Interaction Between Stock Crisis and Exchange Crisis in Emerging

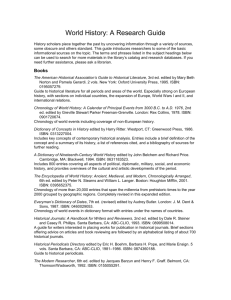

advertisement

International Finance Review, An annual book series (ISSN 1569-3767), Volume 1-8 (published by Elsevier Science) and Volume 9 and after (published by Emerald Publishing, UK): Founding Editor, J. Jay Choi (jjchoi@temple.edu) The IFR publishes theme-oriented volumes on various issues in international finance, such as international business finance, international investment and capital markets, global risk management, international corporate governance and institution, currency markets, emerging market finance, international economic integration, and related issues in international financial economics. Volume 1: Asian Financial Crisis: Financial, Structural, and International Dimensions, Edited by J. Jay Choi, 2000, Elsevier Science (ISBN 0-7623-0686-6) Volume 2: European Monetary Union and Capital Markets, Edited by J. Choi and J. Wrase, 2001, Elsevier Science (ISBN 0-7623-0830-3) Volume 3: Global Risk Management: Financial, Operational, and Insurance Strategies, Edited by J. Jay Choi and Michael R. Powers, 2002, Elsevier Science (ISBN 0-7623-0982-2) Volume 4: The Japanese Finance: Corporate Finance and Capital Markets in Changing Japan, Edited by J. Jay Choi and Takato Hiraki, 2003, Elsevier Science (ISBN 0-7623-1068-5) Volume 5: Latin American Financial Markets: Developments in Financial Innovations, Edited by Harvey Arbeláez and Reid W. Click, 2004, Elsevier Science (ISBN 0-7623-1163-0) Volume 6: Emerging European Financial Markets: Independence and Integration PostEnlargement, Edited by J. A. Batten and C. Kearney, 2006, Elsevier Science (ISBN 0-7623-12645) Volume 7: Value Creation in Multinational Enterprise, Edited by J. Jay Choi and Reid W. Click, 2007, Elsevier Science (ISBN 0-7623-1392-7) Volume 8: Asia-Pacific Financial Markets: Integration, Innovation and Challenges, Edited by Suk-Joong Kim and Michael McKenzie, 2008, Elsevier Sicence (ISBN 978-0-7623-1471-3) Volume 9: Institutional Approach to Global Corporate Governance: Business Systems and Beyond, Edited by J. Jay Choi and Sandra Dow, 2008, Emerald Publishing (ISBN 978-1-84855320-0) Volume 10: Currency, Credit and Crisis: In Search of Financial Stability, Edited by J. Jay Choi and Michael G. Papaioannou, Emerald Publishing, 2009 IFR Volume 1: Asian Financial Crisis: Financial, Structural, and International Dimensions, Edited by J. Jay Choi, 2000, Elsevier Science (ISBN 0-7623-0686-6) PART I. AN OVERVIEW OF THE ASIAN FINANCIAL CRISIS. The Asian financial crisis: moral hazard in more ways than one J. Jay Choi, 3-14 Was capitalism or cronyism the cause of Asia's economic crisis J.W. Dean, 15-44 Origins and policy implications of the Asian financial crisis Phil-Sang Lee, Kyung Suh Park, 45-78 Korean financial crisis and reform: an overview Daesik Kim, Jaeha Park, 79-122 The Asian five: from financial crisis to economic recovery M. Faizul Islam, 123-148 PART II. INTERNATIONAL CAPITAL FLOWS AND CRISIS East Asian crises and global capital flows: cause or effect? C. Lingle, R. Mondejar, 149-174 Financial liberalization, capital mobility, and financial crises Jiawen Yang, 175-198 The impact of liberalization and regionalism on capital markets in emerging Asian economies C. Bilson, V. Hooper and M. Jaugietis, 199-238 PART III. CRISIS AND REFORM IN THE FINANCIAL SECTOR. Two years after