Chapter 17: Quality Cost Management

advertisement

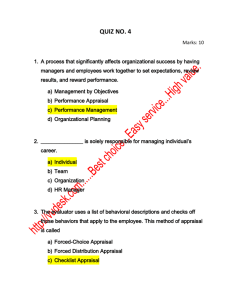

CHAPTER 14 QUALITY COST MANAGEMENT QUESTIONS FOR WRITING AND DISCUSSION 1. All quality costs are incurred because poor quality may or does exist. 2. Prevention costs are incurred to prevent defects in products; appraisal costs are costs incurred to determine whether products are conforming to specifications; internal failure costs are incurred when nonconforming products are detected prior to shipment; external failure costs are incurred because nonconforming products are delivered to customers. 3. External failure costs can be more devastating because of warranty costs, lawsuits, and damage to the reputation of a company, all of which may greatly exceed the costs of rework or scrap incurred from internal failure costs. 4. Agree. It is poor quality, not good quality, that is costly. All quality costs exist because poor quality may or does exist. 5. Interim quality standards are used to measure a firm’s progress toward better quality within a given period. 6. Interim quality reports are used to measure quality improvement with respect to a current-period standard; multiple-period reports are used to measure quality improvement with respect to a base period; long-range reports are used to measure progress toward achieving the goal of zero defects. 7. Both monetary and nonmonetary incentives can be used to motivate employees. For example, employees can be given a bonus that is equal to a fixed percentage of the savings from a suggestion that improved a product’s quality (referred to as gainsharing). Additionally, awards of excellence can be used to recognize those employees who make outstanding quality contributions. 8. Firms should spend about 2.5% of sales on quality costs. The potential savings from quality improvement is $31 million [$36 million (0.18 $200 million) – $5 million (0.025 $200 million)]. 9. A quality cost report shows the amount of cost for each category as well as the relative cost of each category. This report requires managers to identify the costs that should appear in the report, to identify the current quality performance level, and to begin thinking about the level of quality performance that should be achieved. 10. Two major reasons why the accounting department should be responsible for producing quality cost reports: (1) they have the expertise and training, and (2) they have the objectivity. 11. ISO 9000 is a series of five international quality standards. These standards center on the concept of documentation and control of nonconformance and change. ISO 9000 certification can be a requirement of doing business (e.g., in Europe). Also, many companies have found that the process of applying for ISO 9000, while lengthy and expensive, yields important benefits in terms of self-knowledge. U.S. companies are using ISO 9000 certification as a competitive tool, as well. 12. An environmental cost is a cost incurred because poor environmental quality exists or may exist. 13. The four categories of environmental costs are prevention, detection, internal failure, and external failure. Prevention costs are costs incurred to prevent degradation to the environment. Detection costs are incurred to determine if the firm is complying with environmental standards. Internal failure costs are costs incurred to prevent emission of contaminants to the environment after they have been produced. External failure costs are costs incurred after contaminants have been emitted to the environment. 14. Realized external failure costs are environmental costs paid for by the firm. Unrealized or societal costs are costs caused by the firm but paid for by third parties (e.g., members of society bear these costs). 315 EXERCISES 14–1 1. Internal failure 13. Prevention 2. Prevention 14. Prevention 3. Internal failure 15. External failure 4. External failure 16. Prevention 5. External failure 17. External failure 6. External failure 18. Prevention 7. Prevention 19. Prevention 8. Internal failure 20. Appraisal 9. Appraisal 21. External failure 10. Internal failure 22. Prevention 11. External failure 23. Appraisal 12. Appraisal 316 14–2 1. Activity rates: Warranty: Scrap: Inspection: Training: $204,000/2,550 = $80 per unit $153,000/4,250 = $36 per unit $76,500/5,100 = $15 per hour $42,500/170 = $250 per hour Product cost: Warranty: $80 1,700 ................... $80 850 ...................... Scrap: $36 3,400 ................... $36 850 ...................... Inspection: $15 3,400 ................... $15 1,700 ................... Training: $250 85 ...................... $250 85 ...................... Total assigned .................. Divided by units ................ Unit cost ....................... Carburetor A Carburetor B $ 136,000 $ 68,000 122,400 30,600 51,000 25,500 21,250 $ 330,650 170,000 $ 1.95* 21,250 $ 145,350 340,000 $ 0.43* *Rounded. Carburetor A has more than four times the amount of quality costs assigned than Carburetor B. Thus, A appears to be the lower-quality product. 2. The unit quality cost can be used to rank products in order of the lowest quality to that of the highest. This information can then be used to determine where quality improvement efforts should be focused. It may reveal, for example, that products follow the Pareto Principle: 20% of the products are causing 80% of the quality problems. (The Pareto Principle claims that 20% of the people do 80% of the work in any organization.) 317 14–3 1. Brown Company Quality Cost Report For the Year Ended December 31, 2010 Quality Costs Percentage of Sales Prevention costs: Design review ................. Quality training ............... $ 405,000 135,000 $ 540,000 Appraisal costs: Materials inspection....... Process acceptance....... Product inspection......... $ 54,000 67,500 40,500 162,000 2.00 Internal failure costs: Reinspection................... Scrap ............................... $ 67,500 47,250 114,750 1.42 External failure costs: Recalls ............................ Lost sales ....................... Returned goods .............. Total quality costs ............... $ 135,000 270,000 128,250 318 533,250 $1,350,000 6.67% 6.58 16.67% 14–3 Concluded 2. Relative Distribution of Quality Costs Percentage of Total Quality Costs 100 80 60 40 20 0 Quality Costs Prevention Appraisal Internal Failure External Failure Relative Distribution of Quality Costs External Failure 40% 40% 8% Prevention 12% Internal Failure Appraisal Failure costs are almost 50% of the total costs. This indicates that there is still ample opportunity for improving quality by investing more in prevention and appraisal activities. 319 14–4 1. Quality costs: Year 1: $2,100,000 (0.21 Year 2: $1,980,000 (0.18 Year 3: $1,540,000 (0.14 Year 4: $1,200,000 (0.10 $10,000,000) $11,000,000) $11,000,000) $12,000,000) Net income increase: Year 1: (0.21 – 0.18)$11,000,000 = $330,000 Year 2: (0.18 – 0.14)$11,000,000 = $440,000 Year 3: (0.14 – 0.10)$12,000,000 = $480,000 2. Profit potential: (0.10 – 0.025)$12,000,000 = $900,000 The 2.5% goal is the level many quality experts identify as the one that companies should strive to obtain. Pavon Company’s experience shows that it is an achievable goal. Also, although most Japanese companies do not track quality costs, some have measured their costs of quality, and they generally tend to be less than 5% (compared with the U.S. experience that has produced values between 20 and 30%). 3. Sales .................................. Variable expenses ............ Contribution margin .... a$125 Year 3—No Change $11,000,000 7,236,842a $ 3,763,158 Year 3—Change $ 11,000,000 6,345,263b $ 4,654,737 $11,000,000/$190. bQuality costs per unit: Year 1: 0.21 $200 = $42.00 Year 3: 0.14 $190 = $26.60 Decrease in per-unit variable quality cost = $42.00 – $26.60 = $15.40 Decrease in per-unit total variable cost = $125.00 – $15.40 = $109.60 Variable costs (total, Year 3) = $109.60 $11,000,000/$190 = $6,345,263 Increase in profitability: $4,654,737 – $3,763,158 = $891,579 320 14–5 1. 2006: $7,500,000/$30,000,000 = 0.25 2010: $937,500/$37,500,000 = 0.025 The quality cost-to-sales ratio improved from 25% to 2.5%. 2. Internal failure: External failure: Appraisal: Prevention: $2,250,000/$7,500,000 = 30% $3,000,000/$7,500,000 = 40% $1,350,000/$7,500,000 = 18% $900,000/$7,500,000 = 12% The pie chart for 2006 is as follows: Quality Costs Prevention 12% 30% Internal Failure Appraisal 18% 40% External Failure The percentage of quality costs spent on internal and external failures is too high. If costs are reduced to 2.5%, then the company is approaching the goal of zero defects. As zero defects is approached, failure costs will approach zero, leaving the bulk of quality costs in the prevention and appraisal categories. Of these two categories, the prevention category would dominate. 