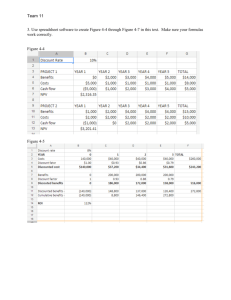

Valuing Real Options by Spreadsheet

advertisement

Valuing Real Options by Spreadsheet: Parking Garage Case Example Richard de Neufville,§ Stefan Scholtes,† and Tao Wang‡ Abstract. This article proposes a simple spreadsheet model for estimating the value of real options in engineering systems. The model has several advantages compared to alternative procedures based on financial mathematics: it is a natural and gentle advancement of the familiar discounted cash flow model; uses standard spreadsheet procedures; is based on data readily available in practice; and provides graphics that explain the results intuitively. This approach should thus be easily accessible to practicing professionals responsible for engineering design and management. A practical example for the design of a parking garage demonstrates the ease of use and presentation of results of this approach. Introduction A “real option” embodies flexibility in the development of a project. It represents a “right, but not an obligation” to take some course of action that may be advisable either if there is some unfortunate turn of events or some new opportunities. A “real option” thus represents either a form of insurance or a means to take advantage of a favorable situation. The use of real options originated in the field of finance (Myers, 1984) and has been developed for the use of management since the early 1990s (see for example Dixit and Pindyck, 1994; Trigeorgis, 1996; Amran and Kulatilaka, 1999; Copeland and Antikarov, 2001). Real options have more recently been applied to the design of infrastructure systems. For example, Leviakangas and Lahesmaa (2002) discuss their application to toll roads; and Ford et al. (2002) to strategic planning. Ho and Liu (2003) present a method for evaluating investments in construction technology; Zhao and Zheng (2003) provide an alternative approach and apply it to parking garages; Zhao, Sundararajan, and Tseng (2004) extend this work to highway development; and de Weck, de Neufville and Chaize (2004) demonstrate how the use of real options could lead to major improvements in performance, on the order of 30%. However, real options have not been widely used in engineering practice. This is probably due to the fact that the standard approaches to their analysis requires an understanding of financial theory; advanced mathematical techniques (such as lattice valuations and stochastic dynamic programming, Wang and de Neufville, 2004); and statistical data that are inaccessible to most engineers. Moreover, even when practitioners are skilled in the use of the financial techniques for evaluating options, the results they produce are difficult to explain to the senior engineers and managers who are ultimately responsible for approving the configuration and design of infrastructure systems. To make the use of real options readily accessible to designers, this article proposes a simple spreadsheet model for estimating the value of real options in engineering systems. The model has several advantages compared to alternative procedures based on financial mathematics: it is a natural and gentle advancement of the familiar discounted cash flow model; uses standard, § Professor of Civil and Environmental Engineering and of Engineering Systems, MIT, Cambridge, MA, 02139, U.S.A. Email: ardent@mit.edu † Professor of Management Science, Judge Institute of Management, Cambridge University, Cambridge CB2 1AG, U.K. Email: s.scholtes@jims.cam.ac.uk ‡ Doctoral candidate, Engineering Systems Division, MIT, Cambridge, MA, 02139, U.S.A. Email: tao@mit.edu 1 readily available spreadsheet procedures; is based on data available in practice; and provides graphics that explain the results intuitively. An options view of capacity Before we explain a realistic application of our approach to options valuation, we will use a simplistic example to lead the reader’s intuition. Suppose we need to determine the capacity of a new infrastructure system. Projected demand for the system is 60,000 units, the operational margin is $800 per processed unit, and the capacity costs are $700 per unit capacity. What capacity should be installed to optimize the value of the system? The naïve view is that for every unit demanded, you will have a net gain of $100, therefore the system can be operated economically and the optimal decision is to install capacity for the full demand of 60,000 units. The corresponding value of the system is $ 6 Mio. The problem with this back-of-the-envelope calculation is obvious to every planner: Capacity must be installed before demand is observed. What if demand is lower or higher than projected? In the case of high demand the system will be over utilized, with the consequence of service level deterioration, long waiting times and unsatisfied customers. In the case of low demand the system becomes a “white elephant”. Millions of dollars have been wasted for a system that will never earn its set-up costs. We need to be able to deal with uncertainties in demand when we make capacity decisions. Suppose, for example that there is a 50/50 chance of a