financial reform: capital market developments in Korea Woon-Youl Choi, Yeong-Ho Woo, 239-262 Korean banking reform following the Asian financial crisis Hisanori Kataoka, 263-292 The Asian financial crisis: an evaluation of market intervention policies by Hong Kong regulators A.K. Bhattacharya, 293-306 PART IV. CRISIS AND REFORM IN THE INDUSTRIAL SECTOR. Asian crisis and implications for industrial policies Sung-Hee Jwa, Jung-Hwan Seo, 307-356 Financial crisis and perspectives on Korean economic development Young Back Choi, 357-378 Ownership structure and family control in Korean conglomerates Ungki Lim, 379-410 The Asian paradox of miracle and debacle: an exploratory study P. Ping Li, Tung-lung Chang, 411-438 Part V. Cultural Factors and Post-Crisis Opportunities. How cultural factors led to risky antecedent market conditions and the 1997 Asian economic crisis E.A. Kellerman, I. Alon, 439-458 Sociopolitical analysis of Korean economic crisis of 1997 S.J. Chang, 459-480 Business in ASEAN's core. Post-crisis opportunities amidst the economic debris Zafar U. Ahmed, F.L. Bartels and J.R.M. Gordon, 481-501 IFR Volume 2: European Monetary Union and Capital Markets, Edited by J. Choi and J. Wrase, 2001, Elsevier Science (ISBN 0-7623-0830-3) PART I: AN OVERVIEW OF EUROPEAN MONETARY UNION AND CAPITAL MARKETS Monetary union and market integration: Capital and goods market issues pertaining to the launching of the Euro J.J. Choi, J. Wrase, 3-12 PART II: APPROACHING MONETARY UNION IN EUROPE: HISTORY AND FOUNDATIONS Historical overview of the transition to monetary union in Europe. K. Phillips, J. Wrase, 13-20 An retrospective structural break analysis of the French German interest rate differential in the run-up to EMU J. Henry, P. McAdam, 21-50 Volatility and misalignments of EMS and other currencies during 1974-1998 M.G. Papaioannou, 51-98 PART III: EUROPEAN MONETARY UNION AND CAPITAL MARKETS The impact of the Euro on primary equity markets E.K. Gatzonas, 99-136 Country and industry effects in Euroland's equity markets I.J.M. Arnold, 137-156 Intra-day transmission of international stock prices C.S. Eun, J.G. Jeong, 157-178 Part IV: Monetary and Fiscal Policy Issues in the Monetary Union Organization and policy procedures of the European system of central banks J. Wrase, 179-194 Monetary and fiscal policy rules in the European economic and monetary union: A simulation analysis G. Haber, R. Neck, W.J. Mckibbin, 195-218 Is there potential for monetary union outside Europe? V. Hooper, 219-232 PART V: TRADE AND MARKET POWER Monetary union expansion: The role of market power in trade M.M. Spiegel, 233-246 The European monetary union vs. U.S.A, cooperation and competition: An examination of welfare benefits L.B. Ramrattan, C.D. Tully, M. Szenberg, 247-266 The Euro exchange rate and consumer prices S. Ranki, 267-275 IFR Volume 3: Global Risk Management: Financial, Operational, and Insurance Strategies, Edited by J. Jay Choi and Michael R. Powers, 2002, Elsevier Science (ISBN 0-7623-0982-2) PART I: RISK: CONCEPT, MEASUREMENT AND MANAGEMENT Global Risk Management: Concepts and Strategies J. Jay Choi and Michael R. Powers, 3-6 Risk, Public Perception, and Education: Quantitative and Qualitative Risk Martin Shubik, 7-14 What’s New in Value at Risk? A Selective Survey Neil D. Pearson, 15-38 Leapfrogging the Variance: The Financial Management of Extreme-Event Risk Michael R. Powers, 