Bob Watt, President of the Nestlé Purina PetCare

advertisement

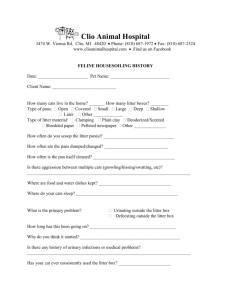

A BROW NR OUWN VNEI VRESRISTI TYY C S ES T U D Y A B N IU C AA SE S T U D Y F ASLPL R2 0I 0N4 G 2 0 0 5 Nestle Purina PetCare Bob Watt, President of the Nestlé Purina PetCare (Purina) Golden Products Division, grabbed the leash for his dog Brownie off the wall hook. Watt thought a short Friday afternoon walk would help him sort through some of the recent marketing issues that had developed at work. Since Ralston Purina was acquired by Nestlé S.A. and merged with Friskies Pet Food Business in 2001, Purina had become a $6 billion division of its parent company. Purina had distinguished itself from its competitors by providing excellent quality products that were a good value. Cat litter— a $1.4 billion industry in the United States— represented 10% of Purina’s total sales. Most of their litter products were sold under the Tidy Cats Brand, which was marketed as a consumer-friendly cat litter for multiple cat homes. The brand carried three types of litter: conventional clay, scooping, and crystals. Purina also produced Yesterday’s News, an organic alternative to the traditional cat litters. Purina had been the leader in the cat litter industry, obtaining 32.6% of the total dollar sales in 2003. The Tidy Cats Brand conventional clay was the highest selling in its segment. Tidy Cats also had a large claim of the scooping segment. Over the past few years, this segment of Purina’s market had grown while sales in the other litter segments had declined. By 2003, it was estimated that 60% of cat litter sales were scooping litter. In the future, Purina wanted to continue to increase sales and to remain the overall leader in the cat litter industry. Watt realized that in order to increase sales and capitalize on the growth in the scooping segment, Purina would have to promote their scooping litter. But, Watt did not know how quickly or aggressively Purina should try to move its consumers off of the conventional clay product and onto the scooping litter. If the company moved too quickly, it could lose its hold as the leader in the conventional clay segment, its primary cash cow1. On the other hand, if Purina moved too slowly, the company could lose its chance to gain more consumers in the scooping market. The Cat Litter Industry Litter History Prior to the 1940s, there were no cat litter products sold on the market. Cat owners, especially those with indoor cats, were forced to use any absorbent material that they had available, such as sand or ashes, as cat box 1 Adapted from Philip Kotler’s Marketing Management 1997 pp 72-4 1 Copyright © 2004-5 by Professor Josef Mittlemann, Brown University. This case was originally written by Paul Lenehan and Caitlin Mehner under the supervision of Professor Josef Mittlemann and Hannah Rodriguez Farrar. It has been revised and modified by Professor Josef Mittlemann with assitance from Natalie Schmid. This case was written for the purpose of class discussion and as a teaching tool and is not intended as a source of data or otherwise. This publication may not be reproduced without the permission of Josef Mittlemann A BROW NR OUWN VNEI VRESRISTI TYY C S ES T U D Y A B N IU C AA SE S T U D Y F ASLPL R2 0I 0N4 G 2 0 0 5 filler. These products were messy; they got cats’ paws dirty and were easily tracked around the house. They were also inefficient at absorbing cat odors. In 1947, Henry Ed Lowe was approached by a neighbor who asked him if he knew of any absorbent products that could be used in place of sand or ashes. Lowe worked for his father at a Michigan industrial absorbents company. He suggested to his neighbor that she use a ground up clay because it absorbed better than sand and was not nearly as messy. Lowe was excited by his discovery and believed that cat owners would benefit from the product. He decided to sell the clay, which he named “Kitty Litter,” in pet stores around Cassopolis, Michigan. Originally, store owners would not charge money for Kitty Litter because they thought no one would pay for it when sand was cheap and easily accessible. Lowe decided to give the clay litter away for free. To his surprise, the litter sold out. People demanded more and some said that they would even pay for the clay. Lowe realized he had created a profitable product and decided to market it across the country by attending cat shows and distributing the litter out of his truck to pet stores and individuals. Lowe entered the grocery store market in 1964 when he created the Tidy Cat brand (see Exhibit 1 for Tidy Cats history). Over the next thirty years, Lowe became known for his quality cat litter products and good customer service. All packages of Tidy Cat litter that were sold came with a money-back satisfaction guarantee. Lowe was also known for his commitment to research and innovation. Title Cat owned a large research and development center in Missouri. The center, known as “The Cattery,” housed 120 cats that tested all new Tidy Cat products before they were sold on the market. The Lowe family owned Tidy Cat until 1991, when it was sold to Golden Cat Corporation, an independent company that was part of a leverage buyout group. Subsequently, in 1995 Golden Cat was sold to Ralston Purina. 2 Litter Today By 2003, there were four main types of cat litter on the market. 3 (See Exhibit 2 for a chart comparing the four litter types). The first was conventional clay, the same type of product that Lowe developed in 1947. The core ingredient in the conventional litter was naturally absorbent clay, which provided odor control. Other ingredients added to the clay helped to eliminate bacteria in the litter box. Consumers like the conventional clay because it required little maintenance and it did not stick to the cats’ paws. Because it was inexpensive to produce in comparison to the other litter formulas, the price for conventional clay tended to be low. Plus, conventional clay had a high cat acceptance rate. In 2003, clay products made up 33% of the total cat litter sales. Scooping clay was released on the cat litter market in 1990. By 2003, scooping litter led the industry in sales, claiming over 60% of the market. The scooping product was made from bentonite, a natural mineral that attracts water and holds it in place as a clump. 