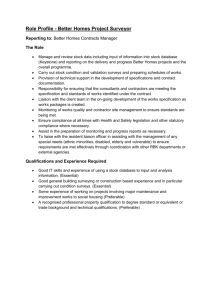

council tax on second and long term empty homes

advertisement

FIFE COUNCIL Policy & Resources Committee 9 January 2003 Agenda Item No…… COUNCIL TAX ON SECOND AND LONG TERM EMPTY HOMES CONSULTATION PAPER 1. Introduction 1.1 The Scottish Executive has issued a consultation paper inviting views on proposals to reduce or remove the existing 50% Council Tax Discount for second and long term empty properties. 2. Background 2.1 The report of enquiry into Local Government Finance published earlier this year recommended that, in the interest of equity, the full council tax should be levied on second homes. The Executive has decided to consult on this issue and has widened it to include long term empty properties. 3. Legislation 3.1 The council tax legislation currently prescribes that furnished properties, which are no-ones main residence, qualify for a 50% discount from council tax. In addition, properties which are unfurnished and are no-one's sole or main residence receive a maximum exemption from council tax for 6 months and, thereafter, receive a 50% discount. 3.2 The current grant distribution arrangements provide that account is taken of the relative ability of each Council to raise council tax. As such, areas, which have a large number of second and long term empty homes, receive compensating central grant support. As a result, the impact of such properties on the council tax base is spread across all Councils. 4. Case for Change 4.1 As stated above, the issue of removing the discount on second homes was raised within the Local Government Committee's enquiry into Local Government Finance. It is suggested that giving such discounts on second properties is often perceived as unfair as, perhaps, their owners are generally able to afford full council tax and should do so. D:\106744820.doc/HD 4.2 Alternatively, it is suggested that second homes can have a significant impact on the nature and sustainability of local communities as second home owners can contribute strongly to certain sectors of rural communities. However, high demand for second homes may affect property prices in some areas, potentially making property less affordable for local residents. Also, properties that have been empty for long periods can deny homes to those in housing need and can be a drain on local resources. 5. Options for Change 5.1 The consultation paper outlines a number of options for change. These can be summarised as follows:1. The removal of the 50% discount on second homes, defined as furnished homes that are no-ones main residence. 2. Removal of 50% discount on long-term empty homes, defined as unfurnished homes that are no-ones sole or main residence (subject to those that are otherwise exempt). 3. The removal of the above discounts could be mandatory or discretionary. 4. Additional income raised from the removal of the above discounts should be taken into account in the grant distribution arrangements and, therefore, any additional income will be shared by all Councils. Alternatively, such income should be retained by individual Councils and discounted in the grant distribution formula. 6. Areas for Consideration 6.1 In principle, the council tax system is a property tax, which takes account of a personal element and operates on the basis that these are charged on a 50/50 split. This explains why, subject to any prescribed exemptions, second and long term empty homes receive a 50% discount i.e. only the property element is charged. Any change to the legislation amending these level of discounts does contradict the principles of the tax, which, to date, have been readily accepted by the public. 6.2 There will be wide variations in the impact of volume of second homes in various areas. It is understood that in Highland, for example, there are a large proportion of second home owners relative to other Councils. In Fife, the volume of such properties is not considered to be a particular issue. However, whilst this consultation paper has been prepared, no detailed research has been carried out into precisely the number of properties that would be affected by the removal of discount as proposed. Currently, some 60,000 properties receive a 50% D:\106744820.doc/HD discount in Scotland. However, most of these properties are receiving a discount because of reasons other than the fact that they are second or long term empty homes. Whilst the consultation paper suggest that there is a potential income of some £25m which could be raised from second and long term empty homes, these figures must be questioned without further research being carried out. There is no requirement, at present, for Councils to be notified that a property is a second home. In addition, those who are actively trying to sell their properties having purchased a new home, will form a large proportion of those receiving a discount (having received an initial 6 months exemption). 6.3 The consultation paper recognises that removing the 50% discount could cause hardship for a number of individuals and suggests that Authorities could also be given a power to grant relief on a case by case basis. Currently, Councils have no powers to reduce or waive payment of council tax for individuals and the introduction of such a scheme for second or long term empty home owners could be seen as discriminatory to the many households on low income which are having significant difficulties making their payments, for which the Council would not have this remedy. 6.4 In a similar vein, the consultation paper suggest that a reduction or a removal of the discount on second or long term empty homes might require the introduction of exemptions e.g. those in tied accommodation, bringing more complexity to the system with the need for additional administration. 6.5 The introduction of a discretionary scheme could allow Councils with a relatively high proportion of second and long term empty homes to remove or reduce discounts in line with locally agreed policy. 7. Financial Implications 7.1 The removal of discount on second and long term empty homes would clearly provide additional revenue from council tax. If the scheme was mandatory, the amount of additional revenue for each Council will clearly be dictated by the volume of such homes in each area. On this basis, it does seem more equitable that such additional income be included in the grant distribution arrangements and shared by all Councils. On the contrary, if the scheme were to be discretionary, then it would be, perhaps, more appropriate that Councils should retain the additional income they derive. 7.2 As stated above, the consultation paper has been issued without detailed research into the actual number of houses, which would be affected by the proposed change and, therefore, it is extremely difficult to predict the value of additional income. In Fife, it is expected that the additional income would be minimal. However, the introduction of a scheme, with the almost inevitable need for specific new exemptions etc would certainly result in increased administration. In the event that D:\106744820.doc/HD additional income would be retained by each Council, there would be a need for software changes, for which there would be a cost, which at this point in time, could not be quantified. 7.3 In supporting the removal of these discounts Councils will need to consider how they will identify second homes as there will be no incentive for owners to declare them as such. 8. Conclusions 8.1 The existing council tax system provides a simple mechanism whereby properties which are no-ones sole or main residence receive a 50% discount from council tax. The system is simple, straight forward and easy to understand. There is a view, however, that the scale of second and long term empty homes in particular areas affects the local community in several ways and that the discount should be removed. 8.2 The removal of discount will provide additional revenue. However, this cannot be quantified at this point in time with any degree of accuracy. 8.3 The removal of discounts, whether mandatory or discretionary, will require additional administration and appropriate resources. These cannot be quantified at this time although these should be much less than the additional income that could be raised. 9. Recommendations 9.1 Members are asked to agree that, in light of the issues raised in this report, the Council advise the Scottish Executive that its preference is for a discretionary scheme of discounts on second and long term empty homes and that any income derived should be retained locally. Brian Lawrie Head of Finance and Asset Management Finance and Asset Management Service (Author - A Traynor Ext 3312) Fife Council North Street Glenrothes KY7 5LT 9 December 2002 D:\106744820.doc/HD