Pure arbitrage – the simultaneous purchase and sale of identical

advertisement

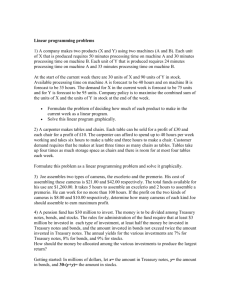

FOR IMMEDIATE RELEASE October 15, 2004 Contact: Stephen Meyerhardt (202) 504-3792 TREASURY CALLS 11-3/4 PERCENT BONDS OF 2005-10 The Treasury today announced the call for redemption at par on February 15, 2005, of the 113/4% Treasury Bonds of 2005-10, originally issued February 15, 1980, due February 15, 2010 (CUSIP No. 912810CM8). There are $2,315 million of these bonds outstanding, of which $1,372 million are held by private investors. Securities not redeemed on February 15, 2005 will stop earning interest. These bonds are being called to reduce the cost of debt financing. The 11-3/4% interest rate is significantly above the current cost of securing financing for the five years remaining to their maturity. In current market conditions, Treasury estimates that interest savings from the call and refinancing will be about $506 million. Payment will be made automatically by the Treasury for bonds in book-entry form, whether held on the books of the Federal Reserve Banks or in TreasuryDirect accounts. Bonds held in coupon or registered form should be presented for redemption to financial institutions or mailed directly to the Bureau of the Public Debt, Definitives Section, P.O. Box 426, Parkersburg, WV 261060426. For more information concerning called coupon or registered bonds, you may contact the Definitives Section at (304) 480-7936. 1 Treasury bills are pure discount securities issued by US Treasury. Treasury bills are sold with an initial maturity of one-month, 3-months, 6-months and one-year. Cash management bills are also sold very short original maturity. In the secondary market, Treasury bills are quoted on a bank discount basis using a 360 day year. A quote of 3% indicates the price of the bill is calculated as a 3% discount from face value. Given, M=$1,000,000 and t = 82 a quote of Yd = 3% can be used to find the purchase price for the bill: D = dollar discount = $1,000,000 * 0.03 * 82/360 = $6,833.33 P = M – D = $1,000,000 – 6,833.33 = 993,166.67 To state the yield on a bill in a comparable format to the yield on Treasury notes and bonds it is necessary to account for the discount interest of the bill and the 360 day money-market convention. For bills with less than 182 days till maturity BEY = D 365 $6,833.33 365 = = 3.063% P t $993,166.67 82 To calculate bond equivalent yield, for bills with maturity greater than 182 days it is also necessary to account for the fact that bills pay no coupons but notes and bonds do. Given, M=$1,000,000 and t = 200 a quote of Yd = 3% can be used to find the purchase price for the bill: D = dollar discount = $1,000,000 * 0.03 * 200/360 = $16,666.67 P = M – D = $1,000,000 – $16,666.67 = 983,333.33 BEY = 2 t 365 2 2 t 365t 2 365 11 M P 2 t 365 1 = 3.089% To compare the yield of a Treasury bill with the yield offered on non-discount money market instruments such as CDs the return on a Treasury bill must be adjusted to account for the discount interest of the bill. The CD equivalent (money market equivalent) yield on a Treasury bill can be found simply from the discount rate (all bill maturities) CDEY = 360 Yd 360 t Yd 2 For the 82 day bill examined above: CDEY = 360 0.03 3.021% 360 82 0.03 Treasury auctions – Treasury bills notes and bonds are sold originally by the Treasury through regularly scheduled auctions. Details concerning the Treasury auctions (announcements, results, etc.) may be found at http://www.publicdebt.treas.gov/ Bills are generally auctioned on a Monday. Buyers receive the bills the following Thursday. Bills auctioned in October 2003: Recent Treasury Bill Auction Results Term Issue Date Maturity Date Discount Investment Rate % Rate % Price Per $100 CUSIP 28-DAY 10-23-2003 11-20-2003 0.895 0.916 99.930 912795NX5 91-DAY 10-23-2003 01-22-2004 0.920 0.939 99.767 912795PG0 182-DAY 10-23-2003 04-22-2004 1.015 1.037 99.487 912795PV7 28-DAY 10-16-2003 11-13-2003 0.870 0.889 99.932 