39-60 PART II: MARKET, CREDIT, AND FINANCIAL RISK Assessing Market and Credit Risk of Country Funds: A Value-at-Risk Analysis Michael G. Papaioannou and E. K. Gatzonas, 61-80 Frictions and Tax-Advantaged Hedge Fund Returns David M. Schizer, 81-96 Financial versus Operational Hedging Bhagwan Chowdhry, 97-106 PART III: INTERNATIONAL RISK A Simple Model of Foreign Exchange Exposure Gordon M. Bodnar and Richard C. Marston, 107-116 The Impact of the Asian Financial Crisis on Multinationals George Allayannis and James P. Weston, 117-130 Managing Political Risk in the Age of Terrorism Llewellyn D. Howell, 131-156 PART IV: INSURING RISK Security Measures and Determination of Capital Requirements Jean-Pierre Berliet, 157-162 Integrating Reinsurance Strategy with Asset Strategy to Achieve Capital Efficiencies Joan Lamm-Tenant, 163-170 The Flight to Quality? Global Capacity and U.S. Reinsurance Prices Mary A. Weiss and Joon-Hai Chung, 171-205 IFR Volume 4: The Japanese Finance: Corporate Finance and Capital Markets in Changing Japan, Edited by J. Jay Choi and Takato Hiraki, 2003, Elsevier Science (ISBN 0-7623-1068-5) PART I: AN OVERVIEW AND COMPARATIVE ANALYSIS The Japanese Finance: Is It Unique? Jongmoo Jay Choi and Takato Hiraki, 3-10 An Analysis of the Relative Performance of Japanese and Foreign Money Management Stephen J. Brown, William N. Goetzmann, Takato Hiraki, and Noriyoshi Shiraishi, 11-34 The Impacts of Japanese Price-Competitive IPO Auctions versus the U.S. Underwriter-Priced IPOs Richard H. Pettway, 35-58 PART II: CORPORATE FINANCE AND CONTROL The Japanese Market for Corporate Control and Managerial Incentives Jun-Koo Kang and Takeshi Yamada, 59-86 Internal Cash Flows and Investment Decisions: A Comparative Study of the US and Japan Raj Aggarwal and Sijing Zong, 87-106 The Supply of Trade Credit in Japanese Firms Richard L. Constand, 107-134 IPO Mechanisms: A Comparison of Book-Building, Discriminatory Price Auctions and Uniform Price Auctions Jaclyn Beierlein and Hideaki Kiyoshi Kato, 135-154 PART III: EQUITY AND DERIVATIVE MARKETS The Efficiency of the Japanese Equity Market Jun Nagayasu, 155-172 Index-Futures Arbitrage in Japan Y. Peter Chung, Jun-Koo Kang, and S. Ghon Rhee, 173-198 Price and Volume Effects Associated With A Change in the Nikkei 225 Index List: New Evidence from the Big Change on April 2000 Hideki Hanaeda and Toshio Serita, 199-226 Did Option Markets Anticipate The Decline In Japanese Stock Prices In 1990? Naoya Takezawa and Nobuya Takezawa, 227-232 An Analysis of Japanese Return Dynamics Conditional on United States Monday Holiday Closures Takato Hiraki and Edwin D. Maberly, 233-252 PART IV: BANKING AND BOND MARKETS Disintermediation and Bond Market Developments in Japan Peter G. Szilagyi and Jonathan A. Batten, 253-278 Bank Stock Returns, Interest Rate Changes, and the Regulatory Environment: New Insights From Japan John Paul Broussard, Kenneth A. Kim, and Piman Limpaphayom, 279-302 Is Issuing Subordinated Debt by Japanese Banks Effective In the Japanese Market? Ayami Kobayashi, 303-324 Comparison of the Short-Term and the Long-Term Characteristics of the Japanese and the US Spot Interest Rate Kenji Wada, 325-346 PART V: INTERNATIONAL CAPITAL MARKET LINKAGES AND TRANSACTIONS Information, Trading Volume and International Stock Market Comovements Louis Gagnon and G. Andrew Karolyi, 347-378 The Time-Varying Behaviour of Credit Spreads