Tax Law II - Çağ Üniversitesi

advertisement

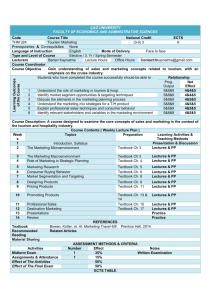

ÇAĞ UNIVERSITY FACULTY OF LAW Learning Outcomes of the Course Code Course Name Credit ECTS LAW 310 3 Tax Law II 2(2–0–0) Prerequisites None Language of Instruction Mode of Delivery Face to face Turkish Type and Level of Course Compulsory/ 3.Year/Spring Semester Type and Level of Course Main / Undergraduate Lecturers Name(s) Lecture Office Contacts Hours Hours Course Coordinator Assist.Prof. Şenol Mon. 14-16 Tue: 13–15 senolkandemir@cag.edu.tr Kandemir Course Objective The aim of this course is to teach Turkish Tax System, Turkish Personal Income and Corporation Tax Law. Relationship Students who have completed the course successfully should be able to; P. O. Net Effect 1 2 explain determination and taxation of income, 2,3,4 2 3 explain determination and taxation of revenue, 2,3,4 3 3 Define declaration of income tax, 2,3,4 4 3 evaluate tax base informations, 2,3,4 5 3 explain solutions about problems between taxpayers and tax administration. 2,3,4 Course Description: Turkish Tax System, Turkish personal income tax law: Tax codes, tax unit, taxable event, taxable income, tax-exempt income, taxable period, taxable transactions, tax Return, tax payment Course Contents: ( Weekly Lecture Plan ) Weeks Topics Preparation Teaching Methods 1 Lectures, questions and answers The historical development of income tax, the textbook income concept 2 Lectures, questions and answers Subject and tax payer of income tax textbook 3 Lectures, questions and answers The commercial earning concept,Concept of textbook commercial activity and its features,The status of company incomes against commercial earning, The finding of commercial earning 4 Lectures, questions and answers The dowloadable and nondepreciable expenses ın textbook determining real method of commercial earning 5 Lectures, questions and answers The exemption and exceptions in commercial textbook earning 6 Lectures, questions and answers The incomes from agriculture, The agricultural textbook concept 7 Lectures, questions and answers Taxation of incomes from agriculture textbook 8 Lectures, questions and answers The wages, The wage concept and its features, textbook The seperation from other component of wages, Taxation of wages 9 Lectures, questions and answers The achievable deductions from gross wage, The textbook exemption and exceptions in wages 10 Lectures, questions and answers The income from liberal profession, The freelancer, textbook The determining and taxation of income from liberal profession 11 Lectures, questions and answers The real estate capital of annuity,The determining textbook of real estate capital of annuity, The exceptions in real estate capital of annuity 12 Lectures, questions and answers The security income, The pernancy and taxation of textbook security income, The other earnings and revenue 13 Lectures, questions and answers The declaring of income tax and the kinds of textbook charter 14 Lectures, questions and answers The leavy and collection of income tax textbook REFERENCES Textbook Türk Vergi Sistemi; Prof. Nurettin BİLİCİ, Seçkin Yayıncılık, ISBN: 975– 02–2280–1; Ankara, 2013. Related Links www.gib.gov.tr Recommended Reading Material Sharing - Activities Midterm Exam Final Exam Contents Hours in Classroom Hours out Classroom Midterm Exam Final Exam ASSESSMENT METODS Number Effects 40% 60% ECTS TABLE Number 14 14 1 1 Hours 2 2 16 18 Total Total / 30 ECTS Credits RECENT PERFORMANCE Notes Total 28 28 16 18 90 =90/30= 3 3