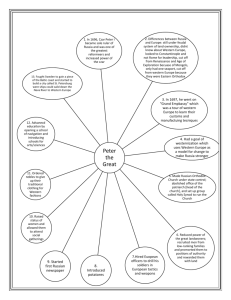

3 - Why does Russia need to build a CEEA with the EU?

advertisement

Establishment of a Common European Economic Area as a Factor of Russia's Sustainable Growth Ivan Samson RECEP director Espace Europe Institute University Pierre Mendes France, Grenoble http://www.upmf-grenoble.fr/espace-europe/ ivan.samson@upmf-grenoble.fr Abstract The idea of integration between the European Union and Russia within a "Common European Economic Area" is now at the top of the agenda in the dialogue between the EU and Russia. This confirms the fact that the EU considers Russia as a strategic partner. What this Common European Economic Area (CEEA) could be remains largely to be defined. This paper aims to argue that the CEEA is not only a positive development for the economic growth of Russia, but that it is a condition for the country’s sustainable growth and productivity increase. The paper then discusses the options for defining the CEEA in the most relevant way for Russia and the main conditions for succeeding in this strategy. JEL classification: E22, F130, F150, F210, F430, O11 Russian-European Centre for Economic Policy, Moscow ( www.recep.org ). The opinions expressed here are those of the author and not those of RECEP or of any institution of the European Union. The author benefited from the comments of Alain Laurent and from talks with Xavier Greffe, Attila Soos, Eric Brunat, Xavier Richer and Mathilde Maurel. His responsibility remains entire. 1 1 - The growing popularity of the CEEA idea "A stable, democratic and prosperous Russia, firmly anchored in a united Europe free of new dividing lines, is essential to lasting peace on the continent". This aim, expressed on June 4, 1999, in the Common Strategy of the European Union on Russia, has three economic dimensions: support of Russia's efforts to achieve WTO membership, the future establishment of an EU-RF free-trade area and creation of the Common European Economic Area. This latter aim has been increasingly reiterated by the new leaders of Russia and the EU, Vladimir Putin and Romano Prodi, laying the foundations of a strategic partnership between the EU and Russia1. The Paris Summit of October 30, 2000, however, did not mention the CEEA idea: "Our shared objective is to maximise the potential of EU enlargement in order to boost exchanges between an enlarged European Union and Russia and between Russia and the applicant countries. The dialogue already under way with Russia on this matter will be continued in the appropriate PCA bodies". The general reference to the Partnership and Cooperation Agreement (PCA), signed 1994 and starting to work December 1997, remained the rule. The seventh Summit held under the PCA took place in Moscow, on May 17, 2001. It expressed "the desire of the Parties to address questions that arise in this context, including the movement of people, goods and services between the enlarged EU and Russia". The CEEA is mentioned as an aim: "We agree to establish a joint high-level group within the framework of the PCA to elaborate the concept of a common European economic space". The eight Summit, held in Brussels on October 3, 2001, displayed a stronger emphasis on the CEEA issue. MM. Putin and Prodi decided "to boost the drive towards closer economic cooperation between Russia and the EU". They agreed "to develop a concept which could form the basis for our medium- and long-term economic strategy. In this connection, we reaffirm the importance we attach to the creation of a Common European Economic Area". Moreover, they agreed on the profile and tasks of the High-Level Group, whose creation had been decided upon at the previous Summit: "The task of the High-Level Group is to elaborate a concept for a closer economic relationship between Russia and the EU, based on the wider goal of bringing the EU and Russia closer together. The High-Level Group will consider the opportunities offered by greater economic integration and legislative approximation and assess options for further work.(...) The High-Level Group will define the core elements which will need to be put in place in order to create a Common European Economic Area.". The first deadline for this task is October 2003. A new momentum is thus given to EU-RF dialogue. The reasons for this speeding-up and intensification are, on the one hand, the decision of the EU to integrate 10 candidate countries (including 8 in Central and Eastern Europe – the CEECs) no later than 2004, and on the other hand, the consequences of the events of September 11, 2001. The EU and Russia are, increasingly, becoming historic and natural partners. 1 For a discussion on the idea of a strategic partnership, see Emerson, Vahl and Whyte (2001) and Vahl (2001).. 2 In December 2001, the EU Commission adopted the “Country Strategy Paper 2002-2006” for the Russian Federation.2 The strategy reiterates once more the importance of the PCA and stresses the EU’s important strategic and economic interest in Russia’s development, inter alia, as a bridge between the EU and Asia. As far as trade and economic relations are concerned, the EU strategy considers: “Russia’s WTO accession on regular commercial terms highly desirable”. The main EU concern is its unbalanced trade structure, dependency on energy imports from Russia and the removal of access restrictions to Russian markets. At the ninth Summit in Moscow, May 29, 2002, and in order to have better access for Russian goods and services to the EU market, Russia obtained the promise of imminent recognition as a market economy, as defined in trade legislation which allows to reduce anti-dumping investigations and charges. Russia also wishes to keep the existing trade preferences, like the EU’s General System of Preferences (GSP) and wants the EU to abolish its quotas on Russian steel exports. During the EU-Russia summit, the two partners reaffirmed the importance they attach “to the creation of a Common European Economic Area [EEA]; we are pleased to have reached an agreement on the terms of reference of the High-Level Group” ... “to elaborate a concept for a closer economic relationship between Russia and the EU, based on the wider goal of bringing the EU and Russia closer together. The [group] will consider the opportunities offered by greater economic integration and legislative approximation, [... and.] identify means and mechanisms to achieve common objectives and consider the timescale for implementation.”3 It was indicated that the creation of the CEEA will take place within the framework of the Partnership and Cooperation Agreement of 1997 and will use its mechanisms. However, the new impulse in the EU’s opening towards transition countries, given by Romano Prodi, and the new impulse in Russia’s economic reform process, given by Vladimir Putin, has turned the integration of Russia within the CEEA into an objective in itself. As a matter of fact, the joint-committees working on PCA implementation were focused on technical discussions, in which progress had been slow. The Summits had declared the intention "to make more effective use of the conciliation procedures of the PCA". What was missing was a strong political spirit, based on the belief that things would change in the near future. The idea of the CEEA has injected this spirit, because it relies upon the understanding of a strategic joint destiny of the EU and Russia, and on a much deeper mutual opening up and integration, as we will see hereafter. Currently, attitudes towards such an integration are becoming increasingly positive both in the EU and in Russia. 2 - What experiences could the Common European Economic Area rely on?/ The European Economic Area, as a concept, is an ad-hoc approach to economic integration which is much stronger and deeper than a free-trade agreement. It can be considered as the strongest form of economic integration with the EU short of accession and, in some cases, as one possible way to accession. The CEEA concept should be located somewhere on the scale of all the possible forms of integration with the EU. It is most appropriately placed between 2 See http://europa.eu.int/comm/external_relations/russia/csp/index.htm. Report to the EU-Russia Summit of 29 May 2002 of the High-Level Group on the common European economic space. 