Restricted or Unrestricted

advertisement

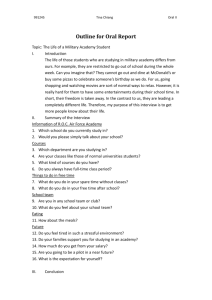

Children’s Services Finance Advisory Network Academies – Accounting for Fixed Assets July 2012 Academies, as both charitable companies limited by guarantee, and exempt charities, use the Companies Act and the Charity SORP as the framework for their accounting requirements. They must also take note of the ‘Academies Accounts Direction’ produced by the Education Funding Agency (EFA) which provides a standard format and treatment of items to ensure consistency across the sector. The guidance given below uses these three publications to highlight the key accounting rules in academies for fixed assets and their funding. What is a fixed asset? The Companies Act 2006 defines fixed assets as ‘… assets of a company which are intended for use on a continuing basis in the company’s activities’ 1. Examples include land, buildings and machines. Examples for an academy include: intangible assets (e.g. software licences, website construction costs - if not included with ICT equipment). tangible assets: o land and buildings (analysed between freehold and leasehold) o plant and machinery (includes vehicles) o furniture and equipment o ICT equipment (could also include software licences) o assets under construction heritage assets investments. The asset's useful life in the academy’s ownership is expected to be more than one year. In general, these assets are shown in the balance sheet at their net book value (i.e. relevant cost/ valuation less depreciation –if applicable). Academies set their own deminimus levels. The Accounts direction 2011/12 provides guidance on policies for fixed assets (9.5.12), this includes ‘the value below which items are not capitalised as fixed assets’ Key Accounting for Fixed assets All fixed assets should be capitalised on initial acquisition and included in the Balance Sheet 1 Assets (other than donated assets) should initially be included in the balance sheet at the cost of acquisition including costs that are directly attributable to bringing Companies Act 2006 853 (6): www.legislation.gov.uk/ukpga/2006/46/pdfs/ukpga_20060046_en.pdf the assets into working condition for their intended use 2, for example stamp duty and non-refundable VAT, professional fees such as architect fees, installation costs, costs of dismantling and restoration and initial delivery and handling costs. This can include costs of interest on loans to finance the construction of such assets but only where the academy has adopted this as a policy for all fixed assets and capitalisation of interest should cease when the asset is ready for use. This applies whether the assets are bought outright or through hire purchase or finance leasing. Subsequent expenditure which enhances (rather than maintains) the performance of fixed assets should be capitalised. Key characteristics of enhancements are: Lengthens substantially the useful life of the asset Increase in open market value Increases substantially the extent to which the asset will be used Repairs, however large, should not be capitalised Examples of items which are not capital include; Salaries of school staff Redecoration New library books (although books bought for a newly built library could be capitalised) Pupil text books School uniforms Capital grants from the EFA are shown in the SOFA under restricted fixed assets and ‘voluntary income’. This is in contrast to an academies revenue funding- the General Annual Grant (GAG), which is shown under ‘restricted general funds’ and ‘charitable activities – educational operations’. The difference in the subjective analysis rests on whether the grant is for a particular service. Voluntary income includes “grants, which provide core funding or are of a general nature provided by government …but will not include those grants which are specifically for the performance of a service” 3. Charitable activities income includes “grants specifically for the provision of goods and services to be provided as part of charitable activities or services to beneficiaries” 4 It can be argued that the capital grant is not for a specific service, whereas the GAG is to specifically provide education for the pupils. If an academy wished to use part of it’s General Annual Grant (GAG) to purchase fixed assets the accounting entries would be; show the purchase as a fixed asset on the balance sheet and transfer an amount equal to the purchase of fixed assets from the restricted general fund to the restricted fixed asset fund (on the SOFA this would be shown in the ‘gross transfers between funds’ row). The annual depreciation charge will then be charged against the restricted fixed asset fund 2 The costs directly attributable to bringing the assets into working condition should only be capitalised for the period in which the activities that are necessary to get the asset ready for use are in progress. This is covered in more detail in paragraphs 19-30 of FRS 15 3 4 Paragraph 121 (b) of the Charity SORP 2005 Paragraph 145 (e) of the Charity SORP 2005 Transfers to the restricted fixed asset fund from GAG should only take place once the individual assets represented by the transfer have been purchased by the academy trust Donated fixed assets Fixed assets donated by third parties are gifts in kind and