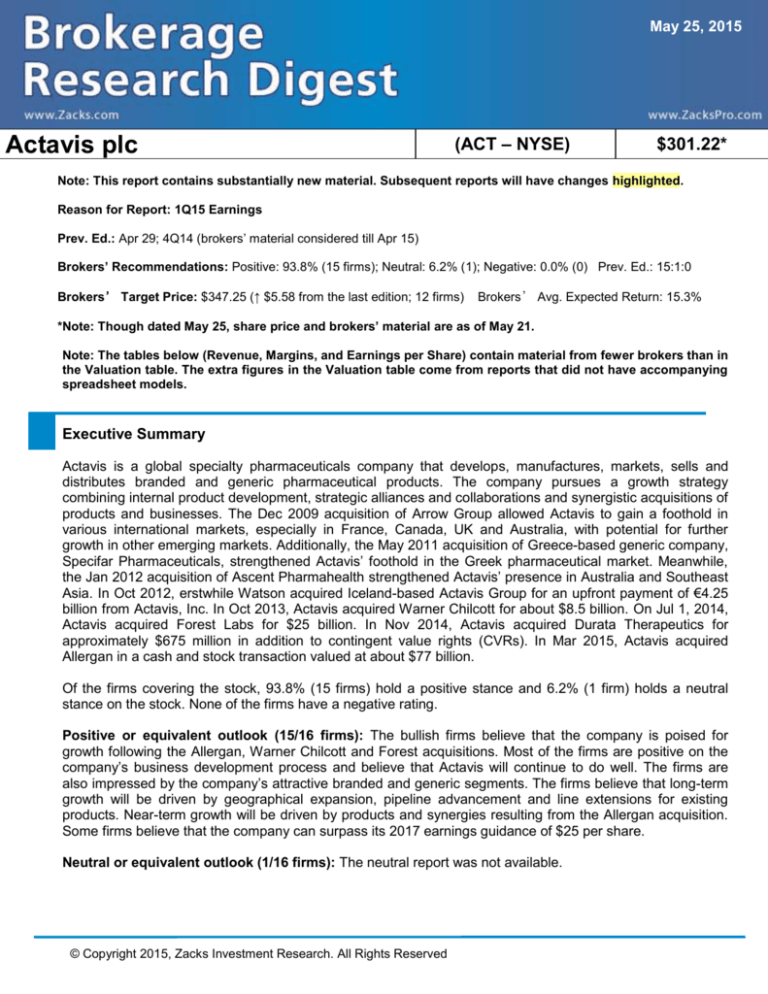

May 25, 2015

Actavis plc

(ACT – NYSE)

$301.22*

Note: This report contains substantially new material. Subsequent reports will have changes highlighted.

Reason for Report: 1Q15 Earnings

Prev. Ed.: Apr 29; 4Q14 (brokers’ material considered till Apr 15)

Brokers’ Recommendations: Positive: 93.8% (15 firms); Neutral: 6.2% (1); Negative: 0.0% (0) Prev. Ed.: 15:1:0

Brokers’ Target Price: $347.25 (↑ $5.58 from the last edition; 12 firms)

Brokers’ Avg. Expected Return: 15.3%

*Note: Though dated May 25, share price and brokers’ material are as of May 21.

Note: The tables below (Revenue, Margins, and Earnings per Share) contain material from fewer brokers than in

the Valuation table. The extra figures in the Valuation table come from reports that did not have accompanying

spreadsheet models.

Executive Summary

Actavis is a global specialty pharmaceuticals company that develops, manufactures, markets, sells and

distributes branded and generic pharmaceutical products. The company pursues a growth strategy

combining internal product development, strategic alliances and collaborations and synergistic acquisitions of

products and businesses. The Dec 2009 acquisition of Arrow Group allowed Actavis to gain a foothold in

various international markets, especially in France, Canada, UK and Australia, with potential for further

growth in other emerging markets. Additionally, the May 2011 acquisition of Greece-based generic company,

Specifar Pharmaceuticals, strengthened Actavis’ foothold in the Greek pharmaceutical market. Meanwhile,

the Jan 2012 acquisition of Ascent Pharmahealth strengthened Actavis’ presence in Australia and Southeast

Asia. In Oct 2012, erstwhile Watson acquired Iceland-based Actavis Group for an upfront payment of €4.25

billion from Actavis, Inc. In Oct 2013, Actavis acquired Warner Chilcott for about $8.5 billion. On Jul 1, 2014,

Actavis acquired Forest Labs for $25 billion. In Nov 2014, Actavis acquired Durata Therapeutics for

approximately $675 million in addition to contingent value rights (CVRs). In Mar 2015, Actavis acquired

Allergan in a cash and stock transaction valued at about $77 billion.