3 3 forms of partnership and full membership. There are four main types of partnership between the EU and third countries: 2.1 Commercial Agreements, which are at the bottom of the pyramid: they create a freetrade zone for industrial goods. Such free-trade agreements include several (possibly many) restrictions on sensitive products. Food products and services are often excluded, totally or partially, from the agreement. Such agreements exist between the EU and the other main OECD developed countries. Such a free-trade zone was to be set up under the "Common Strategy of the EU on Russia". 2.2 Cooperation Agreements include preferential, but not unrestricted, commercial access to the EU market, and beneficiaries are granted EU technical and financial assistance. One particular example of this type of partnership is the successive Lomé Conventions, which link the EU to the ACP countries (70 former European colonies in Africa, the Caribbean and the Pacific). Preferential commercial access is granted through the SGP (system of general preferences), by which duty-free access to the EU market is given to ACP industrial goods within quota limits. Quantities exported above the ceiling are subject to tariffs, according to the MFN rule. Financial and technical assistance has been granted through financial mechanisms to support export revenues of some raw materials (the so-called SYSMIN and STABEX schemes). Note that although ACP countries benefit from the SGP, EU exports are not granted preferential access to ACP markets: they are subject to tariffs in the same way as exports from third countries. Agreements signed between Eastern European countries and the EU between 1988 and 1990 are another example. But these have now been replaced by a third type of partnership – association agreements. 2.3 Association Agreements represent a rather high form of integration with the EU. They include wide commercial preferences in the trade of goods and services, leading to free trade after a transitory period. They plan a process of approximation of laws aiming at ensuring implementation of the four fundamental freedoms, although only the free circulation of goods is itself an objective of association agreements. Association agreements are sometimes asymmetric to the benefit of an EU partner for a limited period. For instance, at the beginning of the enforcement of association agreements with CEECs, the EU granted duty-free access to its market in most fields immediately, while CEECs were allowed to phase out their tariffs via annual reductions over five years. Food products are considered separately because commercial rules of the Common Agricultural Policy apply. Association agreements also include institutional cooperation (political dialogue, cultural cooperation, common decision-making institutions, jurisdictional bodies). European agreements concerning Eastern European candidates to EU accession are the best-known examples of such agreements, also called Europe Agreements, which were followed by the pre-accession process. 2.4 Partnership and Cooperation Agreements were set-up by the EU with most of the CIS countries. Such agreements came into force on December 1, 1997 for Russia, March 1, 1998 for Ukraine and July 1, 1999 for the other CIS countries (the exceptions are Belarus and Turkmenistan, with whom the PCAs have been signed but are not yet in force, and Mongolia, with whom there is only a Trade and Cooperation Agreement, signed in 1993). PCAs offer the prospect of closer cooperation with the EU for non-candidate 4 countries and aim to prevent possible crowding-out effects after the EU enlargement incorporating the CEE countries. The content of such agreements is "to promote trade and investment and harmonious economic relations between the Parties" and "to create the necessary conditions for the future establishment of a free-trade area between the EU and Russia, covering substantially all trade in goods between them, as well as conditions for bringing about freedom of establishment of companies, of cross-border trade in services and of capital movements" (Art. 1). Moreover, "each Party shall provide for freedom of transit through its territory of goods originating in the customs territory or destined for the customs territory of the other Party" (Art. 12), which is important for Kaliningrad, for example. In addition, PCAs include several dispositions concerning the removal of obstacles to competition by enterprises or State aid (Art. 53), the protection of industrial and intellectual property rights (Art. 54), and the approximation of laws in several sectors. The field for law approximation is very broad, but not very binding. Emphasis is also placed on mutual investment activities. The philosophy of such an agreement is to create the conditions for a free-trade area, with the further prospect of developing free movement of services and capital. The sides grant each other most-favoured-nation status in trade and the absence of discriminations concerning goods, labour conditions and the establishment of companies. This regime is much less open than that offered by association agreements. However, the PCA with Russia is oriented towards the Copenhagen criteria, with special emphasis on political dialogue, including twice-yearly summits. The concept of the Common European Economic Area should be located between various forms of partnership and EU membership. This means that the CEEA is a stronger and deeper form of approximation than PCA agreements and may even include some criteria of EU membership, but not all. The point now is to make these elements more precise. 2.5 The European Economic Area of 1992 between the EEC and EFTA The first step is to rely on the experience of 1992: the institutional precedent is the EEA agreement of 1992 between the then-EEC and EFTA. On January 17, 1989, Jacques Delors expressed the idea of a global and structured agreement of the 12 members of the EEC with the 7 members of EFTA (Austria, Finland, Iceland, Liechtenstein, Norway, Sweden and Switzerland). This agreement was signed in Porto on May 2, 1992. It created a European Internal Market representing 95% of the economies of the 19 parties, 380 million consumers and 40% of world trade. The aim of the EEA was to set-up a legal framework for economic interdependency between the EEC and EFTA: 60% of EFTA exports and more than 50% of its IDE went to the EEC. Bilateral free-trade agreements had already eliminated tariff barriers and quantitative restrictions in industrial goods since 1973. After the Luxemburg statement of 1984, an ad-hoc cooperation added to the trade links. But there was still a discrepancy between the rapid rhythm of EEC directives and the slow pace of EFTA-EEC cooperation. The aim of the EEA was thus to set-up an "homogenous European economic area" (Art. 1), binding EFTA countries to the EEC collectively (and no longer individually), and eliminating any discrimination by nationality (Art. 4). The agreement led to the integration by the EFTA 7 of 80% of the legislation on the Internal Market, i.e. 1500 documents. There are four dimensions to the EEA of 1992: 1 – Trade facilitation by implementation of the "four fundamental freedoms". 