Report title - Biopharm Knowledge Publishing

advertisement

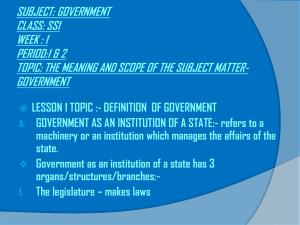

Date prepared – 28 Feb 2005 Report title Early Stage and Discovery Deals: Strategy, Structure and Payment Terms Publish date November 2003 Publisher Bridgehead International ISBN 0-9545760-1-2 Format(s) PDF No. pages 155 pages plus 20 deal contract documents Price $1950 Unique selling point(s) This report will provide in depth knowledge of the key drivers in early stage and discovery deal making: Understanding why companies partner early stage and discovery projects Understand what payment terms are commonplace for early stage/discovery deals Appreciate why companies have evolved from straight licensing to more complex partnering to achieve success Quantify the differing levels of upfront, milestone and royalty payable dependant on stage of development Obtain insight into how companies differ in their partnering strategies Strategies and tips on how to identify, negotiate and secure the best deal Report scope (bullet points) Scope of report: Review the role of partnering in corporate strategy Explore the increasing role of partnering in biopharmaceutical product development Identify the structure of ealry stage/disovery deals – upfront, equity, milestone, royalty, revenue share payments Obtain in depth terms and trends in early stage/disovery deal making between 1998 and 2004 Access twenty eight contract documents provide detailed insight into actual deals Forecasts, projections, market estimates N/A Description This report addresses early-stage deal-making and partnering in terms of strategy, structure and in particular financing. The agreement provides a comprehensive review of payment structures of recent early-stage deal-making, providing numerous examples in the form of case studies and full deal contracts, allowing the reader to understand fully how much partners are paying and under what conditions to access early-stage product developments. Who should buy the report This report is suitable to individuals responsible for and interested in: Board and executive management Business development Licensing/partnering Deal making Business strategy Marketing and promotion Distribution and manufacturing (including contract services) Methodology The report contains an extensive survey of publicly available data sources to establish an insight into the deals terms and structures used by biopharmaceutical companies in late stage deals. Data sources include SEC filing reports, Pharmalicensing deals database, and company press releases. €1950 £1200 Date prepared – 28 Feb 2005 Companies analyzed/mentioned Much of this report is based on case studies and documents in the public domain that provide insight into the deal making activities of the companies concerned. This report contains information on the partnering activities of the following companies: 4SC, Abgenix, Aderis, Advanced Tissue Sciences, Amgen, Antisoma, Arcus Technologies, Arqule, Astex Therapeutics, Autoimmune, Biovation, Canfite, Celgene, Chemical Diversity Labs, Cistron, CuraGen, Cyanotech, Dendreon, Denedreon, Deseret, Duke University, Eli Lilly, EOS, Esperion, Exelixis, Genentech, GlaxoSmithKline, GlycoFi, Gryphon Therapeutics, Guilford,Idenix, Immusol, Indevus, Isis, Medarex, Medtronic, Memory Pharmaceuticals, National Institutes of Health, Neogenesis, Neopharm, Novartis, Novavax, Parkedale, ProQuest, Questcor, Rigel, Roche, Roslin Institute, Sankyo, Schering, Scripps Insititute, Serono, Tanox, Tulane University, Tularik, Unigene Labs, Vernalis, Vertex, Viragen, Wallone, Zymogenetics Report summary Early stage partnering is a core component of both biotech and pharmaceutical business strategy, allowing access to promising new and emerging technologies, even though the risk of compound failure is high. The demand for new compounds to treat the major diseases of the developed world is so great that the major pharmaceuticals companies are willing to pay ever higher fees to access and reward biotech innovation. Deal complexity is increasing both in terms of financial reward structures and exchange of non-monetary capabilities. Big pharma partners have to balance the demands of biotech companies wanting to build internal capabilities and looking for greater involvement in development and commercialization decisions with the continuing issues of high compound failure in preclinical and clinical development. Deals such as the Novartis-Celgene deal for the joint research of selective estrogen receptor modulator compounds (Serms) in December 2000 provide an example of such a deal. Under the terms of the agreement: the licensee is required to pay a substantial upfront payment (US$10 million), has structured future payments against specific