SF Interim loan application - Greater Minnesota Housing Fund

advertisement

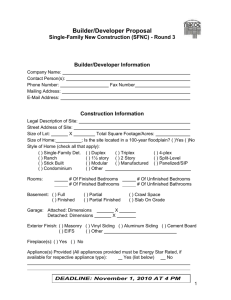

National Community Stabilization Trust (NCST) & Foreclosure Recovery Revolving Loan Program Stabilizing Communities, Strengthening Neighborhoods, Creating Sustainable Homeownership Opportunities Request for Qualifications & Financing Application Application Form -- Part 1 of 2 Borrowers who meet the qualifications of the Foreclosure Recovery Loan Program will work closely with GMHF and its network of statewide partners to meet affordability and other program goals, and ensure quality, green and energy efficient construction. SELECTION CRITERIA Borrowers will be selected based on a range of criteria that include: Relevant residential development experience Experience with similar single family rehabilitation projects Financial resources & organizational capacity to rehab multiple projects simultaneously Quality of previous development projects including references Familiarity with related local, state and federal programs RFQ APPLICATION REQUIREMENTS & SUBMITTAL INFORMATION Interested builder/developers must submit information about their qualifications and experience in completing development projects including the rehabilitation of single family homes and evidence of the financial soundness and capacity of their company, organization or development team. Please complete the following narrative information (Application Form 1 of 2) and attach the Development Financing Plan and Budget (Application Form 2 of 2). Once complete, please email both the completed RFQ Application Form and Project Budget Form directly to ncst@gmhf.com. PRIMARY CONTACT INFORMATION Include the name, address, phone number, and email of a primary organizational contacts and a short description of their role in the organization. Name Address Phone Title & Organizational Role Qualifications/Experience Zip codes for which you are applying for funding and NCST access email OTHER BUSINESS PARTNERS AND DEVELOPMENT TEAM MEMBERS: List additional members of your development team, their responsibilities and experience (marketing, project management, etc.) 1. Name, Title, Business & Responsibilities Qualifications / Experience 2. Name, Title, Business & Responsibilities Qualifications / Experience 3. Name, Title, Business & Responsibilities Qualifications / Experience 4. Name, Title, Business & Responsibilities Qualifications / Experience Identify the corporate structure you are operating under. Limited Liability Corporation (LLC) Limited Partnership Combination of the above (explain): Other, (explain): DBA/Sole Proprietor Subchapter “S” Corporation STATEMENT OF QUALIFICATIONS Experience: Please state your construction rehabilitation and sales activities for the following years: 2014 $ # of units 2013 $ # of units 2012 (YTD) $ # of units Describe the development team’s relevant project experience in planning and financing development projects, emphasizing projects similar to the proposed project (acquisition, rehabilitation and re-sale of existing single family homes to low- and moderate-income homebuyers). Capacity: Provide a brief statement substantiating your organizations ability to manage multiple projects at one time including experience working with the following: architects, builders/contractors, marketing and real estate agents or brokers and first time home buyer programs/products. Proposed Annual Production Volume Identify the approximate number of properties the development team will be able to efficiently and effectively acquire, rehabilitate and market at one time. Eligible properties include single family, duplexes, triplexes or fourplexes provided they are sold to owner occupants. X Production Capacity (Max # of Acq-Rehab units at any point in time) = Number of cycles per year (Ex. If estimating 6 months to acquire and sell, then 2 cycles per yr) Annual Volume Marketing Plan: Briefly describe how you will market and sell properties acquired through the Foreclosure Recovery Program. Include name of broker/agent and any experience they have marketing to first time homebuyers and affordable mortgage programs and products. Describe strategies that will be used to reach targeted income buyers. Financing Plan and Project/Unit Budget: NOTE – YOU MUST FILL OUT AND SUBMIT APPLICATION FORM -- PART 2 OF 2 -- PROJECT BUDGET Based on your current capacity and delivery model fill out the “Financing Plan and Development Budget” spreadsheet (Application Form 2 of 2) with the following information: Estimated number of foreclosed home acquisitions per cycle, average purchase price, average rehab costs, and estimated days to complete, market and resell each home. MANDATORY PROGRAM REQUIREMENTS By checking the boxes below you agree to comply with mandatory program requirements. Use the space provided to explain any unchecked boxes. Developer will use only Minnesota licensed contractor(s) in good standing with the State of Minnesota’s Contractor Licensing Board for all renovation work. If applicant is a general contractor or contractor is a member of the development team: Name MN License # Developer agrees to comply with the Foreclosure Recovery Program’s insurance requirements (Attachment G) If unchecked, provide explanation: Developer affirms that no member of the development team, who is a real property owner, has any pending or prior code enforcement violations from the local jurisdictions in which they plan to operate. If unchecked provide explanation: Developer agrees to rehab homes in compliance with Minnesota Green Communities rehab standards. (http://mngreencommunities.org/publications/download/Specifications-forHousing-Rehabilitation.pdf) Indicate any relevant past experience with green building programs. Minnesota Green Communities Minnesota Greenstar LEED for Homes Minnesota Buildings, Benchmarks and Beyond (B3) Developer agrees to rehab homes in compliance with HUD Housing Quality Standards (HQS). HQS are basic health and safety standards and are required for end buyers to access FHA first mortgage financing. Please review the HQS Inspection Checklist online at: http://www.hud.gov/offices/cpd/affordablehousing/library/forms/hqschecklist.pdf CREDIT WORTHINESS As part of underwriting loans, GMHF seeks credit information on your firm and its principals. While GMHF will be providing acquisition/construction financing, applicants must provide evidence of the financial capacity and strength of the developer/development team. The following submittals are required: Personal tax returns from each partner for the past three years. Permission to run Personal Credit Reports for company principals and partners (credit release form attached). Signed and dated personal financial statements for all partners listed as borrowers for the past three years including statement of commercial and residential real estate owned (if available). Partnership Agreement (if formed at time of application). Roles and responsibilities of each member of the partnership. Three personal references for each of the guarantors (Loan Application). Permission to speak with the accountant of each partner. Business tax returns for the “Borrower” from last three years (unless Borrower is a newly formed entity, LLC, LLP, etc). Aging schedule for accounts payable and accounts receivable. (Required if personal statements show over $100,000 in accounts payable or receivables). NOTE: Financial statements will be confidentially reviewed and will not be shared with any third parties outside of this program. Additional credit information will be requested if you are selected as a builder/developer partner. REFERENCES Provide at least two references below from a city or community development organization such as an HRA, EDA or Nonprofit CDC, for whom you have done work similar to what is proposed in the Foreclosure Recovery Loan Program (i.e. substantial rehab) Organization Contact Name Phone Organization Contact Name Phone Organization Contact Name Phone AUTHORIZATION I/we certify that the information provided herein is true and correct as of the date set forth opposite of my/our signature(s) on this form and understand that intentional misrepresentation of the information may result in disqualification from the program or civil liability. I/we authorize you to share the information collected in this application with our current references and other reputable organizations related to the project. Authorized Signatory #1 Title Date Authorized Signatory #2 Title Date Appendix A Credit Release and Criminal Background Report Greater Minnesota Housing Fund 322 Minnesota Street, Suite 1201 East St. Paul, Minnesota 55101 Ph. 651.221.1997 Memorandum To: From: Re: Credit Release and Criminal Background Report Date: I/We hereby request and authorize you to release to Greater Minnesota Housing Fund and its designees for verification purposes, personal and corporate credit reports and information concerning the company/corporation/partnership and/or the officers and individuals listed below. That information may include but is not limited to: Employment history dates, title, income, hours worked, etc. Banking (checking & savings) accounts of record. Mortgage loan rating (opening date, high credit, payment amount, loan balance, and payment). Any information deemed necessary in connection with a consumer credit report for my loan application. Criminal background report. This information is for the confidential use of this lender, Greater Minnesota Housing Fund (GMHF) in compiling a loan report for funding consideration. A photographic or carbon copy of this authorization (being a photographic or carbon copy of the signature(s) of the undersigned), may be deemed to be the equivalent of the original and may be used as a duplicate original. Name of Application (Please print or type): A. Name of Business: a. Telephone: ( ) B. Name of Affiliated Business: a. Telephone: ( ) 1. Name/Birth Date of Officer/Owner: Address for last two years: Social Security #: 2. Spouse Name/Birth Date of Officer/Owner: Address for last two years: Social Security #: Signature: Signature: Appendix B NCST First Look Program 2011 Income Limits (115%of Statewide Median Adjusted for Family Size) Family Size 1 2 3 4 5 6 7 8 Greater Minnesota Counties1 $58,794 $67,275 $75,613 $84,094 $90,850 $97,606 $104,363 $111,119 Olmsted and Dodge Counties2 $62,531 $71,444 $80,644 $89,556 $96,744 $103,644 $110,831 $118,019 Chisago, Isanti, Sherburne, Wright Counties3 $67,563 $77,338 $86,969 $96,600 $104,363 $112,125 $119,888 $127,650 9 $117,731 $125,063 $135,269 10 $124,488 $132,250 $143,031 These income limits are guidelines you must follow for the NCST First Look Program. Greater Minnesota Housing Fund has increased the income limits from 80% to 115% in order to expand the pool of buyers for homes rehabbed through the program. As mentioned earlier if you do not follow these guidelines you will forfeit the $1,000 held in escrow. GMHF expects that a preponderance of homes will be sold to homebuyers who meet the above income limits. If that is not the case GMHF reserves the right to terminate the developer’s participation in the program. GMHF 2011 Single-Family Acquisition Cost Limits First Look Program GMHF has established acquisition cost limits for developers acquiring properties through the First Look Program. Developers should be purchasing properties that are priced such that after all rehab costs, soft costs and developer profit are included, they are affordable to buyers at or below 80% AMI since many first time homebuyer programs are not available to those making more than 80% AMI. Greater Minnesota Counties4 $175,000 1 Olmsted and Dodge Counties5 $200,000 Chisago, Isanti, Sherburne, Wright Counties6 $200,000 Greater Minnesota limits are based on statewide median income of $73,100. Olmsted and Dodge County income limits are based on Rochester MSA median income of $77,600. 3 Chisago, Isanti, Sherburne and Wright County income limits are based on Minneapolis-St. Paul MSA median income of $84,000. 4 Greater Minnesota limits are based on statewide median income of $73,100. 5 Olmsted and Dodge County income limits are based on Rochester MSA median income of $77,600. 6 Chisago, Isanti, Sherburne and Wright County income limits are based on Minneapolis-St. Paul MSA median income of $84,000. 2 Appendix C.1 BORROWER’S CERTIFICATION AND AUTHORIZATION TO RELEASE HOUSEHOLD INCOME AND DEMOGRAPHICS FORM To Whom It May Concern: I/We have purchased a property whose acquisition was facilitated by the Greater Minnesota Housing Fund (GMHF) through the National Community Stabilization Trust’s (NCST) First Look Program. GMHF requires that certain homebuyer and financing information be reported to them for evaluation purposes. Therefore I/We authorize you to provide GMHF with the information contained in my/our loan application for the purpose of providing the information requested in the form Household income and Demographic Form (appendix C-2). A copy of this authorization may be accepted as an original. Borrower Signature _____________________ Co-Borrower Signature ____________________ Date __________ Date _________ Appendix C.2 Homebuyer Survey Information Form * For households benefiting from GMHF financing All applicant information will be kept confidential. Summary data may be used for statistical/evaluation purposes. Please complete the following form for each household that receives grant assistance from the GMHF. All information will be kept confidential. Summary data may be used for statistical and program evaluation purposes. Surveys should be emailed to ncst@gmhf.com or faxed to (651) 221-1904, Attn: Closing Administrator. Name of Homebuyer (Applicant): Employer(s) and city of employment: Date of Application: Years Employed: Name of Co-Homebuyer (Co-Applicant): Employer(s) and city of employment: Years Employed: Gross Household Income: $ Household Size: Number of Adult Wage Earners: Person with Disability in Household (YES/NO): Age(s) of Children: Age of Head of Household: Type of Housing (New/Existing): Property Address: City: Date of Purchase: Home Stretch/Homebuyer