5 The EEA set up in 1992 by the EEC and EFTA includes the acquis communautaire related to the free circulation of goods, persons, services and capital (12 000 pages) through its transfer into the national laws of the EFTA states; 2 – Non-distorted competition. Like the Treaty of Rome, the EEA agreement sets up rules ensuring fair competition within the EEA. The rules aim to combat concerted decisions and practices, abuse of dominant position, concentration that creates or strengthens a dominant position, and state subsidies that distort competition. The control of these principles is entrusted, according to a specific sharing of competencies, to the Commission, or to an EFTA supervisory authority; 3 – The deepening and broadening of cooperation: it includes the strengthening of existing cooperation and the extension of cooperation to new areas, such as social policy, protection of consumers (EFTA will adopt EC rules for price labelling, misleading advertising, consumer credit), corporate law (for extension to EFTA after the transition period of the European Grouping of Economic Interests); 4 – Institutional and jurisdictional structure. a – The structure of the association: The agreement sets up: an EEA Board (composed of members of the EC Council and Commission and a member of the government of each EFTA state) which lays down overall political orientations; a joint-EEA Committee, which ensures proper functioning of the agreement; a sub-committee of MPs, economic and social partners, etc. b – The jurisdictional structure: This was a very difficult issue because of the asymmetry of the partners in 1992: EFTA was a very flexible international organisation, whereas the EEC was already a very strongly integrated organisation with limitation of competencies and sovereignty transfers. It did not prove possible to set up an EEA Court, as initially planned. The following were excluded from the EEA between the EEC and EFTA, in order to ensure quicker implementation: - Common Agricultural Policy (CAP) and common policy on fishing; - Common Trade Policy (CTP) and the common tariff with third countries; - Harmonisation of direct and indirect fiscal regimes. However, even in these areas, the EFTA 7 had sooner or later to adjust their laws to those of their EEC neighbours’ laws in order to maintain fruitful trade relations. Is the 1992 concept of EEA a good basis for the CEEA between the EU and Russia? On one hand, EEA integration is clearly far from accession. EU membership requires full acceptance of the acquis communautaire. Applicant countries cannot take some parts and reject other parts of the acquis. By contrast, the extent to which the acquis must be adopted by extra-EU EEA members is subject to negotiation, except for the part of the acquis concerning the Single Market. EEA members outside the EU have no say in future elaborations of EU legislation. EU membership makes it compulsory to contribute to the EU budget but, on the other hand, makes each EU country eligible to subsidies in the framework of EU structural policies, regional policy and the CAP (about 75% of EU budget expenses, although the EU intends to exclude the CEECs from the major part of CAP payments). These financial aspects are totally 6 absent from EEA-like agreements. Similarly, EU applicants are supposed to take on the obligations of political, economic and monetary union. This is now part of the acquis. EEA members outside the EU have no such commitments. A closer association between the EU and Russia will have spill-over effects or will impose requirements in such fields as taxation of goods and services, environmental protection schemes, or hygiene standards concerning food products in order to protect consumers. For example, the Polish negotiators on Poland’s accession to the EU regard it as absolutely necessary that local producers will be able to sell meat and milk products inside Poland that do not fulfil the high EU hygiene standards for several years after EU membership. Another example is provided by EFTA, the member-states of which began to reduce VAT-like taxes before the enforcement of the EEA agreement, in order not to distort competition between domestic and EU producers within the EEA. More generally, it can be said in the light of the EEA experience that harmonisation of legislation becomes a necessity sooner or later, even in fields that were excluded from the original agreement, since otherwise benefits from the Single Market are not fully exploited. On the other hand, the reference to the CEA of 1992 could become misleading for Russia. The main reason is the strong asymmetry between the EU and Russia: as shown by Havlik (2002), Russian real GDP amounts to less than 13% of that in the EU(15), in nominal terms to less than 4%; Russia's per capita real GDP is even lower than the average of the CEECs; Russia is a relatively small trading partner for the EU, whereas the EU is the main trading partner for Russia; the commodity structure of Russian exports and imports is also widely different, there is virtually no intra-industry trade between Russia and the EU. This asymmetry is one of the main reasons why Russia's EU membership is not on the agenda. This leads to another difficulty in defining the concept of the CEEA, which is to escape from the paradigm of EU enlargement. Such a paradigm, well-represented by Hamilton (2002), consists of relying on the tools and the dynamics of the EU enlargement for understanding the integration process between the EU and Russia, and leads to a dead end. Reference to the EEA belongs, of course, to this approach. To rely on this paradigm means to under-estimate the asymmetry while focusing on the legal approximation process and neglecting the needs for economic approximation. 3 - Why does Russia need to build a CEEA with the EU? Like the European Economic Area (EEA) for the EEC and EFTA, the CEEA is a pragmatic approach to solving the problems of increasing trade and investments between Russia and the EU. We will therefore offer a preliminary analysis of the problems of EU–Russian trade, and the importance for the Russian economy of improving productivity and achieving sustainable growth. It will then be shown that prospects of imminent EU enlargement strengthen the need for the EU–Russia CEEA. 3.1 The shift towards another growth model for the Russian economy Russia’s macroeconomic situation since 1999 appears fairly healthy. Russian growth is mainly powered by exports: the increase in the trade surplus since 1998 has been 2–2.5 times greater than the rise in GDP. However, as two-thirds of Russian exports are primary goods, 7 Russia’s growth depends on the evolution of world market prices. The point is confirmed by the fact that imports, particularly imports of machinery and equipment, have not increased significantly. We are thus far from a Russian economic boom, based on multi-sectoral productivity increases and strong investment activity. The overall investment rate relative to GDP has remained low at under 20% during the last five years. This is a long way below the rates that are needed for economic take-off in emerging economies – between 25% and 35% in a medium-term perspective. Russia remains mainly a rent economy, with growth driven by primary goods production and export. This model cannot be maintained in the long term for the following reasons: The model is incapable of providing sustainable growth, since growth in such a model depends on increasing world prices for energy or huge investments to increase output; Rent is highly concentrated and largely exported, threatening a situation in which economic growth is accompanied by the growth of inequalities; The model produces effects typical of Dutch disease, i.e. strengthening of primary, state and public service sectors at the expense of industry and agriculture, low inter-sectoral rent flows, and slow growth of productivity; Without strong political will for economic reform, the division of the economy into rich and poor sectors becomes unalterable, because those with dominant economic power do not need structural change. The alternative model for growth in Russia is to turn the country into a diversified manufacturer and competitive exporter. That means making the economy more integrated and open. Such a way forward is more consistent with the human and capital resource endowment of the country. The features of the alternative, sustainable growth model are: Homogenisation of Russia’s internal economic space in order to improve macroeconomic efficiency (factor allocation) and ensure a multiplicatory effect; Strong exports of manufactured goods, requiring major productivity increases through Russian and foreign capital investment. This requires: strong improvement of the investment and business climate; consistent macroeconomic policy (low inflation, stable rouble); consistent social policy to reduce poverty. The concept of this growth model is to transform mineral rent into capital invested in valueadded activities. This model is not a dream: some elements of it are already working in selected open regions, such as Novgorod Velikii, and of course Moscow and St. Petersburg. However, the dynamic factors in these regions are too partial, and disseminating effects fail to operate. Strong sustainable growth requires 30 Novgorods in Russia. A qualitative leap is needed. Such an economic diagnosis is very close to the views expressed by the Ministry of Economic Development and Trade (MEDT) in, for example, ‘The Mid-Term Programme