General Voucher (JV) Instructions

advertisement

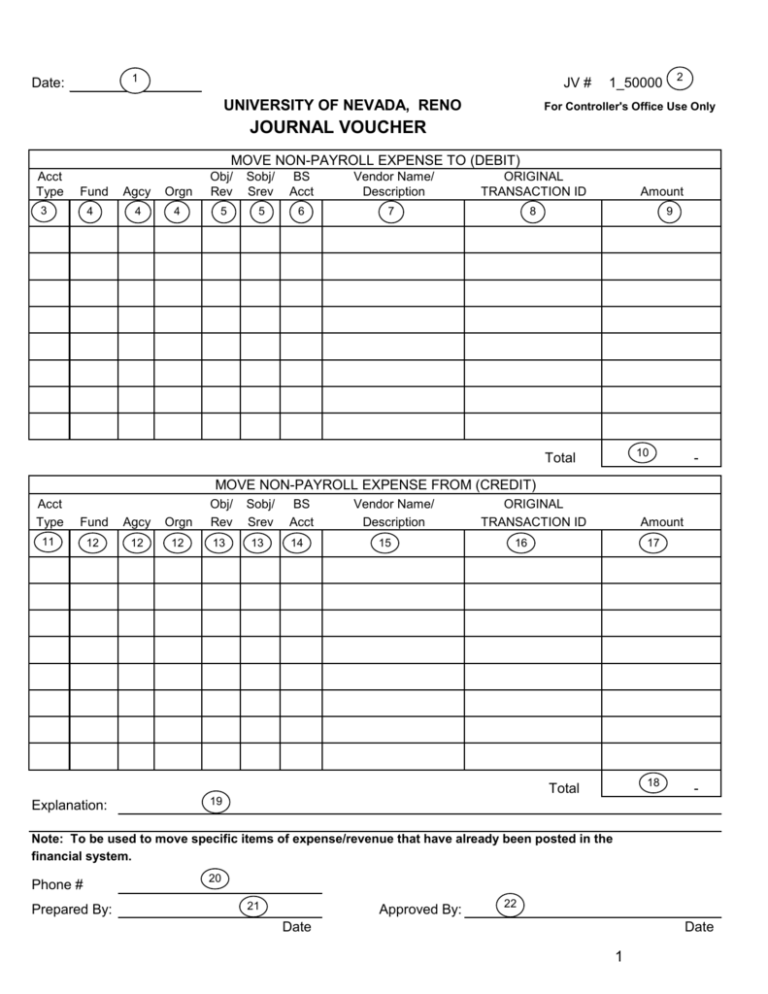

1 Date: JV # UNIVERSITY OF NEVADA, RENO 2 1_50000 For Controller's Office Use Only JOURNAL VOUCHER MOVE NON-PAYROLL EXPENSE TO (DEBIT) Acct Type Fund 3 4 Agcy Orgn Obj/ Rev Sobj/ Srev BS Acct Vendor Name/ Description ORIGINAL TRANSACTION ID 4 4 5 5 6 7 8 Amount 9 10 Total - MOVE NON-PAYROLL EXPENSE FROM (CREDIT) Acct Type Fund Agcy Orgn Obj/ Rev Sobj/ Srev 11 12 12 12 13 13 BS Acct 14 Vendor Name/ Description 15 ORIGINAL TRANSACTION ID Amount 16 17 18 Total Explanation: - 19 Note: To be used to move specific items of expense/revenue that have already been posted in the financial system. Phone # Prepared By: 20 21 Approved By: 22 Date Date 1 General Journal Voucher (JV) Instructions A general journal voucher form is initiated when a department is correcting and/or transferring a previously posted nonpayroll expense or revenue to another account. Or, to correct a non-payroll expense object code and/or sub-object code (reclassify), revenue/sub-revenue source code within the same account. This transaction will post to the financial system with a “JV” transaction code. 1. Date: Enter date of preparation. 2. JV No: If using a pre-numbered form in the forms directory, it will generate a number for you. This number will be the transaction ID a will appear in the document ID field of the applicable balance and activity reports. 3. Debit - Account Type: Enter account type for the type of transaction (revenue, expense or balance sheet account). Account Type – 01 Asset Balance Sheet Account Account Type – 02 Liability Balance Sheet Account Account Type – 22 Expense/Expenditure Account Type – 31Revenue An encumbrance (account type 21) cannot be corrected/transferred with a journal voucher; it must be corrected and/or transferred by contacting the appropriate department (Personnel/Purchasing). 4. Debit - Fund/Agency/Organization: a. If the original transaction was a debit (charge) to the account – enter the account number that this transaction is being transferred to. b. If the original transaction was a credit to the account – enter the account number of the original transaction. c. If the original transaction was a debit to a balance sheet account, account types 01 and 02 – enter only the fund number of the balance sheet account the transaction is being transferred to. d. If the original transaction was a credit to a balance sheet account, account types 01 and 02 – enter the fund number of the original transaction. 5. Debit – Object/Sub-object Codes or Revenue/Sub-Revenue Source Codes: a. If the original transaction was a debit to the account, an account type 22 (expense), and the object and subobject codes are correct – enter the same object and sub-object codes as the original transaction. b. If the original transaction was a debit to the account, an account type 22 (expense), and the object and/or sub-object codes are not correct – enter the correct object and/or sub-object codes for the type of expense incurred. c. If the original transaction was a debit to the account, an account type 31 (revenue), and the revenue and sub-revenue codes are correct – enter the same revenue and sub-revenue code as the original transaction. d. If the original transaction was a debit to the account, an account type 31 (revenue), and the revenue and/or sub-revenue codes are not correct – enter the correct revenue and/or sub-revenue codes for the type of revenue received. 6. Debit – Balance Sheet Account: a. If the original transaction was a debit to a balance sheet account, account types 01 and 02 – enter the balance sheet account number where the transaction is being transferred to. b. If the original transaction was a credit to a balance sheet account, account types 01 and 02 – enter the balance sheet account number of the original transaction. 7. Debit – Vendor Name/Description: Optional description field for the departments use. Can be used as a second reference (i.e. Name of payee/vendor on the original transaction being corrected or the word “correction”). 