Regulation of Increments under various contingencies

advertisement

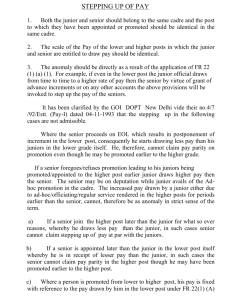

REGULATION OF INCREMENTS UNDER VARIOUS CONTINGENCIES EMPHASIZING NON-QUALIFYING PERIOD INCREMENTS The annual increase in pay is drawn as a matter of course from 1 st of the month in which it falls due, except when it is withheld as a statutory punishment. If a Govt. servant is on leave or is availing joining time on the 1st of the month on which increment falls due, the increased pay will be drawn only from the date on which he resumed duty and not from the first of that month. An increment falling due during leave shall not be drawn till the Govt. servant returns to duty. This is because during leave, the Govt. servant is entitled to draw only leave salary which is based on the pay drawn by him before proceeding on leave. This will not however, have the effect of postponing of future increments provided that the portion of the leave period falling after the due date of increment also count for increment. The increment falling during the period of joining time will also be drawn only on joining the new post, since under Rule 7 of CCS (joining time) Rules 1979, a Govt. servant on joining time will draw joining time pay equal to the pay which was drawn before relinquishment of charge in the old post. 2. Drawal of increment from 1st of the month in which it falls due:- With effect from 1-11-1973, an increment shall be granted from the first of the month in which it falls due instead of from the actual date on which it accrues. (1) (2) (3) (4) The following periods will count for increments:All periods of duty. Service in another posts. All kinds of leave other than E.O.L.. EOL granted (a) On Medical Certificate. (b) Other than on Medical Certificate but due to the inability of the Government servant to join duty on account of civil commotion. (c) For prosecuting technical and scientific studies. (5) (6) (7) (8) Deputation out of India. Foreign Service. Joining Time Period of training before appointment on stipend or otherwise. 3. ADVANCE INCREMENT (S) An Authority, who is competent to create a post, whether temporary or permanent, may grant advance increment(s) not only to the incumbent of the post created under his own power but also to those appointed to other post in the same cadre on the same scale of pay, created with the concurrence of the higher authorities. This power to grant advance increment is invoked also in the cases when the pay of a Government servant has to be fixed under certain circumstances and also to remove anomalies in fixation of pay. 4. STAGNATION INCREMENT (S) (I) Admissible to all employees, the maximum of whose pay scale does not exceed Rs.22,400. (II) Not admissible to those drawing fixed pay. 5. Method of counting broken period Broken periods are to be counted as per following illustrations: To calculate 3 months and 20 days on and from 25 th January, the following should be adopted:Year Month Days th st 25 January to 31 January --7 February to April -3 -th Ist May to 13 May --13 _____________________ __ 3 20 _____________________ (a) (b) The period commencing on 30th January and ending with 2nd March should be deemed as 1 month 4 days as under:- Year Month Days 30 January to 31 January __ __ 2 February __ 1 __ nd Ist March to 2 March __ __ 2 _________________________ __ 1 4 _________________________ th (c) The period commencing on 5 January and ending with 26th March should be deemed as 2 months and 23 days as under:Year Month Days 5th January to 31st January __ __ 27 February __ 1 __ st th 1 March to 26 March __ __ 26 _______________________ __ 2 23 _______________________ th st 6. Method for counting period of Increments As per proviso to Rule 26 (a) FR, for the purpose of arriving at the date of increment in that time scale, the total of all such periods as do not count for increment in that time scale, shall be added to the normal date of increment. In other words, the date of next increment is postponed by the non qualifying periods as under:(1) Date of last increment : 1-06-2000 (2) Period of EOL, suspension and other period not counting for increment From To Particulars Period Y M D 29-7-2000 31-7-2000 EOL without MC __ __ 3 7-10-2000 2-1-2001 Suspension(Not counting) __ 2 27 15-3-2001 5-4-2001 Dies non __ __ 22 _________________ Total of the period which is not counted for __ 3 22 increments _________________ (3) Determination of actual date of increment Date of last increment 1-6-2000 Date of the next increment in normal course 1-6-2001 Total non qualifying period for increment 3 month 22 days Date of increment in accordance with the Proviso to FR 26 (a) 23-9-2001 But the increment will be drawn from 1-9-2001 as an increment falling due on any date in a month has to be drawn from the first of that month. 