Visitor Evidence Base Report Final 1.0

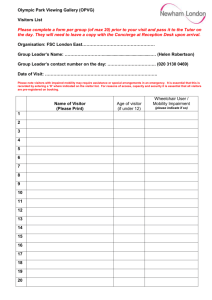

advertisement