Loanable Funds vs. Money Market Analysis

advertisement

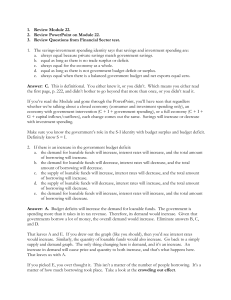

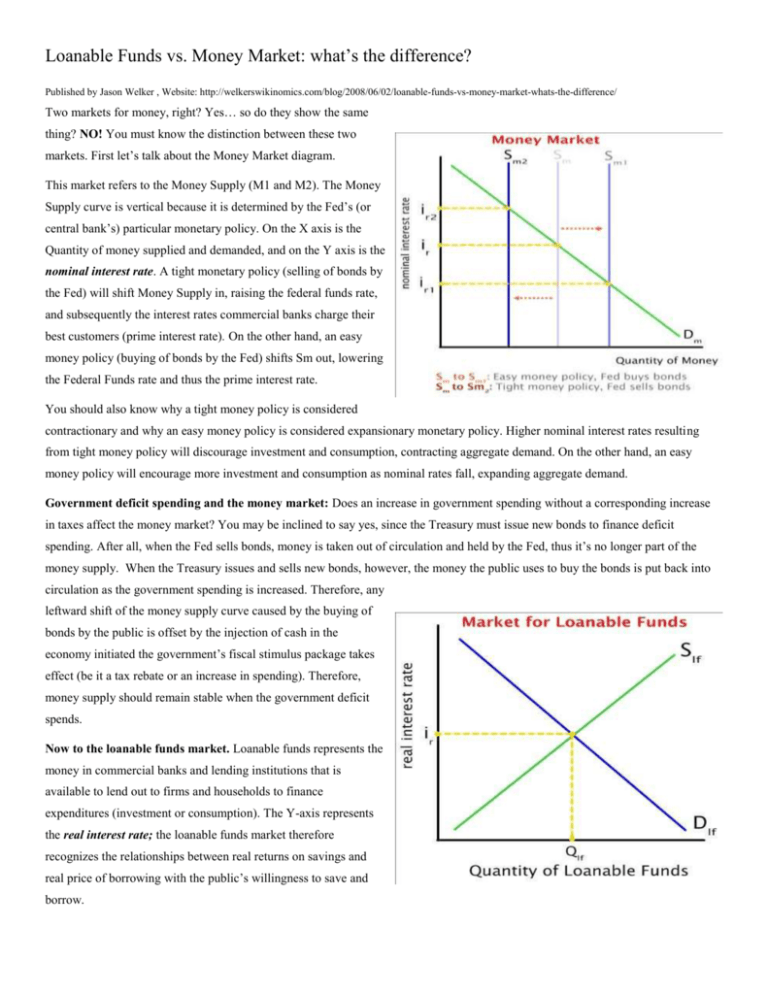

Loanable Funds vs. Money Market: what’s the difference? Published by Jason Welker , Website: http://welkerswikinomics.com/blog/2008/06/02/loanable-funds-vs-money-market-whats-the-difference/ Two markets for money, right? Yes… so do they show the same thing? NO! You must know the distinction between these two markets. First let’s talk about the Money Market diagram. This market refers to the Money Supply (M1 and M2). The Money Supply curve is vertical because it is determined by the Fed’s (or central bank’s) particular monetary policy. On the X axis is the Quantity of money supplied and demanded, and on the Y axis is the nominal interest rate. A tight monetary policy (selling of bonds by the Fed) will shift Money Supply in, raising the federal funds rate, and subsequently the interest rates commercial banks charge their best customers (prime interest rate). On the other hand, an easy money policy (buying of bonds by the Fed) shifts Sm out, lowering the Federal Funds rate and thus the prime interest rate. You should also know why a tight money policy is considered contractionary and why an easy money policy is considered expansionary monetary policy. Higher nominal interest rates resulting from tight money policy will discourage investment and consumption, contracting aggregate demand. On the other hand, an easy money policy will encourage more investment and consumption as nominal rates fall, expanding aggregate demand. Government deficit spending and the money market: Does an increase in government spending without a corresponding increase in taxes affect the money market? You may be inclined to say yes, since the Treasury must issue new bonds to finance deficit spending. After all, when the Fed sells bonds, money is taken out of circulation and held by the Fed, thus it’s no longer part of the money supply. When the Treasury issues and sells new bonds, however, the money the public uses to buy the bonds is put back into circulation as the government spending is increased. Therefore, any leftward shift of the money supply curve caused by the buying of bonds by the public is offset by the injection of cash in the economy initiated the government’s fiscal stimulus package takes effect (be it a tax rebate or an increase in spending). Therefore, money supply should remain stable when the government deficit spends. Now to the loanable funds market. Loanable funds represents the money in commercial banks and lending institutions that is available to lend out to firms and households to finance expenditures (investment or consumption). The Y-axis represents the real interest rate; the loanable funds market therefore recognizes the relationships between real returns on savings and real price of borrowing with the public’s willingness to save and borrow. Since an increase in the real interest rate makes households and firms want to place more money in the bank (and more money in the bank means more money to loan out), there is a direct relationship between real interest rate and Supply of Loanable Funds. On the other hand, since at lower real interest rates households and firms will be less inclined to save and more inclined to borrow and spend, the Demand for loanable funds reflects an inverse relationship. At higher interest rates, households prefer to delay their spending and put their money in savings, since the opportunity cost of spending now rises with the real interest rate. Government deficit spending and the loanable funds market: We learned above that only the Fed can shift the money supply curve, but what factors can affect the Supply and Demand curves for loanable funds? Here’s a few key points to know about the loanable funds market. . - When the government deficit spends (G>tax revenue), it must borrow from the public by issuing bonds. - The Treasury issues new bonds, which shifts the supply of bonds out, lowering their prices and raising the interest rates on bonds. - In response to higher interest rates on bonds, investors will transfer their money out of banks and other lending institutions and into the bond market. Banks will also lend out fewer of their excess reserves, and put some of those reserves into the bond market as well, where it is secure and now earns relatively higher interest. - As households, firms and banks buy the newly issued Treasury securities, (which represents the public’s lending to the government), the supply of private funds available for lending to households and firms shifts in. With fewer funds for private lending banks must raise their interest rates, leading to a movement along the demand curve for loanable funds. - This causes crowding out of private investment. Another, simpler way to understand the effect of government deficit spending on real interest rates is to look at it from the demand side. - Deficit spending by the government requires the government to borrow from the public, increasing the demand for loanable funds. In essence, the government becomes a borrower in the country’s financial sector, demanding new funds for investment, driving up real interest rates. - Increased demand from the government pushes interest rates up, causing banks to supply a greater quanity of funds for lending. The private, however, now has fewer funds available to borrow as the government soaks up some of the funds that previously would have gone to private borrowers. - This leads to the crowding out of private investment, in which private borrowers face higher real interest rates due to increased deficit spending by the government. What could shift the supply of loanable funds to the right? Easy, anything that increases savings by households and firms, known as the determinants of consumption and saving. These include increases in wealth, expectations of future income and price levels, and lower taxes. If savings increases, supply of loanable funds shifts outward, increasing the reserves in banks, lowering real interest rates, encouraging firms to undertake new investments. This is why many economists say that “savings is investment.” What they mean is increased savings leads to an increase in the supply of loanable funds, which leads to lower interest rates and increased investment. On the other hand, an increase in demand for investment funds by firms will shift demand for loanable funds out, driving up real interest rates. The determinants of investment include business taxes, technological change, expectations of future business opportunities, and so on.