321 14–5 3. Continued Internal failure: External failure: Appraisal: Prevention: $112,500/$937,500 = 12% $75,000/$937,500 = 8% $281,250/$937,500 = 30% $468,750/$937,500 = 50% The pie chart for 2010 is as follows: Quality Costs Internal Failure 12% External Failure 8% Prevention 50% 30% Appraisal Quality costs are better distributed than in 2006. Control costs account for 80% of the total quality costs (versus only 30% in 2006). Failure costs have shrunk from 70% of the total in 2006 to only 20% in 2010. Moreover, total quality costs have shrunk from 25% of sales to 2.5% of sales. Costs in every category have been reduced. From an activity-based management perspective, further reductions are possible—at least in the failure categories. These are non-value-added costs and, in theory, can and should be reduced to zero. 4. Some external failure costs are not measured and reported in the accounting records. If the multiplier effect were four (for example), then in 2010, the external failure costs would be $225,000 ([4 $75,000] – $75,000) higher than reported. Given the reality of hidden costs, there is some validity to his point of view and it may be wise to invest additional funds for control activities. 322 14–5 5. Concluded Gainsharing provides a strong incentive for managers to improve quality and reduce quality costs. Gainsharing is a good idea, provided the incentive system is carefully designed. The bonus must be truly based on quality improvements. Quality gains, stemming from quality cost reductions, must flow from true quality improvements. Thus, there should be operational quality measures that provide evidence of actual quality improvements. One possibility is to base bonuses only on reductions in failure and appraisal categories. This provides an incentive for managers to invest in preventive activities— actions that should reduce “poor” quality costs. 14–6 1. Only four of the activities should be implemented: quality training, process control, supplier evaluation, and engineering redesign. Each of these four activities reduces failure costs more than it costs to implement the activity (thus, increasing the bonus pool). The cost reduction for failures is less than the amount spent for product inspection and prototype testing. Total quality costs: Current control ......................... Quality training ......................... Process control ........................ Supplier evaluation .................. Engineering redesign .............. Failure costs ............................. $ 160,000 160,000 200,000 120,000 40,000 184,000* $ 864,000 *$40,000 + ($720,000 – $656,000) + ($200,000 – $120,000) (adds back cost reductions of two activities not implemented). 323 14–6 2. Concluded a. Total quality costs were reduced by $736,000 ($1,600,000 – $864,000). Quality training increased costs by $160,000 but reduced failure costs by $400,000, for a net gain of $240,000. Process control increased costs by $200,000 but decreased failure costs by $320,000, for a net gain of $120,000. Supplier evaluation increased costs by $120,000 but decreased failure costs by $456,000, for a net gain of $336,000. Engineering redesign increased costs by $40,000 but decreased failure costs by $80,000, for a net gain of $40,000. Total net gain: $ 240,000 120,000 336,000 40,000 $ 736,000 b. Distribution percentage: Control costs:* $680,000/$864,000 = 79% (rounded) Failure costs: $184,000/$864,000 = 21% (rounded) *Total control costs less costs of activities not implemented: $1,000,000 – $80,000 – $240,000 = $680,000 Failure costs = $864,000 – $680,000 c. Bonus pool = 0.10 $736,000 = $73,600 3. All of the same activities would be adopted plus prototype testing. Of the activities adopted, training, supplier evaluation, engineering redesign, and prototype testing are all prevention activities and so would not be counted in the cost reduction calculation. Failure costs would now be $104,000 (prototype addition reduces failure costs by an additional $80,000). The initial failure and appraisal costs are $1,600,000 ($1,440,000 + $160,000). The ending failure and appraisal costs are the sum of the current appraisal costs, ending failure costs, and the cost of adding process control: $160,000 + $104,000 + $200,000 = $464,000. Thus, the cost reductions counted for the bonus pool would be $1,136,000 ($1,600,000 – $464,000), and the bonus would be $113,600 (0.10 $1,136,000). This approach has some merit as it encourages managers to invest in value-added activities and avoid the temptation of reducing prevention costs prematurely. It is possible, however, that some prevention activities are not really worth doing, and this approach may lead to an overinvestment in this category. 324 14–7 1. 2. Quality costs, 2009 ................ Less quality costs, 2010 ....... $ 110,000 81,000 $ 29,000 Tru-Delite Frozen Desserts, Inc. Long-Range Performance Report For the Year Ended December 31, 2010 Prevention costs: Training program ................ Supplier evaluation ............. Total prevention ............. Appraisal costs: Test labor ............................. Inspection labor .................. Total appraisal ............... Internal failure costs: Scrap .................................... Rework ................................. Total internal failure ...... External failure costs: Consumer complaints ........ Lost sales, incorrect labeling Total external failure ...... Total quality costs .................... Actual Costs* 2010 Long-Range Target Costs Variance $ 6,000 13,000 $ 19,000 $ 3,750 4,688 $ 8,438 $ 2,250 U 8,312 U $ 10,562 U $ 10,000 30,000 $ 40,000 $ 4,687 2,813 $ 7,500 $ 5,313 U 27,187 U $ 32,500 U $ 18,750 12,500 $ 31,250 $ 2,812 0 $ 2,812 $ 15,938 U 12,500 U $ 28,438 U $ 6,250 0 $ 6,250 $ 96,500 $ $ 6,250 U 0 $ 6,250 U $ 77,750 U Percent of sales ........................ 12.9% 0 0 $ 0 $18,750 2.5% 10.4% *Adjusted for sales of $750,000 [Uses the actual variable cost ratios of 2010 to compute the “actual” unit-level variable costs for this level of activity; prevention costs are discretionary fixed and so are assumed to not change as sales increase; all other costs are assumed to vary with sales volume and so are adjusted to the $750,000 level; for example, test labor is ($8,000/ $600,000) $750,000 = $10,000]. 325 14–7 Concluded 3. Prevention and some appraisal costs can be interpreted as value-added costs. All failure costs are non-value-added. Thus, the distribution of costs for 2015 cannot all be value-added (there are nonzero internal failure costs). If they were, then the variances would be the non-value-added costs being incurred in 2010. 4. There would be a $77,750 increase in profits in 2015 if total quality costs are 2.5% of sales and the targeted distribution is achieved (the $77,750 increase is the savings reported in the long-range performance report in Requirement 2). 14–8 1. Prevention 2. Prevention 3. Internal failure 4. External failure (societal) 5. Detection 6. Prevention 7. Internal failure 8. External failure (societal) 9. Detection 10. External failure (societal) 11. Prevention 12. External failure (private) 13. Internal failure 14. Detection 15. Internal failure 16. Detection 326 14–9 1. Hender Chemicals Environmental Cost Report For the Year Ended December 31, 2010 Environmental Costs Prevention costs: Evaluating suppliers .................... Recycling products ...................... Detection costs: Inspecting products/processes .. Developing perf. measures .......... Internal failure costs: Treating toxic waste ..................... Operating equipment ................... Licensing facilities ....................... External failure costs: Settling claims .............................. Cleanup of soil .............................. Totals ................................................. Percentage* $ 120,000 75,000 $ 195,000 $ 600,000 60,000 660,000 1.10 $ 4,800,000 840,000 360,000 6,000,000 10.00 $ 1,200,000 1,800,000 3,000,000 $ 9,855,000 0.33% 5.00 16.43% *Of operating costs: $60,000,000. 2. Relative Distribution: Environmental Costs Prevention 2% Detection 7% External Failure 30% Internal Failure 61% This distribution reveals that the company is paying little attention to preventing and detecting environmental costs. To improve environmental performance, much more needs to be invested in the prevention and detection categories. 327 14–10 1. Both items should be added to the external failure costs category in the report. The first item would add $525,000 and is a private cost. The second adds $1,200,000 and is a societal cost. Under a full costing regime, the $1,200,000 should also be included in the report. Often, however, only private costs will be included. 2. Hender caused the opportunity cost, and many would argue that it should be disclosed. Whether it will voluntarily disclose this cost is questionable. Management would likely feel that such disclosure would draw unfavorable attention to the company and damage its image. Perhaps if the disclosure is coupled with an announcement of the cleanup of the river and lake, then it could be turned to the advantage of the company: “We are undertaking a cleanup, and one of the major benefits to the community is the restoration of the fishing and recreational opportunities worth $1,200,000 to the community.” 328 PROBLEMS 14–11 1. Lost contribution margin = $8 100,000 = $800,000 or $200,000 per quarter Sales revenue/Quarter = $92 25,000 = $2,300,000 Percent of sales needed to regain lost contribution margin: $200,000/$2,300,000 = 8.7% At 1% gain per quarter, 8.7 quarters, or a little over two years would be needed to regain former profitability. 