Pharmaceutical R&D - Convention on Biological Diversity

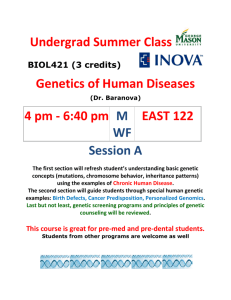

advertisement