demand of 40,000 or 80,000 units, respectively. The expected demand is still 60,000 units. But what is the expected profit? Suppose we install 60,000 units capacity. In the case of a realized demand of 40,000 units we have operating profits of $800 per unit * 40,000 processed units = $32 Mio against set-up costs of $700 per unit * 60,000 units capacity = $ 42 Mio. This results in a loss of $10 Mio. On the upside, we have a demand of 80,000 units but can only process 60,000 units, resulting in a value of $ 6 Mio. Given the 50/50 chance of the two scenarios, the expected value of the system is -$ 2 Mio; the system makes losses on average. Expected Value of the System Choosing capacity so that the expected system value is maximized is different from maximizing the system value for the expected demand level, which was our first, naïve approach. The optimal capacity for the example equals the low-scenario demand and the corresponding expected value is $ 4 Mio1, see Figure 1. $10,000,000 $5,000,000 $0 -$5,000,000 -$10,000,000 0 10000 20000 30000 40000 50000 60000 70000 80000 Capacity Single Scenario Two Scenarios Figure 1. Expected system value as a function of capacity 1 Notice that the optimal value is lower than the naïve optimal value. This is not a coincidence but a general phenomenon: Capacity induces a constraint on the system; the system value suffers in case of a downside demand scenario and this is not fully balanced out by the possible upside demands since upsides are capped at the capacity limit. 2 High capacity has the advantage of exploiting economies of scale, a fact that we haven’t included in our example. Whilst the introduction of scale economies in the example might well increase the optimal capacity level, it would need extreme scale economies to increase it to the level of the naïve solution. The loss in scale economies of a low capacity solution is often more than balanced out by one significant advantage: Low capacity can be regarded as a first stage, enabling future expansion if demand is high. However, in many infrastructure systems, low-cost expansion is only possible if this option is accounted for in the initial design. An, often small, amount of money needs to be invested early on, when the low capacity is installed, to enable a cost-efficient expansion of the system if and when desired. This is the options view of capacity: Build small but invest in the option to expand if needed. To see how this effects our example, suppose we install a low initial capacity now, then observe demand, and can then make an expansion decision which will allow us to capture 50% of the residual demand, i.e. of the demand that we have not satisfy with our initial capacity. It is easy to see that in this example the optimal policy is to install the low-scenario capacity first and then install 50% of the residual capacity later, provided the high-demand scenario occurs. This increases the expected value of the system from $ 4 Mio to $ 5 Mio. The difference of $ 1 Mio is the expected value of the option to expand. A proportion of this option value may have to be invested now, before the scenario is observed, to enable later expansion. The initial investment to “buy the option” is often considerably lower than the expected gain from the option. It is intuitive that the expansion option should become more valuable with increasing demand uncertainty. To see this effect, let us assume the upside and downside scenarios are 60,000 units plus or minus some uncertainty level, measured in percentage deviation; the uncertainty level in the example is thus 33%, leading to a downside of 40,000 and an upside of 80,000 units. Figure 2 shows how the value of the staged system changes as the uncertainty increases. The total value of the staged system decreases but the value of the expansion option, i.e. the difference between the value of the staged system and the value of the non-staged system, increases.2 $7,000,000 $6,000,000 $5,000,000 $4,000,000 $3,000,000 $2,000,000 $1,000,000 $0 0% 10% 20% 30% 40% 50% 60% Uncertainty Level Value of non-staged system Value of staged system Option Value Figure 2. System and option value as a function of uncertainty This is a general phenomenon, formally provable using Jensen’s inequality. The value of an option increases as the underlying uncertainty increases. This is in contrasts to the effect of high capacity, which becomes more detrimental to the system value as demand uncertainty increases. In other words, the higher the uncertainty the lower the optimal initial capacity and the higher the optimal expansion capacity. 