Savings, Loans, and Interest Rate

advertisement

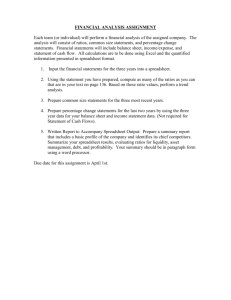

Dr. Antonio Quesada – Director, Project AMP Project AMP Savings, Loans, and Interest Rate Lesson Lab Summary by Barbara Adler, Firestone High School, Akron Scott Waseman, Barberton High School, Barberton Subject: Algebra 1, Algebra 2 Grade: 9th, 10th Topic: Savings, Loans, and Interest Rate Strands: Number and Numeracy Algebra and Functions Mathematical Processes Objectives: Strand: Number and Numeracy • Estimate and compute with real numbers. • Apply rates, ratios, proportions, and percents. Strand: Algebra and Functions • Represent a mathematical relationship using a table, graph, symbols, and words, and describe how a change in the value of one variable affects the value of a related variable. Strand: Mathematical Processes • Communicate mathematical ideas, reasoning, and solutions through the use of appropriate mathematical terminology, notations, symbols, definitions, models, and other representations. Materials: spreadsheet software, internet access, printer, and worksheets Expected time: 2 or 3 class periodsSavings, Loans, and Interest Rate Lesson Lab Plan by Barbara Adler, Firestone High School, Akron Scott Waseman, Barberton High School, Barberton Concepts/ Learning and Ohio Proficiency Objectives Number and Numeracy 2. Estimate and compute with real numbers. 3. Apply rates, ratios, proportions, and percents. Algebra and Functions 6. Represent a mathematical relationship using a table, graph, symbols, and words, and describe how a change in the value of one variable affects the value of a related variable. Mathematical Processes Project AMP Dr. Antonio Quesada – Director, Project AMP 15. Communicate mathematical ideas, reasoning, and solutions through the use of appropriate mathematical terminology, notations, symbols, definitions, models, and other representations. Task Overview Students will use the real life situations of saving money and repaying loans to learn the importance of interest rate and compound interest in consumer applications. The focus is for students to gain an understanding of how savings, interest, and time are related. There is a direct relationship between interest rates and savings over time. Prior knowledge: Students know how to write a percentage rate as a decimal, eg, 8.5% = .085 Students are familiar with basic spreadsheets: how to enter a formula, fill it down a column, and make a spreadsheet chart. After the teacher introduces this exciting topic (below), students complete these tasks: 1. When you save regularly over time, compound interest works for you. • Compare how long it takes to save $100,000, given several interest rates. • Explore how much has to be saved each week, given several interest rates, to save at least $1,000,000 over a working life. 2. When you borrow money, compound interest works against you. • Given the term of a loan, find the monthly payment. • Given the amount you want to pay each month, find how long you will pay. Student pairs will complete the worksheets and discuss their findings. The teacher acts as a facilitator while students are completing the activities. This work is planned for two 50-min classes. At the end of the second class or start of the next class, the teacher will summarize and reinforce the conceptual ideas for the activities. Integration Learning Strategies 1. Teacher introduction. Asking, “Who wants to be a millionaire? without being a superstar or winning the lottery”, the teacher will introduce the goal of saving a substantial sum, given regular savings and time. Use the Interactive Savings calculator www.consumerfed.org/calculator.html at an overhead display. Student enters her/his age, amount saved per week, and annual rate of return. Ask the class to predict the result before you press enter. (Generally their estimate will be very low.) This black-box calculator will produce the amount saved in 20 years, or at age 65. Change the rate of return, get a new estimate, and try again. The class should be impressed. 2. Students work in pairs (2 periods). Each pair needs a copy of both worksheets and a computer with spreadsheet software. Internet access on one classroom computer is useful for demonstration. Access for each pair is desirable for extensions, but not required. Project AMP Dr. Antonio Quesada – Director, Project AMP 3. Whole class summary and discussion. As time permits, explain the impact of inflation: $1,000,000 in 45 years may not be worth what it is today. Use the Inflation Calculator at www.NewsEngin.com to demonstrate this. Classroom/ Information Management After the teacher introduces and motivates the tasks, and distributes the work pages, the students should proceed through the tasks on their own. The teacher will monitor student behavior, assist pairs as needed, and emphasize time. Assessment After completing both worksheet activities, students will write a short narrative to summarize their findings. They will include a table or graph or both. They will share and compare their findings with another group. Selected examples will be discussed with the whole class. Tools and Resources Some suggested links and extensions are • Interactive Savings calculator www.consumerfed.org/calculator.html • AITLC Student Guide to Economics and Business tlc.ai.org • Buying My First Car score.kings.k12.ca.us/lessons/firstcar.htm • Free Tools-- Inflation Calculator www.NewsEngin.com Worksheets Activity worksheets continue on the next page. Worksheet 1: Letting Money Grow for You Worksheet 2: Interest, The Cost of MoneyWorksheet 1: Letting Money Grow for You Basic principles of compound interest1 : Small amounts grow to very large amounts over time. The sooner you start saving, the better. Small differences in interest rates will make a very large difference over time. So, the variables are the amount saved each month or year, how long you save, and the interest rate. ================================================================== 1. With your partner, estimate: a. If you save or invest money and earn interest, how much do you think you’d have to save every year to have $100,000 in 20 years? __________________ 1 Cruz, Humberto, “Math we Just Don’t Get”, The Beacon Journal. 11-22-99, D3. Project AMP Dr. Antonio Quesada – Director, Project AMP b. Divide your answer above by 50. ________________ This is the goal to save every week. c. Brainstorm 3 possible ways you can reduce your spending. For ex, if you buy soft drinks, 1 less coke each day can save about $4 a week or $200 a year. ___________________________ ___________________________ ___________________________ 2. Create a new spreadsheet as shown below. Enter the formulas shown in A3 and B3. Then extend these columns (Calculate-->Fill down) to cover 20 years. To simplify the size of the spreadsheet, we assume that savings and interest on your bank account are deposited only once each year. In reality, interest may be added (“compounded”) daily! Format Column B as currency, 2 places, commas. 3. Study the 2 formulas in the spreadsheet. Describe the function of A3 in a sentence: ____________________________________________________ Explain (1+ $C$4) _____________________________________ Now describe B3 in a sentence: _____________________________________ 4. Experiment with the spreadsheet. Enter your estimate from 1a into C2. Does this choice of yearly savings and interest rate give you more or less than $100,000 in year 20? Continue to play “what-if?”. You can change the entries for yearly savings amount; you can change the interest rate. List 4 combinations of savings and interest rates that produce $100,000 in 20 years. Project AMP Dr. Antonio Quesada – Director, Project AMP 4. Make a spreadsheet chart for each different interest rate. (Just chart column B) Create a line graph. Describe the shape of the chart for each rate. What is the same? What is different as the rate increases? 5. For someone starting work and a savings plan today, it’s quite reasonable to set a much higher goal. • Modify the spreadsheet to extend for 45 years. • Also consider the realistic possibility that you will increase your annual savings each year, as you earn more. Change the formula in B3 to increase your annual savings either by a constant dollar amount, or by a small constant percent . 6. After you explore several combinations of increasing annual savings, and changing interest rates, write a 1-page summary report. Please be sure to discuss what happened in relation to your specific changes in the spreadsheet. Include at least one graph.