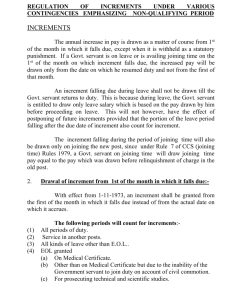

STEPPING UP OF PAY 1. Both the junior and senior should belong

advertisement

STEPPING UP OF PAY 1. Both the junior and senior should belong to the same cadre and the post to which they have been appointed or promoted should be identical in the same cadre. 2. The scale of the Pay of the lower and higher posts in which the junior and senior are entitled to draw pay should be identical. 3. The anomaly should be directly as a result of the application of FR 22 (1) (a) (1). For example, if even in the lower post the junior official draws from time to time to a higher rate of pay then the senior by virtue of grant of advance increments or on any other accounts the above provisions will be invoked to step up the pay of the seniors. It has been clarified by the GOI DOPT New Delhi vide their no.4/7 /92/Estt. (Pay-I) dated 04-11-1993 that the stepping up in the following cases are not admissible. Where the senior proceeds on EOL which results in postponement of increment in the lower post, consequently he starts drawing less pay than his juniors in the lower grade itself. He, therefore, cannot claim pay parity on promotion even though he may be promoted earlier to the higher grade. If a senior foregoes/refuses promotion leading to his juniors being promoted/appointed to the higher post earlier junior draws higher pay then the senior. The senior may be on deputation while junior avails of the Adhoc promotion in the cadre. The increased pay drawn by a junior either due to ad-hoc/officiating/regular service rendered in the higher posts for periods earlier than the senior, cannot, therefore be as anomaly in strict sense of the term. a) If a senior join the higher post later than the junior for what so ever reasons, whereby he draws less pay than the junior, in such cases senior cannot claim stepping up of pay at par with the juniors. b) If a senior is appointed later than the junior in the lower post itself whereby he is in receipt of lesser pay than the junior, in such cases the senior cannot claim pay parity in the higher post though he may have been promoted earlier to the higher post. c) Where a person is promoted from lower to higher post, his pay is fixed with reference to the pay drawn by him in the lower post under FR 22(1) (A) (1) and he is likely to get more pay than a direct appointed whose pay is fixed under different set of rules, for example a UDC on promotion to the post of Assistant get his pay fixed under FR 22 (1) (a) (i) with reference to the pay drawn in the UDC scale whereas the pay of the Assistant (directly recruited) is fixed normally at the minimum under Rule 22-B (2). In such cases the senior direct recruit cannot claim pay parity with the junior promoted from a lower post to a higher post as seniority alone is not a criteria for allowing stepping up of Pay. d) Where a junior get more pay due to additional increment earned on acquiring higher qualifications. In the instances referred to above, a junior drawing more pay than the senior will not constitute any anomaly and therefore stepping up of pay in such cases are not admissible. Removal of anomalies arising as a result of revision of pay scales under RPR-97 Where a Govt. servant promoted to a higher post before 1-1-96, draws less pay in the revised scale than his juniors who is promoted to the higher post on or after 1-1-96, the pay of the senior Govt. servant should be stepped up to an amount equal to the pay as fixed for his junior in that higher post. The stepping up should be done with effect from the date of the promotion of the junior Govt. servant subject to the fulfillment of the following conditions, namely. (1) Both the junior and senior Govt. servants should belong to the same cadre and the post on which they have been promoted should be identical in the same cadre. (2) The pre-revised and revised scales of pay of the lower and higher posts in which they are entitled to draw pay should be identical. (3) The senior Govt. servant at the time of promotion have been drawing equal or more pay than the junior and (4) The anomaly should be directly as result of the application of the provisions of FR 22(1) (a) (i) or any other rule or order regulating pay fixation in such promotion in the revised scale. If even in the lower post the junior official was drawing more pay in the pre-revised scale than the senior by virtue of any advance increments granted to him, these provisions need not be invoked to step up the pay of the senior officer. The orders relating to refixation of pay of the senior officer in accordance with the above provisions should be issued under FR 27 and the senior officer will be entitled to the next increment on completion of 12 months qualifying service with effect from the date of refixation of pay. Authority Note 9 below Rule 7 CCS (RP) Rules 1997. C & AG’s clarification The Govt. of India, MOF have clarified