Training Completed? Homebuyer Will Reside in Home as Primary Residence (Yes/No): Household Family Type: Couple with Children Couple with No Children Single Female with Children Single Female with No Children Single Male with Children Single Male with No Children Other: Previous Residence: Owned Rented Other Previous residence zip code Previous Monthly Rent/Mortgage Payment: $ Zip: Date: Household Race (Head of Household): American Indian/ Alaska Native Asian/Pacific Islander Black/African American Hispanic White Other Date of Sale to Homebuyer: Purchase Price: Appraised Value: Number of Bedrooms: Total Square Feet: Finished Square Feet: Financing Information First Mortgage Amount: $ First Mortgage Product/Lender (e.g. CASA, Fannie Mae 3/2, FHA): First Mortgage Terms: Interest Rate: % Amortization Period (years): Monthly P&I to Service this Debt: $ Bank’s/Lender Loan Processor’s Name: Bank’s/Lender Loan Processor’s Phone Number: Amount of Subordinate Mortgage, if any: $ Subordinate Mortgage Product/Lender (e.g. ECHO, HAF): Terms: Interest Rate: % Amortization Period (years): Monthly P&I to Service this Debt: $ Term (years): Term (years): Other Financial Assistance: GMHF Down Payment Assistance $ Other Down Payment Assistance (e.g. Employer Assistance) $ Total Monthly Principal, Interest, Taxes, and Insurance (PITI): $ Provide the following information about the applicant’s financing: Home Purchase Price: $ Plus Closing Costs (do not include pre-paids): $ * Equals Total Due at Closing: $ First Mortgage Amount: $ Buyer Downpayment: $ ECHO/HAF: $ Other Gap Loan: $ Equity/Savings: $ Other Assistance: $ * Equals Total Sources: $ * Total Due at Closing Should Equal Total Sources Amount I attest to the accuracy of all information disclosed on this form and understand that falsified or incorrect information can lead to legal recourse. Signed (Closing Agent): Company: Date: Phone: Email: Greater Minnesota Housing Fund Internal Use Only Loan Officer: Signature: Date: Income Approved Household? Released by: Date: Appendix D FHA 90-Day Anti-Flipping Rule Waiver Starting February 2011, HUD is suspending the FHA’s 90-day anti-flipping rule for one year. This change should increase local home sales, help investors, and create additional real estate demand (because more FHA financing will be available). HUD says that under the new rule, homes sold within the past 90 days may be sold again with FHA-backed mortgages. However, there are some caveats: All transactions must be arms-length, with no identity of interest between the buyer and seller or other parties participating in the sales transaction. There is no pattern of previous flipping activity for the subject property, as evidenced by multiple title transfers within a 12-month time frame. The property must have been marketed openly and fairly, via MLS, auction, For Sale by Owner offering, or developer marketing (any sales contracts that refer to an “assignment of contract of sale,” which represents a special arrangement between seller and buyer may be a red flag). The waiver is limited to forward mortgages, and does not apply to the Home Equity Conversion Mortgage (HECM) for purchase program. IF SALE PRICE IS 20% MORE THAN ACQUISITION COST: The idea is not that there’s a limit on price increases, rather the increase must be justified. HUD remains very much on the look-out for illegal flipping and one way it does this is to look for price increases of 20 percent or more. Legitimate price increases of 20 percent may be justified by the extent of the renovations. Since the onus is on the seller to justify a higher price, owners should retain receipts and take plenty of before and after photos to show lenders if necessary. HUD says that in cases in which the sales price of the property is 20 percent or more over and above the seller’s acquisition cost, the waiver will only apply if The Lender meets specific conditions outlined below. 1. Justifies the increase in value by retaining in the loan file supporting documentation and/or a second appraisal which verifies that the seller has completed sufficient legitimate renovation, repair, and rehabilitation work on the subject property to substantiate the increase in value and 2. Orders a property inspection and provides the inspection report to the purchaser before closing. The lender may charge the borrower for this inspection. The hire of FHA-approved inspectors or 203(k) consultants is not required. The inspector must have no interest in the property or relationship with the seller, and must not receive compensation for the inspection from any party other than the lender. Also, the inspector may not compensate anyone for the referral of the inspection. The property inspection must cover the structure, including the foundation, floor, ceiling, walls and roof, and the exterior, including siding, doors, windows, appurtenant structures such as decks and balconies, walkways and driveways, roofing, plumbing systems, electrical systems heating and air conditioning systems all interiors and all insulation and ventilation systems, as well as fireplaces and solidfuel-burning appliances. Note: While it is the lender’s responsibility to follow to ensure the property meets these conditions, it will be the developer who needs to provide documentation to the lender to make the case. Appendix E National Community Stabilization Trust (NCST) Program A Program to Access Discounted Foreclosed Homes A tool to save time, reduce costs and streamline the acquisition of bank-owned foreclosed properties. GMHF has established a partnership with National Community Stabilization Trust (NCST) - a national initiative designed to facilitate the transfer of foreclosed and abandoned properties from financial institutions to state and local governments and their nonprofit and for-profit partners, to target the rehabilitation and resale of foreclosed homes, and to encourage more housing market activity and neighborhood stability. NCST works by providing access to “First Look” and “Bulk Properties”, which can be obtained by developer partners at a discount to help enable the transfer of properties to lowand moderate-income homebuyers. NCST provides developers access to properties in an efficient and timely manner. NCST removes the frustration of dealing with slow, unresponsive lender/servicer representatives and provides a streamlined process for property identification, inspection, offering, and acquisition. Typically, when one tries to purchase foreclosed properties without NCST, days are spent trying to reach the real estate agent or negotiate with the bank. Properties are often lost during this time period to another purchaser. Since the NCST process is time-driven, deadlines help ensure that the entire transaction, from inspection, to purchase offer, to closing, happen on time and without frustrating delays, resulting in the best price the lender can offer. National lenders currently participating in this discounted foreclosed home disposition strategy include: Wells Fargo, Chase, Citibank and Bank of America/Countrywide, Fannie