4 Consumers could easily “scoop” these clumps out of the litter, which 2 Source: http://edwardlowe.org/history2.shtml Source: http://www.euromonitor.com/article.asp?id=597 3 Source: http://www.tidycat.com/products.aspx 4 Source: http://www.thecatsite.com/general/litter.html 2 Copyright © 2004-5 by Professor Josef Mittlemann, Brown University. This case was originally written by Paul Lenehan and Caitlin Mehner under the supervision of Professor Josef Mittlemann and Hannah Rodriguez Farrar. It has been revised and modified by Professor Josef Mittlemann with assitance from Natalie Schmid. This case was written for the purpose of class discussion and as a teaching tool and is not intended as a source of data or otherwise. This publication may not be reproduced without the permission of Josef Mittlemann A BROW NR OUWN VNEI VRESRISTI TYY C S ES T U D Y A B N IU C AA SE S T U D Y F ASLPL R2 0I 0N4 G 2 0 0 5 allowed cat owners to remove both liquid and solid waste from the cat box on a daily basis. This helped improve odor control and made the product great to use in multiple cat homes. Plus, the litter did not stick to cats’ paws. Scooping litter cost more than clay, although the price differences have become smaller over time as technology has improved. Crystal litter, made with silica gel crystals, was released in 2001. Similar to scooping litter, the crystal formula absorbed liquid waste. Crystals were covered in micropores that trapped odors but released the moisture. Because the crystals remained dry, the litter box only had to be changed every 30 days in a one cat home. For two cat households, the litter had to be changed every 15 days. The crystal litter did not stick to cats’ paws. When crystals were released, many companies thought they would become the new trend in cat litter. However, it did not sell as expected. It was expensive to produce and not preferred by many cats. By 2003, crystal litter made up only 4.2% of the total cat litter market. In addition to selling the crystal formula alone, many companies sold crystal-conventional clay or crystal-scooping blends. Alternative litters were a small percentage (2.1%) of the cat litter industry. These products were composed of a variety of non-clay substances, such as paper, wood or corn. They were usually priced higher than the clay products and were often carried in health food or specialty stores. In 2003, the cat litter industry experienced a 3.2% increase in dollar sales from the previous year (See Exhibit 3). While the scooping segment experienced a 9.5% increase in sales during that year, the conventional clay, crystal, and alternative litter segments all experienced declines in dollar sales. This suggested that the increase in cat litter sales in 2003 could be attributed primarily to the increase in the scooping segment. Since cat litter’s inception, the largest market for cat box filler has been the United States. However, as of 2003, cat litter sales were becoming more global. The market was expanding and included Australia, New Zealand, and some third world countries. Europe was also viewed as a future large dollar sales market. In the United States, cat litter was sold in a variety of locations including food stores, warehouses, pet stores, local convenience stores, and health food stores. The typical cat litter consumers were females. Cat litter sales depended greatly on whether households had indoor or outdoor cats. Homes with indoor cats used litter more often than consumers with outdoor felines. Urban versus rural settings also played a role in litter use. As of 2003, it was hard to describe which consumers were choosing to buy scooping products instead of conventional clay. Chris Padgett, the Director of Marketing for Purina’s Litter Division, believed there were two types of users who decided to purchase the scooping over the clay. Padgett felt that some of the growth in the scooping segment could be attributed to new cat owners who chose to buy scooping instead of clay because it was more convenient or because it was recommended by pet store. The other group was clay users who decided to switch to scooping. However, these customers often did not switch until they got a new cat in the household, which was usually after a previous feline had died. Company Background 3 Copyright © 2004-5 by Professor Josef Mittlemann, Brown University. This case was originally written by Paul Lenehan and Caitlin Mehner under the supervision of Professor Josef Mittlemann and Hannah Rodriguez Farrar. It has been revised and modified by Professor Josef Mittlemann with assitance from Natalie Schmid. This case was written for the purpose of class discussion and as a teaching tool and is not intended as a source of data or otherwise. This publication may not be reproduced without the permission of Josef Mittlemann A BROW NR OUWN VNEI VRESRISTI TYY C S ES T U D Y A B N IU C AA SE S T U D Y F ASLPL R2 0I 0N4 G 2 0 0 5 In 1894, William Danforth invested capital in the Robinson-Danforth Commission Company, an animal feed company. He worked as a bookkeeper but eventually found his way into sales. 