that in cases where a senior becomes entitled to the benefit of stepping up twice with reference to the pay of the two of his juniors promoted later the benefit of stepping up of pay in accordance with the above orders should be allowed only once with reference to the pay of the first junior and not with reference to the second junior promoted later than the first junior. Authority: C&AG’s decision no.2 below FR 22 Stepping up of pay of the senior for the second time admissible:The pay of the senior ‘A’ is stepped up with reference to the pay of his first junior ‘B’ and at a later date the pay of the ‘B’ is stepped up with reference to another junior ‘C’. Consequent on the stepping up the pay of the junior ‘B’ with reference to ‘C’ the senior ‘A’ may happen to draw lesser pay than his junior ‘B’ in such cases the pay of the senior ‘A’ may again be stepped up at par with his junior ‘B’ provided all the conditions under the general orders for stepping up of pay of ‘A’ vis-à-vis C are fully satisfied. Authority: GOI order (21) below FR 22 Removal of anomaly arising as a result of counting pre-appointment training period of increments in the case of direct recruits. The period of training undergone by a direct recruit before appointments to the post in a Govt. service count for increment in those posts. In the case of departmental candidates, such training period before appointment to another post count for increment only in the post of pay of which is drawn during such training period. Such departmental candidates may happen to draw lesser pay than the direct recruits who are junior to them. This anomaly may arise either at the time of appointment to the new post after training or from the date of drawal of increment by the direct recruits. In order to remove the anomaly, the pay of the departmental candidates who are senior may be stepped up at par with the direct recruit junior from the date of next increment of the junior. The anomaly should be directly to the counting of training period for increment in the case of direct recruits. Authority: G.O.I. DOPT OM No.16-16/89-Estt. (Pay-1) dt.29-3-1993 Increments An increment falling due during leave shall not be drawn till the Govt. servants returns to duty. This is because during leave, the Govt. servant is entitled to draw only leave salary which is based on the pay drawn by him before proceeding on leave. This will not however, have the effect of postponing of future increments, provided that the portion of the leave period falling after the due date of increments also count for increments. Similarly, the increments falling during the period of joining time will also be drawn only on joining the new post, since under Rule 7 of CCS (joining time) Rules 1979, a Govt. servant on joining time will draw joining time pay equal to the pay which was drawn before relinquishment of charge in the old post. When the normal increment is withheld for specified period and the period of such penalty expires after 1st of the month Increment in such cases will be granted/restored from the date the penalty ceases also. Not applicable to advance increments due to passing of certain examination. Such increments, if permissible will be governed by relevant rules and orders. Authority: GIO (12) FR 26. Drawal of increment from the 1st of the month in which its fall due:With effect from 1-11-1973, an increment shall be granted from the first of the month in which its fall due instead of from the actual date on which it accrues. GIO (12) FR 26 The following periods will count for increments:(1) Duty (2) Service in another post, other than a post carrying less pay referred to in FR 15 (a). (3) All kinds of leave including EOL granted on MC (II) without MC but due to inability of Govt. servant to join or rejoin duty on account of civil commotion and (III) for prosecuting higher technical and scientific studies. (4) Deputation out of India under FR 51. (5) Foreign Service. (6) Joining Time (7) Period of Training undergone whether on remuneration of stipend or otherwise, before appointment w.e.f. 1-10-1990 and also admissible to those who were under training on 1-1-1986 and (II) who had undergone such training on or after 1-1-1986 on notional basis up to 30-9-1990 and actual basis w.e.f. 1-10-1990. [GIO (I) FR] Service rendered in a lower stage of the time scale under orders of reduction passed by the disciplinary Authority, will count for increments in the post held by him only if the disciplinary authority states that the reduction will not have effect of postponing his future increments. [FR 29 (i)] A period spent under suspension will count for increments, if the disciplinary proceedings ends with imposition of minor penalty or if the reinstating authority is of the opinion that the Govt. servants has been fully exonerated or that suspension was wholly unjustified. In other cases the period will count if the reinstating