should be recognised as incoming resources in the SOFA and included within the relevant fixed asset category in the balance sheet. The amount at which such gifts in kind are included in the Statement of Financial Activities should be either a reasonable estimate of their current gross value to the academy or, if they have been resold, the amount actually realised.The current gross value will usually be the price that the academy estimates it would have to pay in the open market for an equivalent item. The asset should be depreciated over its expected useful economic life on a basis consistent with depreciation policy for the relevant class of asset. The governors should be able to justify the valuation of the asset included in the accounts and this can be undertaken in a number of ways. The academies handbook provides a number of sources of evidence of valuation: comparable quotations from alternative suppliers; what the academy already pays for that service/asset; cash realised if the gift were to be sold; experience of governors in purchasing similar services or assets; and what the governors would be prepared to pay for that gift out of the academy budget. Buildings Transferred from predecessor Schools When an academy continues to occupy the predecessor school’s premises on a long-term basis under a lease, often at nil or peppercorn rent, they will need to have regard to the requirements in both SSAP 21 and FRS 5 to decide which party takes the risks and rewards of ownership of the asset . Where it is determined that the terms of the lease transfer substantially all the risks and rewards of ownership of the asset to the academy trust the asset should be recognised on the balance sheet as a fixed asset, with a corresponding SOFA entry to voluntary income as a gift in kind. An appropriate valuation of the asset, with supporting assumptions / justifications needs to be undertaken by the Academy. There is no absolute requirement for a professional valuation, however the governors may feel that an independent valuation is the best way forward. It should also be noted that the local authority may have an updated valuation that can be used. Insurance valuations may not be appropriate if they represent simply the re-building cost of the asset rather than its fair value. Depreciation Depreciation should be provided for in accordance with Financial Reporting Standard 15 Tangible Fixed Assets (“FRS 15”), Depreciation is required for the majority of fixed assets and is shown (in the Accounts Direction) under the ‘restricted fixed assets’ column in the SOFA. While the Charities SORP does allow for situations where depreciation would be shown in the unrestricted column of the SOFA5, the ‘Accounts Direction’ shows all depreciation under the restricted fixed assets column. Academies should follow the 'Accounts Direction' approach and therefore treat all fixed assets as restricted, regardless of Charities SORP guidance regarding restricted and unrestricted funds. 5 Ie where the fixed asset that the depreciation relates to represented an unrestricted resource. Freehold Land should not be depreciated. Governors need to decide on depreciation policies, both the rate of depreciation and the method. The two most common methods are straight line and reducing balance. Annual impairment Review An annual impairment review is required (under FRS15) where: a. Depreciation charge and accumulated depreciation are not material because: a. Asset has a very long useful life or b. Residual value is not materially different from carrying value b. Expected useful life of asset exceeds 50 years (therefore relatively small depreciation charge) Therefore if an academy decides to depreciate its buildings over a period exceeding 50 years it will need to undertake an annual impairment review. An impairment occurs if the functional fixed asset’s net book value is higher than its recoverable amount (See SORP para 225). Where the recoverable amount (ie charity usefulness in terms of achieving objectives) is less than net book value of asset then the loss should be treated as additional depreciation In all cases depreciation will be charged on the new (i.e. post impairment) carrying value of the asset. The useful economic lives and residual values of fixed assets should be reviewed at the end of the accounting period , and where there is a material change , the value of the asset should be depreciated over its useful life. (charity SORP paragraph 260) Gain or Loss on Disposal of a Fixed Asset If a fixed asset is disposed of and a ‘gain’ is made this is shown in the SOFA under ‘Other incoming resources’. A loss on disposal of a fixed asset is shown in the SOFA as ‘additional depreciation’. This accounting treatment only applies to disposal of assets, i.e. a realised gain or loss and to impairment losses recognised. It does not apply to unrealised gains or losses e.g. those that arise from revaluation. A gain or loss on revaluation is referred to as an ‘unrealised’ gain or loss because the academy is still holding the asset A gain or loss on sale/disposal is referred to as a ‘realised’ gain or loss because, in selling the asset, the academy has realised the gain or loss. It should be noted that the Academies Financial Handbook (2.85) states “Under the Funding Agreement the approval