On Yen Eurobonds Jonathan A. Batten, Warren P. Hogan, and Seppo Pynnonen, 379-404 Determinants of the Initial Decisions by Japanese Firms to Undertake Foreign Direct Investment Yutaka Horiba and Kazuo Yoshida, 405-424 Part VI: Currency Prediction and Exposure Estimation and Prediction of the Japanese Yen/US Dollar Rate Using An Adaptive Time-Varying Model Ahmed S. Abutaleb, Yuzo Kumasaka, and Michael G. Papaioannou, 425-442 Does the Day-of-the-Week Effect in Foreign Currency Markets Disppear? Evidence from the Yen/Dollar Market Nobuyoshi Yamori and Panos Mourdoukoutas, 443-460 The Exchange Exposure of the Japanese Firms Jongmoo Jay Choi, Takato Hiraki, and Nobuya Takezawa, 461-478 IFR Volume 5: Latin American Financial Markets: Developments in Financial Innovations, Edited by Harvey Arbeláez and Reid W. Click, 2004, Elsevier Science (ISBN 0-7623-1163-0) PART I: AN OVERVIEW Latin Finance: Evolution or Revolution? Harvey Arbeláez and Reid W. Click, 3-14 The Flow of Capital to Latin America, 1973-2000 Lall Ramrattan, Aron A. Gottesman and Michael Szenberg, 15-33 FDI and Stock Market Development in Selected Latin American Countries Wendy M. Jeffus, 35-44 Capital Budgeting Decisions: A Survey of Latin American Practices Harvey Arbeláez, 45-61 PART II: THE FOREIGN EXCHANGE MARKETS AND INTERACTION WITH OTHER MARKETS How Sensitive Is Volatility to Exchange Rate Regimes? – The Case of Chile Viviana Fernández, 65-97 Brazilian Real Futures Trading and Volatility in the Brazilian Equity Market Cynthia J. Brown and Roberto Curci, 99-111 PART III: DOLLARIZATION Dollarization in Cuba Rémy Herrera and Paulo Nakatani, 115-134 Dollarization and Political Risk: Is There a Place for Politics? Harvey Arbeláez, 135-162 Lending of Last Resort, Bank Monitoring and Endogenous Financial Dollarization Germana Corrado, 163-188 PART IV: BANKING IN LATIN AMERICA Concentration and Internationalization of the Mexican Banking Sector Roberto J. Santillán-Salgado, 191-230 Bankruptcy in Banks from Ecuador: Solvency versus Panic Theory Franco Parisi, Carlos Maquieira, and Antonino Parisi, 231-247 Political Distortions and Spread of Banking Crises Across the Pacific Rim Victor Vaugirard, 249-269 PART V: LATIN AMERICAN EQUITY MARKETS Day of the Week and Month of the Year Effects at the Latin American Emerging Markets Alejandra Cabello and Edgar Ortiz, 273-304 Proximity Preference and Market Liquity: Evidence from Latin American ADRs Chandrasekhar Krishnamurti and Aleksandar Šević, 305-327 Alternative Beta Risk Estimators in Emerging Markets: The Latin American Case Robert D. Brooks, Robert W. Faff, Tim Fry, and Diana Maldonado-Rey, 329-344 Open Market Stock Repurchases at São Paolo Stock Exchange – BOVESPA Jairo Laser Procianoy, Luis Fernando Moreira, 345-363 An Empirical Analysis of U.S. Equity Market Spillover Effects into the Equity and Labor Markets of Brazil Alhassan Bangura and Roberto Curci, 365-381 PART VI: LATIN AMERICAN BOND MARKETS Negative Liquidity Premia and the Shape of the Term Structure of Interest Rates: Evidence from Chile Viviana Fernández, 385-414 Embedded Governance in Corporate Bond Indentures: Evidence from Brazil, 1998-2001 Richard Saito, Hsia Hua Sheng, Senichiro Koshio, and Marcos Galileu de Lorena Dutra, 415-437 PART VII: PENSION FUNDS Is the Latin American Pension Reform Model Transferable? An Assessment Utilizing the Venezuelan Social Security System J. Tim Query