for Social and Economic Development of the Russian Federation’ which deals with the period 2002–2004. The prospect of a CEEA between Russia and the EU is likely to foster and give a decisive impulse to this process. Besides its fuel exports, Russia has potential for growth based on an internal market, mainly oriented towards final demand of consumers. This market is currently 8 too small to generate strong endogenous growth, and has a preference for imports, because domestic production fails to meet the standards which Russian consumers desire. The creation of a CEEA with the EU is likely to extend this market by the addition of EU demand and provide new investments in domestic consumer goods production. The potential for additional trade between the EU and Russia is very important/significant [Fontagnié, Freudenberg and Pajot (1999), as well as Busch and Piazolo (2001) have shown that potential for trade expansion remains very large even between the EU and Central and Eastern European countries]. Thus, the CEEA will generate strong flows of investment attracted by the opportunity of using local skills and materials to serve the expanding domestic market. Crucially, it will also open the possibility of serving the huge EU consumer and business markets from a manufacturing base in Russia. The EU represents Russia's largest trade partner, accounting for 33% of Russia's imports and 36% of its exports in 2000 [Soos, Ivleva and Levina (2002)]. Overall, then, the opening of Russia thanks to the CEEA will help to increase the productivity of Russian companies by expanding markets, modernising equipment, and providing information. This will lead to diversification of the production and export structure of the Russian economy towards value-added manufactured goods. 3.2 Fostering structural change in Russia Russia is half-way along the road to a fully-fledged market economy. In short, the liberalisation stage of reform has been largely implemented, with the economy freed from state intervention, at least at the federal level. But the institutions of a market economy are sometimes not in place or not functioning properly. Building the institutional framework of a market economy is a difficult task and there is no rich store of international experience showing how to accomplish this successfully [Samson (1994), Jordan, Samson (2000)]. It requires change in the behaviour of enterprises, producers and consumers, as well as of central and regional administrations. This cannot be achieved by law or decrees alone, because the processes have cultural and political dimensions. They have a cultural dimension because the structural changes also concern values and mentalities, which are often hard to change or are even unchangeable, except by ‘special events’ (of which more below). They have a political dimension because there are confidence and consensus factors involved in the change, and the leaders, political forces and elite, who carry out the change, are an important variable. In this respect, the new political impulse and image given by Vladimir Putin is vital. Under his authority, the reform programme implemented by the MEDT has made substantial progress and the State Duma has done intensive and efficient work: major changes worth citing include the Tax Code, the Corporate Conduct Code, and the Customs Code. However, this process is still too slow to meet the economic requirements of sustainable growth. Lack of rapid progress is producing a bottle-neck in the development of a market economy and impeding the improvement of the business climate. Completion of the institutional framework of the market is needed to reverse capital outflows and to attract both Russian flight capital and foreign capital from abroad. A common weakness of analyses of Russia's opening up is their focus on trade, such as Hamilton (2002), whereas capital flows (investments) represent the main form of the globalised world 9 economy. Current flows of foreign direct investment to Russia are around $3 bn per year, which is 10 times less than flows to China and far below Russian capacities and needs. What are the most recent findings in the economic literature on FDI? New research, conducted by Brenton, di Mauro and Lücke (1999) on Central and Eastern European countries (CEECs), shows complementarities between trade and FDI flows. Di Mauro (2001) showed with gravity equations that the idea of two phases, commercial transition and then FDI transition, is a wrong representation, since nowadays the two phenomena occur simultaneously. In fact, the deciding role is played by investment itself, whether domestic or foreign. In the neo-classical model of growth in a closed economy, the saving rate is exogenous and equals investment/production. A higher saving rate increases the growth rate for a given initial GDP level. However, the causality is not necessarily one-way. Sometimes, especially in open economies, the growth prospects of domestic markets are what cause investment. Barro (1997) showed that this second relation is more active, as did Blomström, Lipsey and Zejan (1993). This relation could also be valid in the case of Russia. The importance of FDI for growth has been widely discussed in the economic literature. In an empirical study on 114 countries spanning 25 years, Barro (1997) showed a strong positive correlation between FDI and economic growth. However, the direction of causality between FDI and growth has been a controversial issue. Two groups of studies exist: The FDI-led growth approach, represented by Sanghamitra (1987), Musleh-ud (1994), Rodriguez-Clara (1996), Balasubramanyam, Salisu and Sapsford (1996) and Borenzstein, De Gregorio and Lee (1998). Based on growth theory (with FDI as one of the factors), FDI enhances economic growth through spill-over effects and technology transfer (changes in the nature of market concentration and the dissemination of technological, managerial and financial expertise in the industries which multinational firms (MNFs) enter). FDI also helps economic growth through capital formation, export promotion and employment augmentation. The growth-driven FDI approach, represented by Tsai (1991), Wheeler and Mody (1992), Markusen (1995), Markusen, Venables, Konan and Zhang (1996), Zhang and Markusen. (1999). Better economic performance creates a better investment environment and profit opportunities. Most studies focus on MNFs, seeing FDI as a substitute for domestic capital, and judging that FDI inflows increase with domestic demand for capital, generated by economic growth. More importantly, income growth makes it possible for MNFs to exploit economies of scale. Human capital development, labour productivity and infrastructure improvements increase marginal return on capital and thus, the demand for investment, including FDI. In fact, very few empirical studies use a robust procedure in addressing the issue of short-term dynamics and the long-run relationship between FDI and income growth. Instead, they implicitly assume the causality from the statistical association. Zhang and Markusen (1999) tested the relationship and the direction of causation with cointegration and error-correction modelling based on Chinese data for 1977–1998. The estimates provide strong support for bidirectional causation between FDI and income in China and a positive long-run relationship between them. Hence, there are virtuous cycle effects. Such an analysis might be the right approach for Russia and might be confirmed empirically: the recent growth of the Russian 10 economy following 1998 induced an increased inflow of FDI, likely to foster growth and attract more FDI. However, such development is dependent on a second factor, which is institutional change towards a better investment climate. This evolution is reinforced by the growth effect of institutional measures and respect for the law. Analysis of the effect of institutions has not been carried out until recently, and institutions were absent from standard economic theory. Institutions appear in descriptive growth studies, after North (1990), and such studies were followed by empirical research relying on an objective approach to institutions. The works of Kormendi and Meguire (1985), Barro (1991) and Levine and Renelt (1992) revealed solid links between the quality of institutions, on the one hand, and