7. Grant of Stagnation Increment to those stagnating at the maximum of their Pay scales. It has been decided that all Central Govt. employees who have opted the revised pay scales of pay in terms of the CCS (RP) Rules 1997 and who have reached the maximum of the revised scales of pay shall be granted one stagnation increment on completion of every two years at the maximum of the respective scales. The stagnation increment shall be equal to the rate of increment last drawn by them in their pay scales. A maximum of three such increments shall be allowed subject to the condition that the grant of stagnation increment shall be restricted to all posts the maximum of the pay scale of which does not exceed Rs.22,400/-. In the case of a Govt. servant whose pay has been fixed at the maximum of the scale as on 1-1-96, the stagnation increment shall be admissible after two years reckoned from 1-1-96. In other words no Govt. servant shall become eligible for the stagnation increment before 1-1-98 under CCS (RP) Rules 1997. The period, if any, spent at the maximum in the pre-revised scale will not be taken into account under CCS (RP) Rules 1997 and the stagnation increment, if any, in the pre-revised scales will not be counted towards grant of maximum three increments in the CCS (RP) Rules 1997. The stagnation increment will count for all purposes such as DA, HRA, CCA and Pensionary benefits including fixation of pay on promotion. The stagnation increments shall be allowed in the same manner as annual increments. Prepared By D.C.Gupta, IDAS Dy.C.D.A Office of the Jt.CDA (BR) Chandigarh Mr. J.S.Fonia has been appointed as Auditor w.e.f. 25-1-90 in the pay scale of 1200-30-1500-40-2040 and promoted to Sr.Auditor w.e.f. 18-10-1993 in the pay scale of Rs.1400-40-1600-52-2300-EB-60-2600. His pay on promotion has been fixed @ Rs.1400/- w.e.f. 18-10-1993 with DNI 1-101994. His pay has been fixed @ Rs.5000/- p.m. with DNI 1-10-1996 under RPR-97. Whereas Shri V.S.Nitnaware was appointed as Auditor w.e.f. 24-81989(FN) and promoted Sr.Auditor w.e.f. 24-2-95 in the pay scale of Rs. 1400-40-1600-50-2300-EB-60-2600. His pay on promotion as Sr.Auditor fixed @ Rs.1400/- p.m. w.e.f. 24-2-95 with DNI 1-2-1996. The pay of Shri. Nitnaware, Sr.Adr. has been fixed @ Rs.5000/- p.m. w.e.f. 1-1-96 with DNI 1-2-1996. Shri. Fonia has represented that his date of annual increment may please be antedated with his junior from 1-10-96 to 1-2-1996 under RPR-97 which has been got antedated to 1-2-96 Please Comments The pay of Shri. J.S.Fonia for antedating is in contraventions of the clarificatory orders already issued vide Para 2 (v) of DO PT New Delhi letter no. 4/7/92-Estt (Pay-I) dated 4-11-93. Wherein it has been clearly lays down that if a senior is appointed later than the junior in the lower post than the junior in such cases the senior cannot claim pay parity in the higher post though he may have promoted earlier to the higher post. In view of the above clarificatory orders his antedating do not falls within the ambit of above Govt. order as he has received less pay up to 17-10-1993 in the auditor scale than Shri. Nitnaware. Similarly, the antedating of their annual increments with Sh.J.S.Fonia in the following individuals are not extending by this office in terms of above clarification. 1. I.S.Bist, Sr.Adr. 2. Sh.B.S.Rana, Sr.Adr. INTRODUCTION PAY FIXATION The basic rules governing the initial fixation of pay of Government servants in different circumstances were FRS 22, 22-C and 31. The pay fixed under any of those rules were further subjected to FRs.27 and 35. FR 30 added a general limitation on the pay fixed in respect of appointment in an officiating capacity. Fundamental Rules 22, 22-C, 30, 31 and 35 were the normal rules governing fixation of the initial pay of a Government servant under FRs. Apart from these Rules, separate order of the Government servant in certain cases as for example (i) Fixation of pay on appointment to selection grade posts; (ii) fixation of pay reemployed Civil and Military pensioners, etc. By notification no. 1/10/89-Estt. (Pay-I) dated 30.08.1989, FR 22 was substituted incorporating interalia the provisions of FR 22-C and orders issued under several office Memoranda from time to time. FRs 22-C, 30 and 31 were deleted. FR 22 (I) Clause (a) (1) deal with fixation of pay of a Government servant holding a non tenure post in a substantive or temporary or officiating capacity on promotion/appointment in a substantive or temporary of officiating capacity to a higher post. Clause (a) (2) deal with fixation of pay of a government servant holding a non tenure post in a substantive or temporary or officiating capacity on transfer/appointment in a substantive or temporary of officiating capacity to another post which is not higher than the post which he was holding. Clause (a) (3) deals with fixation of pay of a Government servant holding a post in a substantive or temporary or officiating capacity on transfer at his own request to a post with the maximum pay in the time-scale of the post lower than his pay in the post held by him on regular basis. Clause (b) deals with fixation of pay of a Government servant on his first appointment in Government service and another case not fulfilling the conditions in clause (a). FR 22 (II) deals with grant of proforma officiating promotion under “Next Below Rule” to a Government servant who is working on deputation under the Government outside his regular line of service on foreign service. FR 22 (III) stipulates that appointment or promotion of a government servant to a post in the same or identical time scale of pay (with reference to the scale of the scale of the post of the post held by him at the time of appointment of promotion) should not be deemed to involve the assumptions of duties and responsibilities of greater importance for the purpose of initial fixation of his pay. FR 22 (IV) stipulates that when a Government servant, while holding an ex cadre post, is promoted or appointed regularly to a post in his cadre, his pay in the new cadre post should be fixed with reference to his presumptive pay in the old cadre post which he would have but for his holding the ex cadre post. FR 27 – This rule vests competent authorities with the power to fix the pay of a Government at a stage higher than that admissible under the provisions of FR 22 by granting premature increments. FR 28 - This rules vests Government with the power to fix the pay of an officiating Government servant at an amount less than that admissible under FR 22. CIRCUMSTANCES WHICH GAVE RISE TO THE FIXATION OF PAY ARE:1. First appointment to any post, whether in a substantive or officiating capacity. 