authority specifically directs that it shall be so counted. Authority: FR 54 (2) and 54 (5) GIO 3 below FR 54. Method of counting broken period Broken periods are to be counted strictly in accordance with the provision of Audit Instructions below FR 9 (18). This is in accordance with the revised definition of the term ‘month’ in article 18 of the CSR as amended by the GOI notification no. 24 (16) E.V/69 dated 18-12-1970. The following are the illustrations for counting broken periods:(a) To calculate 3 months and 20 days on and from 25 th January, the following shall be adopted:Year Month Days 25th January to 31st January --7 February to April -3 -- Ist May to 13th May --13 _____________________ __ 3 20 _____________________ (b) The period commencing on 30th January and ending with 2nd March should be deemed as 1 month 4 days as under:Year Month Days 30th January to 31st January __ __ 2 February __ 1 __ nd Ist March to 2 March __ __ 2 _________________________ __ 1 4 _________________________ th (c) The period commencing on 5 January and ending with 26th March should be deemed as 2 months & 23 days as under:Year Month Days th st 5 January to 31 January __ __ 27 February __ 1 __ st th 1 March to 26 March __ __ 26_________________ __ 2 23 ____________________ Method for counting period of Increments As per provisio to 26 (a) FR, for the purpose of arriving of the date of increment in a time scale the total of all such periods as do not count for increments in the time scale shall be added to the normal date of increment. In other words, the date of next increment is postponed by the non qualifying periods as under:(1) Date of last increment : 1-06-2000 (2) Period of EOL, suspension & other period not counting for increment From To Particulars Period Y M D 29-7-2000 31-7-2000 EOL without MC __ __ 3 7-10-2000 2-1-2001 Suspension(Not counting) __ 2 27 15-3-2001 5-4-2001 Dies non __ __ 22 _________________ Total of the period not counting for increments __ 3 22 _________________ (3) Determination of actual date of increment Date of last increment 1-6-2000 Date of the normal course for next increment 1-6-2001 Total period as non qualifying service for increment 3 month 22 days Date of increment in accordance with the provisio to FR 26 (a) 23-9-2001 But the increment will be drawn from 1-9-2001 as an increment falling due on any date in a month has to be drawn from the first of that month in terms of GIOs (10) and (12) FR 26. Grant of Stagnation Increment to those stagnating at the maximum of their Pay scales. It has been decided that all control Govt. employees who have opted the revised pay scales of pay terms of the CCS (RP) Rules 1997, and who may reach the maximum of the revised scales of pay shall be granted one stagnation increment on completion of every two years at the maximum of the respective scales. The stagnation increment shall be equal to the rate of increment last drawn by them in their pay scales. A maximum of three such increments shall be allowed subject to the condition that the grant of stagnation increment shall be restricted to all posts the maximum of the pay scale of which does not exceeds Rs.22,400/-. In the case of Govt. servants whose pay has been fixed at the maximum of the scale as on 1-1-96, the stagnation increment shall be admissible after two years reckoned from 1-196. In other words no Govt. servant shall become eligible for the stagnation increment before 1-1-98 under RPR-97. The period, if any, spent at the maximum in the pre-revised scale will not be taken into account under RPR-97 and the stagnation increment, if any, in the pre-revised scales will not be counted towards grant of maximum three increments in the RPR-97. The stagnation increment will count for all purposes such as DA, HRA, CCA, Pensionary benefits etc, including fixation of pay on promotion. The stagnation increments shall be allowed in the same manner as annual increments. The Govt. Servant may exercise option to have his pay in the new post under FR 22(I) (a) (I) and FR 22 (I) (a) (2) as the case may be. Mr. J.S.Fonia has been appointed as Auditor w.e.f. 25-1-90 in the pay scale of 1200-30-1500-40-2040 and promoted to Sr.Auditor w.e.f. 18-101993 in the pay scale of Rs.1400-40-1600-52-2300-EB-60-2600. His pay on promotion has been fixed @ Rs.1400/- w.e.f. 18-10-1993 with DNI 1-101994. His pay has been fixed @ Rs.5000/- p.m. with DNI 1-10-1996 under RPR-97. Whereas Shri V.S.Nitnaware was appointed as Auditor w.e.f. 24-81989(FN) and promoted Sr.Auditor w.e.f. 24-2-95 in the pay scale of Rs. 1400-40-1600-50-2300-EB-60-2600. His pay on promotion as Sr.Auditor fixed @ Rs.1400/- p.m. w.e.f. 24-2-95 with DNI 1-2-1996. The pay of Shri. Nitnaware, Sr.Adr. has been fixed @ Rs.5000/- p.m. w.e.f. 1-1-96 with DNI 1-2-1996. Shri. Fonia has represented that his date of annual increment may please be antedated with his junior from 1-10-96 to 1-2-1996 under