Do Shareholders value Corporate Philanthropy?

advertisement

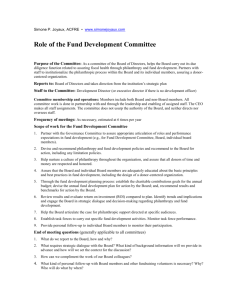

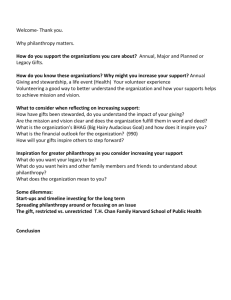

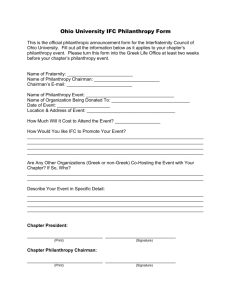

Do Shareholders value Corporate Philanthropy?: An Event Study Test Paul C. Godfrey Craig B. Merrill Marriott School of Management Brigham Young University Jared M. Hansen Texas Tech University Contact Author Information Paul C. Godfrey 789 TNRB Brigham Young University Provo, UT 84602 (801) 422-4522 (801) 422-0539 FAX Paul_Godfrey@byu.edu This draft is intended for review and feedback. Before citing results reported in this paper, please contact the authors for updated information. ABSTRACT Why should rational, profit maximizing managers invest in philanthropy? Godfrey (2005) proposes a new mechanism for shareholder value: Cash flow preservation vs. cash flow creation. The theory presents an intriguing rationale for philanthropy and CSR, but is as yet untested; the major contribution of this paper is to provide a direct test of the theory’s core propositions. Using a sample drawn from the KLD data base, we use an event study model to examine the effect of philanthropic giving on abnormal stock returns surrounding negative legal or regulatory events for 151 companies between 1993 and 2000. The results indicate strong support for the idea that philanthropic giving provides insurance value for shareholders. The study also finds that higher levels of participation in philanthropy do not provide extra insurance protection, and that more tangible forms of giving provide better insurance protection than less tangible forms. (144 words) Key Words: Philanthropy, Event Study, Insurance, Corporate Social Responsibility 2 Do Shareholders value Corporate Philanthropy?: An Event Study Test Why should rational, profit maximizing managers invest in philanthropy? Adherents of strict capitalism and fiduciary duties point out that philanthropy yields no tangible, transactional returns to the firm and is inconsistent with the managerial obligation to return cash to shareholders (Easterbrook & Fischel, 1991; Financial Accounting Standards Board, 1993; Friedman, 1970). The case for philanthropy comes from two different sources; strategic philanthropists argue that, while philanthropy may not generate direct economic returns, it will enhance the firm’s long term competitive position through intangible gains in reputation, legitimacy, or employee loyalty (Fombrun, Gardberg, & Barnett, 2000; Jones, 1995; Post & Waddock, 1995). Business citizenship scholars hold that businesses, granted the right to exist by the larger society, have an obligation to return part of their earnings to that society, philanthropy stands as an obligation borne by business citizens of a community (Logsdon & Wood, 2002; Waddock, 2001; Wood & Logsdon, 2002). The profitability of philanthropy is one concrete example of the larger, longer debate on the relationship of Corporate Social Responsibility (CSR) to Corporate Financial Performance (CFP). This larger debate about whether or not CSR contributes to CFP has a long and tortured history. Godfrey (2005) proposes a new mechanism for shareholder value: Cash flow preservation vs. cash flow creation. While current models use a forward, or “front door,” model (where CSR leads to enhanced CFP), Godfrey’s model suggests a “back door” mechanism (where CSR protects and insures CFP); Godfrey’s model stands as a 3 complement to instrumental theory1. The theory presents an intriguing rationale for philanthropy and CSR, but is as yet untested; the major contribution of this paper is to provide a direct test of the theory’s core propositions. The empirical literature the CSR-CFP link is a quagmire of conflicting results. (Margolis & Walsh, 2001), in an exhaustive study of the empirical literature in this area, note that thirty years of work has not yielded a clear and unequivocal finding in either direction. Within this body of general work is a set of studies dealing with the value of behavioral signals in during crisis. This body of work is broadly consistent with the insurance model we test here. These studies consist of two broad types, both looking at idiosyncratic firm-specific profiles in a context of events common across the sample. First, broad, abstract use of CSR measures linked to economy-wide events. (WTO study, 2005; 1987 stock crash study), and second, firm specific, narrow measures against common industry events. The cotton dust study (1983); and the Chemical industry studies (Northcutt etc.)—social reporting, not activity Both types show limited support for the Godfrey hypothesis about CSR. Neither study provides a direct test, however, as this work doesn’t specifically model philanthropy, nor does it investigate the phenomena at the level of individual firms. We employ a different level of matching: a set of firm-specific attributes (telescoping from broad to narrow) matched with firm-specific events. Thus, we look at idiosyncratic profiles in idiosyncratic contexts. A more stringent test of any central tendency and 1 The insurance model also complements the Business Citizenship logic. Godfrey (2005) notes that the insurance view leads managers to make similar types of investments in social issues and activities as those recommended by Citizenship scholars; however, the fundamental motivation differs. Under a citizenship regime managers act without thinking of profit concerns, while under the insurance model (and the strategic philanthropy model) managerial motivations center on the profit opportunities afforded through CSR activities. 4 a more direct test of the idea that philanthropy or other CSR’s represent individualized insurance policies for firms. This paper also advances and tests three theoretical extensions to Godfrey’s (2005) core model. First, does the insurance effect generalize beyond philanthropy? Philanthropy produces moral goodwill because it is a purely discretionary activity (Carroll, 1979). Godfrey asserts, but does not explore, that other discretionary CSR’s (diversity initiatives, labor practices, environmental preservation). Our data set allows us to examine the effect of several discretionary CSR’s on shareholder wealth. Second, is the insurance effect subject to decreasing marginal returns? The economics of insurance stipulates a clear optimal premium level with investments beyond the optimal level of involvement representing dead weight losses. In terms of CSR helping insure the economic value of a firm’s intangible asset base the hard logic of optimality may break down. Uncertainty surrounding the value of the intangible (relational) assets, and the exact amount of goodwill generated through philanthropy means that rational executives may insure at some level in the neighborhood of the optimum and may err on the side of over-involvement in the hope of providing adequate “coverage.” We hope to shed light on this issue by raising the question Does increasing the level of commitment to philanthropy result in greater levels of shareholder wealth protection? Third, we extend the insurance model by asking Does the type of giving matter? Philanthropy, in particular, is problematic because its noise/signal ratio may be rather high; does a firm donate to the symphony to get prime seats for executives and spouses, or to support community activities? If philanthropy provides a signal for a firm’s moral 5 intentions, commitments, and coloration (Jones, 1995), then do different types of philanthropic activities have different signal values? We present our argument and evidence as follows. We first provide the theoretical rationale and hypotheses we test. We then describe our methodology, data set, and the variables used to test our hypotheses. We next present the results of our analysis and the findings in terms of support for, or rejection of, our