematic gathering of valuable business and investment information directly

over the Internet from accredited members.

ChangeWave surveys its Alliance members on a range of business and investment

research and intelligence topics, collects feedback from them electronically, interprets

and reconciles the information in a cohesive manner and converts the information into

valuable quantitative and qualitative reports.

The Alliance has assembled its membership team from senior technology and business

executives in leading companies of select industries. Nearly 3 out of every 5 members

(58%) have advanced degrees (e.g., Master’s or Ph.D.) and 94% have at least a fouryear bachelor’s degree.

The business and investment intelligence provided by the Alliance provides a real-time

view of companies, technologies and business trends in key market sectors, along with

an in-depth perspective of the macro economy – well in advance of other available

sources.

Copyright ©2005 ChangeWave Research

All rights reserved.

13

ChangeWave Research: Cosmetic Medicine

IV. About ChangeWave Research

ChangeWave Research, a subsidiary of Phillips Investment Resources, LLC, identifies

and quantifies "change" in industries and companies through surveying a network of

thousands of business executives and professionals working in more than 20 industries.

ChangeWave has a very unique asset in its 5,000-member Alliance. We have assembled

our membership team from a broad cross section of more than 20 vertical markets such

as telecom, semiconductors, data storage, and biotechnology, along with a wide range of

professional disciplines including CIOs, IT managers and programmers, executive

management, scientists, engineers and sales personnel.

The ChangeWave Alliance is composed of senior technology and business executives in

leading companies - credentialed professionals who spend their everyday lives working

on the frontline of technological change.

This proprietary research and business intelligence gathering system provides a real-time

view of companies, technologies and business trends in key market sectors along with an

in-depth perspective of the macro economy - well in advance of other available sources.

ChangeWave surveys its 5,000 Alliance members on a wide range of investment

research topics and converts the findings into valuable investment and business

intelligence reports. ChangeWave delivers its products and services on the Web at

www.ChangeWave.com.

ChangeWave Research does not make any warranties, express or implied, as to

results to be obtained from using the information in this report. Investors should

obtain individual financial advice based on their own particular circumstances

before making any investment decisions based upon information in this report.

For More Information:

ChangeWave Research

9420 Key West Avenue

Rockville, MD 20850

USA

Telephone: 301-279-4200

Fax: 301-610-5206

www.ChangeWave.com

service@changewave.com

Helping You Profit From A Rapidly Changing World ™

www.ChangeWave.com

Copyright ©2005 ChangeWave Research

All rights reserved.

14