Making your Simplified Cash Flow Balance19Oct06

advertisement

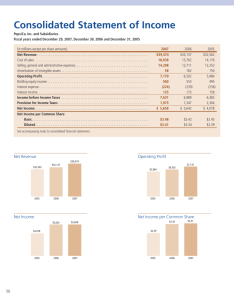

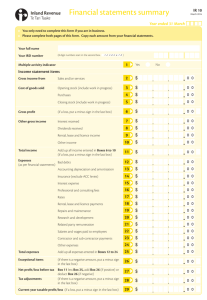

Balancing Your Cash Flow Forecasts FR-CF-1 – Making Your Simplified Cash Flow Forecasts Balance Sudweeks Forecasting your Cash Flow Statement going forward is an important part of your analysis. You must know how much cash is being used each year based on your current assumptions and forecasts. Due to the flexible nature of this analysis framework, you must also be able to understand when you change your forecasts, what is its impact on your cash flow. Historically, half the class will able to make their cash flows balance, usually within the first 30 minutes. Of the other half of the class that I see, nearly 95% of the problems I see can be attributed to a simple formula problem, they left out a line on the balance sheet, a formula was backward, or there was extraneous data. Remember the rule of thumb for this class. After you have worked on a problem for an hour, come and see either me, your mentor, or my Teaching Assistants so we can help. Don’t waste your time unnecessarily. It is a challenge to get your cash flow to balance since a single incorrect formula will throw off the entire analysis. As such, you need to be extremely detailed in your analysis and thorough in your spreadsheet work. Before you come with questions regarding getting your cash flows to balance, here is a list of the twelve most common problems. I will expect you to go through these first before coming and talking with me. These suggestions may be helpful in getting your cash flows to balance correctly. General Comments: 1. The first step is to make sure your balance sheet balances. Put in a “Check on the Balance Sheet” formula below the Liabilities and Shareholders Equity, and put in the formula which is Assets less Liabilities and Shareholders Equity. For the historical information, this should equal zero. If not, go back to the SEC websites and annual or quarterly reports, and find the problem. If the Check is not zero on the forecast columns, then you need to make the balance sheet balance. If assets are greater than liabilities and owner’s equity, you would add to Long-term debt as the plug figure. If assets are less, you would add to cash as the plug figure until the balance sheet balances. These two accounts are your plug figures to make the balance sheet balance. Do not put a formula in the cash cell, as the macro you will be writing will not work. Cash Flow Statement 2. Check to make sure that your forecast and historical cash flow formulas are correct. Check on your historical data first. Sum your cash from operations, investing, and financing, and it should add to your top line. Then make sure you - Page 1 of 3 - Balancing Your Cash Flow Forecasts are picking up this year’s cash and last year’s ending cash, and then the difference between those. The sum of all the cash flows and the difference in cash should balance. If those do not balance, look to your historical cash flow statement. There may be a line which states: “Effect of foreign exchange rates on cash.” It that matches your difference, then the formulas for the historical are correct. 3. Check to make sure that you are referencing the correct column, i.e. liabilities and owners equity are current year less previous year and assets are previous year minus current year. Check every single line. One single incorrect formula will result in a cash flow that doesn’t foot. Copy exactly the Simplified Cash Flow Statement from the Apple Example exactly as is and you should be close. 4. Remember that there should be nothing in the rows which are “calculated differences” in the forecast columns. These are only plug figures for the historical cash flows. We actually create a “simplified cash flow statement” which just takes the difference between the forecast years, rather than a detailed forecast on a year-by-year basis. 5. Check to make sure you are referencing every line in the balance sheet. Note that you will reference Net PP&E indirectly, as you will reference both gross PP&E and accumulated depreciation (net PP&E is the difference between these two). Also you will reference Net Income indirectly, as it is included in your Operating Cash Flow, and so you must take it out of your Shareholders equity via Retained Earnings. 6. Often a company will have a line between Long-term Liabilities and Shareholders Equity which may be minority interests. Make sure it is included in your analysis, and I generally include it in Other Liabilities 7. Make sure that Dividends, if you have them, are included as a decrease in cash, i.e. a negative, and Depreciation and Amortization as a non-cash item, i.e. a positive. A wrong sign will make it impossible to balance. 8. Make sure your Depreciation Expense equals the difference between current years Accumulated Depreciation and previous years Accumulated Depreciation from the balance sheet. Balance Sheet 9. Make sure that you calculate Retained Earnings correctly, which is Previous Retained Earnings plus current Net Income less current Dividends. The easiest way is to use the dividends is in the Simplified Cash Flow statement. However, since in this statement the dividends are negative, dividends, to subtract them, must be added (since adding a negative is the same as subtraction). - Page 2 of 3 - Balancing Your Cash Flow Forecasts 10. Make sure your formulas are correct, and are correctly copied to the forecast columns. Make sure there are no extraneous formulas or data. Income Statement 11. Make sure you are referencing the Net Income line in the income statement. If it is a different line, it will not work. 12. Make sure formulas are correct, and that they match the historical data. Then copy the formulas to the forecast data. If you will first check each of these areas, there is a much greater likelihood that you will be able to balance your cash flows within the first 30 minutes. If you have any questions or suggestions, please see me. Thanks. Bryan FR-4A - Making your Simplified Cash Flow Balance 10May02 - Page 3 of 3 -