RECHARGES – EXPLAINED

advertisement

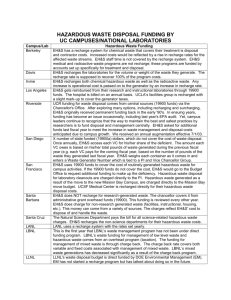

APPENDIX A RECHARGES – EXPLAINED Definition: Costs incurred for services or materials charged by one department to another department. “Total cost also includes an appropriate share of all support services and other overheads.'' BVACOP 2002 1. Recharging Summary 1.1 The Council has a policy of recharging the full cost of support services and facilities to the relevant service area. This is done to comply with accounting practice, to ensure that services reflect ‘true’ costs i.e. include costs from supporting service areas, and to ensure that comparisons can be made between authorities (primarily through the value for money toolkit). 1.2 This practice is not just limited to the public sector, it is also usual in the private sector where recharges (plus a profit element) are applied to goods and services to ensure that businesses make a profit. For example, the purchase price of a new car includes the direct costs of manufacture, plus the indirect costs that are recharged to the buyer on each car purchased: 1.3 Direct costs, e.g. Component parts Construction Paint Indirect costs, e.g. Management Research & development Advertising Showroom Profit margin Profit for manufacturer Profit for dealer The general criteria for how overhead recharges should be calculated are that: - there should be reasonableness in the method of apportionment; and - a consistent methodology should be applied across the organisation. 1.4 Recharges in themselves do not add to the overall costs of the Council as they are an internal transfer of costs already incurred. As a result, provided that the direct costs of all services are reviewed as part of the service review process, then all of the Council’s budgets will have been reviewed. If efficiencies are identified as part of these reviews, meaning that less tasks or reports are required, then costs will fall, the recharge of these costs will also fall and so the net cost to the Council is reduced. FINANCE AND PERFORMANCE (20.9.2010) 1.5 Recharges need to be considered when services carry out their benchmarking exercises against other Authorities in order to ensure the full costs (including support) have been assessed. However, recharges form just one element of further investigation that is needed to understand the costs of a service. 1.6 Recharging provides a means for service managers to challenge colleagues for the cost of a service provided. The Corporate Business Planning process provides service managers with the forum to challenge those costs. 2. Principles 2.1 When making recharges, in accordance with criteria at 1.3 above, they should be charged across users and other beneficiaries in accordance with the seven general principles containing within the Best Value Accounting Code of Practice and shown in Table 1. TABLE 1 BVACOP recommendations for charging of overheads to service users Principle BVACOP Recommended Approach Complete recharging of overheads All overheads not defined as unapportionable central overheads or costs of democracy should be fully recharged to service areas. Correct recipients The system used must correctly identify who should receive overhead charges. Transparency Recipients must be clear about what each recharge covers and be provided with sufficient information to enable them to challenge the approach being followed. Flexibility The recharging arrangements must be sufficiently flexible to allow recharges to be made regularly enough and to the level of detail appropriate to meeting both users' and providers' needs. Reality Recharging arrangements should result in the distribution of actual costs based on fact. Even if the link cannot be direct, reality should be the main aim. Predictability/sta Recharges should be as predictable as possible, although there bility will be practical limitations to this. Materiality 2.2 It is unlikely that a simple system will be adequate to meet all other requirements noted above. However, due regard should be given to materiality to minimise the costs involved in running the system. It is important that the bases of charges are given in a sufficient level of detail to be worthwhile and meaningful. However, there are levels of detail below FINANCE AND PERFORMANCE (20.9.2010) which it may not be sensible to go, as it is not good practice to spend undue time or other resources in getting unnecessarily precise figures. A balance must always be made between the time taken to complete the allocation of costs and the level of accuracy to ensure there are no distortions in the comparisons of service costs with other Local Authorities. 2.3 Within NHDC the overall costs of administering the recharge system are kept down by only carrying out the exercise annually and making use of officer time estimates (see section 4), rather than utilising a formal time recording system. The recharge allocation process itself is a significant task for Accountancy at year-end, but the burden on service areas is minimised. 2.4 There are a number of charging methods, depending on the costs to be recharged, e.g. time allocation, head count, floor space occupied. 3. How Recharges are calculated 3.1 To understand how recharges are calculated it is important to understand the rationale for the charges. Paragraphs 3.2 to 3.5 provide an explanation and Appendix B shows details of the charging basis. 3.2 Government and accounting standards require service accounts to show the full cost of providing those services, including ‘back office’ support activities. All administrative costs must therefore be charged to frontline services. The recharges are as much a part of the service as the front-line providers’ costs. A proportion of the time (and therefore cost) of the relevant service manager and head of service is also charged. 