Of the firms covering the stock, 93.8% (15 firms) hold a positive stance and 6.2% (1 firm) holds a neutral

stance on the stock. None of the firms have a negative rating.

Positive or equivalent outlook (15/16 firms): The bullish firms believe that the company is poised for

growth following the Allergan, Warner Chilcott and Forest acquisitions. Most of the firms are positive on the

company’s business development process and believe that Actavis will continue to do well. The firms are

also impressed by the company’s attractive branded and generic segments. The firms believe that long-term

growth will be driven by geographical expansion, pipeline advancement and line extensions for existing

products. Near-term growth will be driven by products and synergies resulting from the Allergan acquisition.

Some firms believe that the company can surpass its 2017 earnings guidance of $25 per share.

Neutral or equivalent outlook (1/16 firms): The neutral report was not available.

Apr 29, 2015

© Copyright 2015, Zacks Investment Research. All Rights Reserved

Overview

Dublin, Ireland-based Actavis came into existence in Oct 2012 following the acquisition of Actavis Pharma by

the erstwhile Watson Pharma. The company has been very active on the acquisition front with the latest

acquisition being that of Botox-maker Allergan in Mar 2015. Earlier acquisitions include those of Warner

Chilcott, Forest Labs and Durata among others.

The global specialty pharmaceutical company focuses on the development, manufacturing, marketing, sale

and distribution of generic, branded generic, medical aesthetics, brand, biosimilar and over-the-counter

(OTC) products targeting a wide range of therapeutic areas like central nervous system (CNS),

gastroenterology, women’s health, urology, cardiovascular, respiratory and anti-infectives.

Actavis now has a presence in more than 100 countries including several established and growing

international markets.

For more details, check the company’s website http://www.actavis.com

The firms identified the following factors for evaluating the investment merits of Actavis:

Key Positive Arguments

Owing to the Actavis, Warner Chilcott and the Forest

acquisitions, Actavis’ growth prospects have become

stronger. Moreover, with the Allergan acquisition,

Actavis has strengthened its global presence and is one

of the top 10 pharma companies in the world based on

sales.

Actavis is viewed as a diversified and stable global

generics player.

Key Negative Arguments

The generic business generates sales almost

exclusively from the U.S. market, which is highly

competitive and experiences annual price erosion.

Actavis has been entering into several acquisition

agreements of late, as a result of which integration

risks persist.

Biosimilars provide significant commercial opportunity.

Note: The company’s financial year coincides with the calendar year.

Apr 29, 2015

Long-Term Growth

Acquisitions form an integral part of Actavis’ expansion strategy - the company completed four major

acquisitions (Arrow, Specifar, Actavis Group and Warner Chilcott) apart from the Forest and Allergan deals in

the past few years. The Arrow acquisition helped Actavis expand its footprint in ex-U.S. territories, especially

in countries like Australia, New Zealand, Brazil, Scandinavia, Germany, Central and Eastern Europe, Turkey,

Japan and South Africa. It also boosted Actavis’ product offerings and pipeline.

Actavis enhanced its commercial presence in key European markets and strengthened its foothold in the

Greek pharmaceutical market through the May 2011 Specifar acquisition. Meanwhile, the acquisition of

Australia-based Ascent Pharmahealth, the Australian and Southeast Asian generic pharmaceutical wing of

Strides Arcolab Ltd., helped Actavis gain a foothold in Malaysia, Hong Kong, Vietnam and Thailand.

Moreover, Ascent had a 14% market share in the dermatology and skin care market of Australia, which

helped diversify Actavis’ portfolio.

The acquisition of Actavis Group helped the company strengthen its presence in the ex-U.S. generics market

and expanded and strengthened its presence and product portfolio. The Oct 2013 Warner Chilcott

acquisition resulted in the creation of a leading global specialty pharmaceutical company.