Mae, Freddie Mac, GMAC and HUD. NCST requires a single point of contact and a single acquisition entity in order to keep the process efficient for these banks. As such, GMHF has been working with over 25 nonprofit, for-profit and city partners throughout Minnesota. GMHF acts as the intermediary to acquire foreclosed homes at a discount from the lenders via the “First Look” and “Targeted Bulk Sale” programs. The “First Look Program” allows the purchase of foreclosed homes before they are publically listed. All of the properties are past the six-month redemption period, the previous owners have vacated the property, but the property is not yet on the market. The discounts are typically 15% (or more) below current market price due to NCST’s expedited system. Prices are based on a discount formula that passes on cost savings for the lender by avoiding certain holding and transaction costs. The price takes into account the need for below market pricing to enable purchasers to comfortably undertake projects. The “Targeted Bulk Sale Program” allows the purchase of foreclosed homes after they are listed at a discount. The properties have typically been offered for sale through the MLS for a minimum of 30 days. There is no minimum number of properties to be acquired. In spite of the term “bulk sale”, a single property may be purchased. With the private sector, GMHF offers a “Early Look Program”. This allows for-profit partners to purchase homes at a discount that our nonprofit partners have passed on. GMHF continues to act as the intermediary and acquires the foreclosed homes for approved private sector partners. The acquisition of homes through National Community Stabilization Trust is facilitated and administered by GMHF staff at a cost of $3,000 per unit, (plus $1,000 escrow deposit that is returned once the home is resold to an income qualified household). Payment is due in full at the time the purchase agreement for the property is signed with GMHF. Appendix F Questions regarding Minnesota Green Communities should be directed to: Hal Clapp Programs and Loan Officer Greater Minnesota Housing Fund 651.221.1997 x.103 hclapp@gmhf.com Appendix G HUD Housing Quality Standards (HQS) Homes purchased using FHA financing must undergo a full FHA inspection to ensure the home meets the Housing Quality Standards (HQS) established by HUD and are mandatory for FHA homebuyer financing. HQS are the most basic minimum health and safety standards. GMHF would expect that rehab done under the Foreclosure Recovery Program would far exceed HQS standards. The information below is excerpted from the HUD website more recent versions and amendments may have been added GMHF does not attest to their accuracy. Source: 60 FR 34695, July 3, 1995, unless otherwise noted. (a) Performance and acceptability requirements. (1) This section states the housing quality standards (HQS) for housing assisted in the programs. (2)(i) The HQS consist of: (A) Performance requirements; and (B) Acceptability criteria or HUD approved variations in the acceptability criteria. (ii) This section states performance and acceptability criteria for these key aspects of housing quality: (A) Sanitary facilities; (B) Food preparation and refuse disposal; (C) Space and security; (D) Thermal environment; (E) Illumination and electricity; (F) Structure and materials; (G) Interior air quality; (H) Water supply; (I) Lead-based paint; (J) Access; (K) Site and neighborhood; (L) Sanitary condition; and (M) Smoke detectors. (b) Sanitary facilities--(1) Performance requirements. The dwelling unit must include sanitary facilities located in the unit. The sanitary facilities must be in proper operating condition, and adequate for personal cleanliness and the disposal of human waste. The sanitary facilities must be usable in privacy. (2) Acceptability criteria. (i) The bathroom must be located in a separate private room and have a flush toilet in proper operating condition. (ii) The dwelling unit must have a fixed basin in proper operating condition, with a sink trap and hot and cold running water. (iii) The dwelling unit must have a shower or a tub in proper operating condition with hot and cold running water. (iv) The facilities must utilize an approvable public or private disposal system (including a locally approvable septic system). (c) Food preparation and refuse disposal--(1) Performance requirement. (i) The dwelling unit must have suitable space and equipment to store, prepare, and serve foods in a sanitary manner. (ii) There must be adequate facilities and services for the sanitary disposal of food wastes and refuse, including facilities for temporary storage where necessary (e.g., garbage cans). (2) Acceptability criteria. (i) The dwelling unit must have an oven, and a stove or range, and a refrigerator of appropriate size for the family. All of the equipment must be in proper operating condition. The equipment may be supplied by either the owner or the family. A microwave oven may be substituted for a tenant-supplied oven and stove or range. A microwave oven may be substituted for an owner-supplied oven and stove or range if the tenant agrees and microwave ovens are furnished instead of an oven and stove or range to both subsidized and unsubsidized tenants in the building or premises. (ii) The dwelling unit must have a kitchen sink in proper operating condition, with a sink trap and hot and cold running water. The sink must drain into an approvable public or private system. (iii) The dwelling unit must have space for the storage, preparation, and serving of food. (iv) There must be facilities and services for the sanitary disposal of food waste and refuse, including temporary storage facilities where necessary (e.g., garbage cans). (d) Space and security--(1) Performance requirement. The dwelling unit must provide adequate space and security for the family. (2) Acceptability criteria. (i) At a minimum, the dwelling unit must have a living room, a kitchen area, and a bathroom. (ii) The dwelling unit must have at least one bedroom or living/ sleeping room for each two persons. Children of opposite sex, other than very young children, may not be required to occupy the same bedroom or living/sleeping room. (iii) Dwelling unit windows that is accessible from the outside, such as basement, first floor, and fire escape windows, must be lockable (such as window units with sash pins or sash locks, and combination windows with latches). Windows that are nailed shut are acceptable only if these windows are not needed for ventilation or as an alternate exit in case of fire. (iv) The exterior doors of the dwelling unit must be lockable. Exterior doors are doors by which someone can enter or exit the dwelling unit. (e) Thermal environment--(1) Performance requirement. The dwelling unit must have and be capable of maintaining a thermal environment healthy for the human body. (2) Acceptability criteria. (i) There must be a safe system for heating the dwelling unit (and a safe cooling system, where present). The system must be in proper operating