2 3 Spreadsheet model This valuation of flexibility is based on standard discounted cash flow (DCF) analysis used to evaluate projects (see Riggs and West, 1986; de Neufville, 1990; White et al, 1998; DeGarmo et al, 2000). The process discounts future revenues and expenses to place them on a comparable basis, typically the present. The sum of these discounted cash flows is the net present value (NPV). Engineers and managers regularly use computer-based spreadsheets, such as Excel®, to value projects. The process of estimating the value of real options using spreadsheets is simple and easy to execute. Once the basic data have been placed in the spreadsheet, the calculations can be done in minutes. The authors have posted a version of the model at http://ardent.mit.edu/real_options. The process involves 3 steps: 1. Set up the spreadsheet representing the most likely projections of future costs and revenues of the project, and use the Data Table function to calculate its value for a range of design parameters to determine the optimum design for this deterministic case. The result is the base case against which flexible solutions are compared, so as to derive the value of these alternative designs. 2. Explore the implications of uncertainty by simulating ranges of possible scenarios (for example, of the uncertain future revenues) using the Excel® random number generator, Rand(). Each scenario leads to a different NPV, and the collection of scenarios provides the distribution of possible outcomes for a project. In general, a project that is worthwhile on average might turn out to be either unprofitable or highly profitable, depending on the actual circumstances. Use the Data Table function again to determine the best design when the future is uncertain, which is normally different than the one for the unrealistic base case that assumes the future is known. (The difference is due to non-linearity in the data, which means that the value of the project based on expected demand is not the same as the expected value of the project based on actual values – Jensen’s Inequality, see Planetmath) 3. Explore the implications of various ways to provide flexibility by changing the costs and revenues to reflect these design alternatives. The resulting expected values can be compared to the base case to define the value of flexibility. Moreover, the graphical display of the cumulative distribution of the results demonstrates the Value at Risk (VaR) or the worse cases that could occur. This information is often a key factor in decisions about the design of major projects. Practical Demonstration An application to a hypothetical design of a parking garage, inspired by Zhao and Tseng (2003), demonstrates the ease of use of the model. This situation was extrapolated from an actual project in the Bluewater development in England (http://www.bluewater.co.uk/). It assumes that the car park is next to a new commercial center in a region that is growing as population expands. The basic data used are that: The immediate demand is for 750 spaces, and is expected to rise exponentially by another 750 spaces over the next 10 years; Average annual revenue per space used will be $10,000, and the average operating costs (staff, cleaning, etc.) will be about $2,000 per year for each space available (note that the number of spaces used is often lower than the spaces available); The lease of the land will cost $3.6 Million annually; The construction will cost $16,000 per space for pre-cast construction, with a 10% increase for every level above the ground level; 4 The site is large enough to accommodate 200 cars per level; and The discount rate is taken to be 12%. Additionally, economic analysis needs to recognize that actual demand is uncertain, given the long time horizon. The case assumes that the additional future demand could be 50% off the projection, either way, and that its annual volatility for growth is 10%. The designers can design the footings and columns of the original building so that additional levels of parking can easily be added, as was the case for the Bluewater development. The case assumes that doing so will add 5% to the total initial construction cost. This premium is the price to get the real option for future expansion, the right but not the obligation to do so. Step 1: Table 1 represents the basic spreadsheet for calculating the NPV of the parking garage assuming that the demand for spaces grows as projected. This particular version is for 6 levels that provides 1200 spaces. Note that when demand grows beyond the capacity of the facility it cannot benefit from addition demand. Table 1. Discounted Cash Flow Model (6 levels) Year 0 1 Demand 750 Capacity 1,200 Revenue $7,500,000 Recurring Costs Operating cost $2,400,000 Land leasing cost $3,600,000 $3,600,000 Cash flow $1,500,000 Discounted Cash Flow $1,339,286 Present value of cash flow $32,574,737 Capacity costs for up to two levels $6,400,000 Capacity costs for levels above 2 $16,336,320 Net present value $6,238,417 2 3 893 1,015 1,200 1,200 $8,930,000 $10,150,000 $2,400,000 $3,600,000 $2,930,000 $2,335,778 19 20 1,688 1,696 1,200 1,200 $12,000,000 $12,000,000 $2,400,000 $3,600,000 $4,150,000 $2,953,888 $2,400,000 $3,600,000 $6,000,000 $696,641 $2,400,000 $3,600,000 $6,000,000 $622,001 Expected NPV ($, Millions) The Data Table function in Excel® enables the analyst to compute the NPV for parking garages with many different levels, provided that the cost of construction and the capacity in the spreadsheet has been expressed as a formula in terms of the number of levels, as it has in this case. Figure 3 correspondingly displays the NPV for various levels of design for the deterministic case. As can be seen, the optimal design for this base case, that unrealistically assumes that demand is known in advance, is to build 6 floors. The NPV in this case is $6,238,417. 