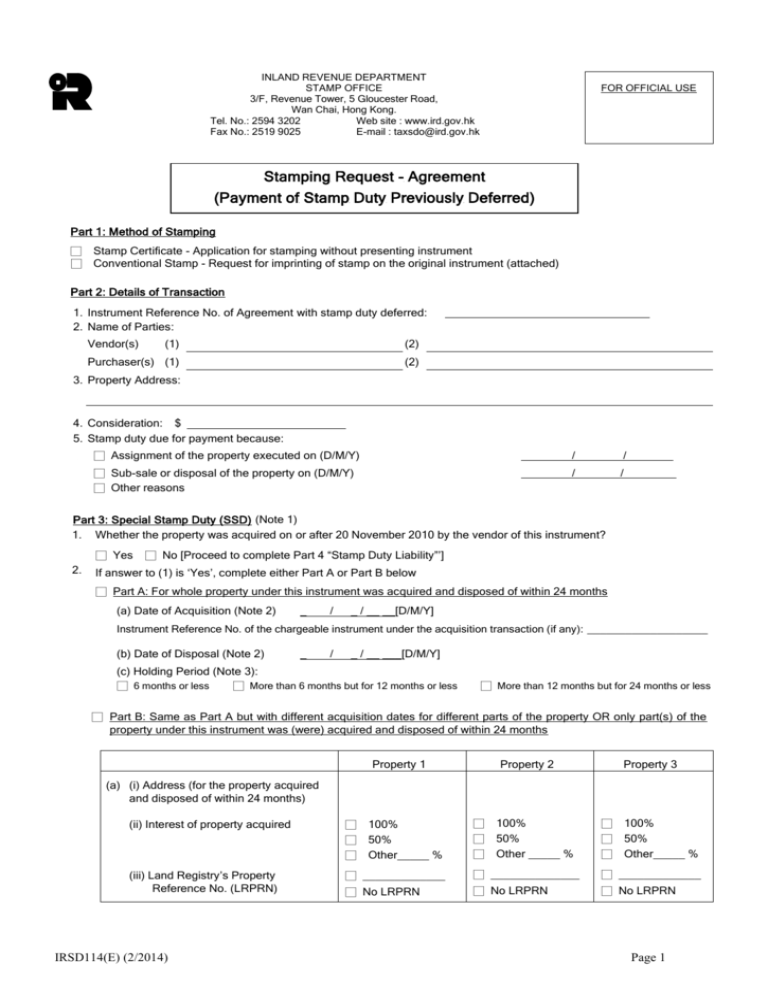

I.R.S.D. 114 (E)

