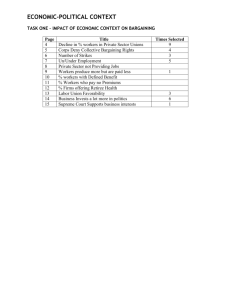

Labor unions: Basic issues

advertisement

Labor unions: Basic issues What do unions do? 1.Determine/influence wages, other compensation (fringe benefits, layoff/unemployment compensation, pensions, insurance) 2.Influence on employment 3.Influence on worker effort or effort requirements, hours etc. 4.Influence on work conditions, safety, take up welfare issues important for workers 5.Influence on work rules, rules of hiring and firing (e.g. LIFO), may serve to enforce agreed rules versus employers 6.Influence on legislation and policy issues, in society generally (mainly relevant for “encompassing unions” only) 7.Coordinate activities with aim to further its goals, such as strikes or strike threats, go-slow or work-to-rule actions Points 1-2 and 7 are the “traditional” roles of labor unions, which imply that unions may act as monopolists in influencing wages and employment levels. Much of the lectures will deal with these issues. Points 3-6 represent the “voice” role of labor unions, which is a role stressed by Richard Freeman and James Medoff in an influential book from 1984. Two ways of organization are “closed shop” and “open shop” Closed shop: There is a common vote or decision whether or not a given firm is to be unionised. If it is unionised, all workers in the firm must belong to the union. If not, typically no worker is unionised. This is a typical organization in the U.S., and to some extent in the U.K, in particular in manufacturing, construction etc. Open shop: There is no requirement that the individual worker is unionised. Open shop is common in most of Europe. At what levels do unions operate? 1.At the plant or firm level, union organized locally 2.At the industry level, common policy set for all firms in a given industry 3.At the national level, “encompassing unions”, which may organize all unionised workers and have more general effects on society. There is an observed tendency for unions to be more“ aggressive” (in particular in terms of wage demands), at the industry level, than at either the local level, or at the national level with encompassing unions. Local unions: May often have reduced bargaining power because an aggressive wage policy would hurt the local firm badly. But generally do not have incentives to think about national issues (such as holding back wages so as not to trigger inflation). Industry-level unions: May have considerable effective monopoly power and power to effectively set high wages, and firms often do not have great incentives to oppose these demands (because high wages largely lead firms to set high prices in that industry, thus recuperating profits). The difference in strategic behavior of these two types of unions will be illustrated in class, later in the lectures on unions. Encompassing unions: In principle these have even greater “monopoly power” than industry unions, in the sense that they can coordinate the wages of more firms and in principle bid up wages. But they may on the other hand have greater incentive to act with restraint, because it realize that aggressive wage demands will lead to unwanted inflation and sub-optimal overall employment levels. This may lead to “peace agreements” between encompassing union and employer organizations (as has been standard in Norway, and partly and Sweden). Note that in several European countries (such as France and Germany) unions organize a small part of workers, but still influence wages for many more. This is illustrated in two the following table. Table 1: Collective bargaining coverage and density (share of labor force that is unionised), various OECD countries, selected years Country Coverage, 1960 Austria Na Australia 85 Belgium 80 Canada 35 Denmark 67 Finland 95 France Na Germany 90 Ireland Na Italy 91 Japan Na Netherlands 100 New Na Zealand Norway 65 Portugal Na Spain Na Sweden Na Switzerland Na UK 67 US 29 Coverage, 1980 Na 85 90 40 72 95 85 91 Na 85 28 76 Na Coverage, 1994 99 80 90 36 69 95 95 92 Na 82 21 85 31 Density, 1960-64 59 48 40 27 60 35 20 34 47 25 33 41 36 Density, 1980-87 51 49 52 37 79 69 16 34 56 45 27 30 37 Density, 1996-98 39 35 Na 36 76 80 10 27 43 37 22 24 21 70 70 Na Na Na 70 21 70 71 78 89 53 40 17 52 61 9 64 35 44 27 55 57 11 83 29 53 20 55 25 18 87 23 35 14 General allocation effects of unions Allocation effects of unions depend on how widespread unionism is, on what variables are actually set by unions, and on how the union behaves with respect to these variables. In addition it depends on what the alternative is, i.e. what would have been the situation in the absence of unions. Traditional