912795NW7 91-DAY 10-16-2003 01-15-2004 0.905 0.923 99.771 912795PF2 182-DAY 10-16-2003 04-15-2004 0.985 1.006 99.502 912795PU9 28-DAY 10-09-2003 11-06-2003 0.855 0.863 99.934 912795NV9 91-DAY 10-09-2003 01-08-2004 0.920 0.939 99.767 912795PE5 182-DAY 10-09-2003 04-08-2004 0.995 1.017 99.497 912795PT2 12-DAY 10-03-2003 10-15-2003 0.920 0.946 99.969 912795QH7 28-DAY 10-02-2003 10-30-2003 0.845 0.863 99.934 912795NU1 92-DAY 10-02-2003 01-02-2004 0.935 0.953 99.761 912795PD7 182-DAY 10-02-2003 04-01-2004 1.005 1.027 99.492 912795PS4 3 Bills auctioned in October 2004: Recent Treasury Bill Auction Results Term Issue Date Maturity Date Discount Investment Rate % Rate % Price Per $100 CUSIP 91-DAY 11-04-2004 02-03-2005 1.950 1.987 99.507083 912795RY9 29-DAY 10-28-2004 11-26-2004 1.760 1.787 99.858222 912795RN3 91-DAY 10-28-2004 01-27-2005 1.855 1.890 99.531097 912795RX1 182-DAY 10-28-2004 04-28-2005 2.040 2.090 98.968667 912795SL6 28-DAY 10-21-2004 11-18-2004 1.570 1.594 99.877889 912795RM5 91-DAY 10-21-2004 01-20-2005 1.770 1.803 99.552583 912795RW3 182-DAY 10-21-2004 04-21-2005 1.990 2.038 98.993944 912795SK8 29-DAY 10-14-2004 11-12-2004 1.555 1.579 99.874736 912795RL7 91-DAY 10-14-2004 01-13-2005 1.680 1.711 99.575333 912795RV5 182-DAY 10-14-2004 04-14-2005 1.955 2.002 99.011639 912795SJ1 10-13-2004 10-15-2004 1.680 1.703 99.990667 912795TD3 28-DAY 10-07-2004 11-04-2004 1.530 1.553 99.881000 912795RK9 91-DAY 10-07-2004 01-06-2005 1.685 1.716 99.574069 912795RU7 182-DAY 10-07-2004 04-07-2005 1.990 2.038 98.993944 912795SH5 14-DAY 10-01-2004 10-15-2004 1.595 1.618 99.937972 912795TD3 2-DAY 4 TREASURY SECURITY AUCTION RESULTS BUREAU OF THE PUBLIC DEBT - WASHINGTON DC FOR IMMEDIATE RELEASE CONTACT: November 01, 2004 Office of Financing 202-504-3550 RESULTS OF TREASURY'S AUCTION OF 26-WEEK BILLS Term: 182-Day Bill Issue Date: November 04, 2004 Maturity Date: May 05, 2005 CUSIP Number: 912795SM4 High Rate: 2.140% Investment Rate 1/: 2.193% Price: 98.918111 All noncompetitive and successful competitive bidders were awarded securities at the high rate. Tenders at the high discount rate were allotted 14.70%. All tenders at lower rates were accepted in full. AMOUNTS TENDERED AND ACCEPTED (in thousands) Tender Type Tendered Accepted --------------------------- ----------------Competitive $ 34,813,000 $ 17,789,775 Noncompetitive 1,085,312 1,085,312 FIMA (noncompetitive) 125,000 125,000 ----------------- ----------------SUBTOTAL 36,023,312 19,000,087 2/ Federal Reserve 6,663,195 6,663,195 ----------------- ----------------TOTAL $ 42,686,507 $ 25,663,282 Median rate 2.130%: 50% of the amount of accepted competitive tenders was tendered at or below that rate. Low rate 2.100%: 5% of the amount of accepted competitive tenders was tendered at or below that rate. Bid-to-Cover Ratio = 36,023,312 / 19,000,087 = 1.90 1/ Equivalent coupon-issue yield. 2/ Awards to TREASURY DIRECT = $850,364,000 In the secondary market, bond dealers provide a continuous market by offering to purchase bills, notes and bonds at the bid (discount rate) price and sell at the ask(offer) (discount rate) price. Quotations for notes and bonds are made in 32nds and 64ths. Clean prices are quoted by bond dealers. A price of 103-18+ is equivalent to $103 + $18/32 + $1/64 = $103.578125 per $100 of face value. The full price equals this clean price plus accrued interest. In February 1985, the U.S. Treasury introduced its own coupon stripping program, Separate Trading of Registered Interest and Principal of Securities (STRIPS). In the STRIPS program a market participant with access to the Fedwire system can wire Treasury notes or bonds to the Federal Reserve Bank of New York and receive separated component securities in return. All 5 Treasury securities including those created in the STRIP program trade in book entry format. In May of 1987 the Treasury began to allow the reconstitution of stripped securities. Pure arbitrage – the simultaneous purchase and sale of identical cash flows. Requires no investment