condition. The system must be able to provide adequate heat (and cooling, if applicable), either directly or indirectly, to each room, in order to assure a healthy living environment appropriate to the climate. (ii) The dwelling unit must not contain unvented room heaters that burn gas, oil, or kerosene. Electric heaters are acceptable. (f) Illumination and electricity--(1) Performance requirement. Each room must have adequate natural or artificial illumination to permit normal indoor activities and to support the health and safety of occupants. The dwelling unit must have sufficient electrical sources so occupants can use essential electrical appliances. The electrical fixtures and wiring must ensure safety from fire. (2) Acceptability criteria. (i) There must be at least one window in the living room and in each sleeping room. (ii) The kitchen area and the bathroom must have a permanent ceiling or wall light fixture in proper operating condition. The kitchen area must also have at least one electrical outlet in proper operating condition. (iii) The living room and each bedroom must have at least two electrical outlets in proper operating condition. Permanent overhead or wall-mounted light fixtures may count as one of the required electrical outlets. (g) Structure and materials--(1) Performance requirement. The dwelling unit must be structurally sound. The structure must not present any threat to the health and safety of the occupants and must protect the occupants from the environment. (2) Acceptability criteria. (i) Ceilings, walls, and floors must not have any serious defects such as severe bulging or leaning, large holes, loose surface materials, severe buckling, missing parts, or other serious damage. (ii) The roof must be structurally sound and weathertight. (iii) The exterior wall structure and surface must not have any serious defects such as serious leaning, buckling, sagging, large holes, or defects that may result in air infiltration or vermin infestation. (iv) The condition and equipment of interior and exterior stairs, halls, porches, walkways, etc., must not present a danger of tripping and falling. For example, broken or missing steps or loose boards are unacceptable. (v) Elevators must be working and safe. (h) Interior air quality--(1) Performance requirement. The dwelling unit must be free of pollutants in the air at levels that threaten the health of the occupants. (2) Acceptability criteria. (i) The dwelling unit must be free from dangerous levels of air pollution from carbon monoxide, sewer gas, fuel gas, dust, and other harmful pollutants. (ii) There must be adequate air circulation in the dwelling unit. (iii) Bathroom areas must have one openable window or other adequate exhaust ventilation. (iv) Any room used for sleeping must have at least one window. If the window is designed to be openable, the window must work. (i) Water supply--(1) Performance requirement. The water supply must be free from contamination. (2) Acceptability criteria. The dwelling unit must be served by an approvable public or private water supply that is sanitary and free from contamination. (j) Lead-based paint performance requirement. The Lead-Based Paint Poisoning Prevention Act (42 U.S.C. 4821-4846), the Residential Lead-Based Paint Hazard Reduction Act of 1992 (42 U.S.C. 4851-4856), and implementing regulations at part 35, subparts A, B, M, and R of this title apply to units assisted under this part. (k) Access performance requirement. The dwelling unit must be able to be used and maintained without unauthorized use of other private properties. The building must provide an alternate means of exit in case of fire (such as fire stairs or egress through windows). (l) Site and Neighborhood--(1) Performance requirement. The site and neighborhood must be reasonably free from disturbing noises and reverberations and other dangers to the health, safety, and general welfare of the occupants. (2) Acceptability criteria. The site and neighborhood may not be subject to serious adverse environmental conditions, natural or manmade, such as dangerous walks or steps; instability; flooding, poor drainage, septic tank back-ups or sewage hazards; mudslides; abnormal air pollution, smoke or dust; excessive noise, vibration or vehicular traffic; excessive accumulations of trash; vermin or rodent infestation; or fire hazards. (m) Sanitary condition--(1) Performance requirement. The dwelling unit and its equipment must be in sanitary condition. (2) Acceptability criteria. The dwelling unit and its equipment must be free of vermin and rodent infestation. (n) Smoke detectors performance requirement--(1) Except as provided in paragraph (n)(2) of this section, each dwelling unit must have at least one battery-operated or hard-wired smoke detector, in proper operating condition, on each level of the dwelling unit, including basements but excepting crawl spaces and unfinished attics. Smoke detectors must be installed in accordance with and meet the requirements of the National Fire Protection Association Standard (NFPA) 74 (or its successor standards). If the dwelling unit is occupied by any hearing-impaired person, - smoke detectors must have an alarm system, designed for hearing-impaired persons as specified in NFPA 74 (or successor standards). (2) For units assisted prior to April 24, 1993, owners who installed battery-operated or hard-wired smoke detectors prior to April 24, 1993 in compliance with HUD's smoke detector requirements, including the regulations published on July 30, 1992, (57 FR 33846), will not be required subsequently to comply with any additional requirements mandated by NFPA 74 (i.e., the owner would not be required to install a smoke detector in a basement not used for living purposes, nor would the have already been installed on the other floors of the unit). ***** (j) Lead-based paint performance requirement--(1) Purpose and applicability. (i) The purpose of paragraph (j) of this section is to implement section 302 of the Lead-Based Paint Poisoning Prevention Act, 42 U.S.C. 4822, by establishing procedures to eliminate as far as practicable the hazards of lead-based paint poisoning for units assisted under this part. Paragraph (j) of this section is issued under 24 CFR 35.24 (b)(4) and supersedes, for all housing to which it applies, the requirements of subpart C of 24 CFR part 35. (ii) The requirements of paragraph (j) of this section do not apply to 0-bedroom units, units that are certified by a qualified inspector to be free of lead-based paint, or units designated exclusively for elderly. The requirements of subpart A of 24 CFR part 35 apply to all units constructed prior to 1978 covered by a HAP contract under part 982. (2) Definitions. Chewable surface. Protruding painted surfaces up to five feet from the floor or ground that are readily accessible to children under six years of age; for example, protruding corners, window sills and frames, doors and frames, and other protruding woodwork. Component. An element of a residential structure identified by type and location, such