5 Danforth was a sickly young boy during his childhood and he had always promised himself that he would live a healthy adult life. He decided to expand his animal feed company into the cereal business, because he felt that it was important to have the best quality products on the market. His slogan “where purity is paramount” and the “Purina” name became the brand of his cereal. Purina Whole Wheat Cereal was endorsed by Dr. Ralston, who encouraged whole wheat cereals because he had a large following of health conscious people. A deal was struck between Danforth and Ralston and the cereal was renamed Ralston Wheat Cereal. Because both names were widely recognized, Ralston and Purina were joined and the Ralston Purina Company was born. The years that ensued saw the company shift toward the production of pet food. In 1926, the Purina Pet Care Center opened and it focused on pet nutrition and pet care. In 1994, the company combined its grocery and human food businesses into a freestanding company, and Ralston Purina acquired the Golden Cat Corporation the following year. Golden Cat, the producer of Tidy Cats, was the current leading marketer of cat litter in North America. Golden Cat Corporation became the Golden Products Division of Purina. (See Exhibit 4 for division employees) In 1997, Ralston Purina acquired Edward Baker Pet Foods, the leading manufacturer of dry pet food in the UK and a major supplier of products to the larger European market. Nestlé S.A., the world’s largest food and beverage company, had purchased Carnation (developer of the Friskies brand) in 1985 and the Spillers brand (popular in Europe) in 1998. These companies established their entry into the pet care business. Nestlé bought Ralston Purina for $10 billion in 2001, creating Nestlé Purina PetCare. This division represented $6 billion of Nestlé’s $60 billion worldwide sales. Because Nestlé did not have much experience in the pet care industry, they allowed Purina to remain reasonably independent. Nestlé did however, integrate Purina into their company and keep them on a ‘tighter leash’ in order to ensure that they would be able to make a profit on their investment. Purina wished to become a part of Nestlé because it would allow them to stay competitive with the consolidation of other retailers and brands within the industry. As of 2003, Nestlé Purina was the world’s largest producer of dry dog food and both dry and moist cat foods. In addition, they were a leading producer of cat litter in both the US and Canada. They employed over 15,000 employees and had manufacturing facilities worldwide. Their mission to “lead the world in advancing the lives of pets” was achieved mainly through innovative products that made people’s experiences with pets easier and more enjoyable. Product Line: Tidy Cats & Yesterday’s News The Golden Products Division manufactured cat box filler, and also marketed related items such as dog and cat liners and deodorizers. Purina sold cat litter under two brands: Tidy Cats and Yesterday’s News. Besides 5 Source: http://www.ralstonpurina.com/company/profile/timeline_articles.asp?article=335 Source: http://www.nestle.com/html/brands/petcare.asp 4 Copyright © 2004-5 by Professor Josef Mittlemann, Brown University. This case was originally written by Paul Lenehan and Caitlin Mehner under the supervision of Professor Josef Mittlemann and Hannah Rodriguez Farrar. It has been revised and modified by Professor Josef Mittlemann with assitance from Natalie Schmid. This case was written for the purpose of class discussion and as a teaching tool and is not intended as a source of data or otherwise. This publication may not be reproduced without the permission of Josef Mittlemann A BROW NR OUWN VNEI VRESRISTI TYY C S ES T U D Y A B N IU C AA SE S T U D Y F ASLPL R2 0I 0N4 G 2 0 0 5 having 3 types of litter, Tidy Cats also had different formulas of their scooping and conventional litter to further segment their target market (see Exhibit 5). The four different formulas included immediate odor control (IOC), long lasting odor control (LLOC), anti-microbial odor control (A-OC) and crystal blend. Each formula stressed a different degree of odor control. Yesterday’s News sold two formulas-- an original unscented formula and a softer texture formula that was available in unscented or fresh scent. The softer texture formula claimed to feel more like the conventional clay, but was three times more absorbent6. Pricing and Sizes The traditional clay was sold in 10-20 pound bags, ranging from $2.20-$5.90 in retail price. In an effort to move consumers towards the scooping litter, Purina never made changes to their conventional clay packaging. The bags, although reasonably priced, were not as consumer friendly as the jugs or pails. Tidy Cats Scoop offered the largest variety of sizes and packaging, including: 14-20 pound jugs, 27-35 pound pails and a 28 pound box. The average retail price was around $6.50-$8.50 for jugs, $11-$13 for pails and $10 for the box size. More costly than the conventional clay, Tidy Cats Scoop required daily maintenance. Tidy Cats Crystals litter was sold in 3.5 and 8 pound jugs for about $8 and $14, respectively. This more expensive line placed greater emphasis on better odor control than the traditional clay. However, it was not as effective as the scooping litter. Crystals make up about 5% of the total cat litter market and its share had decreased by 2003. In contrast to what Purina had projected, crystals had not become popular among consumers. Any noticeable growth in the crystal litter segment had been overshadowed by growth in the scooping segment (see Exhibit 6 for litter growth trends). In order to maintain their share in the crystal litter market, Purina created blends that combined crystals with conventional litter and crystals with scooping litter to provide long lasting performance with easy clean up. The Tidy Cats Scoop Crystal blend ($6.80-$11.30 average retail price) was available in 14 and 20 pound jugs and a 27 pound pail whereas the Tidy Cats Conventional Crystals Blend ($2.80-$5.90 average retail price) came in 10 and 20 pound bags. 6 Source: http://www.yesterdaysnews.com/cat_litter.asp 5 Copyright © 2004-5 by Professor Josef Mittlemann, Brown University. This case was originally written by Paul Lenehan and Caitlin Mehner under the supervision of Professor Josef Mittlemann and Hannah Rodriguez Farrar. It has been revised and modified by Professor Josef