hypotheses. We conclude by noting the limitations of our work and considering the implications of our findings for both academics (theorists and empiricists) and practicing managers. THEORY AND HYPOTHESIS DEVELOPMENT Key Theoretical Constructs Philanthropy and CSR Philanthropy is “an unconditional transfer of cash or other assets to an entity or a settlement or cancellation of its liabilities in a voluntary nonreciprocal transfer by another entity acting other than as an owner (Financial Accounting Standards Board, 1993); emphasis original)”. Corporate social responsibility is defined as actions that are not required by law but that appear to further some social good, and extend beyond the explicit transactional interests of the firm (McWilliams & Siegel, 2001). Both philanthropy and CSR constitute voluntary and discretionary actions by firms, around which stakeholders can make moral attributions of intention. Intangible (relational) assets. Many of a firm’s most valuable assets are resources are intangible, idiosyncratic to the firm, and may have been developed over a number of years (Barney, 1991; Dierickx & Cool, 1989). A number of a firm’s resources are 6 relationship-based because the earning potential of these assets depends on the relationships a firm has with its stakeholders and the related assessments these stakeholders make regarding some (or all) elements of the firm’s activities (Wood & Jones, 1995). Examples of these assets are reputation, loyalty, legitimacy, and trust. These relationship-based intangible assets are termed relational wealth in the Clarkson Principles of Stakeholder Management (Business Ethics Quarterly, 2002). Moral capital/ insurance Jones (1995) offers an account of a firm’s moral reputation wherein stakeholders assess interactions between the firm and its constituents within the overall strategic context of the firm —its visions, strategies, policies, systems, etc.— that all reflect some degree of “moral coloration” by the firm’s policy maker. From these morally colored activities and contexts stakeholders impute moral values, principles, intentions, and character elements. Philanthropy constitutes an action (or interaction) between the firm and its constituents within a context rich in moral intention and coloration; the resulting moral capital represents the outcome of the process of assessment, evaluation, and imputation of moral values and character by stakeholders and communities of a firm based on its philanthropic activities. Shareholder Value Shareholder wealth is the expected discounted value of a firm’s anticipated cash flow stream from the employment of its tangible and intangible assets, consistent with the prescriptions of the Capital Asset Pricing Model (Brealey, Myers, & Marcus, 1995). Insurance adds value to a firm’s equity price by protecting shareholders against risks, such as bankruptcy, that may make it difficult to liquidate a position profitably (Stultz, 1996). 7 Negative Events organizational acts adversely affect stakeholder groups and the communities to which they belong; organizational action or conduct that creates adverse impact on a stakeholder group constitutes the bad act element of an offense. Philanthropy/CSR as Insurance The mens rea effect of CSR. Under the common law tradition, two elements must be present for an offense to occur: a bad act and a bad mind (LaFave, 2000). A bad act requires that some action or conduct be performed that creates harm or adverse impact on another, be it an individual, group, or community. Bad acts must be accompanied by a bad mind in order to constitute an offense, for “Actus not facit reum nisi mens sit rea (an act does not make one guilty unless his mind is guilty)” (LaFave, 2000: 225). This is the doctrine of Mens Rea. The logic of corporate Mens Rea parallels organizational scholarship that views corporations as secondary moral agents (Wherhane, 1985) or as moral agents but not moral actors (Werhane, 1985; Wood & Logsdon, 2002). The doctrine of Mens Rea also underpins the U. S. sentencing guidelines, both the 1991 original and the 2004 revisions. Jurists seek for evidence of proactive ethical and preventive behaviors, as well as considering the firm’s history of ethical and compliance performance when considering punitive sanctions for corporate misdeeds. When bad acts occur, Godfrey (2005) argues that stakeholders invoke the cognitive template suggested by the Mens Rea doctrine to help determine appropriate sanctions. As stakeholders consider possible punishments and sanctions, positive moral capital acts as character evidence on behalf of the firm. Positive moral capital provides counterfactual evidence to mitigate assessments of a bad mind; positive moral capital reduces the probability that the firm possessed the evil state of mind that justifies harsh 8 sanctions (Strong, 1999). Positive moral capital encourages stakeholders to give the firm the benefit of the doubt regarding intentionality, knowledge, negligence, or recklessness. Positive moral capital also addresses the relevant issue of a firm’s history of moral behavior. If stakeholders follow the Mens Rea template found in the United States Sentencing Guidelines, then the nature and severity of punishments for bad acts will be significantly influenced by stakeholder assessments of a bad mind. Negative sanctions may aim to remedy the causes or consequences of adverse impacts, they may seek compensation for adverse impacts, or sanctions may aim to punish the firm and deter future adverse impacts. Remedial sanctions may include new regulations or laws aimed at limiting behavior or establishing future liability, or simply increased scrutiny and monitoring by affected stakeholder groups. Compensatory sanctions may include fines, lawsuits, or other actions aimed at financially compensating impacted groups. Punitive sanctions may include fines, incarceration for key individuals, negative publicity campaigns, or boycotts of the firm’s products or services. Punitive actions may also come in the form of decreased willingness to do business with the firm, or loss of reputation, loyalty, trust, or legitimacy. Moral capital provides insurance-like protection to relational wealth because it fulfills the core function of an insurance contract: it protects the underlying relational wealth and earnings streams against loss of economic value arising from the risks of business operations (Trieschmann & Gustavson, 1998). Positive moral capital provides a reservoir of positive attributions that can be drawn upon to “indemnify” relational wealth against loss of value when stakeholders are adversely affected. This logic gives rise to H1a: In the context of a negative event, declines in shareholder value will be smaller for philanthropic than non-philanthropic firms. 