as a bedroom wall, an exterior window sill, a baseboard in a living room, a kitchen floor, an interior window sill in a bathroom, a porch floor, stair treads in a common stairwell, or an exterior wall. Defective paint surface. A surface on which the paint is cracking, scaling, chipping, peeling, or loose. Elevated blood lead level (EBL). Excessive absorption of lead. Excessive absorption is a confirmed concentration of lead in whole blood of 20 ug/dl (micrograms of lead per deciliter) for a single test or of 15-19 ug/dl in two consecutive tests 3-4 months apart. HEPA means a high efficiency particle accumulator as used in lead abatement vacuum cleaners. Lead-based paint. A paint surface, whether or not defective, identified as having a lead content greater than or equal to 1 milligram per centimeter squared (mg/cm<SUP>2</SUP>), or 0.5 percent by weight or 5000 parts per million (PPM). (3) Requirements for pre-1978 units with children under 6. (i) If a dwelling unit constructed before 1978 is occupied by a family that includes a child under the age of six years, the initial and each periodic inspection (as required under this part), must include a visual inspection for defective paint surfaces. If defective paint surfaces are found, such surfaces must be treated in accordance with paragraph (j)(6) of this section. (ii) The HA may exempt from such treatment defective paint surfaces that are found in a report by a qualified lead-based paint inspector not to be lead-based paint, as defined in paragraph (j)(2) of this section. For purposes of this section, a qualified lead-based paint inspector is a State or local health or housing agency, a lead-based paint inspector certified or regulated by a State or local health or housing agency, or an organization recognized by HUD. (iii) Treatment of defective paint surfaces required under this section must be completed within 30 calendar days of HA notification to the owner. When weather conditions prevent treatment of the defective paint conditions on exterior surfaces within the 30 day period, treatment as required by paragraph (j)(6) of this section may be delayed for a reasonable time. (iv) The requirements in this paragraph (j)(3) apply to: (A) All painted interior surfaces within the unit (including ceilings but excluding furniture); (B) The entrance and hallway providing access to a unit in a multiunit building; and (C) Exterior surfaces up to five feet from the floor or ground that are readily accessible to children under six years of age (including walls, stairs, decks, porches, railings, windows and doors, but excluding outbuildings such as garages and sheds). (4) Additional requirements for pre-1978 units with children under 6 with an EBL. (i) In addition to the requirements of paragraph (j)(3) of this section, for a dwelling unit constructed before 1978 that is occupied by a family with a child under the age of six years with an identified EBL condition, the initial and each periodic inspection (as required under this part) must include a test for lead-based paint on chewable surfaces. Testing is not required if previous testing of chewable surfaces is negative for lead-based paint or if the chewable surfaces have already been treated. (ii) Testing must be conducted by a State or local health or housing agency, an inspector certified or regulated by a State or local health or housing agency, or an organization recognized by HUD. Lead content must be tested by using an X-ray fluorescence analyzer (XRF) or by laboratory analysis of paint samples. Where lead-based paint on chewable surfaces is identified, treatment of the paint surface in accordance with paragraph (j)(6) of this section is required, and treatment shall be completed within the time limits in paragraph (j)(3) of this section. (iii) The requirements in paragraph (j)(4) of this section apply to all protruding painted surfaces up to five feet from the floor or ground that are readily accessible to children under six years of age: (A) Within the unit; (B) The entrance and hallway providing access to a unit in a multiunit building; and (C) Exterior surfaces (including walls, stairs, decks, porches, railings, windows and doors, but excluding outbuildings such as garages and sheds). (5) Treatment of chewable surfaces without testing. In lieu of the procedures set forth in paragraph (j)(4) of this section, the HA may, at its discretion, waive the testing requirement and require the owner to treat all interior and exterior chewable surfaces in accordance with the methods set out in paragraph (j)(6) of this section. (6) Treatment methods and requirements. Treatment of defective paint surfaces and chewable surfaces must consist of covering or removal of the paint in accordance with the following requirements: (i) A defective paint surface shall be treated if the total area of defective paint on a component is: (A) More than 10 square feet on an exterior wall; (B) More than 2 square feet on an interior or exterior component with a large surface area, excluding exterior walls and including, but not limited to, ceilings, floors, doors, and interior walls; or (C) More than 10 percent of the total surface area on an interior or exterior component with a small surface area, including, but not limited to, window sills, baseboards and trim. (ii) Acceptable methods of treatment are: removal by wet scraping, wet sanding, chemical stripping on or off site, replacing painted components, scraping with infra-red or coil type heat gun with temperatures below 1100 degrees, HEPA vacuum sanding, HEPA vacuum needle gun, contained hydroblasting or high pressure wash with HEPA vacuum, and abrasive sandblasting with HEPA vacuum. Surfaces must be covered with durable materials with joints and edges sealed and caulked as needed to prevent the escape of lead contaminated dust. (iii) Prohibited methods of removal are: open flame burning or torching; machine sanding or grinding without a HEPA exhaust; uncontained hydroblasting or high pressure wash; and dry scraping except around electrical outlets or except when treating defective paint spots no more than two square feet in any one interior room or space (hallway, pantry, etc.) or totaling no more than twenty square feet on exterior surfaces. (iv) During exterior treatment soil and playground equipment must be protected from contamination. (v) All treatment procedures must be concluded with a thorough cleaning of all surfaces in the room or area of treatment to remove fine dust particles. Cleanup must be accomplished by wet washing surfaces with a lead solubilizing detergent such as trisodium phosphate or an equivalent solution. (vi) Waste and debris must be disposed of in accordance with all applicable Federal, state and local laws. (7) Tenant protection. The owner must take appropriate action to protect residents and their belongings from hazards associated with treatment procedures. Residents must not enter spaces undergoing treatment until cleanup is completed. Personal belongings that are in work areas must be relocated or otherwise protected