Zacks Investment Research

Page 2

www.zackspro.com

The Forest acquisition pushed up Actavis’ branded products revenues significantly and led to the creation of

a specialty company with a diversified portfolio and a presence in different geographical areas. The

acquisition will also bring about significant synergies and boost earnings and revenues. The Nov 2014

Durata acquisition boosted Actavis’ infectious disease portfolio through the addition of Dalvance.

In Mar 2015, Actavis acquired Botox maker Allergan. With this acquisition, Actavis, which was previously

known for its strong presence in the generics market, finds itself in the company of the top 10 pharmaceutical

companies across the world based on sales. Actavis intends to adopt Allergan as its corporate name.

Allergan and Actavis have complementary product portfolios and ample scope for generating cost synergies.

With the Allergan acquisition, Actavis has strengthened its global presence especially in Canada, Europe,

Latin America and Southeast Asia and other high-value growth markets like China and India. Meanwhile, the

combined U.S. sales force will ensure increased marketing reach. The addition of several blockbuster

therapeutic franchises has boosted Actavis’ North American Specialty Brands business significantly.

Actavis is also working on bringing biosimilars to market. Biosimilars represent significant opportunity and the

company has a collaboration agreement with Amgen for the worldwide development and commercialization

of oncology antibody biosimilars. The products developed under the collaboration will be sold under a joint

Amgen/Actavis label.

While long-term growth will be driven by geographical expansion, pipeline advancement and line extensions

for existing products, near-term growth will be driven by products and synergies resulting from the Allergan

acquisition.

Apr 29, 2015

Target Price/Valuation

Rating Distribution

Positive

Neutral

Negative

Avg. Target Price

High

Low

No. of Analysts with Target

price/Total

93.8%

6.2%

0.0%

$347.25↑

$375.00

$300.00

12/16

Recent Events

Actavis Tops 1Q Earnings by Wide Margin, Provides Outlook – May 11, 2015

Actavis’ 1Q15 earnings came in at $4.30 per share, beating the Zacks Consensus Estimate of $3.84 per

share by a huge margin and increasing 23.2% from the year-ago period.

Revenues for the reported quarter came in at $4.23 billion, up 59% from the year-ago period, beating the

Zacks Consensus Estimate of $4.05 billion.

Reported quarter results included the impact of the Allergan acquisition, effective Mar 17.

Quarterly Details

Actavis has three revenue producing segments -- North American Brands, North American Generics and

International (generic, branded generic, brands outside North America and over-the-counter pharmaceutical

products) and Anda Distribution.

Zacks Investment Research

Page 3

www.zackspro.com

North American Brands revenue soared to $1.74 billion (up significantly from $594 million in the year-ago

period), driven by the Forest acquisition and the performance of legacy products like Lo Loestrin ($83.3

million), Minastrin 24 Fe ($65.4 million), and Estrace Cream ($71.9 million). Products like Bystolic ($164.1

million) and Linzess ($96.2 million) also performed well.

Actavis continues to convert patients to Namenda XR. The company said that about 49% patients have been

converted.

CNS, gastroenterology, women's health, cardiovascular, respiratory & acute care, urology, infectious disease

and dermatology/established brands revenues came in at $541.6 million, $376.6 million, $267.5 million,

$215.9 million, $68.3 million, $37.8 million and $228.3 million, respectively.

North American Generics revenues were $1.78 billion, up 6.4% from the year-ago period. Generic Concerta

and Lidoderm performed well and results were boosted further by the new launches of generic versions of

Intuniv and OxyContin.

International revenues declined 14% from the year-ago period to $558 million reflecting the divestiture of

Western European assets in the second quarter of 2014 as well as the negative impact of currency

movement.

Net revenues from the Anda Distribution segment increased 18% during the quarter to $462 million reflecting

higher product mix to chain drug stores.

Provides 2015 Outlook

Actavis, which acquired Botox maker Allergan in Mar 2015, provided its preliminary outlook for 2015. While

the company expects earnings in the range of $17.00 - $18.50 per share, pro forma revenues are expected

in the range of $22.0 - $22.5 billion (reported revenues of $20.5 - $21 billion).

Actavis has almost completed its pipeline prioritization efforts as well and has identified 70 projects for

continued development including more than 50 in late-stages/regulatory stage of development.