9 Godfrey’s (2005) argument centers specifically on philanthropy; however, the logic of Mens Rea and insurance value should apply for other discretionary CSR’s as well. The discretionary aspect of other CSR activities—those exceeding legal or ethical mandates—allows stakeholders to make attributions of moral coloration or character in relation to these actions as well. If discretion is the driver of moral attribution then firms having exemplary labor relationships, strong efforts to promote diversity in the workplace, a commitment to quality products, and/or a solid record of pro-active environmental stewardship should enjoy the same accumulation of moral capital. We aim to test this proposition directly through H1b: In the context of a negative event, declines in shareholder value will be smaller for firms engaging in other discretionary CSR’s (employee relations, diversity, product quality, and environmental stewardship) than firms not engaging in discretionary CSR’s. Philanthropy and Intangible (Relational) Assets Firms have two types of value producing assets—tangible and intangible. Tangible assets, such as property, plant, and equipment, can be insured through traditional indemnity contracts. Intangible assets, such as brand, loyalty, trust, or legitimacy, do not possess the criteria needed for indemnification in traditional insurance markets. Rejda ((Rejda, 1992): 24) outlines a number of criteria for a functioning insurance market to exist that intangible assets do not meet. First, there must be a large number of homogeneous exposure units (objects to be insured); however, relational wealth—like trust or brand—is not homogenous but rather idiosyncratic to a particular relationship between a given firm and a given set of stakeholders. Second, probable losses must be accidental and unintentional; while some events that cause loss to the value of relationship-based intangible assets may be accidental or unintentional many of 10 the events that negatively impact firm-stakeholder relationships are conscious and deliberate decisions (e.g., closing a plant, discontinuing a product or a product line, stretching out suppliers’ payment terms beyond reasonable limits, cutting philanthropic activity to community groups). Third, the loss must be determinable and measurable; the magnitude of loss to relational wealth is difficult to ascertain both ex ante—no original invoice exists for brand or loyalty—and ex post—losses may occur over a broad geographic region or persist through time. If philanthropy offers insurance-like protection for a firm’s intangible asset base, and if managers are aware of this relationship, then we would expect H2: Philanthropic firms will have higher levels of intangible assets than non-philanthropic firms. The Marginal Value of Philanthropy Godfrey (2005) adopts the underlying logic of the economics of insurance in making his argument. One of those tenets is that there is an optimal value of insurance protection; to under-insure is to leave assets exposed to risk of loss, to over-insure is to pay premiums for no additional coverage (the indemnity is based on the value of the asset, not the amount of the premium). This optimal premium proves relatively simple to calculate, given the values of the assets at risk and the pricing and structure of traditional indemnity contracts. Philanthropy, and CSR in general, present two significant confounds to the economics of insurance. First, as we noted above, intangible assets are difficult to value—certainly to the level of precision necessary to calculate an optimal premium. Managers or risk assessors may estimate with confidence some range of value for each 11 intangible asset; however, a range is not a point estimate. Under such an estimation regime, managers may have incentive to “over-insure” or make investments in philanthropy. Since philanthropic investments send signals of a firm’s moral coloration and intentions (Jones, 1995), and since the assessment of these moral attributes results in positive moral capital, then greater levels of investment should lead to greater levels of goodwill. Second, managers are unsure of the exact “indemnity” offered by stakeholders. Unlike a formal contract that specifies in clear detail the payouts for different assets at risk, including property, plant, and protection against cash flow interruptions. The moral capital and goodwill generated by philanthropy works on an implicit and tacit agreement. Stakeholders form their own assessments and, when negative events occur, they create some idiosyncratic indemnity value. Thus, managers have incentive to “over-insure” in order to increase the probability that stakeholders have the requisite information to grant ample amounts of goodwill based indemnity. This logic leads to: H3a: In the context of a negative event, high participation in philanthropy (or other CSR’s) will have a positive effect on preserving shareholder value An opposite case can be made as well, which focuses on the ex post invocation of goodwill as indemnity. Take for granted that higher levels of philanthropy do in fact lead to a greater stock of moral capital. Along with such greater goodwill, however, comes a greater expectation on the part of stakeholders that the firm will behave in ways consistent with its image and goodwill. Negative events may constitute a “fall from grace,” however, as stakeholders observe that the firm and its managers behavior is not consistent with such high expectations. Rather than granting forgiveness for human 12 error, stakeholders may believe that the high levels of philanthropic activity represented an attempt at ingratiation rather than a sincere commitment to good works. Under such a regime, stakeholders may be more, rather than less, likely to punish the firm; first for the negative event itself and second for the perceived ingratiating behavior (Godfrey, 2005; (Gordon, 1996). This logic leads to H3b: In the context of a negative event, high participation will have a negative effect on shareholder value Tangibility and Signal Value Philanthropy has been impaled in the literature as both an unfair tax on shareholders (Friedman, 1970) and as the provision of an untaxed, discretionary benefit to management. Attending the symphony, opera, or art exhibit as the CEO of a company, under the guise of corporate philanthropic support, represents a unique form of on-the-job consumption (Gillmor, 1999; Minow, 1999). Certain types of philanthropic donations, whether done directly or a corporate philanthropic foundation, will be subject to cynicism and multiple interpretations by stakeholders. Specifically, donations that are abstract or less tangible in nature, such as reporting that the corporation spent 1.5% of its net income on philanthropic activities without detailing where those donations went or what process was used to determine grantees, send signals of moral coloration and intention with a high noise/signal ratio. These types of philanthropy provide “muddy” or “cloudy” signals about the morality of managerial motives because the lack of information contained in the signal cannot adequately thwart the interpretation of managerial perktaking. Corporate giving can be structured in ways that reduce the noise/signal ratio and provide a much clearer signal of moral coloration and intention. Clear and transparent 13 donation criteria and processes reduce the ambiguity around managerial “discretion” and perk-taking. The recipients of donations may also provide clarity as to intentions. To contrast with our description above, we describe these types of gifts and giving as more concrete, or more tangible. For example, a corporate philanthropic gift providing low income housing, heating bill assistance for the elderly or indigent, or support of K-12 education in local neighborhoods provide clear signals because even the most hardened cynics realize the CEO or members of the top management team are unlikely to live in low income housing, need assistance with their heating bills, or send their children to the K-12 institutions receiving corporate grants. This distinction is captured in H4a: In the context of a negative event, more tangible forms of philanthropic giving will have a positive effect on shareholder wealth H4b: The effect will be stronger (more positive) than the effect of less tangible forms of philanthropic giving. METHODOLOGY, DATA, AND FINDINGS (12 PAGES) Methodology Godfrey’s (2005) theory, that philanthropy protects intangible assets when negative events occur, suggests that an event study is not only an appropriate methodology, but the method that will provide the most direct empirical test of the theory’s core propositions. McWilliams and Siegel (McWilliams & Siegal, 2000) criticize the use of event studies in management, and in the social responsibility field in particular, on four grounds. First, they argue that the methodology has been used as a convenient method of investigating financial effects of CSR, but the method has not been explicitly linked with the theory. As we note, and event study provides the most direct test of the Godfrey theory. 