3.3 The staff and associated costs recharged are in respect of staff based in the administrative offices and their associated requirements (furniture, equipment, IT, etc). These include central and departmental overheads in the Directorates. Costs are recharged to services through the apportionment basis as shown in Appendix B. 3.4 Costs are controlled at departmental level in the budgets for business units, e.g. HR/Payroll Services, Finance, IT; rather than in the services that they are recharged to. However, as stated in 1.6, service areas can challenge costs. 3.5 Recharges are calculated and charged annually based on actual costs of services in line with the Best Value Accounting Code of Practice. There is a two-stage process for calculating recharges: firstly all the central services that are being recharged, charge each other as necessary. This could be, for example, Payroll Services being charged I.T. costs for supporting the Payroll computerised system and I.T. being charged for Accountancy support in preparing budgets. In this example, Payroll will have a charge for I.T. and this charge would then become income for I.T. The total cost of I.T. would increase by its charge from Accountancy less the income from Payroll. secondly all the central services costs, which include the costs of recharges in from other central services and income from other central services, are charged to the rest of the organisation. FINANCE AND PERFORMANCE (20.9.2010) 3.6 The recharges in Appendix B are presented in the order that they are charged. 3.7 Where costs are directly attributable to particular services, these are charged to that service. For example, legal work on a specific lease. The remaining costs are then apportioned by either: time allocation - percentages are applied to the actual salary costs together with any departmental running costs to allocate them to services (further explanation below); number based - where the central service is more of a function e.g. payroll, payments or IT, the costs of these activities are recharged to services based on relevant data i.e. headcount, transactions processed in the accountancy system, number of computers. Area occupied – office accommodation is charged out based on the floor space used by a service area 4. Time Allocation 4.1 Rather than apportioning the cost of a team by analysing the time allocation on a team level, we ask for an allocation of time spent on activities by each member of the team. This is done because the allocation of costs is depends on the grade/pay of the specific officer. This is more accurate as clearly the time of a higher grade officer will cost more. 4.2 These are estimates based on officer records of time allocated for the year. The estimates of time allocation are updated at the year end before the final recharges are completed in the accounts. These are necessarily estimates as the authority has chosen not to incur the cost and administrative overhead of implementing a formal time recording system. 4.3 In respect of a related query regarding time recording systems it is worth noting that, at Cabinet on 31st March 2009, it was resolved that “CMT be instructed to take no action in respect of the development of a staff time apportionment system for use during projects. This was because “Cabinet was unable to support this proposal, as Members felt that the there would be limited benefits to be obtained from such a system when measured against the resources needed to introduce and monitor it”. 4.4 Although the issue at hand in this report is in respect of recharges, not projects, the principle remains the same. 5. Recharge “Myths” 5.1 It is sometimes said that a particular service or function should be retained because of the recharges it absorbs and that if the service ceased to function those recharge costs would have to be met by other areas. Additionally it is sometimes stated that a service would offer better value for money if recharges were discounted. Both of these views are misleading for the following reasons: FINANCE AND PERFORMANCE (20.9.2010) 1. As stated at 1.4, recharges do not add to the overall costs of the Council as they are an internal transfer of costs already incurred. However, this also means that, if a service or function stops and therefore provides savings, then the areas generating recharges should also review their service to determine if further savings can be made. Even if it is not possible when an individual change is made, it becomes increasingly likely as more services/functions make changes. 2. The ‘true’ costs of a service or function include the costs from supporting service areas. If these were discounted this would give an unrealistic impression of the service. Support services are necessary for the frontline function to operate and, therefore, should be recharged and probably equate to a percentage of the time of one or more officers. However, as stated in the point above, if the front-line service ceases, then there will be no requirement for the support service. 5.2 Front-line services cannot exist in isolation of the “back-office” functions that support them (whether provided in-house or via an external arrangement, such as shared services). It is important to recognise the close linkage, not only to ensure “true-costs” are identified, but also to help ensure that the impact of decisions in one area are understood and assessed, in another. Cuts to back-office functions, without due regard to front-line requirements, could have significant adverse effects. Cuts to front-line services, without due regard to back-office provision, could lead to waste. 6. Glossary 1. 2, 3. 4. 5. BVACOP Best Value Accounting Code of Practice Direct costs costs specific to delivery, such as staff, equipment, stationery, furniture Net costs residual cost after allowing for any income received Overheads the ongoing administrative expenses of the Council that can’t be attributed to a specific service activity, but are still required for the Council to function Apportionment basis on which costs are charged between users. FINANCE AND PERFORMANCE (20.9.2010) THIS PAGE IS BLANK FINANCE AND PERFORMANCE (20.9.2010)