Revenue

Actavis reported net revenues of $4.23 billion in 1Q15, up 59% y/y. The Allergan business boosted net

revenues by $258 million in 1Q15. The Zacks Digest average net revenues in 1Q15 were in line with the

company report.

Outlook: The company expects pro forma revenues of $22.0 - $22.5 billion (reported revenues of $20.5 $21 billion).

Revenue

($ in million)

Digest

Average

1Q14A

2014A

1Q15A

2Q15E

3Q15E

4Q15E

2015E

2016E

2017E

$2,655.1

$13,062.3

$4,234.2

$5,900.0

$5,954.0

$6,219.0

$21,814.0

$24,874.0

$26,494.5

Digest High

$2,655.1

$13,062.3

$4,234.2

$5,900.0

$5,954.0

$6,219.0

$22,276.0

$25,287.0

$26,804.0

Digest Low

$2,655.1

$13,062.3

$4,234.2

$5,900.0

$5,954.0

$6,219.0

$21,352.0

$24,461.0

$26,185.0

Note: Recent significant developments are in bold.

Actavis reports revenues under three segments – North American Brands, North American Generics and

International and Anda Distribution.

Zacks Investment Research

Page 4

www.zackspro.com

North American Brands

North American Brands revenues in 1Q15 increased 192% y/y to $1.7 billion driven by the acquisition

of Forest as well as the performance of products like Minastrin 24 Fe, Lo Loestrin and Estrace Cream.

Within the company’s North American Brands, CNS revenues in 1Q15 were $541.6 million while

Gastroenterology revenues were $376.6 million, Women's Health revenues were $267.5 million,

Cardiovascular & Respiratory revenues were $215.9 million and Urology, Infectious Disease and

Dermatology/Established Brands revenues were $68.3 million, $37.8 million and $228.3 million,

respectively. The Zacks Digest average revenues for 1Q15 were in line with the company report.

In May 2015, the company said that the U.S. Court of Appeals for the Second Circuit has upheld the

lower court ruling in Dec 2014 under which Actavis is required to continue selling Namenda IR.

As of May 11, 2015, the rate of conversion from Namenda IR to Namenda XR was approximately 50%.

The company expects to achieve a nearly 60% conversion rate by the end of 2Q15. Namenda IR

generics are expected to enter the market in mid-July.

Branded Product Regulatory/Pipeline Updates

Namzaric: In May 2015, the company announced the launch of Namzaric for the treatment of

moderate-to-severe dementia of the Alzheimer's type in patients stabilized on Namenda XR and

Aricept. Namzaric is a fixed dose combination (FDC) of these two drugs. The fixed-dose combination

allows patients to take just one pill per day instead of three pills twice daily.

Viibryd: In Mar 2015, the FDA approved a lower therapeutic dose of Viibryd (20 mg) in addition to its

current dosage option of 40 mg daily.

Saphris: In Mar 2015, Saphris was approved in the U.S. as a monotherapy for the acute treatment of manic

or mixed episodes associated with bipolar I disorder in pediatric patients (ages 10 – 17). Saphris is already

approved for three indications – schizophrenia in adults, acute manic or mixed episodes associated with

bipolar I disorder in adults and monotherapy or adjunctive therapy with either lithium or valproate.

Liletta: In Feb 2015, Actavis announced that Liletta was approved in the U.S. for use by women to prevent

pregnancy for up to three years. The drug is now available in the U.S.

Avycaz: In Feb 2015, the company announced that the FDA has approved Avycaz for the treatment of adult

patients suffering from complicated intra-abdominal infections and complicated urinary tract infections

including pyelonephritis caused by designated susceptible bacteria.

Cariprazine: In Jan 2015, the company announced that the NDA resubmission of cariprazine for the

treatment of schizophrenia and manic or mixed episodes associated with bipolar I disorder was accepted

by the FDA. A final decision on the approval of the candidate is expected in Jun 2015.

Teflaro: Actavis’ sNDA for Teflaro for use in cases of acute bacterial skin and skin structure

infections (ABSSSI) with concurrent bacteremia has been accepted for review with a response

expected in 3Q15.