RPR-97 which has been got antedated to 1-2-96 Please Comment The pay of Shri. J.S.Fonia for antedating is in contraventions of the clarificatory orders already issued vide Para 2 (v) of DO PT New Delhi letter no. 4/7/92-Estt (Pay-I) dated 4-11-93. Wherein it has been clearly lays down that if a senior is appointed later than the junior in the lower post than the junior in such cases the senior cannot claim pay parity in the higher post though he may have promoted earlier to the higher post. In view of the above clarificatory orders his antedating do not fall within the ambit of above Govt. order as he has received less pay up to 17-10-1993 in the auditor scale than Shri. Nitnaware. Similarly, the antedating of annual increments in r/o the following individuals with Sh.J.S.Fonia are not extending by this office in terms of above clarification. 1. I.S.Bist, Sr.Adr. 2. Sh.B.S.Rana, Sr.Adr. ***** INTRODUCTION PAY FIXATION The basic rules governing the initial fixation of pay of Government servants in different circumstances were FRS 22, 22-C and 31. The pay fixed under any of those rules were further subjected to FRs.27 and 35. FR 30 added a general limitation on the pay fixed in respect of appointment in an officiating capacity. Fundamental Rules 22, 22-C, 30, 31 and 35 were the normal rules governing fixation of the initial pay of a Government servant under FRs. Apart from these Rules, separate order of the Government servant in certain cases as for example (i) Fixation of pay on appointment to selection grade posts; (ii) fixation of pay reemployed Civil and Military pensioners, etc. By notification no. 1/10/89-Estt. (Pay-I) dated 30.08.1989, FR 22 was substituted incorporating interalia the provisions of FR 22-C and orders issued under several office Memoranda from time to time. FRs 22-C, 30 and 31 were deleted. FR 22 (I) Clause (a) (1) deal with fixation of pay of a Government servant holding a non tenure post in a substantive or temporary or officiating capacity on promotion/appointment in a substantive or temporary of officiating capacity to a higher post. Clause (a) (2) deal with fixation of pay of a government servant holding a non tenure post in a substantive or temporary or officiating capacity on transfer/appointment in a substantive or temporary of officiating capacity to another post which is not higher than the post which he was holding. Clause (a) (3) deals with fixation of pay of a Government servant holding a post in a substantive or temporary or officiating capacity on transfer at his own request to a post with the maximum pay in the time-scale of the post lower than his pay in the post held by him on regular basis. Clause (b) deals with fixation of pay of a Government servant on his first appointment in Government service and another case not fulfilling the conditions in clause (a). FR 22 (II) deals with grant of proforma officiating promotion under “Next Below Rule” to a Government servant who is working on deputation under the Government outside his regular line of service on foreign service. FR 22 (III) stipulates that appointment or promotion of a government servant to a post in the same or identical time scale of pay (with reference to the scale of the scale of the post of the post held by him at the time of appointment of promotion) should not be deemed to involve the assumptions of duties and responsibilities of greater importance for the purpose of initial fixation of his pay. FR 22 (IV) stipulates that when a Government servant, while holding an ex cadre post, is promoted or appointed regularly to a post in his cadre, his pay in the new cadre post should be fixed with reference to his presumptive pay in the old cadre post which he would have but for his holding the ex cadre post. FR 27 – This rule vests competent authorities with the power to fix the pay of a Government at a stage higher than that admissible under the provisions of FR 22 by granting premature increments. FR 28 - This rules vests Government with the power to fix the pay of an officiating Government servant at an amount less than that admissible under FR 22. CIRCUMSTANCES WHICH GAVE RISE TO THE FIXATION OF PAY ARE:1. First appointment to any post, whether in a substantive or officiating capacity. 2. Transfer from one post to another, whether in a substantive or officiating capacity. 