of the Secretary of State is required before the sale, or disposal by other means, or reinvestment of proceeds from the disposal, of an asset, or group of assets, for which capital grant in excess of £20,000 was paid” .This includes where land and buildings had been transferred from the Local Authority at no cost to the academy The handbook (2.88) also states that “The academy is expected to reinvest the proceeds from all asset sales for which capital grant was received, hence any income from the sale of assets should be maximised. If the sale proceeds are not reinvested the academy must repay to the Secretary of State the same proportion of the proceeds of the sale or disposal as equates with the proportion of the original cost met by the Secretary of State. However, the proceeds from the sale of assets acquired with grant from the Secretary of State cannot be used as the academy’s contribution to further named grant aided projects or purchase”. The Charity SORP (para 69) states that ‘Income generated from assets held in a restricted fund will be legally subject to the same restrictions as the original fund unless either: a) the terms of the original restriction specifically say otherwise or b) the restricted fund is an endowment fund , the income of which is expendable at the discretion of the trustees. Revaluation of Fixed assets An academy does not have to regularly revalue its fixed assets, the Charities SORP (para 26) states that revaluations can be undertaken by a suitably qualified person who could be a trustee or employee. The academy is under no obligation to revalue after ascertaining the initial cost. They must, however, consider value year to year in order to decide if any significant difference between net book value and market value needs disclosing If they do decide to revalue then they must continue to do so every 5 years on a rolling basis for that class of asset. The Charities SORP (para 262) states that “ when an asset is donated, or when it is capitalised as a result of a change in accounting policy, its initial valuation will not be regarded as revaluation and hence will not require the entire class of such assets to be revalued”. The section below on revaluation highlights the accounting required if assets are revalued. If an academy does decide to revalue the benefits are that the balance sheet is more up to date, however the 2011/12 EFA Accounts Direction (9.5.16) states it is unlikely that an Academy Trust will follow a policy of revaluation for tangible fixed assets. This also follows the charity SORP para 26. The DfE in their ‘WGA Briefing note’ for 2011/12 state that they will “ provide to all academies open by 31 March 2012 a professional valuation of land and buildings as at 31 August 2012, by 26 September 2012. We will procure and pay for this valuation on academies’ behalf, and there will be no charge to academies. The valuation can be used in preparing the academic year 2011/12 financial statement”. The note (para 48) does however state that “it is for the academy’s accounting officer who will choose whether to use this valuation or one prepared by the academy in preparing the financial statements for academic year 2011/12.” If an academy has published its audited annual accounts for 2010/11 and decides to include a revalued amount for its assets in its 2011/12 accounts, this brings about additional accounting requirements. Where you revalue your assets, a revaluation reserve will be created for changes in an asset’s value. The Companies Act 2006 requires that the revaluation reserve is separately disclosed on the face of the balance sheet. (See charities SORP paragraph 427 for further details.) The SOFA, under ‘revaluation gains or losses’ will also show the revaluation element. Revaluation – and the Income and Expenditure Account Under the Charities SORP an academy may not need to complete a summary income and expenditure (I&E) account or a ‘statement of total recognised gains and losses’ (STRGL). This is because the SOFA encompasses the main elements of these two statements. However one of the reasons why an academy may have to complete these statements is if the SOFA includes certain items that are open to challenge if they were included in an I&E. One of these items is an ‘unrealised gain / loss’ – i.e. created as a result of revaluation Therefore if an academy undertakes a policy of revaluation of fixed assets (which leads to an unrealised gain or loss and creates the requirement for a revaluation reserve) they will need to consider : Accounting requirements for the revaluation reserve The very likely requirement to produce a summary I&E & a STRGL The diagram below shows the accounting treatment for gains and losses on fixed assets as per the Charities SORP Impairment Loss Loss on disposal Additional depreciation (SOFA) Gain on disposal Other Incoming Resources (SOFA) Revaluation gains / losses Gains and Losses on Revaluation (SOFA) For further information on the summary income and expenditure account and statement of total recognised gains and losses, see Charity SORP, paragraph 423 onwards. CIPFA will be running events covering Academy accounts and also Accounting for School Assets in 2013. Lisa Forster CIPFA Children’s Services FAN No 3 Robert Street London WC2N 6RL Lisa.forster@cipfa.org