and Evaristo Diz, 441-460 Optimal Portfolio Allocations and Funded Pension Systems: The Case of Chile Mirko Cardinale, 461-520 IFR Volume 6: Emerging European Financial Markets: Independence and Integration Post-Enlargement, Edited by J. A. Batten and C. Kearney, 2006, Elsevier Science (ISBN 0-7623-1264-5) Interdependence and integration in emerging European financial markets Jonathan A. Batten and Colm Kearney, 1-14 PART I: FISCAL POLICY Fiscal policy surveillance in the enlarged European Union: Procedural checks or simple arithmetic? Nico Groenendijk, 17-45 The impact of fiscal variables on risk premiums in central and eastern European countries Dalia Grigonyte, 47-68 PART II: MONETARY POLICY AND BANKING Monetary policy operational frameworks compared: Euro area versus some non-Euro area countries Orazio Mastroeni, 71-97 What accession countries need to know about the ECB: A comparative analysis of the independence of the ECB, the Bundesbank and the Reichsbank Richard A. Werner, 99-115 A comparative study of bank efficiency in central and eastern Europe: The role of foreign ownership Peter Zajc, 117-156 A comparative study of banks’ balance sheets in the European Union and European transition countries, 1995-2003 Ilko Naaborg and Bert Scholtens, 157-178 Governance by supranational interdependence: Domestic policy change in the Turkish financial services industry Caner Bakir, 179-211 PART III: FINANCIAL INNOVATION AND LIBERALIZATION The development of financial derivatives markets in an expanded EU Jing Chi and Martin Young, 215-234 Financial liberalization and business cycles: The experience of the new EU member states Lucio Vinhas de Souza, 235-259 Common factors in Euro-denominated emerging market bond spreads Patrick McGuire and Martijn Schrijvers, 261-280 Romanian financial markets Michael Skully and Kym Brown, 281-321 PART IV: EQUITY MARKET INTEGRATION Conditional contemporaneous correlations among European emerging markets Seppo Pynnonen, 325-351 The links between central, east European and western security markets Roy Kouwenberg and Albert Mentink, 353-381 The relations between emerging European and developed stock markets before and after the Russian crisis of 1997-1998 Brian M. Lucey and Svitlana Voronkova, 383-413 Trading versus non-trading returns: Evidence from Russia and the U.K. Uri Ben-Zion and Niklas Wagner, 415-427 PART V: FDI AND ENLARGEMENT Foreign direct investment in emerging and transition European countries Steven Globerman, Daniel Shapiro and Yao Tang, 431-459 Foreign direct investment, stock exchange development, and economic growth in central and eastern Europe Yusaf H. Akbar, Heather Elms and Tej S. Dhakar, 461-472 The impact of EU enlargement on FDI flows Kalman Kalotay, 473-499 IFR Volume 7: Value Creation in Multinational Enterprise, Edited by J. Jay Choi and Reid W. Click, 2007, Elsevier Science (ISBN 0-7623-1392-7) PART I: AN OVERVIEW Introduction to Value Creation in Multinational Enterprise J. Jay Choi and Reid W. Click, 3-15 PART II: MULTINATIONALS AND FOREIGN DIRECT INVESTMENT Strategic and Financial Determinants of Foreign Direct Investments J. Jay Choi and Eric C. Tsai, 19-60 Modeling the Evolutionary Sequence of International Joint Ventures Elmar Lukas, 61-73 New Trends and Performance of Korean Outward FDI after the Financial Crisis Seong-Bong Lee, 75-96 PART III: STRATEGIES AND FIRM PERFORMANCE The Value Creation