Mittlemann with assitance from Natalie Schmid. This case was written for the purpose of class discussion and as a teaching tool and is not intended as a source of data or otherwise. This publication may not be reproduced without the permission of Josef Mittlemann A BROW NR OUWN VNEI VRESRISTI TYY C S ES T U D Y A B N IU C AA SE S T U D Y F ASLPL R2 0I 0N4 G 2 0 0 5 Competition Church & Dwight7 Church & Dwight Co., Inc was founded in 1846 as the world’s leading producer of sodium bicarbonate, or baking soda. It was the parent company of the Arm & Hammer brand, which was known for a range of consumer products developed with baking soda as the main ingredient. Their extensive expertise in the odor control characteristic of baking soda allowed Church & Dwight to enter the PetCare market in 1992, focusing on dog care and cat litter products. By 2003, the Arm & Hammer brand controlled 10.3% of the cat litter market. Their two types of litter that competed with Tidy Cats were Arm & Hammer® Crystal Blend and Arm & Hammer® Super Scoop® litter. The company discontinued the manufacturing of their conventional litter after losing a considerable percentage of their share in the conventional market. Church & Dwight based their Arm & Hammer cat litter brand positioning on its deodorizing capabilities. Clorox8 Founded in 1913 and most recognized for its bleach products, Clorox became a worldwide corporation known for its laundry additives, insecticides, and home cleaning supplies. The company often added to their product line by acquiring struggling brands and revitalizing their product lines. As of 2003, Clorox owned four different litter brands. Clorox Fresh Step carried four types of litter— conventional clay, scooping, crystals, and blends. Clorox Scoop Away©, Clorox Ever Fresh©, and Clorox Ever Clean© (the first scooping litter on the market) offered scooping litter to consumers. Scoop Away and Ever Clean also produced scooping-crystal blends. Clorox controlled 28.5% of the cat litter industry, second only to Purina. Clorox had 7.1% of the conventional sales and 1.8% of the crystal ones. Clorox led the scooping segment with 19.5% of the total dollar sales (see Exhibit 3). Watt summed up the competitive landscape: “In terms of competitive advantage, our two major competitors in this category are Clorox and Church & Dwight. Clorox is very much into household products as opposed to pet products and this gives them some advantages in fragrance technology, which is a very big driver in consumer satisfaction. Second, their products both in the scooping and the traditional clay have a lighter color, almost white. From a consumer standpoint, that is a preference. And that’s one of the reasons why they’re able to charge a premium on their Fresh Step product in particular. It would cost a significant amount for us to do the same. It’s one of those tradeoffs. Arm & Hammer’s key advantage is that they’ve had a fairly significant heritage in odor control. Their brand name stands for baking soda. They had a tremendous 7 8 Source: www.armhammerpets.com/CatProductsHome.htm Source: http://www.clorox.com 6 Copyright © 2004-5 by Professor Josef Mittlemann, Brown University. This case was originally written by Paul Lenehan and Caitlin Mehner under the supervision of Professor Josef Mittlemann and Hannah Rodriguez Farrar. It has been revised and modified by Professor Josef Mittlemann with assitance from Natalie Schmid. This case was written for the purpose of class discussion and as a teaching tool and is not intended as a source of data or otherwise. This publication may not be reproduced without the permission of Josef Mittlemann A BROW NR OUWN VNEI VRESRISTI TYY C S ES T U D Y A B N IU C AA SE S T U D Y F ASLPL R2 0I 0N4 G 2 0 0 5 brand image even before they got into this category, in terms of odor control. And there’s a strong belief that baking soda is a natural odor absorber. That’s a strong competitive plus that they have.” Procter & Gamble9 Procter & Gamble (P&G), while not currently a manufacturer of cat litter, was seen as a possible threat to Purina. In September 1999, P&G acquired Iams, a premium pet food company. Their success in the pet food industry could prompt the company to expand into the pet products market and release a cat litter under their brand name. P&G had a large research budget for the company to study nutritional needs for dogs and cats. In 2003, they spent over $1.7 billion for research and development alone. Watt feared the “unknown”, in terms of not knowing what P&G could come out with: “Procter and Gamble could very well bring out a product in this category that has some sort of proprietary odor control technology that would really surprise us and as a result, we are always looking to see what patents they are applying for and we keep them on our radar screen to see what is new.” Marketing Mix Purina was proud of their close adherence to the company’s mission statement. The company wanted to convey to potential customers and consumers that it made high quality products at a good value for pet owning households. Their products promoted healthy lifestyle choices for cats. They were consumer friendly to ensure that having pets in the home was manageable for owners. Brand Image Both Watt and his Marketing Director Padgett stressed that brand image was extremely important to Purina. The company wanted customers’ trust and product loyalty. Purina always strived to promote their solid value, good prices, and excellent products. In the cat litter industry, Purina also stressed their heavy duty, consumerfriendly products designed for multiple pet homes. For this reason, Purina used brand advertising instead of product advertising. The Tidy Cats and Purina brands were mentioned instead of the specific litter types. Watt commented more on this idea of brand image: “We try to create a brand where people trust us and have a little bit more of a loyalty to our product. We try to create a little