3. Re-appointment in the officiating post after break in service due to leave or service in another post which does not count for increments in that officiating post. PAY ON PROMOTION/APPOINTMENT Fixation of pay of a Government servant on promotion/appointment from one post to higher post. – As per clause (a) (1), when a Government servant holding a post, other than a tenure post, in substantive or temporary or officiating capacity is promoted or appointed in a substantive, temporary or officiating capacity as the case be, to another post carrying duties and responsibilities of greater as the case be, to another post carrying duties and responsibilities of greater importance than those attaching to the post held by him, his initial pay in the time scale of the higher post should be fixed at the stage next above the notional pay arrived at by increasing his pay on respect of the lower post held by him regularly by an increment at the stage at which such pay accrued or rupees one hundred, whichever is more. As per the provision to Clause (a) (1) of FR 22 (I), when a Government servant is, immediately before his promotion or appointment on regular basis to a higher post, drawing pay at the maximum of the time-scale of the lower post, his initial pay in the time-scale of the higher post be fixed at the stage next above the pay notionally arrived at by increasing his pay in respect of the lower post held by him on the regular basis by an amount equal to the last increment in the time scale of the lower post rupees on hundred, whichever is more. With effect from 30-9-1993, the stagnation increment(s) will be taken into account for fixation of pay on promotion to higher post on or after 30-9-1993. NOTE:- The stagnation increment will be taken into account for fixation of pay in respect of appointments/promotions to higher post and also in respect of appointments to another post which does not involve assumption of duties and responsibilities of greater importance than those attaching to the post held by the Government servant. (GIO (27) below FR 22 read with GIO (19) below FR 26) Important Point:- The fixation of pay on promotion/appointment to a higher post under Clause (a) (1) of FR 22 (I) as explained in the proceeding paragraphs is subject to the following conditions:(1) The promotion/appointment to a higher post should fulfill the eligibility conditions as per prescribed in the relevant Recruitment Rules. (2) In case of promotion in the normal line within the cadre which is not a regular basis, i.e. does not fulfill the eligibility conditions, the pay in the higher post may also be fixed under FR 22 (I) (a) (1). If there is substantial increase in pay so fixed, the pay has to be restricted under FR 53 so as not to exceed the basic pay in the lower post by more than the amounts shown below(a) For example in receipt of basic pay up to Rs.8,000 p.m. (b) For employees in receipt of basic pay above Rs.8000 p.m. 15% of basic pay subject to a maximum Rs.1000/- p.m. 12 ½ % of basic pay subject to a maximum of Rs.1000/- p.m. In the case where pay in the manner indicates above comes to more than the minimum or at the minimum of the promotional posts, the employees concerned will be allowed pay at the minimum of the scale. (GIO (2), below FR 35) (3) The pay in the higher post should be fixed only with reference to the pay drawn in the lower post which has been held by the Government servant on regular basis. OPTION OF DATE FOR FIXATION OF PAY ON PROMOTION TO THE HIGHER POST:As per sub-para of Clause (a) (1) to FR 22 (I), a Government servant promoted to a higher post on regular basis is given an option for fixation of his pay on the higher post as under:(a) Either his initial pay may be fixed in the higher post on the basis of Clause (a) (1) of FR 22 (I) straightway from the date of promotion without any further review on accrual of increment in the pay scale of the lower post; or (b) His pay on promotion may initially be fixed of the time-scale of the new post above the in the lower post from which he is promoted, which may be refixed in accordance with Clause (a) (1) of FR 22 (I) on the date of accrual of next increment/on the date of accrual of stagnation increments in the time-scale of the pay of the lower post. The option should be exercised by the Government servant within one month from the date of promotion. This option is not available in the cases of appointment of deputation to an ex cadre post, or to a post on ad-hoc basis or on direct recruitment basis. However, in cases where an ad-hoc promotion is followed by regular appointment without break, the option is admissible as from the date of initial promotion which should be exercised within one month from the date of such regular appointment. Note:-In the order promoting the Government servant, it should be mentioned that he has to exercise the option within one month and that option once exercised is final. 