14 Second, McWilliams and Siegel (2000) note that many event studies are not consistent with the efficient markets hypothesis. Efficient markets hypothesis holds that investors will rapidly incorporate new and unexpected information about a firm into its share price. Thus, the specific “event window”—the time frame investigators use to measure investor adjustments to the stock price—must be sufficiently short. For example, McQueen and his colleagues show that investors incorporate new macroeconomic information into their pricing models in a matter of minutes (CITE NEEDED). We estimated our models using a series of nested event windows, beginning with a very narrow window (t (the event day) and t-1 (a 2-day tight window) and a broader window (a 5-day, t-2 through t+2, window). Third, consistency with efficient markets hypothesis further means that the event under study should be the only relevant event that investors would incorporate into their pricing calculations during the event window. Material events that coincide with the event of interest, such as earnings announcements, new product announcements, major sales, or a merger or acquisition announcement, confound the ability of the event study methodology to assign abnormal share price movements to the focal event. In their review of CSR related event studies, McWilliams and Siegel (2000) found that in one extreme example, the entire data set should have been discarded because of confounding events. Fourth, McWilliams and Siegel (2000) note that several studies rely on extremely small sample sizes, sometimes as small as 20. For an event study to produce meaningful results the sample size must be large enough to have sufficient statistical power and to warrant claims of generalizability. 15 Data and Variables Sample. The KLD Socrates data base constitutes the universe of potential samples for our study. The Socrates data base contains 3rd party assessments (done by KLD personnel) of a firm’s performance along several social involvement and responsibility dimensions for each firm in the S&P 500 since 1991. We limited our sample to the decade 1991-2000 and drew our sample from firms in data set for all years, or 160 firms. We chose this sample because we assumed that relevant negative events would be relatively rare (we would need a large time horizon from which to draw a significant number of events) and that any relationship between philanthropy and share returns would not depend on the time frame of the study. Our net sample of 160 firms yielded 254 possible events, with 99 firms experiencing an event and 61 firms not experiencing an event. We chose 2000 as the closing year of our study because in late 1999 and throughout 2000 the industry experienced a wave of merger activity that created a new category—the supermajors. Dependent Variable: The dependent variable is the abnormal return to a firm’s share price experienced in the event window surrounding a negative event. We defined the negative event of interest broadly, as the initial public report of a lawsuit or regulatory action against a company in the sample. We used the Wall Street Journal as our source; as the premier business newspaper in the United States, the Wall Street Journal produces reports, announcement, or stories about material events affecting large publicly held and private companies. The Journal often picks up and reports material events reported in smaller local papers. Our initial search yielded 254 potential events, of which we settled on a sample of 204 negative events. We eliminated events that were negative, but not 16 legal or regulatory (such as an announcement of layoffs), or were legal but positive for the company (such as winning a lawsuit or having a positive regulatory finding), or those that dealt with individuals within a company or formerly associated with a company. We then screened these events for confounds by searching the Wall Street Journal using a 7 day window (t-5, t+2) for other material announcements. We also eliminated events for which we did not have corresponding KLD reports of firm CSR activities. This yielded a final sample of 151 events. Thus, our sample size is large enough to run regressions with enough power to warrant confidence in our results. The abnormal return is defined as CARit n (R it Eit ) for the ith firm over the t n event window centered on t (t=o represents the event day) and bounded by n (the window on either side), R represents the actual change in stock price, and E captures the expected (equal-mean-value) return for the share price on that day. CAR captures the sum of the day-to-day differences between the firm’s actual and expected returns. The narrowness of our windows is consistent with efficient markets hypotheses and answers one critique of McWilliams and Siegel (1999). We drew stock return data from the Center for Research in Security Prices (CRSP) data tapes and used the Wharton Research Data Service modeling software to calculate an equal-mean-value, market adjusted expected stock return for each firm by using the previous 180 days returns as regression inputs to calculate anticipated return. We estimated CAR for two windows to account for different assumptions about leakage (public knowledge of the event before its publication in the Wall Street Journal), and 17 interpretation (some events may contain enough ambiguity that investors take time to factor in the impact of the event on price). Independent Variables. The social responsibility ratings in the KLD Socrates data base provide the base measures for our independent variables. KLD is an appropriate data source because 1) it is known to all market participants, and 2) the KLD data exhibits construct validity for the underlying CSR constructs. Efficient markets theory holds that investors will use all publicly available data at the time of the event to price the stock. The date of the focal event was clearly demarcated; however, the actual collection and release of the KLD rating data for any year is uncertain. Conversations with KLD managers indicated that the data collection process for each company follows no rigid schedule, but that the year end data for any year represents all ratings collected during the year. To control for the possibility that a KLD rating in any year chronologically followed a focal event, we lagged our CSR measure by one year to create a conservative and strict test of the efficient markets assumption.. Social responsibility measures. 41 core measures of social responsibility in the Socrates data base constitute the foundation measures for our variables. These measures underpin KLD’s evaluations in five separate domains of CSR: Community Relations (philanthropy)2, Employee Relations, Environmental Stewardship, Product Quality, and the promotion of Diversity. We began by sorting the foundation measures into those that capture endogenous choices by a firm’s management, and those capturing non- 2 The community relations dimension captured by KLD becomes our measure of philanthropy. The Community Strengths measured by KLD that represent endogenous managerial choices all fit the FASB definition used by Godfrey (2005) in defining philanthropy: “an unconditional transfer of cash or other assets to an entity or a settlement or cancellation of its liabilities in a voluntary nonreciprocal transfer by another entity acting other than as an owner (Financial Accounting Standards Board, 1993); emphasis original)”. 