bit of a special feeling, showing cats talking, the way a lot of people view their pets like little children or human beings. Again, our advertising tries to have a consistent look to it. We’re trying to emphasis that Tidy Cats is for households that have more than one cat—multiple cat 9 Source: http://www.pg.com/about_pg/sectionmain.jhtml 7 Copyright © 2004-5 by Professor Josef Mittlemann, Brown University. This case was originally written by Paul Lenehan and Caitlin Mehner under the supervision of Professor Josef Mittlemann and Hannah Rodriguez Farrar. It has been revised and modified by Professor Josef Mittlemann with assitance from Natalie Schmid. This case was written for the purpose of class discussion and as a teaching tool and is not intended as a source of data or otherwise. This publication may not be reproduced without the permission of Josef Mittlemann A BROW NR OUWN VNEI VRESRISTI TYY C S ES T U D Y A B N IU C AA SE S T U D Y F ASLPL R2 0I 0N4 G 2 0 0 5 households (see Exhibit 7 for print advertisement). We’re specially designed for this and it’s an implicit statement that we are better than most other products that are made for single cat households. If ours is strong enough for multiple cat households, it’s another way of saying ours is heavy duty. We have tried to stay away from very hard competitive claims versus our competitors and take more of the high ground in creating a brand. You look at our competitive products, you see a lot of claims versus the leading cat litter—that’s us. Our feeling is that we don’t want to get into that game. Again, we want to create an image.” Marketing Strategies Purina’s litter marketing strategy took into account these goals as well as the trends taking place in the industry. Although Yesterday’s News was designed as a niche brand, Tidy Cats products were not targeted to a small market. Instead, Purina targeted the litter products to a large, broad group— females ages 24-54 with higher incomes. Tidy Cats was also focused their products on households with more than one cat (55% of households had more than one cat and 70% of cat product sales were made by those individuals). Purina was the industry leader in marketing spending. While the whole industry spent $32 million on advertising per year, about half of that was from Purina alone. The company’s marketing budget was distributed as follows: Advertising (mainly through television, radio, and print ads) …….. 25% Trade promotion ………………...…………………………………..40% Consumer promotion ………….…………………………………….25% Other expenses (i.e. market research) ………….........………………10% Purina always marketed their brand in advertisements. They believed that the consumer should decide what kind of litter best fit their cat needs. Although Purina did not promote a specific kind of litter, their advertisements always showed scooping litter because it is the segment with the most growth in sales. Pet store employees had a variety of brands to choose to market towards consumers. Some employees preferred local brands and smaller labels to the national brands, like Tidy Cats. While these alternative brands were more expensive, some smaller pet stores carried them exclusively. It was fairly common for pet store employees to recommend scooping litter before the conventional clay litter because conventional clay was seen as an inferior product. 8 Copyright © 2004-5 by Professor Josef Mittlemann, Brown University. This case was originally written by Paul Lenehan and Caitlin Mehner under the supervision of Professor Josef Mittlemann and Hannah Rodriguez Farrar. It has been revised and modified by Professor Josef Mittlemann with assitance from Natalie Schmid. This case was written for the purpose of class discussion and as a teaching tool and is not intended as a source of data or otherwise. This publication may not be reproduced without the permission of Josef Mittlemann A BROW NR OUWN VNEI VRESRISTI TYY C S ES T U D Y A B N IU C AA SE S T U D Y F ASLPL R2 0I 0N4 G 2 0 0 5 A PetCo® employee commented about selling litter to cat owners 10: “Well, what litter you use should be between you and the cat. Some cats don’t like some litters, so some experimentation may be necessary. Clumping is easiest because clay must be replaced totally once a week, while clumping is easily disposed of. Here in the store, the best sellers are Tidy Cat, Scoop Away, and Fresh Step. We only sell clay in the form of Tidy Cat clay. Clay’s reduced price may be the only important thing to some people, and that’s why they’d buy it. But some people have deeper relationships with their cat and experiment until they get it right.” Trade promotions made up a large part of Purina’s marketing budget. Trade promotions were a common and efficient way to teach potential retail customers about the advantages of selling Tidy Cats products in their stores. They were also an important way for the Tidy Cats sales team to try and negotiate for more shelf space from retailers. To promote Tidy Cat products to the consumers, Purina would run in-store demonstrations and promotions. Cross promotion was also used for cat owners who purchased a Purina cat brand food. They would receive a coupon for litter at the register or in the food packaging. Purina had a competitive advantage in their promotional methods because they sold products that covered all areas of cats’ needs. Thus, Purina could target cat owners through a series of their other pet products. Research and Development Market research was extremely important to Purina and they felt that understanding the consumers’ needs was crucial for the company’s future success. Purina used a variety of techniques to gauge consumer opinions. Every week, 60 people were cold called to track consumer views on the Tidy Cats brand. Large, comprehensive tracking reports were done once every four months. Purina also created focus groups to obtain general reactions towards current and new litter products. Consumer in-home tests or observational tests at Purina’s pet institute were used to gain in depth opinions on the Tidy Cats products. Purina also used Bases tests to show quantitative projections of how successful a product would become over time and if it was worth the investment. Although these tests cost $150,000, many companies used them because they were extremely informative. Watt and Padgett mentioned that Purina always had to reinvent or create new products for consumers to buy. Watt stressed that Purina sells a “total product package”, not just the litter inside the box, pail, or jug. Thus, product developments included creating blends of litter types and packaging improvements. Purina worked hard to develop products that were consumer-friendly. For instance, Tidy Cats offered their litter in multiple 10 Source: Lisa. Telephone interview. 