growth, FDI and foreign trade, on the other hand. Subjective assessments of the importance of institutional quality have been developed more recently, based on expert data (country-risk agencies). Mauro (1995) established a solid relation between bureaucratic efficiency and investment (and, indirectly, growth). Knack and Keefer (1995) measured security of property rights and established a robust and positive relation to both growth and investment. Barro (1997) followed Knack and Keefer’s reliance on subjective assessment by experts and focused his attention on respect for law, particularly that concerning contracts and property rights. The correlation with growth is strongly positive. Studies of transition economies started later, but show the same patterns as regards the effect of institutions. The first major research was developed by Brunetti, Kisunko and Weder (1997a) of the World Bank, also using a subjective approach to institutions. A first work on 18 transition economies between 1990 and 1995 revealed a solid link between growth and the credibility of institutions. Another work scrutinised the link between FDI and growth, with FDI being used to assess the credibility of institutions: Brunetti, Kisunko and Weder (1997b) established a solid causality link between the credibility of institutions and both growth and investment. The most recent study, to our knowledge, conducted by Grogan and Moers (2001), is not based on expert views, but on a broader sample of civil society in 25 transition countries from 1990 to 1998 and assessed the impact of perceptions of the role of ‘legal safeguards’, ‘corruption and crime’, ‘law fostering investment’ and ‘risk of non-payment, risk of non-repatriation of capital’. The findings are that quality of institutions is significant for growth, and also for low inflation and economic liberalisation. Moreover, FDI and institutional quality are mutually reinforcing. In studying the experience of CEEC candidates in the approximation of laws, one important finding is that the prospect of EU membership strongly accelerates structural change. Piazolo (2000) shows that requirements for transition towards a market economy overlap with the requirements for EU accession. In another paper, Piazolo (1999) argues that the CEECs can enhance their economic growth prospects through EU-induced institutional change. Adapting the CEECs' institutions according to the EU acquis communautaire helps to establish a functioning market-oriented framework. An estimate of the potential growth effect resulting from this process of institutional rapprochement through EU membership suggests a static bonus in GDP of 12%, not accounting for induced capital accumulation and an additional bonus of up to 24%. 11 The use of the acquis communautaire as a reference, which is already well-functioning and allows creation of a single institutional space, combines with the ‘special event’, represented by the idea of becoming an EU member soon, and the combination produces rapid change in mentalities and behaviours. To take an example: even though the EU competition regime is far from perfect for transition countries, it has been demonstrated by Fritsch and Hansen (1997) and Estrin and Holmes (1998) that rapid implementation of the regime in the context of Europe agreements provides a much-needed anchor for domestic institutions, enhances legal certainty and can foster integration between the EU and the CEECs. Under certain conditions, the orientation of structural reform in Russia towards the EU acquis communautaire may bring a similar result. Of course, Russian history is rather different from that of the CEECs and EU membership is not an objective. The PCA already includes several chapters dealing with the institutional framework of a market economy in Russia, but its committees have not managed to produce a visible effect on the transformation process. Therefore, the CEEA with Russia should be designed to create the ‘special event’ which will carry Russia quickly through its current structural bottle-neck and dramatically improve the investment climate in the country. 3.3 The prospect of EU enlargement favours EU–Russian rapprochement EU membership for 8 or 10 CEEC countries (discussion remains open concerning Bulgaria and Romania) plus Cyprus and Malta is no longer a distant target, and is achievable in the near future. The impact of this enlargement on the Russian economy and on EU–Russian cooperation is a very controversial question. RECEP is investigating this issue and will present its views and measurements in another paper. What we offer here are only initial observations (the simulation conducted by RECEP with GTAP model is still in progress). Trade between Russia and the CEECs has decreased by three times since 1989. The asymmetry of the late-Soviet period, when Russia was more important for the CEECs, has been inverted: in 2000, the CEECs represented 8% of Russia’s imports and 22% of its exports, while Russia represented 9% of CEEC imports and 2% of CEEC exports. This trend suggests that EU enlargement is likely to have consequences for Russia, based on the fact that about 70% of Russia's exports stem from energy, while CEEC sales are more diversified. Russian experts, such as Zuev (2001), assume a likely deterioration in trade and the economic regime for Russia in its relations with the CEECs after their accession to the EU. On the plus side, introduction of EU tariffs in the CEECs will be positive for Russia, because EU tariffs are much lower than those currently in force in the CEECs. However, a number of concerns have been raised by the author, such as application of new non-tariff barriers to trade, deterioration of conditions for the transit of goods (including the problem of transit between Kaliningrad and the rest of Russia), trade diversion due to an increased productivity gap with the CEECs, diversion of investments from Russia to the new EU members, increased competition, infrastructure problems, etc. From a political point of view, the process of EU enlargement is welcomed by Russia, since it is understood that Russia will have a reliable neighbour on the continent to the west of its borders, and that the EU will be increasingly able to adopt policies independently of the US. At 12 the end of his visit to Italy to hold talks with the Italian President in November 2000, Vladimir Putin stated unequivocally that Russia had a positive attitude towards EU enlargement4. This favourable political climate should be a basis for intensifying cooperation between Russia and the EU15 in order to prevent any crowding-out of Russia. In a similar way, closer cooperation between Russia and the CEECs should be fostered, in order to keep these important export markets for Russia. This issue is now a part of Russia’s export strategy. The building of a CEEA that will embrace Russia and the EU15, as well as the new CEEC members, is an adequate solution to these issues. The CEEA is more than a useful solution for Russia – it is a necessary solution, since the enlarged Union will represent 55% of Russian exports. This is almost the same percentage as the EEC share of EFTA exports when the EEA was signed in 1992. 3.4 The spirit of building a common European home We should not underestimate the support that can be provided by public opinion in the EU and Russia for the task of reconnecting the two main parts of the European continent, which share a common history and destiny. It is clear that the iron curtain has not moved eastwards, but has definitely disappeared. This corresponds to Mikhail Gorbachev's motto of building a common European home or to Francois Mitterand’s idea of a large European family. It is in accordance with the values of European democracy, which managed to embrace the traditions of different cultures and nations. Movement into the CEEA should not be understood on the Russian side as a further step away from traditional CIS allies. On the contrary, most of the western CIS countries have made their strategic choice in favour of closer ties with the EU, so that closer interaction with the EU is also a way for Russia to keep these traditional allies. Moreover, in a second step, there is no reason why entry of some other CIS countries into the CEEA should not be envisaged. 