18 endogenous reactions by stakeholders to a firm’s choices and actions. An expert panel verified the classification of items into these categories; rater scores were compared using Cohen’s Kappa statistic for multiple raters; the test statistic yielded a value of 0.6148 (p < 0.0001). Raters agreed on the initial classification for 28 of the 41 items; differences between raters were resolved by consensus among the raters. Our variables built on only those items representing positive managerial choices in each domain of CSR. Appendix A provides a detailed description of each the KLD foundation variables we used to construct the CSR variables. We captured two elements for each social responsibility domain—participation and high participation, each based on counts of the KLD individual item scores that reflect endogenous managerial choices in within the area. Participation is a dummy variable, 0 if no participation (sum of area scores = 0), 1 otherwise; high participation is also a dummy variable, 1 if sum of area scores > 1, 0 otherwise. Since the underlying KLD measures are ordinal (1,0 variables based on participation in discrete activities within a domain) we avoided summing scores within or across domains; we maintained the ordinal consistency of the data. The 4 measures of philanthropic (community) involvement consist of two “more tangible” measures—involvement in community housing or education projects—and two “less tangible” measures—total corporate giving at the 1.5% of net income level and innovativeness in the giving program. Our “more tangible” measure is a discrete variable (1 if a firm scored a 1 in the KLD ratings for either of the more tangible measures, 0 otherwise), as is our “less tangible” variable (1 if a firm scored a 1 in the KLD ratings for either of the less tangible measures, 0 otherwise). 19 Other Variables. We measured the level of relational or intangible assets through market to book ratio, drawn from the Compustat data tapes. Efficient markets hypothesis suggests that control variables will be superfluous as investors have already calculated known controls, such as industry, size, management tenure, etc. into their current calculations; it is only new information that affects the firm’s valuation during an event. We included size, market to book, and an industry dummy to capture involvement in manufacturing or service-based industries as control variables in the regressions, although each proved insignificant, consistent with the efficient markets hypothesis. Findings Table 1: Presents the basic statistics for the variables used in the study. Pearson product moment correlation matrix ********************** Insert Table 1 about here ********************** Table 2: Presents 4 model specifications run using OLS regression techniques. We do not report the parameter estimates for the control variables (size, market-to-book, manufacturing/service dummy) because these variables proved insignificant and the efficient markets hypothesis stipulates these variables will have no explanatory power. ********************** Insert Table 2 about here ********************** Figure 1: We include basic Box Plot results to buttress support for our hypotheses. Panel A presents the box plots for the market to book variable, divided by participation in philanthropy. Panel B presents box plots for the mean CAR-1 variables 20 for each of three subgroups—those not engaged in philanthropy, firms engaged in a single philanthropic area, and firms engaged in multiple philanthropic areas. ********************** Insert Figure 1 about here ********************** Table 3 presents the results of regression models subdividing philanthropic participation into “more tangible” and “less tangible” manifestations. ********************** Insert Table 3 about here ********************** The insurance effect of philanthropy The parameter estimate for participation in philanthropy reported in Model 1,Table 1, has a positive sign and is statistically significant at p < 0.001. This evidence warrants rejection of the null hypothesis and provides strong support for H1A; firms engaged in philanthropy experience smaller declines in share prices in the face of negative events. We assert that the evidence confirms Godfrey’s core assertion— philanthropy does appear to have an insurance effect. Model 2 includes the variables for the other endogenous choices of involvement in CSR by firms; none of these variables proves significant, and the overall regression equation loses statistical significance. Model 2 does not provide statistical evidence strong enough to reject the null hypothesis and H1B is not supported. Models 1 and 2 support a narrow reading of the philanthropy as insurance hypothesis; although philanthropy, and community relations, appears to act as an “umbrella” insurance policy 21 against general negative events, other types of CSR do not offer shareholders such protection. The role of intangible assets We tested the assertion that firms with high levels of intangible assets would be more likely to engage in philanthropy than firms with lower levels of such assets. Figure 1, panel A, shows the box plot highlighting the mean values and variance of the intangible asset variable for each of the two subgroups. While the box plot provides supporting evidence, a t-test of sample means (assuming equal variances) fails to provide the statistical evidence needed to reject the null hypothesis. H2 is not supported. The variance around the means indicates that while the firms with high levels of intangible assets engage in philanthropy, those with lower levels do as well. The marginal value of philanthropy Models 3 and 4 (Table 1) test the two “marginal value” hypotheses. These models control for the positive effect of participation in philanthropy and test the value of additional commitments in this arena by firms. The negative sign of the Philanthropy High Participation variable implies a rejection of H3a and support for H3b; however, the variable is not statistically significant from zero so we cannot warrant that assertion with strong evidence. The lack of significance for the parameter estimate allows us to assert with confidence that involvement in more philanthropic areas does not provide with any additional protection—philanthropy beyond a certain amount may not exhibit negative marginal gain, but it clearly indicates no positive marginal gain; when coupled with the fact that increased involvement in philanthropy expends resources. Similar to overinsuring a tangible asset, the marginal return to the firm of increasing its commitment to 22 philanthropy represents a deadweight loss to shareholders in premiums paid with no additional indemnification. We measured the effect size of the three groups to further explore this phenomenon. The gamma () statistic measures the effect of an entity’s placement in a treatment, as opposed to a control, group (CITE NEEDED, Cohen, 1988). The Box plots portrayed in Figure 1, Panel B, show what appears to be an inverted U type of relationship between insurance value and philanthropy. The difference between being in the moderate philanthropy (treatment) vs. no involvement (control) groups is moderate (g= 0.54), while the difference between being in the high philanthropy vs. no involvement group is small (g = 0.27). The box plot and gamma statistic data again imply, but do not warrant, support for H3b, that firms involved in many areas of philanthropy may be creating high expectations that result in perceptions of ingratiation rather than enhanced perceptions of responsibility or virtue. The tangibility of giving H4a and H4b assert that more tangible forms of philanthropic giving will result in greater levels of shareholder value protection because these types of philanthropy send a clearer signal of moral coloration and intention than less tangible forms of giving. The evidence presented in both Models 5 and 6 (Table 3) provides strong support for H4a and H4b; the more tangible variable is positively signed and statistically significant (p < 0.001). More tangible forms of giving appear to provide a clearer signal of good intentions than do merely giving, a signal investors (at least) reward with lower reductions in shareholder value when negative events occur. 