Certain profit Arbitrage can occur when prices diverge in: Spatially separated markets, i.e. New York and London Markets separated by delivery date, i.e. cash and futures markets Markets where identical cash flows trade contemporaneously, i.e. Treasury bond and STRIPS markets. The opportunity to engage in arbitrage transactions ensures that the price of Treasury notes and bonds will not diverge greatly from their theoretical value found from the spot rate curve. It is possible to strip Treasury notes, bonds and inflation protected securities through the STRIPS program and to reconstitute Treasury notes, bonds and inflation protected securities through the STRIPS program. STRIPS are pure discount securities analogous to Treasury bills. The tax treatment of STRIPS in the U.S. and other countries produces measurable impact on the price of STRIPS. In the U.S. owners of STRIPS pay tax on the imputed interest, i.e although owners of STRIPS receive no cash flow they are taxed on the change in price of the discount security. The price approaches face value as time to maturity approaches zero. For purpose of taxation of non-US citizens some countries treat the imputed interest from a STRIP as a capital gain if the STRIP security was created from the corpus of a Treasury note or bond. TIPS – Treasury Inflation Protected Securities The coupon rate equals the real rate of interest at the auction date. The principal adjusts to provide an inflation protected total return. Interest rate: The interest rate, real yield, and price are determined in each auction. Bidding is in terms of real yield. Competitive and noncompetitive bids are awarded at the highest real yield of bids accepted in the auction. The Treasury sells all inflation-indexed notes in single-price auctions. The amount of each semiannual interest payment is calculated on the security's inflation-adjusted principal amount on an interest payment date. Principal amount: The inflation-adjusted principal amount can be derived daily by multiplying the face amount by the applicable index ratio. The numerator of the index ratio is the CPI-U on a 6 specific day, and the denominator is the CPI-U on the original dated date. In the case of a reopening of an outstanding issue, the denominator is the CPI-U for the original dated date. Consumer Price Index: The Treasury uses the non-seasonally adjusted U.S. City Average All Items Consumer Price Index for All Urban Consumers (CPI-U), published monthly by the Bureau of Labor Statistics of the U.S. Department of Labor. The CPI-U represents prices of all goods and services purchased for consumption by urban households. User fees (such as water and sewer service) and sales and excise taxes paid by the consumer are also included. Income taxes and investment items (such as stocks, bonds, and life insurance) are not included. The CPI-U includes expenditures by urban wage earners and clerical workers, professional, managerial, and technical workers, the self-employed, short-term workers, the unemployed, retirees and others not in the labor force. The CPI-U used by the Treasury for the first day of each calendar month is the CPI-U for the third preceding calendar month. For example, the CPI-U used for April 1 in any year is the CPI-U for January, which is reported in February. The factor the Treasury uses to calculate the principal amount of an inflation-indexed note each day is determined by a linear interpolation between the CPI-U for the first day of the month and the CPI-U on the first day of the next month. Factors are available at Historical Reference CPI Numbers and Daily Index Ratios. Schedule for issue: The Treasury issues 10-year inflation-indexed notes on July 15 of each year and reopenings on October 15 and January 15. The Treasury usually announce an offering several days before the auction. Federal income tax treatment: Generally an investor must report as income, for Federal income tax purposes, the interest earned on inflation-indexed notes in the year in