2. Transfer from one post to another, whether in a substantive or officiating capacity. 3. Re-appointment in the officiating post after break in service due to leave or service in another post which does not count for increments in that officiating post. PAY ON PROMOTION/APPOINTMENT Fixation of pay of a Government servant on promotion/appointment from one post to higher post. – As per clause (a) (1), when a Government servant holding a post, other than a tenure post, in substantive or temporary or officiating capacity is promoted or appointed in a substantive, temporary or officiating capacity as the case be, to another post carrying duties and responsibilities of greater as the case be, to another post carrying duties and responsibilities of greater importance than those attaching to the post held by him, his initial pay in the time scale of the higher post should be fixed at the stage next above the notional pay arrived at by increasing his pay on respect of the lower post held by him regularly by an increment at the stage at which such pay accrued or rupees one hundred, whichever is more. As per the provision to Clause (a) (1) of FR 22 (I), when a Government servant is, immediately before his promotion or appointment on regular basis to a higher post, drawing pay at the maximum of the time-scale of the lower post, his initial pay in the time-scale of the higher post be fixed at the stage next above the pay notionally arrived at by increasing his pay in respect of the lower post held by him on the regular basis by an amount equal to the last increment in the time scale of the lower post rupees on hundred, whichever is more. With effect from 30-9-1993, the stagnation increment(s) will be taken into account for fixation of pay on promotion to higher post on or after 30-9-1993. NOTE:- The stagnation increment will be taken into account for fixation of pay in respect of appointments/promotions to higher post and also in respect of appointments to another post which does not involve assumption of duties and responsibilities of greater importance than those attaching to the post held by the Government servant. (GIO (27) below FR 22 read with GIO (19) below FR 26) Important Point:- The fixation of pay on promotion/appointment to a higher post under Clause (a) (1) of FR 22 (I) as explained in the proceeding paragraphs is subject to the following conditions:(1) The promotion/appointment to a higher post should fulfill the eligibility conditions as per prescribed in the relevant Recruitment Rules. (2) In case of promotion in the normal line within the cadre which is not a regular basis, i.e. does not fulfill the eligibility conditions, the pay in the higher post may also be fixed under FR 22 (I) (a) (1). If there is substantial increase in pay so fixed, the pay has to be restricted under FR 53 so as not to exceed the basic pay in the lower post by more than the amounts shown below(a) For example in receipt of basic pay up to Rs.8,000 p.m. (b) For employees in receipt of basic pay above Rs.8000 p.m. 15% of basic pay subject to a maximum Rs.1000/- p.m. 12 ½ % of basic pay subject to a maximum of Rs.1000/- p.m. In the case where pay in the manner indicates above comes to more than the minimum or at the minimum of the promotional posts, the employees concerned will be allowed pay at the minimum of the scale. (GIO (2), below FR 35) (3) The pay in the higher post should be fixed only with reference to the pay drawn in the lower post which has been held by the Government servant on regular basis. OPTION OF DATE FOR FIXATION OF PAY ON PROMOTION TO THE HIGHER POST:As per sub-para of Clause (a) (1) to FR 22 (I), a Government servant promoted to a higher post on regular basis is given an option for fixation of his pay on the higher post as under:(a) Either his initial pay may be fixed in the higher post on the basis of Clause (a) (1) of FR 22 (I) straightway from the date of promotion without any further review on accrual of increment in the pay scale of the lower post; or (b) His pay on promotion may initially be fixed of the time-scale of the new post above the in the lower post from which he is promoted, which may be refixed in accordance with Clause (a) (1) of FR 22 (I) on the date of accrual of next increment/on the date of accrual of stagnation increments in the time-scale of the pay of the lower post. The option should be exercised by the Government servant within one month from the date of promotion. This option is not available in the cases of appointment of deputation to an ex cadre post, or to a post on ad-hoc basis or on direct recruitment basis. However, in cases where an ad-hoc promotion is followed by regular appointment without break, the option is admissible as from the date of initial promotion which should be exercised within one month from the date of such regular appointment. Note:-In the order promoting the Government servant, it should be mentioned that he has to exercise the option within one month and that option once exercised is final. 