2. At the end of three years, quality costs will be 4% of sales, a reduction equal to 12% of sales. Savings = 0.12 $92 100,000 = $1,104,000 Increase in unit contribution margin = $1,104,000/100,000 = $11.04 Projected unit CM = $11.04 + ($92 – $90) = $13.04 Projected total CM at $92 price = $13.04 100,000 = $1,304,000 Price decreases: $1.00: Total CM = $12.04 110,000 = $1,324,400 $2.00: Total CM = $11.04 120,000 = $1,324,800 $3.00: Total CM = $10.04 130,000 = $1,305,200 Recommended decrease is from $92 to $90. Increase in contribution margin: $ 1,324,800 (1,304,000) $ 20,800 329 14–11 Concluded 3. To find the point where the price should first be reduced, we need to find the point where total contribution margin remains unchanged. Let X = CM/Unit. Current CM = 100,000X New CM = 110,000(X – $1) 100,000X = 110,000(X – $1) 10,000X = $110,000 X = $11 When the unit CM is greater than $11, the price should be reduced by $1.00. To find this point in time: Current CM = $92 – $90 = $2 Gain needed = $11 – $2 = $9 Annual CM needed = $900,000 ($9 100,000) Quarterly CM needed = $900,000/4 = $225,000 Quarterly percent of sales needed = $225,000/$2,300,000 = 9.8% At 1% per quarter, it will take 9.8 quarters to gain $9 per unit. Thus, after 9.8 quarters, the price can decrease by $1. 4. The difference is long-run versus short-run thinking. The marketing manager had a strategic orientation. We can see the value of cost information, particularly quality cost information, in strategic decision making. In fact, the emphasis on total quality control and the identification of specific quality costs drove the decision. Once the decision was made, the need to reduce the costs as planned is critical, emphasizing the importance of a quality cost control program. Interim and longer-range reports would be quite useful in controlling quality costs. 330 14–12 1. Quality Costs Prevention costs: Quality training ....................... Appraisal costs: Product acceptance ............... Internal failure costs: Scrap ....................................... Rework .................................... $ External failure costs: Repair ...................................... Order cancellation.................. Customer complaints ............ Sales allowance ..................... 0.2% $ 240,000 1.6 $ 450,000 270,000 $ 720,000 4.8 $ 90,000 150,000 121,500 45,000 $ 406,500 $1,396,500 Total quality costs ....................... 2. 30,000 Percentage of Sales 2.7 9.3% Profits: $1,500,000 Quality costs: $1,396,500 Quality costs/Sales = 9.3% Quality costs/Profits = 93% Wayne should be concerned as the quality cost ratio is 9.3%, and the quality costs are almost as large as income. Although the ratio is lower than the 20 to 30% range that many companies apparently have, there is still ample opportunity for improvement. 3. Prevention: Appraisal: Internal failure: External failure: $30,000/$1,396,500 = 2.1% $240,000/$1,396,500 = 17.2% $720,000/$1,396,500 = 51.6% $406,500/$1,396,500 = 29.1% 331 14–12 Concluded The pie chart is as follows: Quality Costs Internal Failure 51.6% Appraisal 17.2% 2.1% Prevention 29.1% External Failure Too much is spent on failure costs. These costs are non-value-added costs and should eventually be eliminated. Prevention and appraisal activities should be given much more emphasis. If anything, experiences of real-world companies (e.g., Tennant and Westinghouse) indicate that the control costs should be 80% and the failure costs 20%. The distribution of quality costs needs to be reversed! 4. The company should increase prevention and appraisal costs. The additional amounts spent on these programs will be recouped with additional savings from a resulting decrease in failure costs. 5. Quality costs: $15,000,000 2.5% = $375,000 Profits would increase by $1,021,500 ($1,396,500 – $375,000). 332 14–13 1. Prevention costs: Quality planning (F)..................... New product review (F)............... Quality training (F) ...................... Total prevention ..................... Appraisal costs: Materials inspection (F) .............. Product acceptance (V) .............. Field inspection (V) ..................... Total appraisal ....................... Internal failure costs: Scrap (V) ...................................... Retesting (V) ................................ Rework (V) ................................... Downtime (V) ............................... Total internal failure .............. External failure costs: Warranty (V) ................................. Allowances (V)............................. Complaint adjustment (F) ........... Total external failure .............. Total quality costs ............................ 333 January February $ 2,000 500 1,000 $ 3,500 $ $ 2,500 13,000 12,000 $ 27,500 2,500 15,000 14,000 $ 31,500 $ 10,000 6,000 9,000 5,000 $ 30,000 $ 12,000 7,200 10,800 6,000 $ 36,000 $ 15,000 7,500 2,500 $ 25,000 $ 86,000 $ 18,000 9,000 2,500 $ 29,500 $100,500 $ 2,000 500 1,000 3,500 14–13 Concluded 2. Actual Costs Prevention costs: Quality planning (F).......... New product review (F).... Quality training (F) ........... Total prevention .......... Appraisal costs: Materials inspection (F) ... Product acceptance (V) ... Field inspection (V) .......... Total appraisal ............ Internal failure costs: Scrap (V) ........................... Retesting (V) ..................... Rework (V) ........................ Downtime (V) .................... Total internal failure ... External failure costs: Warranty (V) ...................... Allowances (V).................. Complaint adjustment (F) Total external failure ... Total quality costs ................. Bud. Costs* Variance $ 2,500 700 1,000 $ 4,200 $ 2,000 500 1,000 $ 3,500 $ 500 U 200 U 0 $ 700 U $ 2,500 14,000 14,000 $ 30,500 $ 2,500 14,300 13,200 $ 30,000 $ $ 12,500 7,000 11,000 5,500 $ 36,000 $ 11,000 6,600 9,900 5,500 $ 33,000 $1,500 400 1,100 0 $3,000 U U U $ 17,500 8,500 2,500 $ 28,500 $ 99,200 $ 16,500 8,250 2,500 $ 27,250 $ 93,750 $1,000 250 0 $1,250 $5,450 U U 0 300 F 800 U $ 500 U U U U *Budgeted costs need to be adjusted to reflect actual sales of $550,000. Fixed costs don’t change with sales. However, variable costs do, and so the budgeted variable cost ratio can be used to make the adjustment. For example, the adjusted budget for scrap is ($10,000/$500,000) $550,000 = $11,000. For January, quality costs were 18% of sales ($99,200/$550,000). This is higher than the budgeted amount of 17%, but lower than previous periods. 334 14–14 1. 2009 Appraisal costs: Prevention costs: Internal failure costs: External failure costs: $360,000/$2,048,000 = 17.6% $8,000/$2,048,000 = 0.4% $1,000,000/$2,048,000 = 48.8% $680,000/$2,048,000 = 33.2% The pie chart for 2009 is as follows: Quality Costs Appraisal 17.6% External Failure 0.4%Prevention 33.2% 48.8% Internal Failure 335 14–14 Continued 2010 Appraisal costs: $328,000/$2,048,000 = 16.0% Prevention costs: $160,000/$2,048,000 = 7.8% Internal failure costs: $820,000/$2,048,000 = 40.0% External failure costs: $740,000/$2,048,000 = 36.1% (Total adds to 99.9% due to rounding error.) The pie chart for 2010 is as follows: Quality Costs Appraisal 16.0% External Failure 36.1% 7.8% Prevention 40.0% Internal Failure Yes. More effort is clearly needed for prevention and appraisal activities. The movement is in that direction, and total failure costs have declined. 336 14–14 Concluded 2. Major Company Performance Report: Quality Costs One-Year Trend For the Year Ended December 31, 2010 Actual Costs 2010 Prevention costs: Quality circles ................. Design reviews ............... Improvement projects .... Total prevention ........ Appraisal costs: Packaging inspection .... Product acceptance ....... Total appraisal .......... Internal failure costs: Scrap ............................... Rework ............................ Yield losses .................... Retesting ......................... Total internal failure . External failure costs: Returned materials ......... Allowances ..................... Warranty.......................... Total external failure . Total quality costs ............... $ Actual Costs* 2009 40,000 20,000 100,000 $ 160,000 $ $ 300,000 28,000 $ 328,000 $ 400,000 50,000 $ 450,000 $ 100,000 F 22,000 F $ 122,000 F $ 240,000 320,000 100,000 160,000 $ 820,000 $ 350,000 450,000 200,000 250,000 $ 1,250,000 $ 110,000 130,000 100,000 90,000 $ 430,000 F F F F F $ 160,000 140,000 440,000 $ 740,000 $ 2,048,000 $ 200,000 150,000 500,000 $ 850,000 $ 2,558,000 $ 40,000 10,000 60,000 $ 110,000 $ 510,000 F F F F F $ 4,000 2,000 2,000 8,000 Variance $ 36,000 18,000 98,000 $ 152,000 U U U U *To compare 2010 costs with 2009 costs, the costs for 2009 must be adjusted to a sales level of $10,000,000. Thus, all variable costs will change from the 2009 levels. For example, the adjusted product inspection cost is ($320,000/$8,000,000) $10,000,000 = $400,000. Profits increased by $510,000. 3. $2,048,000 – ($10,000,000 2.5%) = $1,798,000 337 14–15 1. Prevention 1.00% 4.17 5.00 6.67 10.00 2006 ....... 2007 ....... 2008 ....... 2009 ....... 2010 ....... Appraisal 2.00% 2.50 4.29 2.50 1.00 Internal 16.00% 10.00 5.00 4.17 2.40 External 12.00% 8.33 3.57 3.33 1.60 2. Trend in Quality Costs 35 Percentage of Sales 30 25 20 15 10 5 0 2006 2007 2008 Year 338 2009 2010 Total 31.00% 25.00 17.86 16.67 15.00 14–15 Concluded Trend by Category Percentage of Sales 20 15 10 5 0 2006 2007 2008 2009 2010 Year Prevention Appraisal Internal Failure External Failure Yes, quality costs overall have dropped from 31% of sales to 15% of sales, a significant improvement. Real evidence for quality improvement stems from the fact that internal failure costs have gone from 16% to 2.4%, external failure costs from 12% to 1.6%, and appraisal costs from 2% to 1%. This reduction of failure costs has been achieved by putting more resources into prevention (from 1% to 10%). 