from contamination. ***** Appendix H Lead Based Paint MINOR REPAIR AND MAINTENANCE ACTIVITIES Following are a sample of FAQ’s from the EPA website regarding lead paint remediation. The full 78 page document can be viewed by following this link http://www.epa.gov/lead/pubs/rrp-faq.pdf Question: If a renovator disrupts 6 square feet or less of painted surface per room in several rooms inside one property, does the RRP Rule apply? Answer: No, as long as no prohibited work practices are used and the work does not involve window replacement or demolition of painted surfaces. The exception to the RRP rule for work that disrupts 6 square feet or less of painted surface applies to each individual room and is inclusive of all work done in the room in any 30-day period. Question: If a renovator disrupts 20 square feet or less of painted surface per side on several sides of the exterior of one property, does the RRP Rule apply? Answer: Yes. To qualify for the exception for minor repair and maintenance activities, the total amount of exterior paint disrupted must be 20 square feet or less. In addition, the job must not use prohibited practices or involve window replacement or demolition of painted surfaces. More FAQ’s at this link: http://www.epa.gov/lead/pubs/rrp-faq.pdf Private Sector Foreclosure Recovery Revolving Loan Program – Application Form, Part 1 of 2 20 Appendix I National Community Stabilization Trust First Look Program TERMS & CONDITIONS FOR PARTICIPATION 1) PROJECT GOALS MUST BE CONSISTENT WITH STATE AND LOCAL COMMUNITY GOALS: Your acquisition rehab project must be consistent with state and local community goals. State and local community goals include: Rehabilitate and redevelop foreclosed, vacant and/or abandoned homes for the purpose of stabilizing neighborhoods, stimulating local housing markets, encouraging private investment and improvement of local tax base, and where applicable, to complement federally funded Neighborhood Stabilization Program (NSP) foreclosure recovery efforts. Provide sustainable homeownership opportunities for low- and moderate-income homebuyers. Rehabilitate foreclosed homes to green and healthy building standards fostering energy conservation, improving health for families, and creating sustainable communities. Create local green jobs in the residential construction trades and supporting industries. Preserve existing affordable and market rate homes. 2) HOW TO ACQUIRE DISCOUNTED FORECLOSED PROPERTIES Developers must be approved to participate in the program through a separate application. Developers will be re-approved annually based on performance in meeting the program goals. Developers must also participate in GMHF sponsored orientation and training on green building standards and foreclosed home acquisition process. This orientation can be given in person or via a webinar. Once qualified, developers are given access to exclusive NCST lists of discounted bank owned properties. Participating builders and developers may also obtain foreclosed homes through local realtors and brokers, REO auctions, and directly from banks. Appraisals are recommended but not required on properties. 3) ELIGIBLE FORECLOSED PROPERTIES Properties must be between 1 and 4 units in size to target acquisition and rehab of typical owneroccupied homes, townhomes, duplexes, triplexes, and quad homes. Developers’ acquisition costs cannot exceed GMHF’s acquisition cost limits (see Appendix B). 4) PROPERTY INSPECTION, SCOPE OF WORK, REHAB GUIDELINES and REQUIRED SUBMITALS SEND AT COUNTER OR ACCEPTANCE Prior to GMHF Submitting an Offer to Purchase – Prior to GMHF submitting a purchase offer to a lender on the developers’ behalf GMHF will require the following: A detailed property inspection report that notes the useful life of major systems; mechanical, roofing, electrical, plumbing (FORM I) An estimate of the rehab costs (FORM I) Complete set of digital photographs of existing home conditions, including; o Exterior front and back photos (house, yard, etc) Private Sector Foreclosure Recovery Revolving Loan Program – Application Form, Part 1 of 2 21 o o Interior photos of all living spaces, including basement Specific photos of areas in need of substantial rehab SEND AT ACCEPTANCE Prior to Closing – Developers participating in the program must provide the following prior to closing on the purchase through GMHF: A complete scope of work and contractor bids (PROVIDE CONTRACTOR BIDS) Method of satisfying MN Green Communities checklist form for items on the rehab scope of work (FORM II) SEND AT CLOSING Prior to the Sale to Resident Homebuyer – Prior to the sale to resident homebuyer developer shall provide to GMHF the following: Buyer information - Household Income and Demographics Form (FORM III): The form will be filled out and sent to GMHF by the mortgage underwriter. However it is the developer’s responsibility to provide the form along with the Borrower’s Certification and Authorization to Release to the homebuyer and buyers realtor to ensure that the underwriter receives it. The form asks for information such as income, family size, mortgage terms and other buyer demographics. Property Information (FORM IV): GMHF will provide the developer with a property information sheet in excel format. Developer is to input property data such as final rehab cost, sale price, length of time on market, etc. Certification of all of the following, as included on (FORM IV): o Energy Audit: Energy audit completed o Home Buyer Warranty: Minimum 1 year Home Buyer Warranty provided to homebuyer o Furnace: Furnace has an estimated useful life of at least five (5) years and an efficiency rating of 82% or higher o Roof: Roof has an estimated useful life of at least five (5) years o Water Heater: Water heater has an estimated useful life of at least (3) years o Photos: Before and After Photos have been submitted (Attach photos) Quarterly Reports: Developer agrees to provide GMHF with quarterly data on property/development activity. GMHF will provide the forms in electronic format. Rehab Standards: Developer agrees to rehabilitate or cause the rehabilitation of the property by contractors to the following minimum standards: (1) Local Building Code Requirements. (2) Minnesota Overlay to the Green Communities Criteria. Any element on the rehab scope of work must be rehabbed to Minnesota Green Communities standards. For example, Energy Star appliances, low VOC paints, water conserving faucets and radon mitigation. For assistance on meeting the Minnesota Overlay to the Green Communities Criteria, please refer to the Minnesota Green Communities Rehabilitation Specifications that can be downloaded by following this link. http://mngreencommunities.org/publications/download/Specifications-for-Housing-Rehabilitation.pdf (3) Lead Paint: On homes built before 1978 all work must be conducted and completed in compliance with lead mitigation and removal procedures provided by HUD. Contractors performing work on homes should be aware of the rules regulating how work needs to be performed since this can add significant