10 5 0 2 3 4 5 6 7 8 9 -5 -10 -15 Number of Floors Traditional NPV Recognizing uncertainty Figure 3. Expected NPV for Different Design (Number of Floors) 5 Step 2: Recognizes the uncertainty in the forecast demand by simulating possible scenarios. The analysis applies the Rand() function and uses the Data Table functions to change the input demand. This example analysis ran 2000 scenarios, which took about 1 minute on a standard PC. Figures 4a and 4b illustrate the results for a 5-level design both in terms of a histogram representing the probability distribution (PDF), and the associated cumulative probability diagram (CDF). The expected results for different levels of design appear in Figure 3. This analysis provides useful insights that motivate the use of flexibility. It shows that: Uncertainty can lead to asymmetric returns. In this case, although the chance of higher and lower demands are equal, the upside value of the project is limited (because the fixed capacity cannot take advantage of higher demands) while the downside risks are substantial and can lead to great losses. The expected value of the project when uncertainty is recognized is thus not equal to its value in the deterministic case (as Figures 3 and 4a indicate). The CDF in Figure 4b shows the Value at Risk (VaR), that is, the chance that a loss will exceed any specific threshold. It shows for example that there is about 10% chance that the losses from a 5-level parking garage would equal or exceed $4 million. 600 5-floor design 500 Frequency Simulated Mean 400 6-floor design 300 Deterministic Result 200 100 0 -17.8 -15.6 -13.5 -11.3 -9.2 -7.0 -4.9 -2.7 -0.6 1.6 3.7 5.9 8.0 Figure 4a. Histogram or Probability Distribution Function for NPV’s (in Mio $) for 5-level design recognizing demand uncertainty compared to deterministic optimal design 6 1 0.9 Probability 0.8 0.7 0.6 CDF for Result of 0.5 Simulation Analysis (5floor) 0.4 Implied CDF for Result of Deterministic NPV Analysis (6-floor) 0.3 0.2 0.1 0 -20 -15 -10 -5 0 5 10 Figure 4b. Cumulative Distribution Function for NPV’s (in Mio $) for 5 level design recognizing demand uncertainty compared to deterministic optimal design Step 3: In this phase the analyst explores ways to limit the downside risk (VaR) and take advantage of upside potential. For example, the above analysis easily shows how the designers can reduce the VaR by creating smaller designs that lower the chance that demand will not fill the facility. Using the available information, Figure 5 compares the cumulative distribution function of NPV for 4-floor design and 5-floor design. In this case, the smaller design eliminates the chance of really big losses, but at the cost of never making any substantial profit. Thus, although building smaller provides good insurance against losses, it is not sufficient to make the project attractive. 1 0.9 Probability 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0 -20 -15 -10 -5 5-Floor Design 0 5 10 4-Floor Design Figure 5. Reduction of Downside Risk by Designing Smaller The analyst can explore options to take advantage of possible growth by building these designs into the spreadsheet. This case considered the possibility of making the columns big enough to support additional levels, should demand justify expansion of the parking garage in later years. (This is exactly what was done in the parking structures for the Bluewater development.) Table 2 7 shows the appropriately modified spreadsheet. It incorporates 3 additional rows for “Decision on expansion”, “Extra capacity”, and “Expansion cost”. For this example, the “Decision on expansion” is based on the criterion that the capacity is less than the demand for two consecutive years, and the assumed decision rule is to construct 2 extra floors or 400 spaces. (This is just an example, other criteria and rules could be programmed in.) Table 2. Discount Cash Flow Model for 4 level design with embedded expansion option (for one demand realization path) Year Demand Capacity Decision on expansion Extra capacity Revenue Recurring Costs Operating cost Land leasing cost Expansion cost Cash flow Discounted Cash Flow Present value of cash flow Capacity cost for up to two levels Capacity costs for levels above 2 Price for the option Net present value 0 1 1,055 800 2 3 1,141 1,234 800 1,200 Expand Expand 0 400 400 $8,000,000 $8,000,000 $12,000,000 19 2,075 2,000 20 2,002 2,000 0 0 $20,000,000 $20,000,000 $1,600,000 $1,600,000 $2,400,000 $3,600,000 $3,600,000 $3,600,000 $3,600,000 $8,944,320 $10,822,627 $2,800,000 -$6,144,320 -$4,822,627 $2,500,000 -$4,898,214 -$3,432,651 $36,117,599 $6,400,000 $7,392,000 $689,600 $18,725,599 $4,000,000 $3,600,000 $4,000,000 $3,600,000 $12,400,000 $12,400,000 $1,439,724 $1,285,468 The value of this “call option” that permits expansion in the case of favorable demand is shown in Figure 6. The capability to add capacity adds greatly increases both the maximum