which it is earned. Income that reflects the inflation adjustment to principal must be reported even though the inflation adjustment to principal it is not received until the maturity date or the date the security is sold. This income-reporting requirement means that inflation-indexed securities are especially attractive investments for tax-deferred accounts, such as IRAs and 401(k) plans, and for nontaxable accounts, which include pension funds. An investor may want to consult a tax advisor to review possible income tax implications before investing in inflation-indexed notes or bonds. For further information on the tax treatment of inflation-indexed securities, see IRS Publication 550, "Investment Income and Expenses" at http://www.irs.gov/formspubs/. Accrued interest TIPS: 0.50 c M (SD LCD) CPI U SD where CPI-U0 = Index level on auction date. ( NCD LCD) CPI U 0 If settlement date is 11/15/04 CPI-USD = CPI-U11/15/04 = CPI-U8/01/04 + 15/31*(CPI-U9/01/04 – CPI-U8/01/04) 7 Agency securities: The Federal government and many state governments have established agencies whose purpose is to improve the flow of credit to specific sectors of the economy. These agencies are either government sponsored enterprises or federally related institutions. Government sponsored enterprises - privately owned but publicly chartered entities. Federal National Mortgage Association (FNMA) - Created by Congress in 1938. FNMA is a private corporation that improves liquidity in the mortgage market by buying mortgages in the secondary market. Common stock of Federal National Mortgage Association (FNM) trades on the NYSE. December 2002: in millions of $ Mortgage Portfolio Outstanding Mortgage backed securities $797,693 $1,029,456 Fannie Mae is the largest investor in home mortgage loans in the United States. Fannie Mae purchases mortgage loans directly from the lenders who originate them. Fannie Mae obtains funds by issuing debt in domestic and global capital markets. Fannie Mae sells mortgage backed securities. FNMA is an innovator in security design and issuance methods. Fannie Mae's operations enhance liquidity in the mortgage market. Mortgage loan originators and lenders that sell the mortgage loans to Fannie Mae use the proceeds from the sale of mortgages to originate more mortgage loans. Fannie Mae also earns fee income on the outstanding amount of mortgage-backed securities (MBS), which are securities backed by pools of mortgage loans for which Fannie Mae provides a guaranty of timely payments of principal and interest. In 1995, Fannie Mae received over $1.0 billion in guaranty fee income. Federal Home Loan Banks - provide credit to member thrifts (savings and loans) to finance mortgage lending. Farm Credit Banks - Provide credit agricultural industries. Student Loan Marketing Association - Corporation that provides loans to students and improves liquidity in the student loan market by buying loans in the secondary market. Federal Home Loan Mortgage Corporation (FHLMC) - Freddie Mac makes mortgage funds available by buying conventional and government insured mortgages in the secondary market. 8 Resolution Funding Corporation - Established in 1989 to help fund the bailout of the savings and loan industry. Federal Financing Corporation - Established in 1987 to recapitalize the Federal Savings and Loan Insurance Corporation (FSLIC). Federally related institutions - operated by the Federal government. The debt of Federally related institutions is backed by the full faith and credit of the U.S. Treasury. Most financing for Federally related institutions is obtained by the Federal Financing Bank. Export-Import Bank The Export-Import Bank raises funds for use in encouraging international trade between the U.S. and other trading partners. The issues of the Export-Import Bank and other federally related institutions are backed by the full faith and credit of the U.S. Treasury. Commodity Credit Corporation Government National Mortgage Association (GNMA) Tennessee Valley Authority 9