view of unions, that was prevalent in the professional literature up until around 1980: The main effects of labor unions is to impose allocation losses on society, as they impose a degree of monopolism in the supply of labor, on the firms and the economy, thereby raising general wages and lowering employment. Traditionally recognized views of unions are in addition: - that they work hard to attain wages that are similar across employed workers within the given firm or sector that they organize, implying that wages tend to vary “too little” with productivity. This may lead to allocation losses e.g. because of too little incentive to put up effort, or to take education. - That they push up wages for the workers that they organize, leading to “unjust” union-nonunion wage differentials (i.e. those workers who are not unionised, earn relatively too little). This was a view early exposed by Milton Friedman. Arguments that may imply that unions have favourable (or less unfavourable) allocation effects: 1. The “voice” aspect. The idea here is that a union, more easily than individual workers, is able to raise issues with management, which are of common concern to workers, and which would lower worker welfare if not dealt with. The union may serve as an information channel for complaints, e.g. about work conditions, contractual issues etc. 2. Productivity effects. It is possible that the “voice” aspect may have countervailing and positive effects on productivity (counteracting the negative effects mentioned above), leading to more satisfied, and productive, workers under unions. 3. Contract enforcement issues. Contracts offered by firms to individual workers (in particular if they are mainly “implicit” as will be discussed in the lectures on that topic) may be reneged or defaulted by firms, and unions may serve as guarantist that the contracts will be abided by. 4. The countervailing power argument. This is particularly relevant when firms have considerable monopoly power which is exercised versus workers. The union may then have force to “balance” the distribution of power, between workers and firms, in ways that individual workers cannot. 5. Reduction of bargaining costs. The union is an efficient instrument for conducting bargaining versus the firm, in particular when the alternative is a situation with individual bargains, between each worker and firm. 6. Saving of monitoring and enforcement costs. This issue is particularly relevant when workers differ in productivity and there, in the absence of unions, would be individual wage setting. Wages would then vary by productivity across workers, and firms would need (and workers themselves require) that individual workers output is measured. Unions by contrast tend to demand more or less equal wages for workers with given seniority and education. Then a situation without unions does not necessarily require that individual workers’ outputs be measured, and the amount of costly monitoring would be reduced. The union solution only requires that aggregate output be measured, which requires no individual monitoring. 7. Macroeconomic effects. These effects will under unions depend strongly on the level at which unions operate. Encompassing unions may provide macroeconomic benefits even when compared to a competitive solution, by often making possible a lower inflation rate and higher overall employment as a result of union restraint (when the union realizes that high wage claims “mainly” results in high inflation and/or low employment). The monopoly union model We will now consider a few standard analytical models of union behavior, and the effect of such behavior on the economy. We start with the most basic analytical model of the labor market, namely the simple monopoly union model. In this model, the union is assumed to determine the wage, and the firm then sets employment. We make the following assumptions: -Homogeneous labor, all N workers in a firm are organized in one union, where N is exogenously given (in the short run). -Firms are price takers and profit maximizers, have production functions f(L) were L is the number of workers employed in production, f’ > 0 f’’’ < 0. -L<N, i.e., not all workers in the local union will actually be employed, N-L = U will be unemployed. -The union has a utility function of the form (aggregating up the utilities of all N workers belonging to the union): (1) u(w)L + u(b)(N-L), u’ C 0, u’’ 0 (u’’ = 0 here implies worker risk neutrality, u’’< 0 implies worker risk aversion), where b express unemployment benefits if a given worker is not going to be employed in a period. This function