development milestones (totaling US$29 million), is obliged to pay significant double-digit royalties on sales (10-12%), and has provided a series of non-monetary benefits or 'quids'. The quids include shared research management and decision making, and access for commercialization of compounds generated during the research program that applicable to other therapeutic fields, in particular oncology. Whilst the potential rewards for Novartis are high if lead compounds for osteoporosis move through to the clinic, Celgene retains a substantial say in the direction of the research and the ability to commercialize compounds independently of Novartis, despite the fact that it is Novartis' money that has funded the research program. The use of non-monetary compensation is becoming more common in deals but is not quantified in terms of the benefit or costs to the partners when looking at deal values. Therefore, deal values need to be assessed in terms of monetary and non-monetary benefits in order to obtain a more rounded understanding of valuation. This report addresses early stage and discovery deal making (deals relating to products in discovery, lead identification and preclinical stage development) in terms of strategy, structure and in particular financing. The report reviews the payment structures of early stage/discovery deal making, providing benchmark figures for all parts of deals, along with case studies and examples of full deal contracts. Section 2 provides an overview of the reasons why companies choose to partner early stage technologies and compounds, and includes a GlaxoSmithKline case study. Section 3 looks at the evolving role of partnering in creating value for both parties in a deal. In addition, this section provides an overview of the processes and models used for partnering deals. Date prepared – 28 Feb 2005 Section 4 provides a detailed review of early stage deal making strategy and deal structures, with a host of case studies that examine how companies have innovatively derived value from a wide range of partnering agreements. Section 5 takes an in-depth look at the payment strategies used by dealmakers to finance early stage and discovery deals. Section 6 covers how to identify and secure the right early stage deal. Section 7 provides a detailed analysis of the deal terms used by biopharmaceutical companies and academic organizations, using primary data. The appendices provide an information resource, including definitions and outlines of deal terms and press releases, as well as a series of sample contracts. Testimonials Table contents Executive summary Chapter 1 Introduction Chapter 2 Why do companies partner early stage compounds? 2.1. Summary 2.2. The role of partnering in corporate strategy 2.2.1. Licensing out 2.2.2. Licensing in 2.3. Partnering for revenue 2.4. Partnering in for pipeline development 2.4.1. Case study: One company’s tactics – GlaxoSmithKline’s approach to in-licensing Chapter 3 The evolving role of partnering in biopharmaceutical development 3.1. Summary 3.2. Licensing to partnering 3.3. The traditional licensing model 3.4. The evolution from licensing to partnering 3.5. Sharing risk and reward Excerpt 3.1 Novartis-Celgene agreement – December 2000 3.6. Sharing knowledge 3.7. What has been learned from the partnering model? 3.8. Complex partnering models 3.8.1. Process 3.8.2. Structure 3.8.3. Financing 3.9. Future trends 3.9.1. Biotechs competing with pharma for deals Case study: 3.1 Abgenix-Curagen Chapter 4 Early stage deal strategies and structures 4.1. Summary 4.2. Considering the deal 4.3. When do companies partner? Date prepared – 28 Feb 2005 4.3.1. License early 4.3.1.1. Early stage case studies Case study 4.1 Genentech-Dendreon Case study 4.2 Roche-Vernalis Case study 4.3 Roche-Gryphon Therapeutics Case study 4.4 Roche-Antisoma Case study 4.5 Exelixis-GlaxoSmithKline Case study 4.6 Tularik-Amgen Case study 4.7 Roche-Memory Pharmaceuticals Case study 4.8 GlaxoSmithKline-Unigene Labs Case study 4.9 Vertex-Novartis Case study 4.10 Isis-Eli Lilly 4.3.2. License late 4.3.2.1. Late-stage case studies Case study 4.11 Idenix-Novartis (development stage) 4.3.3. University licensing Case study 4.12 Scripps Research Institute-Cyanotech 4.4. Early and late-stage deals-a cost comparison 4.4.1. What do companies spend on partnering? 