4 - What content and options for a CEEA concept? The concept of the CEEA, which emerges from the present analysis, highlights mutual intensification of exports and FDI between the EU and Russia, fuelled by a self-enforcing mechanism of growth and structural change in Russia oriented towards the EU acquis. The main features of this concept are presented in what follows, although several options still remain open and need to be discussed further. RECEP has begun studies to simulate the impact of various forms of this concept on the Russian economy. 4.1 Cornerstones of the proposed CEEA concept The most important features and requirements of the CEEA are as follows: The core of the CEEA concept is a major increase in flows of goods and capital between the EU and Russia, connected to productivity increases in most sectors of the Russian economy; The CEEA requires broad adoption by Russia of the acquis regarding two issues which are crucial for market transparency and efficiency: company law (Chapter 5: public disclosure of 4 Kommersant, Interfax, November 28, 2000, quoted by V. Zuev 13 the identity of those empowered to represent a company, its financial situation; protection of intellectual and industrial property rights) and competition policy (Chapter 6: antitrust legislation, state aid, mergers, liberalisation of market entry). These are the main factors capable of improving the investment climate in Russia. Following the spill-over effects of the CEEA, some additional and partial approximations in laws on such issues as taxation (Chapter 10), agriculture (Chapter 7), environment (Chapter 22) and consumer protection (Chapter 23) would increase the benefits of the single market (see next item); Another major tool of the CEEA is the implementation of a single market between Russia and the EU, ensuring the four fundamental freedoms, which are the free movement of goods, persons, services and capital. This means the broad adoption in EU–Russian exchanges of provisions of the first four chapters of the acquis. Together with the two essential chapters mentioned above, Russia will thus need to broadly adopt the acquis in its first six chapters; Strengthening and broadening of cooperation: this sub-title of the EEA concept of 1992 should be kept because it helps to focus in a pragmatic way on the issues likely to bring the largest and quickest mutual benefits within the CEEA. With regard to existing cooperation, the energy dialogue is in first place, since it is the best example of a mutually advantageous issue. Another special field for new cooperation is internal and external use of the euro by Russia; Elements of membership criteria and of Maastricht criteria: political dialogue in the CEEA framework and cooperation on security issues will lead to inclusion of large parts of the first and second pillars of the Copenhagen criteria in the definition of the CEEA; Institutional and jurisdictional structure: the first step towards the institution of the CEEA was the creation of the High-Level Group after the 7th Summit. The point is to define to what extent PCA institutions are able to provide a basis for CEEA institutions; Administrative structure building for enforcement and implementation of laws and regulations The adoption of the acquis cannot be limited to the formal legal process: the key issue is to ensure implementation of these laws and to provide the administration necessary for following-up and controlling this process. Proper functioning of the CEEA is thus connected with the improvement of economic federalism in Russia and requires a reform or radical change in the working, and possibly in the structure, of state administration. To summarise, the content of the CEEA proposed here relies on intensive co-production made possible by Russia’s broad adoption of the acquis in six chapters, on complex cooperation measures in political, economic and social fields and on administrative reform in Russia to improve economic federalism and control implementation of laws and regulations. 4.2 Options and implementation of the CEEA as a tool for modernising Russia Further definition and implementation of the CEEA concept and sequencing should not forget the comprehensive logic of the CEEA. It is important to remember that the free-trade agreements between the EC and EFTA signed in 1973 brought slow results compared to the accelerating integration dynamic within the EC. The purpose of building the EEA in 1992 was to boost this process by injecting self-enforcing integration dynamics. The concept of the CEEA between the EU and Russia aims at injecting similar integration dynamics, which, as in the EEA, go far beyond trade liberalisation. However, in the case of Russia, this process must be initiated by a strong rapprochement, in which the acquis fosters market institution-building in Russia as the condition for launching an integration dynamic within the CEEA that will intensify mutual flows of trade and investments. The EU will function as an outside peg for 14 institution building. The other conditions are administrative reform and the unification of the internal Russian market, without which the quick shift towards a sustainable growth model will not happen. One major weakness of the CEEA discussion is that it is conceived within the paradigm of EU enlargement and its tools, whereas this issue is not on the agenda. According to this paradigm for example, it is not acceptable to select what part of the acquis is relevant for Russia, whereas the other approach subordinates the legal approximation to its impact on economic convergence [Hamilton (2002)]. On the contrary, the CEEA should be more understood as a tool for economic approximation between the EU and Russia than as an institutional target in itself. There is no reason to press the binding function of the acquis on Russia, and a strategy of ‘take this and leave that’ is reasonable5. However, it is also important to prevent domestic lobbies from dictating Russia’s attitude towards the acquis. The key point is not acquis orthodoxy, but the high economic consistency, described above, which is behind the orientation of Russian structural change toward the acquis. The broad adoption of six chapters of the acquis is a huge challenge for Russian society, entailing orientation towards the highest standards in economic and social life. Three important remarks need to be made: There is a broad field for discussion between the two parties to define the precise content of acquis adoption in the six chapters and the process for achieving it; The right sequencing between the six chapters needs to be found. Broad opening of borders should keep in step with the modernisation of Russian companies through strong investment activity relying largely on outside (foreign and repatriated Russian) capital. It is not unthinkable that, after a change in the investment climate, the CEEA could be mainly characterised by extensive, joint-productive activities between EU and Russian partners; Russia is neither an EFTA country nor a CEEC. Its national specifics, both geographical and historical, must be taken into account, as well as the distinctive features of its society. Moreover, the CEEA concept should bear in mind Russia's specific situation, and the asymmetry caused by its lower per capita GDP and institutional development. The special position of Kaliningrad also needs to be considered: a recent report written by Samson (2002) shows that this region is not really depressed and contains many potentialities. This opens the way for a step-by-step approach, keeping these factors in view. For example, the mutual opening up could be quicker on the EU side than on the Russian side. Precedents of asymmetric treatment granted by the EU (CAP agreements, association agreements) demonstrate that the mutually-beneficial integration of Russia into the CEEA is quite feasible, despite Russian–EU asymmetry. Manzocchi and Ottaviano (2001) showed that the asymmetric phasing-out of trade barriers within the accession process (Europe Agreements) reduces the insider-outsider income gap. Many options remain open for other elements of the CEEA concept, which are less precise and sometimes less binding. Such options will be defined later on. However, the six chapters should have rather binding force for creating a common area. Of course, important adaptation work is needed, with numerous relevant EU directives giving birth to a national legislative process. One should not underestimate the huge work that has to be done in this respect, for 5 See, for example, in Fritsch and Hansen (1997) a contribution by Nikolaides and Mathis, in which the authors analyse under what circumstances EU laws and policies are inadequate or inappropriate for promoting and maintaining competition in transition economies. 