value of the project (up to almost $30 million) and its expected value (about $10 million). The estimated value of the option is the difference between the expected value with the option ($10,517,140) and that without (-$28,800), that is $10,488,340 in this case. 100.0% 90.0% Mean for NPV without Options 80.0% CDF for NPV with Options Probability 70.0% 60.0% 50.0% 40.0% CDF for NPV without Options 30.0% Mean for NPV with Options 20.0% 10.0% 0.0% -30 -20 -10 0 10 20 30 40 Figure 6. Option to expand adds significant value to design Beyond the expected value of the option, the flexibility provided by building small at the start with the option to expand has several further advantages. The spreadsheet approach to the analysis of the value of options brings these out, as the financial approaches to calculating only value do not. As Table 4 indicates, the flexible approach to the design of this facility: Reduces the maximum possible loss, that is the Value at Risk; 8 Increases the maximum possible and the expected gain; While maintaining the initial investment costs low. Table 3. Results from the Spreadsheet Model Perspective Deterministic Recognizing Uncertainty Simulation No Yes Option Embedded No No Incorporating Real options Yes Yes Design 6 levels 5 levels 4 levels with strengthened structure Estimated Expected NPV $6,238,416 $3,536,474 $10,517,140 Table 4. Comparison of Results with and without Options Design Initial Investment Expected NPV Minimum Value Maximum Value With Options (4 levels, strengthened structure) $18,081,600 $10,517,140 -$13,138,168 $29,790,838 Without Options (5 levels) $21,651,200 $3,536,474 -$18,024,062 $8,316,602 Comparison Better with options Better with options Better with options Better with options Conclusion A spreadsheet model for the valuation of real options is easy to use and provides insight into the way that flexibility in design minimizes exposure to risk and maximizes the potential for gain under favorable circumstances. Compared to alternative approaches that require advanced mathematics and financial concepts, and that focus narrowly on the expected value of an option and ignore the ways options change the distribution of outcomes, the spreadsheet approach is both much easier to use and more useful. Because the spreadsheet model for the valuation of real options rests on tools and data that are readily available to practicing engineers and managers, it should be accessible and useful to them. Acknowledgements The authors appreciate the advice of senior staff of Laing O’Rourke (UK) who worked with the lead authors on the application of the spreadsheet model, and its validation through practical examples, during the Cambridge-MIT Institute Workshop on Real Options in May 2004. References Amram, M. and Kulatilaka, N. (1999) Real Options - Managing Strategic Investment in an Uncertain World, Harvard Business School Press, Boston, MA. Copeland, T. and Antikarov, V. (2001) Real Options - A Practitioner's Guide, TEXERE, New York, NY. DeGarmo, E. et al (2000) Engineering Economy, 11th Ed., Prentice-Hall, Upper Saddle River, NJ. de Neufville, R. (1982) “Airport Passenger Parking Design,” ASCE Journal of Urban Transportation, 108, May, pp. 302 – 306. de Weck, O., de Neufville, R. and Chaize, M. (2004) “Staged Deployment of Communications Satellite Constellations in Low Earth Orbit." Journal of Aerospace Computing, Information, and Communication, Mar., pp. 119-136. 9 Dixit, A. and Pindyck, R. (1994) Investment under Uncertainty, Princeton University Press, Princeton, NJ. Ford, D., Lander, D. and Voyer, J. (2002) “A Real Options Approach to Valuing Strategic Flexibility in Uncertain Construction Projects,” Construction Management and Economics, 20, pp. 343 – 351. Ho, S. and Liu, L. (2003) “How to Evaluate and Invest in Emerging A/E/C Technologies under Uncertainty,” J. of Construction Engineering and Management, 129(1), pp. 16 – 24. Leviakangas, P. and Lahesmaa, J. (2002) “Profitability Evaluation of Intelligent Transport System Investments,” J. of Transportation Engineering, 128(3), pp. 276 – 286. Myers, S. (1984) “Finance theory and financial strategy.” Interfaces, 14, Jan-Feb, pp. 126-137. Trigeorgis, L. (1996) Real Options: Managerial Flexibility and Strategy in Resource Allocation, MIT Press, Cambridge, MA. Planetmath.org “Jensen’s Inequality.” http://planetmath.org/encyclopedia/JensenInequality.html Riggs, J. and West, T. (1986) Engineering Economics, McGraw-Hill, New York, NY. Wang, T. and de Neufville, R. (2004) “Building Real Options into Physical Systems with Stochastic Mixed-Integer Programming.” 8th Annual Real Options International Conference, Montreal, Canada. http://www.realoptions.org/papers2004/de_Neufville.pdf White, J. et al (1998) Principles of Engineering Economics Analysis, John Wiley and Sons, New York, NY. Zhao, T., Sundararajan, S., and Tseng, C. (2004) “Highway Development Decision-Making under Uncertainty: A Real Options Approach,” J. of Infrastructure Systems, 10(1), pp. 23 – 32. Zhao, T. and Tseng, C. (2003) “Valuing Flexibility in Infrastructure Expansion.” J. of Infrastructure Systems, 9(3), pp. 89 – 97. 10