20 Mar. 2004. 9 Copyright © 2004-5 by Professor Josef Mittlemann, Brown University. This case was originally written by Paul Lenehan and Caitlin Mehner under the supervision of Professor Josef Mittlemann and Hannah Rodriguez Farrar. It has been revised and modified by Professor Josef Mittlemann with assitance from Natalie Schmid. This case was written for the purpose of class discussion and as a teaching tool and is not intended as a source of data or otherwise. This publication may not be reproduced without the permission of Josef Mittlemann A BROW NR OUWN VNEI VRESRISTI TYY C S ES T U D Y A B N IU C AA SE S T U D Y F ASLPL R2 0I 0N4 G 2 0 0 5 packaging formats and sizes. Also, some of their litter packages on the market were easier to pour from and hold due to a scooping lid and containers with handles. Distribution Tidy Cats product was shipped from either the Purina factory or warehouses. It was shipped according to orders from stores aggregated at the retail customers’ central warehouses (see Exhibit 8 for retailer breakdown). Normally, when the backroom stock was depleted, a message was sent electronically to the warehouses, alerting the need for more products. Products were stocked in the backroom according to normal usage statistics. If a big sale occurred, this could cause supply problems if the stores were unprepared for such an event. Stores could end up with unsatisfied customers because of empty spaces on their shelves. It was in their best interest to naturally increase the shelf spaces allocated to the product. It was imperative that a customer found the product for which they were looking because one in five litter customers would leave a store if an item they regularly purchased was out of stock 11. When a customer left, it represented a loss for both Purina and the store. It was to the store’s advantage to keep the shelves stocked at all times. In addition, it was important for Purina to urge stores for an increased allocation of shelf space because they also would not like a customer to buy another brand simply because the Tidy Cats brand was out of stock. Purina always negotiated with each customer the initial allotment of shelf space and the amount of product that they would ship. After the first shipment, Purina no longer had any official say in the frequency of shelf restocking that took place. The sizes and amounts were normally chosen by the retailers based on consumer demand. However, Purina continuously tried to encourage their customers to stock Purina products over other competing brands. Price Competition John Leonard, Division Controller for Golden Products, illustrated Purina’s process of choosing their selling price to retailers, in relation to their competitors: “When competitors lower their pricing, they lower their price that they’re charging to the retail customers, not to the consumers. They may go to their trade customers and say ‘we’re going to lower our prices 5%.’ When they do that, the retail customer then has to decide whether they want to reflect that price change on the shelf and hopefully get better velocity and make more money through volume, or they can pocket that price decrease and go about their business. Clorox, a couple years back, lowered their prices on their Scoop Away brand and were trying to get a better price-value relationship. They thought they could also get some market share by doing that. Unfortunately, that kind of backfired, because we weren’t about to reduce our pricing and I don’t think anyone else did. And I don’t think most of the customers changed their shelf prices the full percentage that Clorox reduced their price by. 11 Source: IRI Shelf Audit, 2002, Anderson Consulting, The Retail Problems of OOS 10 Copyright © 2004-5 by Professor Josef Mittlemann, Brown University. This case was originally written by Paul Lenehan and Caitlin Mehner under the supervision of Professor Josef Mittlemann and Hannah Rodriguez Farrar. It has been revised and modified by Professor Josef Mittlemann with assitance from Natalie Schmid. This case was written for the purpose of class discussion and as a teaching tool and is not intended as a source of data or otherwise. This publication may not be reproduced without the permission of Josef Mittlemann A BROW NR OUWN VNEI VRESRISTI TYY C S ES T U D Y A B N IU C AA SE S T U D Y F ASLPL R2 0I 0N4 G 2 0 0 5 If all of our competition went out and systematically reduced all their prices and our product now was in a position where we couldn’t justify keeping our price where it is, we would have to consider a price reduction. But, if one customer did it and no one else followed and we still maintained our sales, we wouldn’t do it— we wouldn’t follow that.” Purina had never increased their selling price to customers since their acquisition of the Tidy Cats. However, in 2003, they had to reflect an increase in their costs of goods sold (mostly due to increases in oil/fuel manufacturing and transportation costs) by increasing their price to retailers. The Decision While Bob Watt walked Brownie down the street of his suburban neighborhood, he contemplated the issues that he would