is based on an assumption that all workers have the same probability L/N of being employed, and a probability (NL)/N of being unemployed in the period. The firm’s profit function is (2) R = pf(L) – wL – e(N-L), where p is the output price, w the wage, and e is the part of b paid by the firm (such that the government pays b-e). The firm takes w, e and p as given in maximizing R with respect to L, yielding (3) dR pf ' ( L) w e 0 . dL Thus the employment level L is affected by w in the following way (found differentiating (3): (4) dL 1 0. dw pf ' ' ( L) Thus a higher wage will reduce employment, something that must be recognized by the union in setting the wage. The union can be assumed to maximize (1) with respect to w, taking into consideration the relationship (4) (i.e., the union knows that after it has set the wage, the firm will respond by setting L in such a way that (4) holds). We then simply set L = L(w) (where L(w) fulfils (4)) in (1), and maximize (1) with respect to w. This yields: (5) dU 1 u ' ( w) L u ( w) u (b) 0. dw pf ' ' ( L) This condition says that the slope of the firm’s demand curve, dL/dw, is to equal the slope of the union’s equivalent tradeoff between L and w, along an indifference curve for the union, which is found differentiating (1), as follows: (6) dL u ' ( w) L . dw u ( w) u (b) Thus the union indifference curve should be tangent to the firm’s demand function for labor, which is the highest utility level the union can achieve. This is illustrated in a figure in class. It is easy to show that the monopoly union model leads to inefficiently low employment. Departing from the monopoly union solution, the union and the firm could in principle bargain and reach a new solution that is better for both parties. The monopoly union solution thus is a sort of prisoners’ dilemma case. This will be illustrated in class, in a simple figure, and through the wage-employment bargaining solution to be discussed later (and which resolves this dilemma). . The wage bargaining (“right-to-manage”) model A more realistic alternative to the monopoly union model is the “right-to-manage” model, where the union and the firm bargain over the wage, and the firm subsequently sets employment. The employment rule is then the same as in The game played under this model is strategically very similar to that under the monopoly union model. In the first stage, there is bargaining between the union and firm over the wage of all employed workers (while those who do not obtain employment receive a fixed pre-set compensation). In the second stage, the firm sets employment (at a level below full employment). Consider now a simplified case where e = 0 and the firm thus pays nothing of unemployed workers’ unemployment benefits. Then we may define the maximand for this problem as follows: (7) N u(w) L u(b)( N L) pf ( L) wL pf '( L) w , 1 where the first of the two main expression on the right-hand side is the socalled Nash product, where β and 1-β are the relative bargaining strengths of the union and the firm. The Nash bargaining solution is found maximizing the Nash product under the constraint of firm profit maximization with respect to L, i.e. condition (3) (with e = 0), corresponding to maximizing N with respect to the two variables w and L, where λ is a Lagrange multiplier associated with the latter constraint. The first-order conditions for the Nash maximization problem are (8) N u '( w) LU 11 (1 ) LU 0 w (9) N u ( w) u (b) U 11 pf ''( L) 0 , L where union net utility and firm profits are U and Π respectively, and where we in the last expression use that pf’-w = 0. The solution can be written on the form (10) u '( w) L u ( w) u (b) 1 (1 )U L. pf ''( L) The expression (10) can be compared to (5), the corresponding expression in the monopoly union case. The left-hand side of (5) was the derivative of the union’s objective function along the firm’s demand curve for labor, and it has the same interpretation here. In (5), this derivative was zero, as the union could choose its preferred wage. Here by contrast, the union must bargain with the firm over the wage, and cannot in general reach its preferred solution along the firm’s demand curve. This is expressed by the right-hand side of (10) being positive, in the general case where β is between zero and unity (implying that the union ideally would have preferred a higher wage). We see also that as a special case, when β→1, we are again in the monopoly union model as the union then has all the bargaining power in the union-firm relationship (and can again dictate the wage). This will be represented graphically in class.