Exp_steb

1

OPET ANNUAL GENERAL MEETING

Mariehamn 13. - 14. 9. 1999

Technical session: EXPORT MARKETS FOR

RENEWABLE ENERGY

Export Markets for Wind Power in India

Matti Heikkilä, STE , Wind Energy

Group leader Guillermo J. Escobar, BESEL

BACKGROUND

India is a huge country with a population exceeding 1 billion. Strong industrialization has been a characteristic feature for the country in recent years. Today India is suffering from severe power shortage. Weekly blackouts both within industry and households are very common. In remote rural locations some 80 000 villages are still without access to electric grid.

These factors have made renewable production of electricity an interesting technical and also economic option. Today, the installed renewable capacity of the country totals 1350 MW. Out of this some 1000 MW is wind capacity. Although relatively tiny figure for a country like India, it still gives entrance to the club of five countries, whose installed wind capacity exceeds 1000 MW. The club consist of Germany with

3200 MW, USA with 2500 MW, Denmark with 1600 MW, Spain with 1100 MW and

India with its 1000 MW.

THE SITUATION TODAY

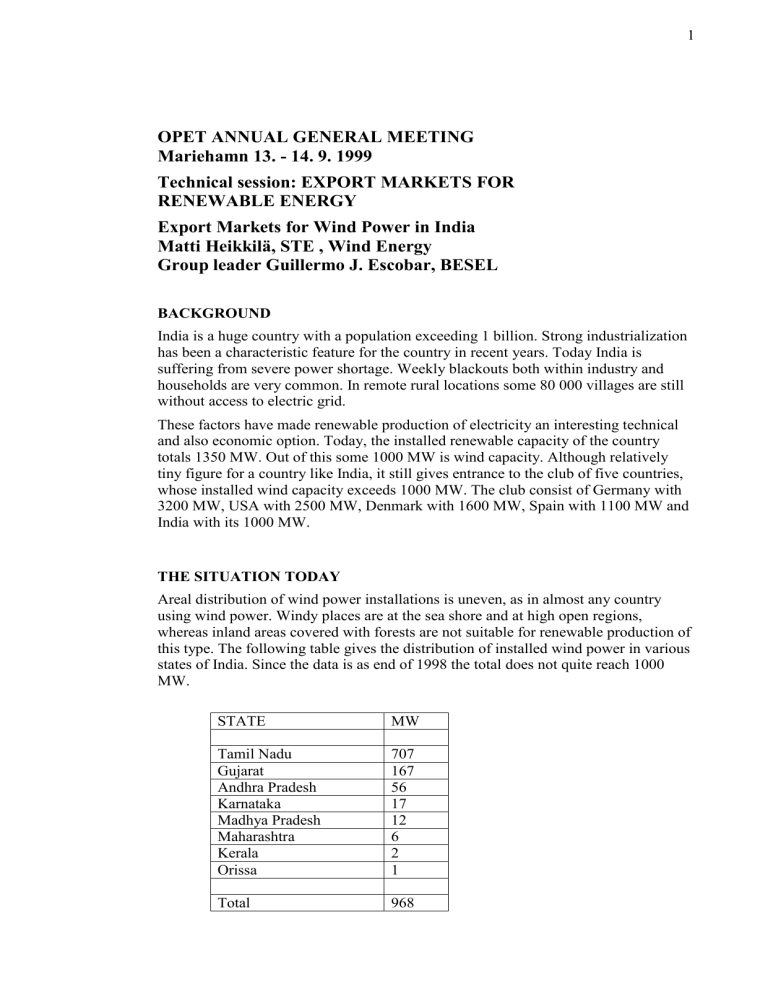

Areal distribution of wind power installations is uneven, as in almost any country using wind power. Windy places are at the sea shore and at high open regions, whereas inland areas covered with forests are not suitable for renewable production of this type. The following table gives the distribution of installed wind power in various states of India. Since the data is as end of 1998 the total does not quite reach 1000

MW.

STATE

Tamil Nadu

Gujarat

Andhra Pradesh

Karnataka

Madhya Pradesh

Maharashtra

Kerala

Orissa

Total

12

6

2

1

968

MW

707

167

56

17

THE FIRST BOOM

The following figure, which shows the temporal development of wind power construction in India, reveals some interesting features.

INDIA, installed capacity, MW per year

(BTM Consult 1999)

400

350

300

250

200

150

100

50

0

1993 1994 1995 1996 1997 1998 1999 2000 2001

The market opened in 1993, and some years after that the wind power capacity rose dramatically, culminating in 1995 to almost 400 MW in one year. After that, a declined followed, which was almost equally dramatic. The bottom was reached in

1998. Since then, however, a new start has emerged.

The initial rise was due to strong govermental campaigns, which included economic incentives and legislative measures to help permits to construct, and access to grid.

The measures were strong enough to encourage all types of actors to enter the market, including seekers for fast returns for investments. Technical quality of the turbines was not of much concern, there were not enough standards to guide construction, utilities were unprepared for this new activity, and quality and reliability of wind power was very much in question. Public informing was insufficient or nonexisting.