costs to the project. (see Appendix G for FAQ’s and a link to EPA website) (4) Asbestos Mitigation and Removal. The presence of any asbestos in the home, such as asbestos floor tile (9 inch tiles), ceiling tiles, furnace pipe, duct, hot water heater pipe wrap or other materials must be disclosed and be properly removed, contained or mitigated. (5) In order for a buyer to get FHA financing the renovated property must meet HUD Housing Quality Standards without exception (Appendix F). (6) Developer agrees to have an energy audit performed on each home acquired. Audit is to include a list of energy improvements to be made by the contractor. A pre-and post-rehab blower door test is to be done to ensure performance measures are met. GMHF will pay for energy audits on the first two homes. Private Sector Foreclosure Recovery Revolving Loan Program – Application Form, Part 1 of 2 22 (7) Property Risk and Liability: Developer assumes all risks associated with the purchase and rehabilitation of the property, including financial risk. Developer must provide an independent Home Buyer Warranty for a minimum of 1-year. The contractor also certifies that to the best of their knowledge the following: (1) Furnace: Furnace must have an estimated useful life of at least five (5) years and an efficiency rating of 82% or higher; (2) Roof: Roof must have an estimated useful life of at least five (5) years; (3) Water Heater: Water heater must have an estimated useful life of at least (3) years; 5) HOMEBUYER TRAINING Homebuyer training is encouraged, but not required. However, Developer should note that for certain sources of gap and down payment subsidy, including Minnesota Housing, GMHF, NSP and FHLB funds, homebuyer training through an approved homebuyer training program is required. 6) AFFORDABLE MORTGAGE PRODUCTS Developer agrees to ensure that all homebuyers use an affordable mortgage product with competitive fixed interest rates, amortization schedules, and loan term of no less than 20 years. Homebuyer must obtain first mortgage financing that meets GMHF standards (a prime loan, either conventional, or FHA, RD, VA). 7) WAIVER OF FHA’S 90-DAY ANTI-FLIPPING RULE Due to past abuses of the homebuyer market by real estate speculators, anti-flipping provisions were added to FHA financing which typically required that no FHA funds be used to finance a home purchased within 90 days. These provisions have been waived for approved foreclosure recovery projects. However, certain conditions apply in order for properties to be exempt and sold within the 90-day period. Please note that developers purchasing homes through this NCST program who adhere to GMHF’s program guidelines should qualify for the waiver and be able to sell within 90 days of purchase. There are several important FHA conditions and ultimately it is up to the developer to work with the FHA underwriter to satisfy them that the home is not subject to the 90-day rule. Below are a few of the criteria to get a waiver: (1) All transactions must be arms-length, with no identity of interest between the buyer and seller or other parties participating in the sales transaction. (2) In cases in which the sale price of the property is 20 percent or more above the seller’s acquisition cost, the waiver will only apply if the developer can provide the lender/underwriter with proof that the increase was justified due to improvements to the property. (3) The lender must order a property inspection and provide the inspection report to the purchaser before closing. The lender may charge the borrower for this inspection. (4) A description of the ruling is attached as (Appendix D). 8) GMHF FORECLOSED HOME TRANSFER FEE: GMHF charges a $3,000 foreclosed home transaction fee, which covers the administrative and legal costs to manage the program, clear title and acquire the property from NCST. All other closing and recording fees are the responsibility of the developer, and typically range from $600-$800. 9) ESCROW OF FUNDS - to Ensure Homes are Sold to Income Qualified Buyers Over and above the Transfer Fee, GMHF requires developers to escrow an additional $1,000 at closing. These funds will be fully reimbursed only if prior to closing with the end buyer, the developer provides evidence that the following conditions were met; Property was sold to an owner-occupant buyer that meets GMHF income requirements Buyer income and demographic data is received (see Appendix C.1/ C.2) If the above conditions are not met, developer will forfeit the $1,000 escrowed funds. 10) AUTHORIZATION FOR INDEPENDENT THIRD PARTY HOME INSPECTION From time to time GMHF may contract with a third party inspector to ensure that subject property was rehabbed according to the standards set out in the scope of work and program criteria. GMHF will pay for these services but developer agrees to provide access to the property and such Private Sector Foreclosure Recovery Revolving Loan Program – Application Form, Part 1 of 2 23 construction and closing documents as may be needed to verify the improvements were done according to program guidelines. 11) CONTRACTOR-CERTIFICATION (Minnesota Green Communities Requirements) Developer/Contractor will be asked to self-certify that all building components addressed as part each home’s rehab meet Minnesota Green Communities Criteria by completing the “Method of Satisfying Green Communities Criteria and Certification” Form (Appendix F). This will require developers to participate in a training session hosted by GMHF. The training can be web based or in person. 12) CONDITIONS FOR RESALE OF HOMES TO RESIDENT HOMEOWNERS The Developer agrees to sell the property to a resident homebuyer who will occupy the home as the purchaser’s primary residence (“Resident Homeowner”). Developer must actively market the homes to reach income-qualified resident homebuyer(s) (Appendix A). If the property is sold to a non-income qualified homebuyer the developer will forfeit the $1,000 held in escrow by GMHF. Developer shall not lease the property. The Developer shall provide to the Resident Homeowner at least a one-year basic systems warranty and a clean truth-in-housing / sale-of-housing report if required by the municipality (no waivers). Homebuyer must obtain first mortgage financing that meets GMHF standards (a prime loan, either conventional, or FHA, RD, VA). Upon the sale of the home to an income qualified owner occupant, GMHF will reimburse the $1,000 held in escrow provided GMHF has received the Household Income and Demographics Form. It is the responsibility of the Developer to provide the form to the buyer or buyer’s agent so that it can be given to the loan underwriter to verify and return to GMHF. The buyer’s Certification and Authorization to Release form and the Household Income and Demographics form are attached as Appendix C.1 and C.2 Private Sector Foreclosure Recovery Revolving Loan Program – Application Form, Part 1 of 2 24

![[Agency] recognizes the hazards of lead](http://s3.studylib.net/store/data/007301017_1-adfa0391c2b089b3fd379ee34c4ce940-300x300.png)