CHAPTER 9 Financial Planning and Forecasting Financial

advertisement

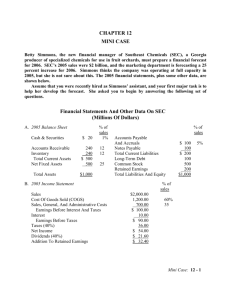

CHAPTER 9 Financial Planning and Forecasting Financial Statements Topics in Chapter Financial planning Additional Funds Needed (AFN) formula Forecasted financial statements Financial Planning and Pro Forma Statements Three important uses: Forecast the amount of external financing that will be required Evaluate the impact that changes in the operating plan have on the value of the firm Set appropriate targets for compensation plans Steps in Financial Forecasting 1. Forecast sales 2. Project the assets needed to support sales 3. Project internally generated funds 4. Project outside funds needed 5.Decide how to raise funds 6. See effects of plan on ratios and stock price 1 Problem: If Sales Co. needs to buy assets to support S. What assets? Goal: Determine the source of funds to support Assets: Note: Balance sheet must remain balanced. Therefore, Assets Liab &/or owners equity. 1.) Spontaneously generated liability- liabilities that automatically w/o a specific action between creditor and firm. Ex: Accounts Payables and accruals Note: Notes Payable is not a spontaneous liability because it involves an action between creditor and firm. 2.) Sales NI We know NI goes to 2 places: dividends or additions to RE. Note: additions to RE owners equity. define: payout ratio (d) - the percentage of NI that goes to shareholders. retention ratio (RR)- the percentage of NI that is retained. d + RR = 1 3.) External funding 2 AFN Model A crude model to estimate external funds needed to support Sales after accounting for internally generated and automatically generated sources of funds. Assumptions: 1. Firm is operating at full capacity 2. Each type of asset grows proportionally w/ sales 3. Spontaneously generated liabilities grow proportionally w/ Sales. 4. Profit margin (M) is constant 5. Firm can accurately forecast in Sales. AFN = Required - in Spontaneous in Assets Liabilities AFN = (A*/S0) ∆S - (L*/S0) ∆S - in RE - (M) (S1) (RR) where: A* = assets required to support sales S0= Sales last year ∆S = in Sales = S1 - S0 L* = in Spontaneous Liabilities M = Profit Margin = NI/ Sales profit per $ of Sales RR= Retention Ratio S1= S0 + ∆S 3 Notes: 1. A*/S0 = capital intensity ratio = required $s of assets for every $ in Sales A*/S0 AFN Why? 2. L*/S0 = spontaneous liability to sales ratio = $ amt of spontaneously generated liab for every $ in Sales L*/S0 AFN Why? 3. M AFN Why? 4. RR AFN Why? 4 Ex: 2009 Balance Sheet (Millions of $) 2009 Income Statement (Millions of $) Key Assumptions: Operating at full capacity in 2009. Each type of asset grows proportionally with sales. Account Payables and accruals grow proportionally with sales. 2009 profit margin and payout will be maintained. 5 If Sales are expected to by $500 million in 2010, find: a. the capital intensity ratio: b. the spontaneous liability to sales ratio: c. the payout ratio: d. the retention ratio: e. the profit margin: f. Expected Sales in 2010: g. How much do we expect assets to increase by? Since we expect the capital intensity ratio will be maintained 6 Assets vs. Sales h. Find AFN: i. How would increases in these items affect the AFN? - Higher sales: - Higher dividend payout ratio: - Higher profit margin: 7 i continued. How would increases in these items affect the AFN? - Higher capital intensity ratio, A*/S0: -If company pays suppliers sooner: 8 Forecasted Financial Statements (FFS) Method Contrast AFN model and FFS model 1. Both begin with Sales forecast 2. Both fore cast assets and spontaneous liability - AFN capital intensity (A/S) assumed constant for all assets - AFN spontaneous liab. to sales intensity (L/S) assumed constant for all spontaneous liabs - FFS (each Asset)/S different for all assets - FFS (each spon. liab)/S different for all spon. liabs. Percent of Sales Method to forecast financial statements Steps: 1. Project sales based on forecasted growth rate in sales 2. Forecast some items as a percent of the forecasted sales - Costs - Cash - Accounts receivable - Inventories - Net fixed assets - Accounts payable and accruals 3. Choose other items - Debt - Dividend policy (which determines retained earnings) - Common stock 9 Sources of Financing Needed to Support Asset Requirements Given the previous assumptions and choices, we can estimate: - Required assets to support sales - Specified sources of financing Additional funds needed (AFN) is: - Required assets minus specified sources of financing Note: - If AFN is positive, then you must secure additional financing. - If AFN is negative, then you have more financing than is needed. 1. Pay off debt. 2. Buy back stock. 3. Buy short-term investments. 10 EX: Recall, the following financial statements for a company. We have calculate AFN using the AFN method. Let's recalculate the AFN using the FFS method. Recall: Sales are projected to increase $500 million in 2010. Assume interest rate on debt is 10 %. No new common stock will be issued to raise the AFN. Any external funds needed will be raised as debt, 50% notes payable, and 50% L-T debt. Percent of Sales: Inputs 2009 Actual 2010 Proj. COGS/Sales 60% 60% SGA/Sales 35% 35% Cash/Sales 1% 1% Acct. rec./Sales 12% 12% Inv./Sales 12% 12% Net FA/Sales 25% 25% AP & accr./Sales 5% 5% Other Inputs Percent growth in sales 25% Growth factor in sales (1 + g) 1.25 Interest rate on debt 10% Tax rate 40% Dividend payout rate 40% 11 2010 First-Pass Forecasted Income Statement 2010 1st Pass Calculations Sales 1.25 Sales09 = $2,500.0 Less: COGS 60% Sales10 = 1,500.0 35% Sales10 = 875.0 SGA EBIT Interest $125.0 0.1(Debt09) = 20.0 EBT $105.0 Taxes (40%) 42.0 Net Income $63.0 Div. (40%) $25.2 Add to RE $37.8 2010 Balance Sheet (Assets) Calcuations 2010 Cash 1% Sales10 = $25.0 Accts Rec. 12%Sales10 = 300.0 Inventories 12%Sales10 = 300.0 Total CA Net FA Total Assets $625.0 25% Sales10 = 625.0 $1,250.0 12 2010 Preliminary Balance Sheet (Claims) Calculations AP/accruals Notes payable 100 2010 Without AFN 5% Sales10 = $125.0 Carried over 100.0 Total CL $225.0 L-T debt 100 Carried over 100.0 Common stk 500 Carried over 500.0 Ret earnings 200 +37.8* 237.8 Total claims $1,062.8 What are the additional funds needed (AFN)? - Required assets = $1,250.0 - Specified sources of fin. = $1,062.8 - Forecast AFN: $1,250 - $1,062.8 = $187.2 How will the AFN be financed? Additional notes payable = 0.5 ($187.2) = $93.6. Additional L-T debt = 0.5 ($187.2) = $93.6. 13 2010 Balance Sheet (Claims) w/o AFN AFN With AFN AP accruals $125.0 $125.0 Notes payable 100.0 Total CL $225.0 L-T Debt 100.0 Common stk 500.0 500.0 Ret earnings 237.8 237.8 Total claims $1,071.0 $1250.0 +93.6 193.6 $318.6 +93.6 193.6 Equation AFN = $184.5 vs. Pro Forma AFN = $187.2. Note: 1. Equation method assumes a constant profit margin. 2. Pro forma method is more flexible. More important, it allows different items to grow at different rates. 14 Excess Capacity Note: Excess capacity lowers AFN. Economies of Scale Recall from ECN 250 economies of scale 1. marginal costs associated with increasing output 2. 'ing additions to output associated with increasing assets. Note: this indicates that increased sales will not require proportional increase in assets. Lumpy Assets In many industries, fixed assets are added in large discrete units. Note: Lumpy assets leads to large periodic AFN requirements because of recurring excess capacity. 15