15 example, in demonopolising the banking sector, or creating the conditions of freedom of establishment and service provision. In certain respects, this process takes the same direction as accession to the WTO. In addition to foreign trade regulation, important measures of legislation approximation in the field of internal economic regulation are characteristic of the WTO discussions, as they are of the CEEA discussions. The areas concerned include intellectual property rights, competition, subsidies to industry, opening up of the services market, prices and norms in agriculture etc. The question which arises is: how to organise WTO and CEEA negotiations? The fact that the WTO requirements are less deep and comprehensive in these fields suggests that negotiating WTO accession should be a first step, followed by concentration on the CEEA. This approach is correct, but sometimes not optimal, for two reasons. According to Prikhodko and Pakhomov (2001), WTO accession requires the changing of more than 1000 laws and regulations on foreign trade issues alone, not to mention laws and regulations on internal economic regulation. This is an immense and long task and in several fields the legal process can start immediately in the CEEA perspective, without awaiting the outcome of the WTO discussions. This was already partly the case in competition issues. The second reason why it may not be right to focus first exclusively on WTO accession is that lack of an institutional framework based on the impulse provided by the acquis might make it hard for Russia to reap the full benefit of economic opening up, as well as other advantages associated with WTO accession. However, one good reason for supporting a sequenced approach relies in what we could call the "political economy of opening up": the expert staff which the Russian government mobilised for WTO negotiation is rather narrow, and it is the same staff that is discussing CEEA issues. The margin for intensifying CEEA thinking without damaging WTO negotiation is thus very limited. The discussion of options for the CEEA should, however, take into account the greater economic distance between the EU and Russia, compared with that between the EU and CEE countries. This is principally reflected in levels of economic development, but also by economic history and the late and young capitalism that appeared in Russia at the end of the 19th century. GDP per capita 1999 $ PPP (purchasing power parity) Russia Bulgaria Czech R. Estonia Hungary Latvia Lithuania Poland Romania Slovak R. Slovenia 7473 5071 13018 8355 11430 6264 6656 8450 6041 10591 15977 Source: World Bank Russia's per capita GDP is lower than the average of the CEE candidate-countries, and of course, much lower than those of the EFTA countries when the EEA was created in 1992. This fact should be taken into account when discussing the options for the CEEA and the transition phases which Russia would need in adopting the acquis. However, as the table shows, Russia’s PPP per capita is not very far from the CEEC average and is more developed than four candidate countries (estimations of Russia’s PPP per capita are between 5500 and 7500 USD) . The distance is greater as regards the institutional framework of a market economy. However, like WTO accession, CEEA integration should not mean brutal and extensive opening up, or loss of protection. The process would involve adaptation periods, in which selected industries would prepare for the new competition conditions, as happened with 16 Brazil’s automotive industry when that country acceded to the WTO. A transition period of 12 years was introduced in the CEEC for implementing the right of foreigners to buy land. One issue of special importance for the CEEA is that the four fundamental freedoms call for free movement of persons between the EU and Russia. This was also stressed by EU commissioner Chris Patten during the Moscow Summit of December 3, 20016. The issue has extremely strong symbolic power as a visible sign that the iron curtain has been demolished and that we are all living in the same Europe. Free movement of persons is the highest message of confidence that the EU can give to the Russian people. Is it realistic to envisage this measure being implemented in the near future? Our view is yes, within the CEEA. Free movement of persons in the EU is planned for CEEC candidate countries with a delay of seven years after EU membership, after the period needed for reducing the strongest asymmetries, i.e. around the year 2011. If a strong and efficient impulse is given to the building of a CEEA between the EU and Russia, with strong investment activity and an economic boom in Russia, the prospect of free movement of persons seems realistic in a similar time-scale following the formal start of the CEEA. Concrete ways of liberalising the movement of people between the EU and Russia could be tried earlier on a small scale in Kaliningrad, which has been nominated by the two sides as a pilot-region for EU–Russia cooperation. *** Through the building of a CEEA, the EU is not aiming to uniformise Russia, but to offer a model for economic and legal integration which can help to boost Russian economic performance. Both the EU and Russia have achieved internal unities, made up of a huge diversity of nations, cultures, and religions. The time has now come to close the gap opened in Europe at the beginning of the last century. Integration within a CEEA opens the way to this objective. For Russia, the concept can offer a time-saving of 10-15 years. The anchoring of Russia’s economic growth and institutional change to the European Union, the world’s biggest economy, will save the Russian people from another long test of patience, allowing rapid changeover to a strong and sustainable growth model in Russia and thus, a better life for its citizens. References Balasubramanyam V. N., Salisu M. and Sapsford D. (1996), FDI and Growth in EP and IS Countries. Economic Journal, 106, 434, January, pp.92-105 Barro R. J. (1991), Economic Growth in a Cross Section of Countries. QJE 106(2) May, pp.407-443 Barro R. J. (1997), The Determinants of Economic Growth: A Cross-Country Empirical Study. MIT Press, 145 pages. Blomström M., Lipsey R. E. and Zejan M. (1993), Is Fixed Investment the Key to Economic Growth? National Bureau of Economic Research, WP No. 4436. 6 As reported by the Financial Times Dec 11, 2001 by Andrew Jack and Michael Mann 17 Borenzstein E., De Gregorio J. and Lee J-W.(1998), How Does Foreign Direct Investment Affect Economic Growth ? Journal of International Economics, 45, 1, June, pp. 115-135 Brenton P., di Mauro F. and Lücke M. (1998), Economic Integration and FDI: An Empirical Analysis of Foreign Investment in the EU and in Central and Eastern Europe. CEPS Working Document n°124. Brunetti A., Kisunko G. and Weder B. (1997a), Credibility of Rules and Economic Growth: Evidence from a World-Wide Survey of the Private Sector. World Bank Policy Research Working Paper 1760. Brunetti A., Kisunko G. and Weder B. (1997b), Institutions in Transition: Reliability of Rules and Economic Performance in Former Socialist Countries. World Bank Policy Research Working Paper 1809. Busch C. M. and Piazolo D. (2001), Capital and Trade Flows in Europe and the Impact of Enlargement. Kiel Institute of World Economics, Economic systems 25, issue 3, septembre, pp183-214. Di Mauro F. (2001), Economic Integration Between the EU and the CEECs: a Sectoral Study. CEPS Working Document No. 165, April. Emerson M., Vahl M. and Whyte N. (2001), The Elephant and the Bear – The European Union, Russia and their Near Abroad. CEPS. Estrin S. and Holmes P. (eds) (1998), Competition and Economic Integration in Europe. Elgar, Cheltenham, UK and Northampton, MA. Fontagnié L., Freudenberg M. and Pajot M. (1999), Le potentiel d'échanges entre l'Union Européenne et les PECO, Un réexamen. Revue économique, Vol. 60, No. 6, November, pp. 