4.5. Licensing strategy case studies Case study 4.13 Chemical Diversity Labs Case study 4.14 4SC Case study 4.15 Memory Pharmaceuticals Case study 4.16 Astex Technologies Case study 4.17 GlycoFi Case study 4.18 ARCUS Therapeutics Case study 4.19 Zymogenetics inc Case study 4.20 Antibacterial drug development 4.6. Deal types Chapter 5 Payment strategies 5.1. Summary 5.2. Deciding a strategy 5.3. Payment options 5.3.1. Upfront payments 5.3.1.1. Conditionality of upfront payment 5.3.2. Loans 5.3.3. Convertible loans 5.3.4. Equity 5.3.5. R&D funding 5.3.6. Annual fixed payments 5.3.7. Milestone payments 5.3.8. Innovative forms of payment-'quids' 5.3.8.1. Products 5.3.8.2. Extended rights to pipeline/technology 5.3.8.3. Skills transfer 5.3.8.4. Public relations 5.3.8.5. Other quids 5.3.9. Royalties 5.3.9.1. Issues affecting royalty rates 5.3.9.2. Royalties on combination products Case study 5.1 Scripps Research Institute-Cyanotech 5.3.9.3. Guaranteed minimum/maximum annual payments 5.3.9.4. Royalty stacking 5.3.9.5. Royalties and supply/purchase contracts 5.3.10. Option payments Case study 5.2 Guilford-ProQuest Date prepared – 28 Feb 2005 Chapter 6 How to make the right deal 6.1. Summary 6.2. Constructing the deal 6.3. Finding the right partner 6.3.1. What attracts a partner? 6.3.2. Where to look for a partner 6.3.3. Sources of information 6.3.4. Building a network 6.3.4.1. Early stage networking events 6.3.4.2. Networking for biopharmaceutical executives 6.3.5. Becoming partner of choice 6.4. Deal timeframes 6.5. Deal valuation 6.5.1. Factors contributing to the deal valuation 6.5.1.1. Intellectual property 6.5.1.2. Development phase 6.5.1.3. Cost of clinical trials 6.5.1.4. Time to commercialization 6.5.1.5. Benchmark values 6.5.1.6. Preclinical/clinical data 6.5.1.7. Risk of failure 6.5.1.8. Size and value of therapeutic market 6.5.1.9. Competition for licensing rights 6.5.1.10. Partner's expertise/reputation in given field 6.5.1.11. Impact on internal R&D programs 6.5.2. Due diligence as a valuation tool 6.6. Guidelines for early stage deal payments 6.6.1. Upfront payments 6.6.2. Milestone payments 6.6.3. Royalties 6.7. Keeping a deal successful 6.7.1. Commitment to the deal 6.7.2. Know your partner 6.7.3. Thorough due diligence 6.7.4. Patent and IP management 6.7.5. Comprehensive deal agreement 6.7.6. Feasible and achievable milestones 6.7.7. Proactive management of issues 6.7.8. Regular communication 6.7.9. Tracking of payments and royalties 6.8. When to negotiate termination 6.9. What makes a deal 'newsworthy'? Chapter 7 Deal terms and trends - a data analysis of early stage and discovery deals 7.1. Summary 7.2. Putting it into practice 7.3. Public data 7.4. Survey data 7.5. Headline valuations 7.6. Components of the deal 7.6.1. Equity involvement 7.6.2. Upfront payments 7.6.3. Milestone payments 7.6.4. Royalty rates 7.7. Early stage and discovery deal details Date prepared – 28 Feb 2005 Chapter 8 Appendices 8.1. Glossary of terms 8.2. Resources 8.3. Complex deal terms: an outline 8.4. Early stage partnering agreements 8.5. Payment clause from Guilford-ProQuest, March 2000 8.6. Press releases Excerpt 3.1 Excerpt 3.2 Case study 4.1 Genentech-Dendreon Case study 4.2 Roche-Vernalis Case study 4.3 Roche-Gryphon Therapeutics Case study 4.4 Roche-Antisoma Case study 4.5 Exelixis-GlaxoSmithKline Case study 4.6 Tularik-Amgen Case study 4.7 Roche-Memory Pharmaceuticals Case study 4.8 GlaxoSmithKline-Unigene Labs Case study 4.9 Vertex-Novartis Case study 4.10 Isis-Eli Lilly Case study 4.11 Idenix-Novartis (development stage) Case study 4.12 Scripps Research Institute-Cyanotech Case study 4.13 Chemical Diversity Labs Case study 4.14 4SC Case study 4.15 Memory Pharmaceuticals Case study 4.16 Astex Technologies Case study 4.17 GlycoFi Case study 4.18 ARCUS Therapeutics Case study 4.19 Zymogenetics inc Case study 4.20 Antibacterial drug development 8.7. References Contract documents – the following are provided as part of the report in PDF format: Scripps-Cyanotech – Apr 1998 – Technology for the production of an aldolase catalytic antibody in microalgae Vertex-Schering – Aug 1998 – Design novel compounds for the diagnosis, treatment or prevention of conditions or diseases of the central nervous system and peripheral nervous system Duke University-Cistron – Sep 1998 – Effect of IL-1 beta with vaccines when given intranasally NIH-Neopharm – Mar 1999 – Mesothelin MAb for ovarian, head and neck cancers Tanox-Biovation – Mar 1999 – Application of deimmunization technology to certain of our monoclonal antibodies and protein products Tulane University-Indevus – Apr 1999 – Pituitary adenylate cyclase activating polypeptide (PACAP) and its use for neuroprotection Canfite-Aderis – May 1999 – IB-MECA for use in treatment of cancer, viral infections and others Novartis-Rigel – May 1999 – T cell regulators for transplantation and inflammation Parkedale-Novavax – Oct 1999 – Adjuvant for influenza vaccine Date prepared – 28 Feb 2005 Medarex-EOS – Feb 2000 – Fully human monoclonal antibodies Guilford-ProQuest – Mar 2000 – Development of PQ-1002 to develop a prodrug of propofol Vertex-Novartis – May 2000 – Novel chemical entities, targeting