Perspective of International Strategic Management Reid W. Click, 99-123 Ownership Structure, Diversification Strategy, and Performance: Implications for Asian Emerging Market Multinational Enterprises Juichuan Chang, 125-148 Successful Adaptation Strategies of Multinational Enterprises in Central and Eastern Europe Roxana Wright, 149-167 The Relationship between Organizational Structures and Performance: The Case of Fortune 500 Nicole Avdelidou-Fischer, 169-206 PART IV: MERGERS AND ACQUISITIONS Difficulties in Value Creation: Telecom New Zealand’s Acquisition of AAPT Ltd. Alireza Tourani-Rad and Zoltan Toth, 209-227 Analysis of Global Competitors’ Reaction to Mega Merger Announcements by an MNC: The Case of Citicorp-Travelers Merger Isaac Otchere and Suhadi Mutopo, 229-254 A Combined Cascade Model to Explain Industrial Consolidation: Theory and an Application to Steel Huaichuan Rui, 255-281 PART V: FINANCE AND GOVERNANCE Measuring and Managing the Foreign Exchange Exposure of Chinese Companies Patrick J. Schena, 285-306 U.K. Measures of Firm-Lived Equity Duration Richard A. Lewin, Marc J. Sardy, and Stephen E. Satchell, 307-338 Multinationals and Exchange Rate Pass-Through Alexandra Lai and Oana Secrieru, 339-364 Corporate Governance in Russia: A Case of Timeliness of Financial Reporting in the Telecom Industry Robert W. McGee, 365-390 PART VI: THE FINANCIAL SERVICES SECTOR Mergers and Consolidation of Financial Service Firms: Global Trends and Strategies for Value Creation Edward C. Boyer and J. Jay Choi, 393-417 Cross-Border Investment in the Latin American Banking Sector Jesús Arteaga-Ortiz, Harvey Arbeláez and Wendy M. Jeffus, 419-438 PART VII: THE INFLUENCE OF THE STATE Governance and Political Risk Arvind K. Jain, 441-460 Strategic Trade Policy for Small States: A Political Economy Perspective Jaleel Ahmad, 461-473 Strategic IPO Underpricing: The Role of Chinese State Ownership Yong Wang, Xiaotian (Tina) Zhang, 475-495 Multinationals versus State Power in an Area of Globalization: The Case of Microsoft in China Jean-Marc F. Blanchard, 497-534 Internationalization and Value Creation in the Global Textiles and Apparel Industry: A Comparative Analysis of Lithuania and Moldova Sanford L. Moskowitz, 535-564 Strategy during an Industry Crisis: The Post-Quota Experience of Turkish Apparel Manufacturers Liesl Riddle, 565-587 IFR Volume 8: Asia-Pacific Financial Markets: Integration, Innovation and Challenges, Edited by Suk-Joong Kim and Michael McKenzie, 2008, Elsevier Sicence (ISBN 978-07623-1471-3) PART I: AN OVERVIEW Introduction to Asia-Pacific Financial Markets: Integration, Innovation and Challenges Suk-Joong Kim and Michael McKenzie, 3-13 PART II: ASIA-PACIFIC STOCK MARKET INTEGRATION A New Approach for Estimating Relationships between Stock Market Returns: Evidence of Financial Integration in the Southeast Asian Region, 17-37 T.J. Brailsford, T.J. O’Neill, and J. Penm Correlation Dynamics between Asia-Pacific, EU and US Stock Returns, 39-61 Stuart Hyde, Don Bredin and Nghia Nguyen Conditional Autocorrelation and Stock Market Integration in the Asia Pacific, 63-94 Suk-Joong Kim and Michael D. McKenzie The Impact of the Opening Up of the B-Share Markets on the Integration of the Chinese Stock Markets, 95-116 Langnan Chen, Steven Li and Weibin Lin A Single Currency for ASEAN-5: An Empirical Study of Economic Convergence and Symmetry, 117-139 Zhi Lu Xu, Bert