1139-1168 Fritsch M. and Hansen H. (eds) (1997), Rules of Competition and East-West Integration. Kluwer, Boston, Dordrecht and London. Grogan L. and Moers L. (2001), Growth Empirics with Institutional Measures for Transition Countries. Economic Systems, Vol. 25, 4, pp.323-344. Hamilton Carl B. (2002): Russia’s European Integration, escapism and current realities, unpublished, Stockholm School of Economics and CEPR, London, July 2002. Havlik °Peter, (2002): Costs and Benefits of Economic Integration: Some Lessons for the Russian Federation, RECEP and WIIW Working paper, June. Jordan A. and Samson I. (2000), Vers une typologie des politiques de réformes postsocialistes : à la recherche des institutions. GTD, Working Paper, March. Knack S. and Keefer P. (1995), Institutions and Economic Performance, Cross-Country Test Using Alternative Institutional Measures. Economics and Politics 7(3) November, pp. 207-227 Kormendi R. C. and Meguire P. G. (1985), Macroeconomic Determinants of Growth: CrossCountry Evidence. Journal of Monetary Economy, pp. 141-163 Levine R. and Renelt D. (1992), A Sensivity Analysis of Cross-Country Growth Regression. AER 82, pp. 942-963 Manzocchi S. and Ottaviano G. (2001), Outsiders in Economic Integration. Economics of Transition, Vol. 9 (1), pp. 223-249 18 Markusen J. R. (1995), The Boundaries of Multinational Enterprises and the Theory of International Trade. JEP 9, 2, Spring, pp. 169-190 Markusen J. R., Venables A., Konan D. and Zhang K. H. (1996), A Unified Treatment of Horizontal Direct Investment, Vertical Direct Investment and the Pattern of Trade in Goods and Services. NBER Working Papers 5696. Mauro P. (1995), Corruption and Growth. QJE 110, pp. 681-712 Musleh-ud (1994), Export Processing Zones and Backward Linkages. Journal of Development Economics, 43, 2, April, pp. 369-385 North D. (1990), Institutions, Institutional Change and Economic Performance. CUP Cambridge. Piazolo D. (1999), Growth Effects of Institutional Change and European Integration. Economic Systems, Vol. 23, 4, pp. 305-330 Piazolo D. (2000), Eastern Europe Between Transition and Accession: an Analysis of Reform Requirements. Kiel Working Papers No. 991. Prikhodko S., Pakhomov A.: Problems and Prospects of Russia's accession to WTO ; RECEP Working Paper September 2001. Rodriguez-Clara A. (1996), Multinationals, Linkages and Economic Development. AER 86, 4, September, pp. 852-873 Samson I. (1994), The Stabilisation of Transition in Post-Communist Societies, Communication at the PROMETEE seminar, Buenos-Aires July. Presented also at the conference ‘Central Russia at the edge of XXIth century’ Orel (Russia) July 1995. Samson I. (dir) (2002), The Kaliningrad Economy – at the Edge of EU Enlargement. ‘Promoting Trade and Investment in Kaliningrad Oblast’. Economic Survey, Tacis, The European Commission, Brussels, March. Sanghamitra (1987), Externalities and Technology Transfer Through Multinational Corporations: a Theoretical Analysis. Journal of International Economics, 22, 1–2, February, pp. 171-182 Soos A., Ivleva E. and Levina I. (2002), The Russian Manufacturing Industry in the Mirror of its Exports to the European Union. RECEP Research Paper, March, www.recep.org/rp/. Tsai P. L. (1991), Determinants of Direct Foreign Investments in Taiwan: an Alternative Approach with Time-Series Data. World Development, 19, 2–3, February–March, pp. 275-285 Vahl M. (2001), Just Good Friends? The EU-Russian ‘Strategic Partnership’ and the Northern Dimension. CEPS Working Document, No. 166. Wheeler D. and Mody A. (1992), International Investment Location Decision: the Case of US Firms. Journal of International Economics, 33, 1–2 August, pp. 57-76 Zhang K. H. and Markusen J. R. (1999), Vertical Multinational and Host-Country Characteristics. Journal of Development Economics, 59, 2, August, pp. 233-252 Zuev V. (2001), Relations between Russia and the EU. Working Paper, IMEMO. 19 RUSSIA’S FOREIGN TRADE7 Table 1. Commodity structure of Russian exports* Agricultural raw materials and foodstuffs Energy and fuels $ mn % $ mn % Chemical products $ mn Wood and paper Textiles and footwear % $ mn % $ mn 1996 1688 1997 1407.1 1998 1186.9 1999 764.2 2000 2001** 1298.8 1335.75 1 2.1 1.8 1.8 1.1 1.3 1.5 38214.9 38061.3 27648.6 30601.4 52142.2 48487.4 6 46.8 47.4 41.5 44.3 53.5 55.2 7005.5 6577.1 5587.8 5676.5 6801.4 6360.10 6 8.6 8.2 8.4 8.2 7 7.2 3492.9 3501.9 3405.8 3594.3 4276 4157.03 9 4.3 4.4 5.1 5.2 4.4 4.7 901.1 826.3 725.5 694.2 655.4 544.125 1.1 1 1.1 1 0.7 0.6 16178.9 16714.8 14708.2 14147.2 16681.7 12940.6 7 % 19.8 20.8 22.1 20.5 17.1 14.7 Machinery and $ mn 7874.6 8176 7316.5 7257 8394.3 8756.92 equipment 7 % 9.7 10.2 11 10.5 8.6 10 Other $ mn 6229.5 5097.9 6063.9 6383.7 7216.8 5246.94 5 % 7.6 6.2 90 9.2 7.4 6.1 Total $ mn 81585.4 80362.4 66643.2 69118.5 97466.6 87829.0 2 % 100 100 100 100 100 100 * Total registered exports, excluding exports to Belarus ** January-November Source: Customs Committee Metals and metal products 7 % $ mn Prepared by S. Afontsev, RECEP. 20 Table 2. Commodity structure of Russian imports* 1996 1997 1998 11168.1 12714.6 10265.6 1999 7673.7 2000 2001** 6976.8 7782.1 Agricultural raw $ mn materials and foodstuffs % 26 26.3 26.3 28.4 23.1 23.4 Energy and $ mn 1720.6 1869.8 1416.2 723.3 1382.6 894.9 fuels % 4 3.9 3.6 2.7 4.6 2.7 Chemical $ mn 6309.4 7019.2 5940.5 4446.1 5620.7 6286.5 products % 14.7 14.5 15.2 16.4 18.6 18.9 Wood and $ mn 1446 1738.3 1530.6 955.9 1136.8 1354.1 paper % 3.4 3.6 3.9 3.5 3.8 4.1 Textiles and $ mn 1966.9 1935.7 1267.6 1150 1451.1 1599.3 footwear % 4.6 4 3.3 4.3 4.8 4.8 Metals and $ mn 3748.1 3310.8 2664.7 1955 2491.6 2502.8 metal products % 8.7 6.9 6.8 7.2 8.3 7.5 Machinery and $ mn 13671.7 16938.8 13909.3 8773.4 9227.1 10809.9 equipment % 31.8 35.1 35.7 32.4 30.6 32.5 Other $ mn 2978.9 2731.3 1976.9 7978.2 1855.2 2073.1 % 6.8 5.7 5.2 5.1 6.2 6.1 Total $ mn 43009.7 48258.5 38971.4 33655.6 30141.9 33302.6 % 100 100 100 100 100 100.0 * Total registered exports, excluding exports to Belarus ** January-November Source: Customs Committee Table 3. Regional structure of Russian foreign trade* (%) Exports Total 100 100 100 100 100 100 100 CIS 18.6 18.7 19.5 19.2 14.7 13.4 14.0 Imports EU CEE Other Total 33.6 13.7 34.1 100 32.1 14.8 34.4 100 32.9 15.7 31.9 100 32.5 14.6 33.7 100 34.1 15.2 36 100 35.8 17.3 33.5 100 37.4 16.7 31.9 100 1995 1996 1997 1998 1999 2000 2001* * * Total registered foreign trade ** January-September Source: Customs Committee 21 CIS 29.1 31.6 26.8 26 27.6 34.4 28.8 EU CEE Other 38.4 11 21.5 34.5 8.6 25.3 36.9 10.1 26.2 36.1 8.8 29.1 36.9 7.0 28.5 32.8 7.2 25.6 35.1 5.5 30.6 VARIOUS INDICATORS FOR RUSSIA AND CANDIDATE COUNTRIES (2000) Russia Bulgaria Cyprus Area Population Pop. density GDP PPP/ GDP % Agriculture % added value % employment Inflation Unemployment Budget bal. Trade bal. exp > EU imp < EU EU trade bal Current acc. FDI stock FDI net flow Czech Estonia Hungary Latvia Lithuania Malta Poland Romania Slovakia Slovenia Turkey Rep 79 45 93 65 65 0,3 313 238 49 20 775 10.3 1.4 10 2.4 3,7 0,4 38,6 22,4 5,4 2 65,3 130 32 108 37 57 1240 124 94 110 98 84 13018 8355 11430 6264 6656 8450 6041 10591 15977 6380 2.9 6.9 5.2 6.6 3,3 5 4 1,6 2,2 4,6 7,2 1000 km² 17 075 mln inhab 144.8 inhab/km² 8 USD per capita 7473 annual 8.3 111 8.2 74 5071 5.8 9 0.8 82 6.4 13 21.3 10.5 4.4 235.3 35.8 32.8 -27851 14.5 n.a. 10.3 16.4 -0.7 74.1 51.2 44 146 3.8 9.2 4.9 3.4 -3.2 12.2 47.7 55.9 2098 3.9 5.1 3.9 8.8 -4.2 90.1 68.6 61.9 2330 6.3 7.4 3.9 13.7 -0.7 74.5 76.5 62.6 94 4.8 6.5 10 6.4 -3.1 87.6 75.1 58.4 1086 4.5 13.5 2.6 14.6 -2.7 58.5 64.6 52.4 118 7,6 2,3 19,6 1,9 0,9 2,4 16 4,5 -3,3 -6,6 69,8 71,9 47,9 33,5 43,3 59,9 4,3 1773 3,3 18,8 10,1 16,1 -3,5 64,7 69,9 61,2 10530 12,6 42,8 45,7 7,1 -3,8 78,8 63,8 56,6 1061 4,5 36,7 12,1 18,6 -6,7 92,8 59,1 48,9 -434 3,2 14,6 9,9 34,9 8,9 54,9 7 6,6 -2,3 -11 86,4 50,9 63,8 52,3 67,8 48,8 1818 12266 18.4 161 -0.2 -5 239 7.1 -5.2 n.a. 1.8 -4.7 2213 9 -6,7 1980 8 -3.3 1790 2.9 -6.9 943 5.7 -6 -14,5 683 n.a. 3,4 18 -6,3 671 5,3 -3,7 317 2,8 -3,7 1000 10,8 -3,3 1348 1 Ann. average % active pop.(ILO) % GDP % exp/imp % tot exp % tot imp With country (mlnEUR) % GDP EUR per cap. % GDP 4.8 Sources: Eurostat from national sources http://europa.eu.int/comm/enlargement/report2001/#Conclusions PPP calculations World Bank 1999 For Russia: RECEP from national sources -4,9 n.a. 0,5 23