23 The evidence presented here provides strong support for the assertion that philanthropy acts as a form of insurance against negative business events. Philanthropic activity does not parse based on the level of a company’s intangible assets. Increased involvement in philanthropy (measured as the number of areas a firm is involved in) does not create additional insurance protection; in fact, the collective evidence presented here lends support to the notion that high levels of corporate involvement in philanthropy may erode the insurance value of philanthropy. More tangible forms of philanthropy enhance the insurance value of philanthropy by sending clearer signals of a firm’s moral intentions, commitments, and coloration than merely giving to philanthropic causes. IMPLICATIONS Limitations As with any empirical study, ours has limitations and weaknesses. First, we only studied one type of negative event, legal or regulatory actions against firms, and we did not parse these events into more specific categories such as labor or diversity issues, environmental claims, or product quality problems. Future work should look at different types of events, labor, product recalls, environmental disasters, etc. Finer grained analysis may find support for the insurance value of other CSR behaviors; ones that match more closely specific types of negative events. The result surprises us because, if the logic of philanthropy follows the logic of the insurance market, then firms should only buy umbrella policies after purchasing specific coverage for specific business risks. A test with specific social responsibility events (environmental crises, labor strikes or 24 issues) could determine whether or not more directed efforts in CSR provides specific coverage. Second, we used coarse (discrete) measures of involvement in philanthropy and other CSRs. We feel confident about our assertions in terms of firm involvement in philanthropic activities, but the nature of our data does not warrant assertions about various levels of philanthropy. This moderates our findings, particularly our assertions about the inverted U relationship between philanthropy and insurance protection. Future research based on fine-grained, continuous measures of philanthropic activity (such as actual philanthropic dollars, direct vs. foundation-based giving, actual projects supported, etc.) may shed clearer and, hopefully, more light on this important and intriguing area of philanthropy and CSR. Third, our study, while empirically robust, provides a high-level view of theoretical processes that beg investigation and elaboration at deeper levels through firmspecific and event-specific case studies. For example, does the insurance value of a firm’s philanthropic activity depend on the transparency of its decision process and the extent to which company managers make known their philanthropic endeavors? Going beyond investors and share price, when bad things happen how do affected stakeholders integrate philanthropic and CSR activities into their calibration of appropriate responses? Researchers using smaller scale, finer grained investigative techniques (historical case analysis, ethnographic studies, etc.) can help flesh out the mechanisms and implications for managers of an insurance view of philanthropy and CSR. In terms of practical relevance and replicability, case study research should yield greater insights into the 25 architecture (organizational and cognitive) that supports the creation and exploitation of moral capital. Implications for Academics Our study provides initial and strong support for the insurance hypothesis. The novelty of Godfrey’s (2005) approach lies in its “back door” approach to the relationship between CSR and CFP. Support for this model argues that those studying corporate social involvement may be well served to reverse the figure-ground relationships in thinking about, and modeling, relationships between business (both individual businesses and business as an institution) and society. One such figure-ground reversal would be to question the conceptual (and empirical) sharpness of the market vs. non-market stakeholder approach (Baron, CITE NEEDED). Our study supports the notion that how a firm treats non-market stakeholders (community needs met through philanthropy) has tangible economic value for its market-based stakeholders. We invite scholars to consider what other types of figure-ground relationships should be reversed in our understanding of business and society relationships. The literature on Corporate Social Responsiveness argues that firms should respond to stakeholder needs and concerns. The ingratiation literature argues that managers must tread lightly in this area because a heavy hand may be seen as evidence of ingratiation vs. commitment behaviors. Our tentative support for the proposition that more philanthropic involvement leads to less insurance protection is broadly consistent with the logic of ingratiation—lots of activity may create false impressions that appear ingratiating in retrospect. This presents theorists and managers alike with a vexing question: what defines the inflection point between appropriate responsiveness and 26 inappropriate ingratiation? How do managers and stakeholders manipulate not only CSR’s but also other substantive and symbolic elements of their relationship to send signals (make judgments) about their true intentions? Theorists and empirical researchers need to take up these questions and consider how managers do (and should) make and make public commitments to philanthropy and other CSRs. The signal value of more tangible forms of philanthropy is a result not directly predicted by Godfrey’s (2005) insurance model. This finding, coupled with the tentative support for the declining marginal value of philanthropy, implies that shareholders and traders (and perhaps other stakeholders as well) have quite sophisticated ways of determining how much, and what type of, philanthropy they find valuable as insurance. If tangibility matters in terms of insurance value, what does this imply about the signaling values of other CSR’s? Do specific environmental practices create more goodwill than other, more general commitments? What about labor and diversity? Does a tangible commitment to minority participation on the board of directors represent a more (or less) tangible commitment to diversity than a women and minority business subcontractor/supplier contract? Both theoretical and empirical modeling needs to take on these finer-grained, yet important, questions in order to advance our understanding of how philanthropy and other CSRs create insurance value. Implications for Executives As (Saiia, Carroll, & Buchholtz, 2003) find, “Strategic Philanthropy” has become the operating buzzword in many corporations. Our study supports strategic philanthropy as a general principle; however, our study supports a notion of strategic philanthropy far broader than that conceived of by most academics and executives. The logic of insurance 27 suggests that executives should consider both value adding (front door) and value preserving (back door) drivers when defining what is strategically valuable for the corporation and its shareholders in terms of commitments to CSR. The insurance model argues that behaviors associated with Citizenship obligations, general community or issue involvement in domains holding little front door strategic value to the corporation may create substantial back door value through the generation goodwill that investors and other stakeholders can draw down when bad things happen. As Godfrey (2005) argues, the