Bystolic and Diovan (valsartan) FDC: In Dec 2014, the company announced that it received a CRL from

the FDA for its NDA for the FDC of Bystolic and Diovan. Actavis is looking to get the combination approved

for the treatment of hypertension.

Dalvance/Xydalba: Dalvance is approved for the treatment of acute bacterial skin and skin structure

infections (ABSSSI) in adults. Dalvance is also being developed as a single-dose regimen and a

supplemental new drug application (sNDA) is expected to be filed by mid-2015. Dalvance also has the

Zacks Investment Research

Page 5

www.zackspro.com

potential to be studied for additional indications like hospitalized community-acquired pneumonia and

pediatric osteomyelitis.

Eluxadoline: The company is looking to get eluxadoline approved for the treatment of diarrhea and

abdominal pain in men and women suffering from diarrhea predominant irritable bowel syndrome.

The candidate enjoys priority review status in the U.S. Actavis expects to submit additional data to support its

filing. A final decision on the approval of eluxadoline is expected in 2Q15. Actavis expects to launch

eluxadoline in late 2015 or early 2016, if approved. Eluxadoline is also under review in the EU.

Linzess: The company expects to submit a sNDA for Linzess as a potential low dose version for the

treatment of patients with chronic idiopathic constipation (CIC) in 2016.

DARPin: Phase II studies for DARPin for the treatment of wet neovascular age-related macular

degeneration (AMD) and diabetic macular edema are ongoing in Japan and the U.S. A phase III study

is expected to begin enrollment in late 2Q15 or early 3Q15.

Restasis: A U.S. submission for a multi-dose preservative free formulation of Restasis is planned by

the end of 2015.

Bimataprost SR: Phase III studies are ongoing in the U.S. and will be initiated in the EU later this year

for the treatment of glaucoma.

SER 120: Phase III data on the low-dose nasal formulation for the treatment of nocturia is expected to

be available later in 2015.

$ in million

North American

Brands

2014A

2015E

2016E

2017E

2018E

Est. Growth (‘14-’17)

$4,631.4

$6,744.0

$7,368.0

$8,039.0

$8,661.0

–

North America Generics and International Segment

North America Generics revenues in 1Q15 were $1.22 billion, up 19% y/y driven by strong sales of

Actavis’ generic versions of Lidoderm and Concerta and the launch of new products like the generic

versions of OxyContin and Intuniv. The company launched 20 generic products in the U.S. in 2015.

International revenues were $558 million, down 14% y/y, reflecting the divestiture of Western

European assets in 2Q14 and negative currency impact, partially offset by the Forest acquisition.

Actavis said that it has 7 first-to-file (FTF) opportunities including generic versions of Uceris, Letairis,

and Mirvaso.

The Zacks Digest average revenues for 1Q15 were in line with the company report.

Recent Product Approvals/Launches

On May 7, 2015, Actavis announced that it will immediately re-launch its generic version of

AstraZeneca's Pulmicort Respules (budesonide inhalation suspension) 0.25 and 0.5 mg vials

following a decision from the U.S. Court of Appeals for the Federal Circuit to uphold a lower court's

ruling that United States Patent No. 7,524,834 is invalid. The Appeals court also dismissed the Mar

12, 2015 injunction preventing Actavis from distributing its generic version of Pulmicort Respules.

Pulmicort Respules is a maintenance medicine used to control and prevent asthma symptoms in

children (1 - 8 years). For the 12 months ended Dec 31, 2014 total U.S. brand and generic sales of

Pulmicort Respules were approximately $1.2 billion.

Zacks Investment Research

Page 6

www.zackspro.com

Generics Pipeline/Patent Lawsuits

On Oct 16, 2014, Actavis announced that it has filed an ANDA for its generic version of Pfizer and Tris

Pharma's Quillivant. Quillivant is approved to manage pain severe enough to require daily, around-theclock, long-term opioid treatment for ADHD. As per IMS Health, total U.S. sales of Quillivant for the 12

months ending Jun 30, 2014, were $52 million.

$ in million

North American

Generics

2014A

2015E

2016E

2017E

2018E

Est. Growth (‘14-’17)

$4,163.6

$4,693.0↑

$4,630.0↑

$4,578.0↑

$4,570.0↑

–

Anda Distribution

According to the company, Anda Distribution segment’s net revenues increased 18% y/y to $462

million in 1Q15 driven by higher product mix to chain drug stores. The Zacks Digest average

revenues in 1Q15 were in line with the company’s report.