3. Quality costs at the 2006 rates: 2009 ........ 2010 ........ Prevention $6,000 5,000 Appraisal $12,000 10,000 Internal $96,000 80,000 Profit increase (2009): $186,000 – $100,000 = $86,000 Profit increase (2010): $155,000 – $75,000 = $80,000 339 External $72,000 60,000 Total $186,000 155,000 14–16 1. Iona Company Interim Performance Report: Quality Costs For the Year Ended December 31, 2010 Prevention costs: Fixed: Quality planning ..... Quality training....... Special project ....... Quality reporting .... Total prevention ................ Appraisal costs: Variable: Proofreading .......... Other inspection .... Total appraisal .................. Failure costs: Variable: Correction of typos Rework .................... Plate revisions ....... Press downtime ..... Waste ...................... Total failure ....................... Total quality costs ............ Actual Costs Budgeted Costs Variance $ 150,000 20,000 100,000 12,000 $ 282,000 $ 150,000 20,000 80,000 10,000 $ 260,000 0 0 20,000 U 2,000 U $22,000 U $ 520,000 60,000 $ 580,000 $ 500,000 50,000 $ 550,000 $20,000 U 10,000 U $30,000 U $ 165,000 76,000 58,000 102,000 136,000 $ 537,000 $ 1,399,000 $ 150,000 75,000 55,000 100,000 130,000 $ 510,000 $ 1,320,000 $15,000 1,000 3,000 2,000 6,000 $27,000 $79,000 $ U U U U U U U The firm failed across the board to meet its budgeted goals for the year. All categories and each item were equal to or greater than the budgeted amounts. 340 14–16 Continued 2. Iona Company Performance Report: Quality Costs One-Year Trend For the Year Ended December 31, 2010 Prevention costs: Fixed: Quality planning ..... Quality training....... Special project ....... Quality reporting .... Total prevention ................ Appraisal costs: Variable: Proofreading .......... Other inspection .... Total appraisal .................. Failure costs: Variable: Correction of typos Rework .................... Plate revisions ....... Press downtime ..... Waste ...................... Total failure ....................... Total quality costs ............ Actual Costs 2010 Actual Costs 2009 $ 150,000 20,000 100,000 12,000 $ 282,000 $ 140,000 20,000 120,000 12,000 $ 292,000 $ 10,000 U 0 20,000 F 0 $ 10,000 F $ 520,000 60,000 $ 580,000 $ 580,000 80,000 $ 660,000 $ 60,000 F 20,000 F $ 80,000 F $ 165,000 76,000 58,000 102,000 136,000 $ 537,000 $1,399,000 $ 200,000 131,000 83,000 123,000 191,000 $ 728,000 $1,680,000 $ 35,000 55,000 25,000 21,000 55,000 $ 191,000 $ 281,000 Variance F F F F F F F Profits increased $281,000 because of the reduction in quality costs from 2009 to 2010. Thus, even though the budgeted reductions for the year were not met, there was still significant improvement. Moreover, most of the improvement came from reduction of failure costs, a positive signal indicating that quality is indeed increasing. 341 14–16 Continued 3. Trend in Total Quality Costs 0.25 Percentage of Sales 0.20 0.20 0.18 0.165 0.15 0.14 0.10 0.11 0.05 0.00 2006 2007 2008 2009 Year Note: Percentages are calculated as follows: 2006: $2,000,000/$10,000,000; 2007: $1,800,000/$10,000,000; 2008: $1,815,000/$11,000,000; 2009: $1,680,000/$12,000,000; 2010: $1,320,000/$12,000,000. 342 2010 14–16 Continued 4. Multiperiod Trend by Category 10 Percentage of Sales 8 6 4 2 0 2006 2007 2008 2009 2010 Year Prevention Appraisal Internal Failure External Failure Increases in prevention and appraisal costs with simultaneous reductions in failure costs are good signals that overall quality is increasing. (Decreases in external failure costs are particularly hard to achieve without quality actually increasing.) 343 14–16 Concluded 5. Iona Company Long-Range Performance Report For the Year Ended December 31, 2010 Actual Costs 2010a Prevention costs: Fixed: Quality planning ........ Quality training.......... Special project .......... Quality reporting ....... Total prevention ................... Appraisal costs: Variable: Proofreading ............. Other inspection ....... Total appraisal ..................... Failure costs: Variable: Correction of typos ... Rework ....................... Plate revisions .......... Press downtime ........ Waste ......................... Total failure .......................... Total quality costs ............... Long-Range Target Costsb Variance $ 150,000 20,000 100,000 12,000 $ 282,000 $ 0 112,500 0 26,250 $ 138,750 $ 150,000 92,500 100,000 14,250 $ 143,250 $ 650,000 75,000 $ 725,000 $ 187,500 48,750 $ 236,250 $ 462,500 U 26,250 U $ 488,750 U $ 206,250 95,000 72,500 127,500 170,000 $ 671,250 $ 1,678,250 $ $ 206,250 95,000 72,500 127,500 170,000 $ 671,250 $ 1,303,250 aExcept 0 0 0 0 0 $ 0 $ 375,000 U F U F U U U U U U U U for prevention costs, which are fixed, actual costs of 2010 are adjusted to a sales level of $15 million by multiplying the actual costs at $12 million by 15/12. This report is prepared at the end of 2010. b2.5% of $15,000,000 = $375,000. Quality training: 30% $375,000 = $112,500 Quality reporting: 7% $375,000 = $26,250 Proofreading: 50% $375,000 = $187,500 Other inspection: 13% $375,000 = $48,750 344 14–17 1. Prevention ................. Appraisal ................... Internal failure ........... External failure.......... Total ..................... Diapers 0.9% 0.8 1.8 1.5 5.0% Napkins 1.00% 1.17 1.08 0.75 4.00% Paper Towels 1.63% 1.63 1.63 1.63 6.52% Total 1.08% 1.08 1.55 1.30 5.01% The company has achieved its goal as no more than 5% of sales was spent on quality (in total). Looking at individual products, the best outcome (napkins) seems to be where appraisal and prevention costs exceed failure costs. If this distribution is better, the total suggests that more should be spent on prevention and appraisal. Opportunities to do so are present in the diaper and paper towel lines. 2. Prevention ................. Appraisal ................... Internal failure ........... External failure.......... Total ..................... Diapers 1.8% 1.6 3.6 3.0 10.0% Napkins 2.00% 2.33 2.17 1.50 8.00% Paper Towels 3.25% 3.25 3.25 3.25 13.00% Total 2.15% 2.15 3.10 2.60 10.00% For this scenario, the goal of 5% is far from being reached. If the idea of balancing costs by category is true, then further reductions can be achieved by shifting more resources into prevention and appraisal activities. Of the three lines, the diaper line is particularly one where more resources should be spent on prevention and appraisal activities. Shifting more resources into these two categories has the potential to reduce the percentage for each line to 5% or below. Shifting more resources into prevention for paper towels and napkins would not create balanced categories. It appears difficult to achieve the overall 5% goal by balancing category costs. The preceding results suggest that the even distribution suggestion of the divisional manager may not be the optimal combination. Perhaps even more emphasis should be placed on control costs. 345 14–17 Concluded 3. Prevention ................. Appraisal ................... Internal failure ........... External failure.......... Total ..................... Diapers 1.80% 1.60 3.60 3.00 10.00% Napkins 3.33% 3.89 3.61 2.50 13.33% Paper Towels 2.03% 2.03 2.03 2.03 8.12% Total 2.15% 2.15 3.10 2.60 10.00% Again, more should be spent on prevention and appraisal activities. However, the lines on which to concentrate these resources are now the diaper and paper towel lines. 4. If quality costs are reported by segment, a manager will know where to concentrate efforts for cost reduction. COLLABORATIVE LEARNING EXERCISE 14–18 1. Len should know that the bonuses are intended for those who legitimately achieve the budgeted quality goals. The three actions taken by Len were manipulative in nature—their objective was simply to massage the performance statistic so that he could receive his bonus. Since Len’s bonus is achieved simultaneously with that of his employees, there is some question whether he really had their interest in mind or simply his own. The behavior exhibited by Len is not ethical. The heart of ethical behavior is sacrificing one’s selfinterest for the well-being of others. By engaging in manipulative behavior, Len is damaging the reputation of the company and providing poor services and products to customers. Len should have stressed the importance of achieving the quality goals by continuing to strive for the current year’s goal by improving quality. If the goal is not achieved this year, then the lack of financial reward should be an additional incentive for better performance for the coming year. 2. First and foremost, the company should attempt to hire individuals with integrity. Second, the company should make sure that the performance and reward system is fair and acceptable to managers and employees. Perhaps the company could provide a percentage of the savings from quality improvements rather than making it an all or nothing bonus, based on achieving some predetermined target. Finally, the company should have in place a good monitoring system to discourage the type of behavior Len is exhibiting, e.g., a good internal audit program. 346 14–18 Concluded 3. Len has violated the ethical code; he has a responsibility to “refrain from engaging in any conduct that would prejudice carrying out duties ethically” (III2) and to “abstain from engaging in or supporting any activity that might discredit the profession” (III-3). CYBER RESEARCH CASE 14–19 Answers will vary. 347