insurance model invites executives to reach out and serve diffuse groups and become involved in social issue resolution with little direct bearing on the corporation’s strategy. Philanthropy may act as an “umbrella policy” and protect value during general negative events, but executives and decision makers should not neglect specific social responsibilities associated with clear and specific liabilities such as environmental degradation (remediation) or labor issues. In terms of specific events, investors and other stakeholders may indemnify (or penalize) the firm first based on its performance in a specific social domain, then draw down the umbrella policy. Direct giving toward tangible causes such as support for discrete and concrete community projects. Firms involved in housing and education saw greater insurance value, managers should consider these areas of community involvement. Less tangible giving can be made more tangible by providing a transparent decision process and accounting for activities and donations. That is, executives should provide a clear rationale for donations to the local symphony or opera, and an accounting of what benefits accompany that donation and who the beneficiaries were. Transparency and 28 accountability strengthen the clarity of the signal regarding a firm’s moral intentions and coloration. CONCLUSION Godfrey’s (2005) insurance model presents a new way to think about the business value of Corporate Philanthropy. This paper provides strong support that philanthropy provides an indemnity that protects shareholder wealth when negative events occur. This study stands as one of many on the general subject of the relationship between CSR and CFP, and as such it becomes one brick in a long wall of research on this topic. Our findings present theorists, empirical researchers, and executives with intriguing insights for rethinking the overall value of philanthropy. 29 REFERENCES Barney, J. B. 1991. Firm resources and sustained competitive advantage. Journal of Management, 17: 99-120. Brealey, R. A., Myers, S. C., & Marcus, A. J. 1995. Fundamentals of corporate finance. New York: McGraw-Hill. Business Ethics Quarterly. 2002. Appendix: Principles of stakeholder management. Business Ethics Quarterly, 12(2): 257-264. Dierickx, I. & Cool, K. 1989. Asset stock accumulation and sustainability of competitive advantage. Management Science, 35: 1504- 1511. Easterbrook, H. F. & Fischel, D. R. 1991. The Economic Structure of Corporate Law. Cambridge, Massachusetts: Harvard University Press. Financial Accounting Standards Board. 1993. Accounting for Contributions Received and Contributions Made. Norwalk, Connecticut: Financial Accounting Business Board. Fombrun, C., Gardberg, N. A., & Barnett, M. L. 2000. Opportunity platforms and safety nets: Corporate citizenship and reputational risk. Business and Society Review, 105(1): 85-106. Friedman, M. 1970. The Social Responsibility of Business is to Increase Profit. New York Times Magazine(September 13): 33. Gillmor, P. E. 1999. Disclosure of Corporate Charitable Contributions as a Matter of Shareholder Accountability. The Business Lawyer, 54: 1007-1022. Godfrey, P. C. 2005. The Relationship between Corporate Philanthropy and Shareholder Wealth: A risk management perspective. Academy of Management Review, 30(4): 777798. Gordon, R. A. 1996. Impact of Ingratiation on Judgments and Evaluations: A metaanalytic investigation. Journal of Personality and Social Psychology, 71(1): 54-70. Jones, T. M. 1995. Instrumental stakeholder theory: A synthesis of ethics and economics. Academy of Management Review, 20: 404- 437. LaFave, W. R. 2000. Criminal Law (3rd ed.). St. Paul: West Group. Logsdon, J. M. & Wood, D. J. 2002. Business Citizenship : From domestic to global level of analysis. Business Ethics Quarterly, 12(2): 155-187. Margolis, J. D. & Walsh, J. P. 2001. People and Profits: The search for a link between a company's social and financial performance. Mahweh, New Jersey: Lawrence Erlbaum Associates. McWilliams, A. & Siegal, D. 2000. corporate social responsibility and financial performance : correlation or misspecirication. Strtegic Manegment Journal, 21: 603-609. McWilliams, A. & Siegel, D. 2001. corporate social responsiblity: a theory of the firm perspective. Acadamy of Manegment Review, 26(1): 117-127. Minow, N. 1999. Corporate charity: an oxymoron? The Business Lawyer, 54: 1005. Post, J. E. & Waddock, S. A. 1995. Strategic philanthropy and partnerships for economic progress. In R. F. America (Ed.), philanthropy and economic development. westport, Connecticut: Greenwood press. Rejda, G. E. 1992. Principles of risk management and insurance (4th ed.). New York: Harper Collins. Saiia, D. H., Carroll, A. B., & Buchholtz, A. K. 2003. Philanthropy as Strategy: When corporate giving 'begins at home'. Business & Society, 42(2): 169-201. 30 Strong, J. W. 1999. McCormick on Evidence (5th ed.). St. Paul: West Group. Stultz, R. 1996. Rethinking risk management. Journal of Applied Corporate Finance, 9(3): 8-24. Trieschmann, J. S. & Gustavson, S. G. 1998. Risk Management and Insurance (10th ed.). Cincinnati: Southwestern College Publishing. Waddock, S. 2001. Leading corporate citizens: vision, values, value added. Boston, MA: McGraw-Hill. Wherhane, P. H. 1985. Persons, Rights, and Corporations. Englewood Cliffs, N. J.: Prentice-Hall. Wood, D. J. & Jones, R. E. 1995. Stakeholder mismatching: A theoretical problem in empirical research on corporate social performance. International Journal of Organizational Analysis, 3(3 (July)): 229-267. Wood, D. J. & Logsdon, J. M. 2002. Business Citizenship: From individuals to organizations. Business Ethics Quarterly, 12(3): 59-94. 31 Appendix A: KLD Variables included in Study Community (Philanthropy) Generous Giving (COM-str-A). The company has consistently given over 1.5% of trailing three-year net earnings before taxes (NEBT) to charity, or has otherwise been notably generous in its giving. Innovative Giving (COM-str-B). The company has a notably innovative giving program which supports nonprofit organizations particularly those promoting self-sufficiency among the economically disadvantaged. Companies that permit nontraditional federated charitable giving drives in the workplace are often noted in this section as well. Support for Housing (COM-str-C). The company is a prominent participant in public/private partnerships that support housing initiatives for the economically disadvantaged, e.g., the National Equity Fund or the Enterprise Foundation. Support for Education (COM-str-D). The company has either been notably innovative in its support for primary or secondary school education, particularly for those programs that benefit the economically disadvantaged, or the company has prominently supported job-training programs for youth. KLD began assigning this strength in 1994. Other Strength (Com-str-X). The company has an exceptionally strong volunteer program, in-kind giving program, or other particularly strong community program. Diversity CEO (DIV-str-A). The company's chief executive officer is a woman or a member of a minority group. Promotion (DIV-str-B). The company has made notable progress in the promotion of women and minorities, particularly to line positions with profitand-loss responsibilities in the corporation. Board of Directors (DIV-str-C). Women, minorities, and/or the disabled hold four seats or more (with no double counting) on the board of directors, or one-third or more of the board seats if the board numbers less than 12. Family Benefits (DIV-str-D). The company has outstanding employee benefits or other programs addressing work/family concerns, e.g., childcare, elder care, or flextime. 