$ in million

Distribution Business

2014A

$1,683.8

2015E

$1,800.0↑

2016E

$1,800.0↓

2017E

$1,900.0↓

2018E

$2,000.0↓

Est. Growth (‘14’17)

–

Agreements and Acquisitions

On Mar 17, 2015, Actavis announced that it has completed the acquisition of Allergan in a cash and stock

transaction valued at about $77 billion. On a pro forma basis, the combined company has three blockbuster

franchises (ophthalmology, neurosciences/CNS and medical aesthetics/dermatology/plastic surgery) each

with annual revenues of more than $3 billion. The deal is expected to be earnings accretive (double-digit

accretion) within a year. The company expects annual synergies of at least $1.8 billion starting 2016, in

addition to the $475 million of annual savings previously announced by Allergan.

The Allergan acquisition added several blockbuster therapeutic franchises to Actavis’ portfolio and boost its

North American Specialty Brands business. The specialty product franchises (gastroenterology,

cardiovascular, women's health, urology and infectious disease) are expected to generate combined

revenues of about $4 billion. Actavis intends to invest $1.7 billion every year on R&D. Several firms are

positive on this deal which will bring in significant synergies and drive growth.

On Jan 26, 2015, the company announced that it will acquire Auden Mckenzie for approximately £306

million in cash along with a two-year royalty on a percentage of gross profits of one of Auden Mckenzie's

products. The acquisition of Auden Mckenzie is expected to be immediately accretive to Actavis' earnings in

2015.

Please refer to the Zacks Research Digest spreadsheet on ACT for further details on revenue.

Margins

The company reported gross margin of 67.6% in 1Q15, up from 57.6% in 1Q14. R&D expense increased

62.7% y/y to $284 million in 1Q15. SG&A expenses at Actavis amounted to $877.6 million in 1Q15, up

79.9% y/y. The Zacks Digest average for gross margin, R&D expense and SG&A expense was in line with

the company report.

Zacks Investment Research

Page 7

www.zackspro.com

Margins

Gross

Operating

Pre-tax

Net

1Q14A

2014A

1Q15A

2Q15E

3Q15E

4Q15E

2015E

2016E

2017E

57.6%

26.0%

60.6%

28.5%

67.6%

27.6%

72.5%

28.3%

72.6%

28.6%

72.4%

29.1%

73.1%

29.1%

74.3%

26.3%

74.4%

25.3%

Outlook: Actavis expects R&D expenses to be around $1.7 billion in 2015.

Note: As per the Zacks Digest model, COGS is expected to increase 25.3% y/y in 2015 and 7.4% y/y in

2016. Further, SG&A expense is expected to increase 72.2% y/y in 2015 and 2.2% y/y in 2016, and R&D

expense is expected to increase 76.3% y/y in 2015 and 6.3% y/y in 2016.

Please refer to the Zacks Research Digest spreadsheet on ACT for further details on margins.

Earnings per Share

Earnings came in at $4.30 per share in 1Q15, up 23% y/y. 1Q15 earnings surpassed the expectations of

most firms. According to the Zacks Digest model, 1Q15 adjusted earnings per share were in line with the

company’s report.

EPS

Digest High

Digest Low

Digest Average

1Q14A

2014A

1Q15A

2Q15E

3Q15E

4Q15E

2015E

2016E

2017E

$3.49

$3.49

$3.49

$13.99

$14.02

$13.98

$4.30

$4.30

$4.30

$4.52

$4.52

$4.52

$4.52

$4.52

$4.52

$4.68

$4.68

$4.68

$17.54↑

$18.08↑

$16.74

$20.33↑

$21.75↑

$17.85

$24.63

$25.20

$24.05

2015 Outlook

Actavis expects earnings in the range of $17.00 - $18.50 per share.

The company expects to earn $25 per share in 2017.

Please refer to the Zacks Research Digest spreadsheet on ACT for further details on EPS.

Analyst

Copy Editor

Arpita Dutt

-

Content Editor

Lead Analyst & QCA

Arpita Dutt

Last Updated By

Neelakash Sarkar

Reason for Update

1Q15

Zacks Investment Research

Page 8

www.zackspro.com