advertisement

INLAND REVENUE DEPARTMENT STAMP OFFICE 3/F, Revenue Tower, 5 Gloucester Road, Wan Chai, Hong Kong. Tel. No.: 2594 3202 Web site : www.ird.gov.hk Fax No.: 2519 9025 E-mail : taxsdo@ird.gov.hk FOR OFFICIAL USE Stamping Request - Agreement (Payment of Stamp Duty Previously Deferred) Part 1: Method of Stamping □ Stamp Certificate - Application for stamping without presenting instrument □ Conventional Stamp - Request for imprinting of stamp on the original instrument (attached) Part 2: Details of Transaction 1. Instrument Reference No. of Agreement with stamp duty deferred: 2. Name of Parties: Vendor(s) (1) (2) Purchaser(s) (1) (2) __________ 3. Property Address: 4. Consideration: $ 5. Stamp duty due for payment because: □ Assignment of the property executed on (D/M/Y) __ / □ Sub-sale or disposal of the property on (D/M/Y) □ Other reasons __ / __ __ / / Part 3: Special Stamp Duty (SSD) (Note 1) 1. Whether the property was acquired on or after 20 November 2010 by the vendor of this instrument? □ Yes 2. □ No [Proceed to complete Part 4 “Stamp Duty Liability”’] If answer to (1) is ‘Yes’, complete either Part A or Part B below □ Part A: For whole property under this instrument was acquired and disposed of within 24 months (a) Date of Acquisition (Note 2) _ / _ / __ __[D/M/Y] Instrument Reference No. of the chargeable instrument under the acquisition transaction (if any): ___________________ (b) Date of Disposal (Note 2) _ / _ / __ ___[D/M/Y] (c) Holding Period (Note 3): □ 6 months or less □ More than 6 months but for 12 months or less □ More than 12 months but for 24 months or less □ Part B: Same as Part A but with different acquisition dates for different parts of the property OR only part(s) of the property under this instrument was (were) acquired and disposed of within 24 months Property 1 Property 2 Property 3 (a) (i) Address (for the property acquired and disposed of within 24 months) 100% 50% Other_____ % 100% 50% Other _____ % 100% 50% Other_____ % (ii) Interest of property acquired □ □ □ (iii) Land Registry’s Property Reference No. (LRPRN) □ _____________ □ ______________ □ _____________ □ No LRPRN □ No LRPRN □ No LRPRN IRSD114(E) (2/2014) □ □ □ □ □ □ Page 1 (b) Amount of the total consideration for that property (c) Date of Acquisition [D/M/Y] (Note 2) Instrument Reference No. of chargeable instrument under acquisition transaction (if any) the the (d) Date of Disposal [D/M/Y] (Note 2) $________________ $________________ $_______________ Property 1 Property 2 Property 3 __ / _ / _ __ __ / _ / _ __ __ / _ / _ __ __________________ ___________________ __________________ __ __ / _ / _ __ / _ / _ __ __ / _ / _ __ (e) Holding period (Note 3) (i) 6 months or less □ □ □ (ii) More than 6 months but for 12 months or less □ □ □ (iii) More than 12 months but for 24 months or less □ □ □ 3. Any applicable exemption to SSD? □ Yes [Please also complete Form IRSD118(E)] (Note 4) □ No Part 4: Stamp Duty Liability (A) Ad Valorem Duty 1. Original: $ 2. Duplicate(s): copies 3. Total amount payable: 4. Share of payment: Vendor $ $ % Purchaser % Other % (B) Special Stamp Duty (if applicable) 1. Amount payable: 2. Share of payment: $ Vendor % Purchaser % Other % Part 5: Declaration by the Applicant I hereby declare that to the best of my knowledge, information and belief, the information contained in this form is true, correct and complete. Signature: Date: / / Name: Capacity: □Vendor □Purchaser □Legal Representative □Property Agent □Other Part 6: Solicitor Firm Details (if applicable) Business Registration & Branch No.: __________ Contact Reference No.: Telephone No.: Organization Chop _________ Fax No.: □ Please tick ✓ if applicable Notes 1. The liability to Special Stamp Duty (SSD) will arise if there is sale and purchase or transfer of a residential property of which the property is acquired by the vendor or transferor on or after 20 November 2010 and disposed of by the vendor or transferor within 24 months from the date of acquisition. 2. For SSD purposes, the date of a chargeable agreement for sale is the date a person “acquires” or “disposes of” a property. Chargeable agreement for sale includes both Provisional Agreement for Sale and Purchase and Agreement for Sale and Purchase. If there is no chargeable agreement for sale, the date of conveyance will be the date of acquisition and disposal. Where there is more than one chargeable agreement for sale in a transaction, the date of the first agreement will be taken as the date of “acquisition” or “disposal” of a property. 3. SSD is calculated at varying rates based on the holding period of the property by the vendor before disposal. If the property was acquired by the vendor on or after 20 November 2010 and before 27 October 2012 and disposed of by the vendor within 24 months, the rates of SSD are - Page 2 4. 5. 6. 7. (a) 15% if the property has been held for 6 months or less; (b) 10% if the property has been held for more than 6 months but for 12 months or less; (c) 5% if the property has been held for more than 12 months but for 24 months or less. e.g. Date of acquisition = 20 Nov 2010 (i) holding period for 6 months or less = resold on or before 19 May 2011 (ii) holding period for more than 6 months but for 12 months or less = resold on or before 19 Nov 2011 but after 19 May 2011 (iii) holding period for more than 12 months but for 24 months or less = resold on or before 19 Nov 2012 but after 19 Nov 2011 SSD will be exempted in the following cases – (a) Nomination of the spouse, parents, children, brothers and sisters to take up the assignment of the property, or sale or transfer of the property to the spouse, parents, children, brothers and sisters. (b) Addition / deletion of name(s) to / from a chargeable agreement for sale or Assignment if the person(s) added / deleted is the spouse, parents, children, brothers and sisters of the original purchaser(s). (c) Sale, transfer or vesting of properties made by the courts or pursuant to court orders (including the compulsory sales order made under the Land (Compulsory Sale for Redevelopment) Ordinance (Cap.545), and the foreclosure order made to a mortgagee, irrespective of whether the mortgagee is a financial institution within the meaning of section 2 of the Inland Revenue Ordinance), and the property was sold to/transferred to or vested in the vendor by or pursuant to any decree or order of any court. (d) Sale of mortgaged properties by a mortgagee which is a financial institution within the meaning of section 2 of the Inland Revenue Ordinance, or by a receiver appointed by such a mortgagee. (e) Sale of the estate of a deceased person by the personal representative, and sale or transfer of a residential property by a person whose property is inherited from a deceased person’s estate or is passed to that person under the right of survivorship. (f) The property sold relates solely to a bankrupt’s estate or the property of a company which is being wound up by the court by reason of its inability to pay debts. If space is insufficient, please provide other details on a separate sheet. If there is any change of Purchaser or Consideration, please attach the related nomination or supplemental agreement (or a certified true copy) for reference. For nomination, it must be stamped. You may present the nomination or supplemental agreement (with the relevant application form) for stamping/adjudication together with this stamping request. Please pay by crossed cheque payable to “The Government of the Hong Kong Special Administrative Region” or “The Government of the HKSAR” Personal Information Collection Statement 1. IRD will use the information provided by you in connection with this Request or the Property concerned for the purposes of the Ordinances administered by it and may disclose/ transfer any or all of such information to any third party (e.g. the Rating and Valuation Department) provided that the disclosure / transfer is authorized or permitted by law. 2. Except where there is an exemption provided under the Personal Data (Privacy) Ordinance, you have the right to request access to and correction of your personal data. Such request should be addressed to the Superintendent of Stamp Office at 3/F, Revenue Tower, 5 Gloucester Road, Wan Chai, Hong Kong. 3. If a stamp certificate is issued in respect of the Instrument concerned, some of the information provided by you will be shown therein. Any person holding a stamp certificate may check its authenticity via IRD “e-Stamping System”. 4. If you are the agent / representative of the relevant parties, please inform them of this Personal Information Collection Statement and also take note of your obligations under the Personal Data (Privacy) Ordinance. 如需本表格的中文版,可在稅務局網頁 www.ird.gov.hk 下載 或致電 2594 3202 與本署聯絡。 Page 3