32 Women/Minority Contracting (DIV-str-E). The company does at least 5% of its subcontracting, or otherwise has a demonstrably strong record on purchasing or contracting, with women- and/or minority-owned businesses. Employment of the Disabled (DIV-str-F). The company has implemented innovative hiring programs, other innovative human resource programs for the disabled, or otherwise has a superior reputation as an employer of the disabled. Progressive Gay/Lesbian Policies (DIV-str-G). The company has implemented notably progressive policies toward its gay and lesbian employees. In particular, it provides benefits to the domestic partners of its employees. KLD began assigning strengths for this issue in 1995. Other Strength (DIV-str-X). The company has made noteworthy diversity achievements that do not fall under other KLD categories. Employee Relations No-Layoff Policy (EMP-str-B). The company has maintained a consistent no-layoff policy. KLD has not assigned strengths for this issue since 1994. Cash Profit Sharing (EMP-str-C). The company has a cash profit-sharing program through which it has recently made distributions to a majority of its workforce. Employee Involvement (EMP-str-D). The company strongly encourages worker involvement and/or ownership through stock options available to a majority of its employees, gain sharing, stock ownership, sharing of financial information, or participation in management decision-making. Strong Retirement Benefits (EMP-str-F). The company has a notably strong retirement benefits program. Other Strength (EMP-str-X). The company has a good employee safety record or demonstrates other noteworthy commitments to its employees’ well being. Environmental Stewardship Beneficial Products and Services (ENV-str-A). The company derives substantial revenues from innovative remediation products, environmental services, or products that promote the efficient use of energy, or it has developed innovative products with environmental benefits. (The term “environmental service” does not include services with questionable environmental effects, such as landfills, incinerators, waste-to-energy plants, and deep injection wells.) Through 1994, “substantial revenues” was specified as more than 4% of total revenues. 33 Pollution Prevention (ENV-str-B). The company has notably strong pollution prevention programs including emissions reductions and toxic-use reduction programs. Recycling ((ENV-str-C). The company either is a substantial user of recycled materials as raw materials in its manufacturing processes, or a major factor in the recycling industry. Alternative Fuels (ENV-str-D). The company derives substantial revenues from alternative fuels. The term “alternative fuels” includes natural gas, wind power, and solar energy. The company has demonstrated an exceptional commitment to energy efficiency programs or the promotion of energy efficiency. Communications (ENV-str-E). The company is a signatory to the CERES Principles, publishes a notably substantive environmental report, or has notably effective internal communications systems in place for environmental best practices. KLD began assigning strengths for this issue in 1996. Property, Plant, and Equipment (ENV-str-F). The company maintains its property, plant, and equipment with above average environmental performance for its industry. KLD has not assigned strengths for this issue since 1995. Product Quality Quality (PRO-str-A). The company has a long-term, well-developed, company-wide quality program, or it has a quality program recognized as exceptional in U.S. industry. R&D/Innovation (PRO-str-B). The company is a leader in its industry for research and development (R&D), particularly by bringing notably innovative products to market. Benefits to Economically Disadvantaged (PRO-str-C). The company has as part of its basic mission the provision of products or services for the economically disadvantaged. 34 Table 1a: Basic Statistics 1. MeanCAR-2 2. MeanCAR-1 3. Phil 4. Empl 5. Envr 6. Divs 7. Prod 8. Phil High 9. Empl High 10. Envr High 11. Divs High 12. Prod High 13. Phil Less Tang 14. Phil More Tang 15. Size 16. M2B 17. Service N 151 151 151 151 151 151 151 151 151 151 151 151 151 151 150 151 147 Min Max μ SD -24 21.4 -1.02 5.26 -14 18.5 -0.74 4.11 0.0 1.0 0.42 0.49 0.0 1.0 0.34 0.48 0.0 1.0 0.36 0.48 0.0 1.0 0.46 0.50 0.0 1.0 0.22 0.41 0.0 1.0 0.14 0.35 0.0 1.0 0.08 0.27 0.0 1.0 0.11 0.32 0.0 1.0 0.21 0.41 0.0 1.0 0.01 0.08 0.0 1.0 0.27 0.45 0.0 1.0 0.25 0.44 660 180557 17001 27046 0.5 84.9 5.97 9.90 0.0 1.0 0.27 0.44 Table 1b: Kendall Tau correlation matrix 1. MeanCAR-2 2. MeanCAR-1 3. Phil 4. Empl 5. Envr 6. Divs 7. Prod 8. Phil High 9. Empl High 10. Envr High 11. Divs High 12. Prod High 13. Phil Less Tang 14. Phil More Tang 15. Size 16. M2B 17. Service 1 1 0.55*** 0.13** -0.0 0.07 0.02 -0.0 0.03 -0.0 0.05 -0.0 0.06 0.01 0.19*** 0.04 0.00 0.08 2 3 0.55*** 0.13** 1 0.17*** 0.17*** 1 0.01 0.17** 0.09 0.15* 0.10 0.38*** -0.0 0.04 0.00 0.47*** -0.0 -0.0 0.08 0.12 -0.0 0.25*** 0.08 0.09 0.04 0.69*** 0.21*** 0.65*** 0.01 0.23*** 0.06 0.08 -0.0 -0.0 4 5 -0.0 0.07 0.01 0.09 0.17** 0.15* 1 0.36*** 0.36*** 1 0.17** 0.11 0.32*** 0.17** 0.07 0.09 0.40*** 0.24*** 0.27*** 0.47*** 0.16** 0.12 0.11 0.10 0.12 0.13* 0.18** 0.10 0.12* 0.22*** 0.09 -0.0 -0.2*** -0.2*** 6 7 8 9 0.02 -0.0 0.03 -0.0 0.10 -0.0 0.00 -0.0 0.38*** 0.04 0.47*** -0.0 0.17** 0.32*** 0.07 0.40*** 0.11 0.17** 0.09 0.24*** 1 0.22*** 0.32*** 0.07 0.22*** 1 0.06 0.31*** 0.32*** 0.06 1 -0.0 0.07 0.31*** -0.0 1 -0.0 0.11 0.03 0.20** 0.56*** 0.23*** 0.35*** 0.20** 0.08 0.15* -0.0 -0.0 0.33*** 0.00 0.40*** -0.0 0.32*** 0.06 0.60*** -0.0 0.28*** 0.18*** 0.21*** 0.09 0.31*** 0.14** 0.01 0.12* -0.0 -0.0 -0.0 -0.1 *** significance <= 0.001 ** significance <= 0.05 * significance <= 0.1 10 0.05 0.08 0.12 0.27*** 0.47*** -0.0 0.11 0.03 0.20** 1 0.02 -0.0 0.06 0.17** 0.06 0.01 -0.2** 11 -0.0 -0.0 0.25*** 0.16** 0.12 0.56*** 0.23*** 0.35*** 0.20** 0.02 1 -0.0 0.41*** 0.22*** 0.20*** 0.10 0.02 12 0.06 0.08 0.09 0.11 0.10 0.08 0.15* -0.0 -0.0 -0.0 -0.0 1 -0.0 0.14* 0.04 0.04 . 13 0.01 0.04 0.69*** 0.12 0.13* 0.33*** 0.00 0.40*** -0.0 0.06 0.41*** -0.0 1 0.16** 0.16** 0.07 0.01 14 0.19*** 0.21*** 0.65*** 0.18** 0.10 0.32*** 0.06 0.60*** -0.0 0.17** 0.22*** 0.14* 0.16** 1 0.22*** -0.0 -0.1 15 0.04 0.01 0.23*** 0.12* 0.22*** 0.28*** 0.18*** 0.21*** 0.09 0.06 0.20*** 0.04 0.16** 0.22*** 1 0.06 0.09 16 0.00 0.06 0.08 0.09 -0.0 0.31*** 0.14** 0.01 0.12* 0.01 0.10 0.04 0.07 -0.0 0.06 1 -0.0 17 0.08 -0.0 -0.0 -0.2*** -0.2*** -0.0 -0.0 -0.0 -0.1 -0.2** 0.02 . 0.01 -0.1 0.09 -0.0 1 36 Table 2: OLS Regression Results: The insurance value of philanthropy meanCAR-1 (Constant) PHIL DIVS EMPL ENVR PROD PHIL HIGH DIVS HIGH EMPL HIGH ENVR HIGH PROD HIGH n F / Sig. R^2 / Adj R^2 Beta Sig -1.49 0.001 1.86 0.006 Beta -1.74 1.48 0.89 -0.15 0.46 -0.30 Sig 0.003 0.048 0.228 0.849 0.549 0.740 Beta Sig -1.49 0.001 2.23 0.004 -1.17 0.295 151 7.783 0.006 0.050 0.043 151 1.455 0.188 0.066 0.021 151 4.447 0.013 0.057 0.044 Beta -1.74 1.73 1.88 0.10 0.08 -0.15 -1.24 -1.57 -0.51 0.68 2.13 151 1.351 0.122 Sig 0.003 0.037 0.032 0.906 0.924 0.870 0.292 0.128 0.719 0.586 0.622 0.186 0.032 37 Table 3: The effect of more tangible forms of philanthropy Model meanCAR-1 Beta (Constant) -1.39 PHIL MORE TANG 2.71 PHIL LESS TANG -0.11 n 151 F / Sig. 6.539 R^2 / Adj R^2 0.081 1 Sig 0.001 0.000 0.887 0.002 0.069 Model Beta -1.42 2.69 151 13.144 0.081 2 Sig 0.000 0.000 0.000 0.075 38 Figure 1: Intangible assets and philanthropy M2B Mean +/- 2 SE MB 10.0 8.0 6.0 4.0 0 CSE No Part Mean 5.14 Levene's Test F M2B* Sig. 2.54 0.11 1 Part Mean 7.19 t-test for Equality of Means t 1.25 df 149 Sig. (2-tail) 0.21 Mean Diff 2.05 Std. Error Diff 1.64 95% CI of Diff Lower -1.19 Upper 5.29 * Equal variances assumed 39 Figure 2: Box Plots of Philanthropy Participation levels 4.00 95% CI MeanCAR-1 2.00 0.00 -2.00 -4.00 1.00 2.00 3.00 CSE_grouping No Part Mean -1.5 Mod Part Mean .7 Hi Part Mean -.5 (mod vs. no) = .54 (moderate effect) (no vs. hi) = .27 (small effect) 40 41