2. In the event of the officer refusing promotion even after the above concession become available, he would be debarred from promotion for a period of one year. [FR 22 and GIOs (15) & (28) the reunder ] Clarification relating to FR 22 (I) (a) (1). –FR 22 (I) (a) (1) applies not only a respect of promotions to higher appointments in the direct line of promotions to higher appointments in the direct line of promotion but also in respect of appointment to another post (carrying higher responsibility than the post held by the Government servant) outside the ordinary line which is generally termed as ex cadre appointment, provided that in respect of that ex cadre appointment, the Government servant is entitled to or elects to draw pay in the time-scale of the ex cadre post. However, the option to have the pay fixed in the cadre post on the accrual of next increment in the cadre post is not admissible. In cases of appointment/promotion from one ex cadre post to another ex cadre post where the official opts to draw pay in the scale of the ex cadre post, the pay in the second or subsequent ex cadre post should be fixed under the normal rules [i.e. FR 22 (I) (a) (1) or (a) (2)] with reference to the pay in the cadre post only. If on appointment to a second or subsequent ex cadre post in a higher pay scale than that of the previous ex cadre post, the pay fixed under normal rules with reference to the pay in the cadre post happens to be less than that drawn in the previous ex cadre post, the differnece may be allowed as personal pay to be absorbed in future increase in pay. Application of FR (I) (a) (1) to State Government servants on appointment to higher post in the Government of India – when a State Government servnat is appointed to a post under the Central Government and the post carries duties and responsibilities of greater importance than those attaching to the post held by him under State Government, the initial pay may be fixed under FR 22(a) (1). [GIO (11), FR 22] Fixation of pay on transfer from one post to another when the appointment does not involve assumption of higher responsibilities—As per Clauses (a) (2) of FR 22 (I), when a Government servant holding a post, other than a tenure post, in a substantive at temporary of officiating capacity is appointed in a substantive, temporary or officiating capacity, as the case may be, to another post which does not involve assumption of duties and responsibilities of greater improtance than those attaching to the post held by him , his initial pay in the new post should be fixed at the stage which is equal to his pay in respect of the old post held by him on regular basis and he will draw his next increment in the new post on the date on which he would have received and increment in the time-scale of the old post. If there is no such equal stage in the time-scale of the new post, his initial pay in the new post will be fixed at the stage next above his pay in respect of the old post and he will draw his next increment in the new post on completion of the period when an increment is earned in the time-scale of the new post. The above provision is applicable also in the cases of appointment to nonfunctional Selection Grade posts. The above provision is applicable also in the case of appointment to a lower post at own request when the maximum pay of the lower post is not less than the pay drawn in the old post. Protection of pay drawn under Central/State PSUs, Autonomous Bodies, etc., on appointment under Central Government.—In respect of candidates working in Public Sector Undertakings, Universities, Semi-Government Institutions or Autonomous Bodies, who are appointed as direct recruits on selection through interview only by a properly constituted agency including departmental authorities making recruitment directly. Their initial pay will be fix at a stage in the scale of pay attached to the post so that the Pay and Dearness Allowances already being drawn by them in their parent organizations. In the event of such a stage not being available in the post to which they have been recruited, their pay may be fix at a stage just below in the scale of the post to which they have been recruited. The pay fixation is to be made by the employing Ministries/Departments after verification of all the relevant documents to be produced by the candidates who were employed in such organisations. [ GIOs (28) and (29), below FR 22, Swamy’s Compilation of FR and SR, Part-I Fourteenth Edition] ANOMALIES CAUSES AND REMEDIES 1. CAUSES 1. The pay of a Govt. servant fixed under FR 22 (I) (a) (I) on promotion to a higher post may sometimes turn to be lower than the pay drawn by a junior official who is promoted later. 2. The pay of a Govt. servant fixed on promotion to a higher post before the revision of pay scale. The pay of the junior official promoted on or after 1-1-96 may draws higher pay due to the notional increase of the rate of increment in the revised pay scale after 1-1-1996 under RPR-97. 3. Due to rationalization of pay scales. 2. REMEDIES Whenever such anomaly occurs, the following action will be taken to safeguard the interest of the senior officer. The pay of the senior officer in the higher post will be stepped up to a figure equal to the pay as fixed for the junior officer in the higher post. The stepping up will, however, be done with effect from the date of promotion or appointment of the junior officer and will be subject to the following conditions:********