D. Ward and Christopher Gan PART III: BUBBLES AND SPILLOVERS Periodically Collapsing Bubbles in the Asian Emerging Stock Markets, 143-155 Ako Doffou Currency Crises in Asia: A Multivariate Logit Approach, 157-173 Jan P.A.M. Jacobs, Gerard H. Kuper and Lestano Evidence of Bubbles in the Malaysian Stock Markets, 175-202 Gary J. Rangel and Subramaniam S. Pillay PART IV: STOCK MARKETS Abnormal Returns After Large Stock Price Changes: Evidence from Asia-Pacific Markets, 205227 Vu Thang Long Pham, Do Quoc Tho Nguyen and Thuy-Duong Tô Price Limits in Asia-Pacific Financial Markets: The Case of the Shanghai Stock Exchange, 229244 Bert Scholtens and Yao Liu China’s Securities Markets: Challenges, Innovations, and the Latest Developments, 245-262 Xinyi Yuan, Wei Fan, and Qiang Liu Temporal Causality of Return of Index Futures and Stock Markets: Evidence from Malaysia, 263288 Wee Ching Pok Price Behaviour Surrounding Block Transactions in Stock Index Futures Markets: International Evidence, 289-303 Alex Frino, Jennifer Kruk and Andrew Lepone PART V: CORPORATE FINANCE The Determinants of Capital Structure: Evidence from Vietnam, 307-326 Van Nam Nguyen, Biger Nahum and Xuan Quyen Hoang Shareholders’ Value Creation and Destruction: The Stock Prices’ Effects of Merger Announcement in Japan, 327-345 Ognjenka Zrilic and Yasuo Hoshino Takeovers and Shareholder Value Creation of the Stock Exchange of Thailand, 347-370 D.E. Allen and A. Soongswang PART VI: FUNDS MANAGEMENT Herd Behaviour of Chinese Mutual Funds, 373-391 Jean Jinghan Chen, Xinrong Xiao and Peng Cheng Performance Persistence of Pension Fund Managers: Evidence from Hong Kong Mandatory Provident Funds, 393-424 Patrick Kuok-Kun Chu Financial Market Implications of India’s Pension Reform, 425-443 Hélène Poirson PART VII: BANKING AND DEBT MARKETS On the Safety and Soundness of Chinese Banks in the Post-WTO Era, 447-470 Lei Xu and Chien-Ting Lin MARKET DISCIPLINE BY C.D. HOLDERS: EVIDENCE FROM JAPAN WITH A COMPARISON TO THE US, 471-495 Ayami Kobayashi WHAT ARE THE NEXT STEPS FOR BOND MARKET DEVELOPMENT IN THAILAND?, 497-519 Jonathan A. Batten and Pongsak Hoontrakul IFR Volume 9: Institutional Approach to Global Corporate Governance: Business Systems and Beyond, Edited by J. Jay Choi and Sandra Dow, 2008, Emerald Publishing (ISBN 978-1-84855-320-0) PART I: AN OVERVIEW: CORPORATE GOVERNANCE AND GLOBAL CONTEXT Probing Corporate Governance Globally: Impacts of Business Systems and Beyond, 3-31 Raj Aggarwal, Jongmoo Jay Choi and Sandra Dow How “Attractive” is Good Governance for FDI?, 33-54 Giorgio Fazio and G.M. Chiara Talamo PART II: THE ENLARGED STAKEHOLDER PERSPECTIVE How do Japanese Banks Discipline Small and Medium-Sized Borrowers?: An Investigation of the Deployment of Lending Technologies, 57-80 Hirofumi Uchida, Gregory F. Udell, and Nobuyoshi Yamori Business-Society Reciprocity as a Guideline for Global Corporate Governance, 81-96 S. J. Chang Expanding the limits of Corporate Responsibility: An institutional approach, 97-115 Alice de Jonge The Theory and Practice of Government De-regulation, 117-139 Shann Turnbull PART III: INTERNAL GOVERNANCE MECHANISMS: BOARD OF DIRECTORS AND EXECUTIVE COMPENSATION Corporate Governance Mechanisms and Performance Related CEO Turnover, 143-161 Atreya Chakraborty and Shahbaz Sheikh Size and Advisory Role of Corporate Boards, 163-185 Arun Upadhyay Financial Contracts for CEO’s: Expropriation or Effective Corporate Governance?, 187-206 Olivier Maisondieu-Laforge, Yong H. Kim, and Young S. Kim Corporate Governance & Interlisted Stocks: The Persistence of Country Specific Traits, 207-238 Sandra Dow and Jean McGuire PART IV: OWNERSHIP AND CONTROL The Information Content of Ticker Symbol Change: Evidence from Multiple Class Shares, 241266 Najah Attig The dual roles of Japanese main banks: Contrast before and after the Bubble-bursting, 267-300 Yong-Cheol Kim and Kooyul Jung PART V: THE IMPACT OF LEGAL TRADITION Legal Rights Matter: Evidence from Panel Data on Creditor Protection and Debt, 303-336 Thomas W. Hall and Fredrik Jörgensen Derivative Claims, the UK Companies Act 2006 and Corporate Governance: A Roadmap to Nowhere?, 337-384 Arad Reisberg Corporate Governance and Ultimate Control, 385-413 Narjess Boubakri, Omrane Guedhami and Oumar Sy Scorecard on Corporate Governance in East Asia: A Comparative Study, 415-458 Yan Leung Cheung and Hasung Jang PART VI: EXTRA-LEGAL INSTITUTIONS The Nature of Political Connections and Firm Value, 461-494 Cao Jiang An End of History for Corporate Governance? The Resilience of Culture, 495-520 Loong Wong IFR Volume 10: Currency, Credit and Crisis: In Search of Financial Stability, Edited by J. Jay Choi and Michael Papaioannou, Emerald Publishing, 2009 PART 1: AN OVERVIEW: FINANCIAL CRISES AND GLOBAL CONTEXT The US versus Asian Financial Crisis Jongmoo Jay Choi and Michael G. Papaioannou The Sub Prime Market Crisis, Structured Products in the Securities Credit Markets, and Hedge Funds Rosaria Troia PART II: IDENTIFYING CAUSES: INSTITUTIONS AND REGULATION Blame the Bankers? An Empirical Study of Cyclical Credit Quality Risto Herrala Regulatory Use of Credit Ratings: How it Impacts the Behavior of Market Constituents Viktoria Baklanova On Regulating Financial Innovations Eduardo Pol PART III: THE INTERNATIONAL ECONOMIC AND FINANCIAL SETTING Important Structural Trends and Developments In the Foreign Exchange and OTC Derivative Markets Harvey Arbeláez and E. K. Gatzonas Interaction Between Stock Crisis and Exchange Crisis in Emerging Convertible Currency Markets Nabiha Nefzi and Mounira Ben Arab Exchange Rate Changes and Price Dynamics in Poland Piotr Misztal Russian Banking in Transition: Survey and Synthesis Mikhail A. Sherstnev PART IV: THE ROLE OF PUBLIC DEBT AND GOVERNMENT GUARANTEES Assessing Sovereign Bond Portfolios: Some Risk Measures Michael Papaioannou Currency Swaps and Australian Debt Management Practice Alham Yusuf and Jonathan Batten Evaluating the Implicit Guarantee to Fannie Mae and Freddie Mac Using Contingent Claims Michael Gapen PART V: THE IMPACT OF MONETARY POLICIES AND ECONOMIC MICROSTRUCTURE Effectiveness of Monetary Policy: Market Reactions and Volatility Interactions Thomas Lee and John Zyren Are Microfinance Institutions in Developing Countries a Safe Harbour Against the Contagion of Global Recession? Roberto Moro Visconti Trade Credit during Financial Crises: Do Negotiated Agreements Work? Alexander Agronovsky and Christoph Trebesch PART VI: LESSONS FOR MAINTAINING FINANCIAL STABILITY From Wall Street to Main Street – A European Perspective Andreas Mattig and Stefan Morkoetter Risk Management Lessons from Madoff Fraud Pierre Clauss, Thierry Roncalli, and Guillaume Weisang Returning Agency Back to Finance: The Critical Role of Politics and Governance in Financialization Loong Wong