8. Debit – Original Transaction ID: Enter original transaction code and ID of the transaction being transferred/corrected (i.e. to correct payment voucher 123456CEO, enter “PV123456CEO”, to correct a PCard enter “P121581313A”). 9. Debit – Amount: Enter dollar amount of the transaction. The amount can be less than the original amount. 10. Debit – Total: If using a pre-numbered form in the forms directory, it will calculate for you. 11. Credit – Account Type: Enter account type for the type of transaction (revenue, expense or balance sheet account). 2 Account Type – 01 Asset Balance Sheet Account Account Type – 02 Liability Balance Sheet Account Account Type – 22 Expense/Expenditure Account Type – 31Revenue An encumbrance (account type 21) cannot be corrected/transferred with a journal voucher; it must be corrected and/or transferred by contacting the appropriate department (Personnel/Purchasing). 12. Credit – Fund/Agency/Organization: a. If the original transaction was a credit to the account – enter the account number that this transaction is being transferred to. b. If the original transaction was a debit to the account – enter the account number of the original transaction. c. If the original transaction was a credit to a balance sheet account, account types 01 and 02 – enter only the fund number of the balance sheet account the transaction is being transferred to. d. If the original transaction was a debit to a balance sheet account, account types 01 and 02 – enter the fund number of the original transaction. 13. Credit – Object/Sub-Object Codes or Revenue/Sub-Revenue Source Codes: a. If the original transaction was a credit to the account, an account type 22 (expense), and the object and subobject are correct – enter the same object and sub-object codes as the original transaction. b. If the original transaction was a debit to the account, an account type 22 (expense), and the object code and sub-object code are not correct – enter the same object code and sub-object codes as the original transaction. c. If the original transaction was a credit to the account, an account type (31), and the revenue source code and sub-revenue source code are correct – enter the same revenue source code and sub-revenue source code as the original transaction. d. If the original transaction was a debit to the account, an account type (31), and the revenue source code and/or the sub-revenue source code are not correct – enter the same revenue source code and sub-revenue source code as the original transaction. 14. Credit – Balance Sheet Account: a. If the original transaction was a credit to a balance sheet account, account types 01 and 02 – enter the balance sheet account number where the transaction is being transferred to. b. If the original transaction was a debit to a balance sheet account, account types 01 and 02 – enter the balance sheet account number of the original transaction. 15. Credit – Vendor Name/Description: Optional description field for the departments use. Can be used as a second reference (i.e. Name of payee/vendor on the original transaction being corrected or the word “correction”). 16. Credit – Original Transaction ID: Enter original transaction code and ID of the transaction being transferred/corrected (i.e. to correct payment voucher 123456CEO, enter “PV123456CEO”). 17. Credit – Amount: Enter dollar amount of the transaction. The amount can be less than the original amount. 18. Credit – Total: If using a pre-numbered form in the forms directory, it will calculate for you. 19. Explanation: Enter justification for transfer or explanation of correction (i.e. correcting sub-object code, originally charged to supplies should have been non-inventory equipment). 20. Prepared By: Name of preparer. 21. Telephone Number: Telephone number of the contact/prepared by name. 22. Approved By: Authorized signature on the debit account(s). When completed and approved route/bring to the Controller’s Office Mail Stop 124 for processing. 3