2. In the event of the officer refusing promotion even after the above concession become available, he would be debarred from promotion for a period of one year. [FR 22 and GIOs (15) & (28) the reunder ] Clarification relating to FR 22 (I) (a) (1). –FR 22 (I) (a) (1) applies not only a respect of promotions to higher appointments in the direct line of promotions to higher appointments in the direct line of promotion but also in respect of appointment to another post (carrying higher responsibility than the post held by the Government servant) outside the ordinary line which is generally termed as ex cadre appointment, provided that in respect of that ex cadre appointment, the Government servant is entitled to or elects to draw pay in the time-scale of the ex cadre post. However, the option to have the pay fixed in the cadre post on the accrual of next increment in the cadre post is not admissible. In cases of appointment/promotion from one ex cadre post to another ex cadre post where the official opts to draw pay in the scale of the ex cadre post, the pay in the second or subsequent ex cadre post should be fixed under the normal rules [i.e. FR 22 (I) (a) (1) or (a) (2)] with reference to the pay in the cadre post only. If on appointment to a second or subsequent ex cadre post in a higher pay scale than that of the previous ex cadre post, the pay fixed under normal rules with reference to the pay in the cadre post happens to be less than that drawn in the previous ex cadre post, the differnece may be allowed as personal pay to be absorbed in future increase in pay. Application of FR (I) (a) (1) to State Government servants on appointment to higher post in the Government of India – when a State Government servnat is appointed to a post under the Central Government and the post carries duties and responsibilities of greater importance than those attaching to the post held by him under State Government, the initial pay may be fixed under FR 22(a) (1). [GIO (11), FR 22] Fixation of pay on transfer from one post to another when the appointment does not involve assumption of higher responsibilities—As per Clauses (a) (2) of FR 22 (I), when a Government servant holding a post, other than a tenure post, in a substantive at temporary of officiating capacity is appointed in a substantive, temporary or officiating capacity, as the case may be, to another post which does not involve assumption of duties and responsibilities of greater improtance than those attaching to the post held by him , his initial pay in the new post should be fixed at the stage which is equal to his pay in respect of the old post held by him on regular basis and he will draw his next increment in the new post on the date on which he would have received and increment in the time-scale of the old post. If there is no such equal stage in the time-scale of the new post, his initial pay in the new post will be fixed at the stage next above his pay in respect of the old post and he will draw his next increment in the new post on completion of the period when an increment is earned in the time-scale of the new post. The above provision is applicable also in the cases of appointment to nonfunctional Selection Grade posts. The above provision is applicable also in the case of appointment to a lower post at own request when the maximum pay of the lower post is not less than the pay drawn in the old post. Protection of pay drawn under Central/State PSUs, Autonomous Bodies, etc., on appointment under Central Government.—In respect of candidates working in Public Sector Undertakings, Universities, Semi-Government Institutions or Autonomous Bodies, who are appointed as direct recruits on selection through interview only by a properly constituted agency including departmental authorities making recruitment directly. Their initial pay will be fix at a stage in the scale of pay attached to the post so that the Pay and Dearness Allowances already being drawn by them in their parent organizations. In the event of such a stage not being available in the post to which they have been recruited, their pay may be fix at a stage just below in the scale of the post to which they have been recruited. The pay fixation is to be made by the employing Ministries/Departments after verification of all the relevant documents to be produced by the candidates who were employed in such organisations. [ GIOs (28) and (29), below FR 22, Swamy’s Compilation of FR and SR, Part-I Fourteenth Edition] 1. The pay of a Govt. servant fixed under FR 22 (I) (a) (I) on promotion to a higher post may sometimes turn to be lower than the pay drawn by a junior official who is promoted later. 2. The pay of a Govt. servant fixed on promotion to a higher post before the revision of pay scale. The pay of the junior official promoted on or after 1-1-96 may draws higher pay due to the notional increase of the rate of increment in the revised pay scale after 1-1-1996 under RPR-97. 3. Due to rationalization of pay scales. 2. REMEDIES Whenever such anomaly occurs, the following action will be taken to safeguard the interest of the senior officer. The pay of the senior officer in the higher post will be stepped up to a figure equal to the pay as fixed for the junior officer in the higher post. The stepping up will, however, be done with effect from the date of promotion or appointment of the junior officer and will be subject to the following conditions:-