selected kinases Rigel-Questcor – Sep 2000 – IRES translation mechanism of the hepatitis C virus Roslin Institute-Viragen – Nov 2000 – Avian transgenics technology Novartis-Celgene – Dec 2000 – Joint research of selective estrogen receptor modulator compounds Isis-Eli Lilly – Aug 2001 – Identify, characterize and / or develop antisense oligonucleotides Zymogenetics-Ares (Serono) – Aug 2001 – Fund and conduct activities focused primarily on discovery and development of one or more new products related to selected receptors Immusol-Neogenesis – Oct 2001 – Therapeutics against HIV Medtronic-Advanced Tissue Sciences – Oct 2001 – Collaboration to explore the application of technology in areas of therapeutic interest Wallone-Esperion – Feb 2002 – Pro-apolipoprotein A-I developments GSK-Unigene – Apr 2002 – Oral PTH Sankyo-Tularik – Jun 2002 – Collaborative research, discover, develop, manufacture and market products that agonize or antagonize various program targets for the treatment of disease in humans Dendreon-Genentech – Aug 2002 – Trp-p8, a viable target candidate for therapeutic monoclonal antibodies, small molecules, and other therapeutic molecules and therapeutic vaccines Deseret-Autoimmune – Aug 2002 – Manufacture, marketing and sale of Colloral, a product for nutritional support of patients with rheumatoid arthritis Exelexis-GSK – Oct 2002 – Delivery of small molecule compounds in early phase II clinical testing Genome-ArQule – Oct 2002 – Development of molecules from screening against a GTC target Amgen-Genome – Dec 2002 – Therapeutic agents for bone diseases Tularik-Amgen – May 2003 – Discovery, development and commercialization of oncology therapeutics List of tables, charts Chapter 2 Figure 2.1 Percent gross revenue from in-licensed compounds Figure 2.2 Total licensing revenues 1998-2003 Figure 2.3 GSK: Contribution of licensing-in Table 2.1 GSK: CEDDS and global locations Table 2.2 GSK: Business development collaborators list Chapter 3 Date prepared – 28 Feb 2005 Excerpt 3.1 Novartis-Celgene agreement dated December 2000 Table 3.1 Deal making mathematical models Chapter 4 Figure 4.1 Competitors per deal Figure 4.2 Agreements signed by phase of development (1998-2003) Figure 4.3 Theoretical distribution of licensing deals Figure 4.4 Optimal stage for deal making—pharma vs biotech Figure 4.5 % drugs dropped at each stage of development (1997-2001) Figure 4.6 Companies % R&D budget spend on licensing Table 4.1 Probability of development stage success Table 4.2 Deal types in biopharmaceutical alliances Chapter 5 Table 5.1 Payment strategies—components of the deal Table 5.2 Variants affecting royalty payments Chapter 6 Figure 6.1 Key information sources for partnering executives Figure 6.2 Time taken for stages of development Table 6.1 Attributes that attract partners Table 6.2 Major early stage partnering events Table 6.3 Major networking clubs worldwide Table 6.4 Timeframes for phases of deal development Table 6.5 Factors contributing to deal valuation Table 6.6 Upfront payments for early stage deals Table 6.7 Milestone payments for early stage deals—first payment Table 6.8 Number of milestone steps in deal Table 6.9 Milestone payments for early stage deals—total payments Table 6.10 Royalty rates in early stage deals Table 6.11 Ongoing due diligence to keep a deal successful Chapter 7 Figure 7.1 Deal size (US$ M) for early stage deals Figure 7.2 Median headline deal values for early stage deals Figure 7.3 Frequency of data in public domain for each deal stage Figure 7.4 Frequency of equity payments in early stage deals (US$ M) Figure 7.5 Upfront payments for early stage deals Figure 7.6 Upfront payments for early stage deals Figure 7.7 Distribution of milestone payments for early stage deals—first payment Figure 7.8 Distribution of milestone payments for early stage deals—total payments Figure 7.9 Effect of stage of development on early stage royalty rates Figure 7.10 Frequency of royalty rates for early stage deals Figure 7.11 Frequency of revenue/profit share in early stage deals Table 7.1 Headline values for early stage deals Table 7.2 Equity involvement in early stage deals Table 7.3 Upfront payments for early stage deals Table 7.4 Milestone payments for early stage deals—first payment Table 7.5 Milestone payments for early stage deals—total payments Table 7.6 Number of milestone steps in deal Table 7.7 Milestone payments for each early stage Table 7.8 Royalty rates in early stage deals Date prepared – 28 Feb 2005 Table 7.9 Royalty rates in early stage deals—(excluding joint venture royalties) Table 7.10 Royalty rates in early stage deals—Partnering Tools Table 7.11 Royalty rates for early stage deals Table 7.12 Early stage deals with financials supplied Sample pages To follow.