Local inhabitants had suspects for these new constructions, and wind power could not gain their acceptance.

2

3

As a result, the favor of wind power declined. Incentives were diminished, utilities showed reluctance and financing became uncertain. Change of governments and lack of faith in the sustainability of economic incentives finally scared off the investors.

STARTING ANEW

In 1998 the government realized that wind power, however, is indispensable for the country, and decided to try and remedy the situation. A new start for wind power was set as a national goal. New incentive system was created, new legislation set in force, and new tecnical and meteorological studies performed. The experience of earlier years was taken into account, and earlier errors were avoided. A new national goal for the development was set: 5% of the total energy consumption in 2020 should be covered by wind. This would require new capacity of at least 5000 MW. Technically, and in the light of the wind potential in India, the goal is quite realistic.

Main player in the realization of the goal is the Ministry of Non-Conventional Energy

Sources (MNES). It has created subgoals to increase wind power capacity by 200 MW to 300 MW per year, and to achieve this, have performed areal studies and technical surveillance of equipment, made contacts with local authorities, and created master plans to develope the most promising areas.

Another important player is the Indian Renewable Energy Development Agency

(IREDA), whose task is to arrange financing for the development. Projects are able to get favourable loans for up to 85% of total costs. At present, US$ 187 million has been granted for these purposes.

Projects are partly state owned, but features of market liberalisation also exist. Private construction and operation is possible, there is access to public grid, and in some states feed-in tariffs have been set in force.

For the private sector, a full 100% depreciation in the first year has been granted.

Additional incentives will be gained, if construction projects include positive social effects to the areas of construction, such as creating new jobs or invigorating economic activities in the area. These requirements are very often satisfied in connection with wind farm projects.

An example in Maharashtra, Central Western India, shows that an official target of

100 MW by March 2000 has been set. To achieve these, necessary grid reinforcements have been performed. Tax reductions for the first 6 years have been granted for the producers. A near term technical and economic potential for 500 MW in four specific locations has been identified.

The followind table gives an estimate of various production costs for electricity.

Production costs euro/kWh

Wind 0.035 - 0.045

Diesel

Coal

0.055

0.038

4

According to the data, wind power should be competitive already at current production costs. As the feed-in tariff in several states of India amounts to 0.05 - 0.06 euro/kWh, private enterprises for producing and selling wind electricity should be able to make profit.

All of the major western wind turbine manufacturers are already present in India, and compete for market shares with each other and local manufacturers. It is an open competitive market, were quality and price are the decisive factors. Local participation is very much a success factor in the competition. Joint ventures, technology transfer to local companies, local submanufacture and entrepreneuring are very much in favour when decisions to buy are made. Some of the economic incentives from the government are not possible without sufficient local involvement.

THE JUNE 1998 NATURAL DISASTER

In June 1998 a strong cyclone hit the state of Gujarat, which houses three large wind farms. Wind speeds grew up to 70 m/s in the gusts, and the direction of the wind could change 180 o

in less than a second. The wind farms were hit very badly. Out of the 315 turbines at the site 129 were destroyed, totaling 30 MW. The towers were bent at the elevation of 3 to 10 meters, nacelles were stuck nose on to the ground, and blades were splitted and crashed against the earth.

All other constructions shared the same fate: destroyed were buildings, bridges, railway constructions etc. The number of human casualties rose to 3000.

Whereas it is not advisable to dimension turbines to withstand every and any natural disaster, local climatic conditions in India must be taken into account by those selling, buying and operating wind turbines there.

WIND POWER IN CHINA TODAY

Another Asian giant which has shown growing interest for wind energy is China.

Although not as concrete as those in India, the plans to utilize wind energy are taking shape in an increasing pace.

Theoretical resources are almost limitless, 250 000 MW has been quoted as the technical potential. Up till today, the country has developed only 220 MW, but annual growth rates have exceeded 50 % since 1995. A near term national goal is 1000 MW by the end of 2000, which cannot be considered as unrealistic.

Problems lie at the administrative side. Independent power producers have problems in accessing the grid, and end users may have difficulties in financing wind energy purchases. However, two joint ventures with Western wind power manufacturers have already been established - one with the German Nordex Balcke Dürr and the other with the Spanish MADE Renewable Energy. The goal is to produce locally wind turbines with rated power up to 600 kW. That Cina is serious and ambitious with renewables is reflected in the fact that wind power is included in government´s priority list for foreign investments.

5

In this huge economy small openings may show volumes that already are very interesting for Europe´s wind turbine manufacturers. As an examle, a wind farm of 24

MW was reacently built together with three Chinese investors and the Dutch company

NUON.

SUMMARY

To summarise, wind power markets in Far East Asia and especially in India are growing continuously. All elements for further growth are present. Politically wind power is in favour, and governmental programs have been announced and ministries given responsibility to foster them. Legal framework is developling and financial instruments created. Economic incentives are available for wind power constructers, and even local acceptance, both at the administrative and private level, is developing favourably. There is every reason for turbine manufacturers in Europe to take advantage of this large and growing market.