have to face Monday morning. Watt knew that it was important for Purina to follow the industry trend away from clay and towards the more profitable scooping litter. But, he also realized that Purina had a number of devoted customers who still used clay litter for their cats. These issues raised a series of questions for Watt to consider: Should Purina be more aggressive in their marketing towards current consumers in an attempt to make them switch from purchasing conventional clay to the scooping litter? Should Purina take a more active role in their distribution process in an attempt to reach favorable shelf spaces and increase shelf area in order to push their scooping litter? Should Purina work with the retailers, while touting their market leader status, to maximize sales and profits while minimizing empty spaces on the shelves for both products? Should Purina take a laissez-faire approach towards their marketing, letting the market (customer and consumer demand) drive sales in the right direction? As Watt approached his driveway, he wondered which options would be best for the company’s future growth. 11 Copyright © 2004-5 by Professor Josef Mittlemann, Brown University. This case was originally written by Paul Lenehan and Caitlin Mehner under the supervision of Professor Josef Mittlemann and Hannah Rodriguez Farrar. It has been revised and modified by Professor Josef Mittlemann with assitance from Natalie Schmid. This case was written for the purpose of class discussion and as a teaching tool and is not intended as a source of data or otherwise. This publication may not be reproduced without the permission of Josef Mittlemann A BROW NR OUWN VNEI VRESRISTI TYY C S ES T U D Y A B N IU C AA SE S T U D Y F ASLPL R2 0I 0N4 G 2 0 0 5 Exhibit 1 Tidy Cats History 1947 Instead of delivering sand for cat boxes, Edward Lowe offers a new material. $800 million industry is born with Kitty Litter® brand. 1964 Tidy Cat® sold in grocery stores. 1977 Kitty Litter® adds microencapsulated deodorant. 1982 Tidy Cat® offers triple odor control-absorbing, deodorizing, with fresh, clean scent. 1985 Tidy Cat® cat box liners introduced. 1986 Kitty Litter®/Tidy Cats® 99% dust-free. 1989 Intro Tidy Cat® cat box deodorizer. 1990 Scooping Litter enters the cat litter market 1991 Intro Tidy Cat® moisture-activated odor control. Kitty Litter Maxx® Scoop and Tidy Cat Scoop® join rapidly growing scooping fillers. 1995 Ralston Purina acquires Tidy Cats® 1998 Tidy Cats® introduces High Performance Formula for Multiple Cats®. 1999 Tidy Cats Scoop® formula enhances clump hardness over time. 2000 Tidy Cats Crystals® lasts 30 days. Tidy Cats® Disposable Box-cat box/litter in one introduced. 2001 Introduction of Tidy Cats® Crystals Blend™. * To simplify, Tidy Cats®, Tidy Cat™ and Tidy Cat® are shown as Tidy Cats®. Data source: Tidy Cats Website < www.tidycat.com/about>, April 2004 12 Copyright © 2004-5 by Professor Josef Mittlemann, Brown University. This case was originally written by Paul Lenehan and Caitlin Mehner under the supervision of Professor Josef Mittlemann and Hannah Rodriguez Farrar. It has been revised and modified by Professor Josef Mittlemann with assitance from Natalie Schmid. This case was written for the purpose of class discussion and as a teaching tool and is not intended as a source of data or otherwise. This publication may not be reproduced without the permission of Josef Mittlemann A BROW NR OUWN VNEI VRESRISTI TYY C S ES T U D Y A B N IU C AA SE S T U D Y F ASLPL R2 0I 0N4 G 2 0 0 5 Exhibit 2 Comparison of Litter Types Conventional Clumping Silica Alternative Best performance Good performance Very good Performance Longest lasting Least odor control Excellent odor control Typically not as good as other forms Great odor control Most maintenance Maintenance Least required; fill and forget Weekly changes Price Lower than other forms Daily solid waste Daily clump and waste removal required removal Monthly changes Less frequent changes Higher than conventional Highest per pound Similar to clumping and conventional Typically higher than clay equivalent Environmentally friendly Other Cat acceptance not as good as clay Low dust Often purchased for “green” reasons Data source: Nestlé Purina Tidy Cats Marketing Division, Chris Padgett, 20 March 2004 13 Copyright © 2004-5 by Professor Josef Mittlemann, Brown University. This case was originally written by Paul Lenehan and Caitlin Mehner under the supervision of Professor Josef Mittlemann and Hannah Rodriguez Farrar. It has been revised and modified by Professor Josef Mittlemann with assitance from Natalie Schmid. This case was written for the purpose of class discussion and as a teaching tool and is not intended as a source of data or otherwise. This publication may not be reproduced without the permission of Josef Mittlemann A BROW NR OUWN VNEI VRESRISTI TYY C S ES T U D Y A B N IU C AA SE S T U D Y F ASLPL R2 0I 0N4 G 2 0 0 5 Exhibit 3 Cat Litter Market Share 14 Copyright © 2004-5 by Professor Josef Mittlemann, Brown University. This case was originally written by Paul Lenehan and Caitlin Mehner under the supervision of Professor Josef Mittlemann and Hannah Rodriguez Farrar. It has been revised and modified by Professor Josef Mittlemann with assitance from Natalie Schmid. This case was written for the purpose of class discussion and as a teaching tool and is not intended as a source of data or otherwise. This publication may not be reproduced without the permission of Josef Mittlemann A BROW NR OUWN VNEI VRESRISTI TYY C S ES T U D Y A B N IU C AA SE S T U D Y F ASLPL R2 0I 0N4 G 2 0 0 5 $ Share of Total $ $ Share of Type Chg Share of $ Share of Type Chg vs Year Cat Litter Type vs Prev Ago Total Cat Litter Share Nestle Purina Pet Care Clorox Oil Dri Church & Dwight Private Labels All Other Companies 100.0 32.6 28.5 7.0 10.0 17.3 3.9 Dollar Sales $ Sales Percent Change from 1 yr ago $1,041,930,912 $339,294,634 $296,431,942 $73,068,455 $103,711,812 $179,871,356 $40,965,029 3.2 5.8 6.3 0.8 -2.8 4.0 -13.8 Clumping Purina Tidy Cat Immediate Odor Control Tidy Cat Anti-Microbial Odor Control Tidy Cat Long Lasting Odor Control Tidy Cat Crystal Blend Clorox Fresh Step Scoop Away Scoop Away Crystal Blend Church & Dwight Arm & Hammer Spring Step Arm & Hammer Spring Step Crystal Blend Oil Dri Private Labels All Other Clumping Brands 60.6 19.2 7.9 1.6 6.6 3.1 19.5 8.8 10.7 1.1 9.5 9.5 1.1 3.6 8.4 0.4 100.0 31.7 13.0 2.6 10.9 5.1 32.2 14.5 17.7 1.9 15.7 15.7 1.7 5.9 13.8 0.6 0.0 1.3 -0.6 -0.2 1.5 0.6 0.3 0.7 -0.3 1.5 -1.5 -1.5 -0.7 0.0 0.0 -0.1 0.0 1.3 -0.6 -0.2 1.5 0.6 0.3 0.7 -0.3 1.5 -1.5 -1.5 -0.7 0.0 0.0 -0.1 $630,917,574 $199,791,476 $82,001,422 $16,507,893 $68,982,646 $32,299,263 $203,315,052 $91,464,012 $111,799,276 $11,797,136 $99,184,926 $99,184,926 $10,998,386 $37,033,281 $87,312,394 $4,070,438 9.5 14.2 4.8 2.8 26.4 23.9 10.7 14.7 7.7 460.2 -0.2 -0.2 -21.1 10.3 9.7 -10.3 Conventional Purina Tidy Cat Immediate Odor Control Tidy Cat Anti-Microbial Odor Control Tidy Cat Long Lasting Odor Control Tidy Cat Crystal Blend Clorox Fresh Step Oil Dri Jonny Cat Brand Arm & Hammer Spring Step Private Labels All Other Conventional Brands 33.2 11.6 2.8 1.0 6.9 0.8 7.1 7.1 3.4 1.8 0.4 8.8 1.5 100.0 35.1 8.5 3.1 20.9 2.5 21.5 21.5 10.4 5.5 1.3 26.4 4.6 0.0 -0.2 0.1 0.1 0.5 -0.9 1.1 1.2 -0.3 -0.5 -0.7 0.9 -0.9 0.0 -0.2 0.1 0.1 0.5 -0.9 1.1 1.2 -0.3 -0.5 -0.7 0.9 -0.9 $345,617,711 $121,148,160 $29,438,187 $10,639,436 $72,202,716 $8,646,652 $74,395,536 $74,395,425 $35,918,558 $18,849,530 $4,526,888 $91,212,275 $15,729,353 -4.4 -4.9 -2.9 -1.1 -2.0 -30.6 1.0 1.0 -7.0 -12.6 -37.6 -1.0 -20.0 4.2 1.7 1.8 100.0 39.5 42.8 0.0 2.9 -0.8 0.0 2.9 -0.8 $43,705,037 $17,258,583 $18,721,351 -11.1 -4.0 -12.7 Crystal (Silicon Gel) Tidy Cat Crystal Fresh Step Crystal Alternative Clay 2.1 100.0 0.0 0.0 $21,690,592 -6.3 Yesterday's News 0.1 4.9 4.4 4.4 $1,067,513 710.6 Pa Purr Alternative 0.0 1.2 -0.8 -0.8 $266,917 -42.6 Feline©Pine 1.0 This case 48.6was originally 13.0 written13.0 $10,551,584 27.7 Copyright 2004-5Alternative by Professor Josef Mittlemann, Brown University. by Paul Lenehan and Caitlin Mehner under 15 the supervision of Professor Josef Mittlemann and Hannah Rodriguez Farrar. It has been revised and modified by Professor Josef Mittlemann with assitance from Natalie Schmid.only This accounts case was written for the purpose class discussion a teaching tool and is not intended as a source of data or otherwise. This **** Chart for about 70% ofoftotal sales in and theaslitter market. publication may not be reproduced without the permission of Josef Mittlemann Doesn't include specialty stores or warehouse sales A BROW NR OUWN VNEI VRESRISTI TYY C S ES T U D Y A B N IU C AA SE S T U D Y F ASLPL R2 0I 0N4 G 2 0 0 5 Data source: IRI /Nielsen 52-week total category dollar sales Exhibit 4 Biographical Summary of Key People Year Started Name and Position 1980 B.S., applied-math economics, Brown University, 1974; MBA, Univ. of Chicago 1976; marketing at Procter & Gamble (4 yrs); President of Golden Products Division under Ralston Purina, 1980 1988 Univ. of Virginia; MBA, 1985; started at Ralston Purina in marketing 1979 B.S., accounting and finance, Univ. of Iowa, 1978; accounting management of production facilities for Ralston Purina (5 yrs); pet food financial analyst, 1994; In cat litter industry for 9 yrs Robert (Bob) Watt President of NPPC Golden Products Division Chris Padgett Director of Marketing John Leonard Division Controller Background Exhibit 5 Breakdown for Different Types of Formula Usage Tidy Cats Scoop Tidy Cats Conventional Blend 9% Blend 13% AOC 12% AOC 12% IOC 32% IOC 41% LLOC 34% by Professor LLOC 47% 16 Copyright © 2004-5 Josef Mittlemann, Brown University. This case was originally written by Paul Lenehan and Caitlin Mehner under the supervision of Professor Josef Mittlemann and Hannah Rodriguez Farrar. It has been revised and modified by Professor Josef Mittlemann with assitance from Natalie Schmid. This case was written for the purpose of class discussion and as a teaching tool and is not intended as a source of data or otherwise. This publication may not be reproduced without the permission of Josef Mittlemann A BROW NR OUWN VNEI VRESRISTI TYY C S ES T U D Y A B N IU C AA SE S T U D Y F ASLPL R2 0I 0N4 G 2 0 0 5 LLOC=Long Lasting Odor Control, AOC= Anti-Microbial Odor Control, IOC= Immediate Odor Control Data source: IRI /Nielsen 12-week total category dollar sales, 2003 Exhibit 6 Trend in Cat Litter Industry $1,600 $1,400 1,222 in millions 1,435 1,512 1,139 $1,200 1,006 $1,000 807 861 905 $600 389 419 428 433 473 432 549 447 595 451 635 Total Litter Market Clumping 1,074 $800 $400 1,302 1,371 673 736 786 833 890 Conventional 459 465 470 475 485 Crystal 55 62 70 75 82 All Other 455 $200 13 55 19 95 19 96 19 97 19 98 19 99 20 00 20 01 20 02 20 03 20 04 20 05 $0 Data source: IRI /Nielsen 52-week total category dollar sales 17 Copyright © 2004-5 by Professor Josef Mittlemann, Brown University. This case was originally written by Paul Lenehan and Caitlin Mehner under the supervision of Professor Josef Mittlemann and Hannah Rodriguez Farrar. It has been revised and modified by Professor Josef Mittlemann with assitance from Natalie Schmid. This case was written for the purpose of class discussion and as a teaching tool and is not intended as a source of data or otherwise. This publication may not be reproduced without the permission of Josef Mittlemann A BROW NR OUWN VNEI VRESRISTI TYY C S ES T U D Y A B N IU C AA SE S T U D Y F ASLPL R2 0I 0N4 G 2 0 0 5 Exhibit 7 Tidy Cat 2004 Print Advertisement 18 Copyright © 2004-5 by Professor Josef Mittlemann, Brown University. This case was originally written by Paul Lenehan and Caitlin Mehner under the supervision of Professor Josef Mittlemann and Hannah Rodriguez Farrar. It has been revised and modified by Professor Josef Mittlemann with assitance from Natalie Schmid. This case was written for the purpose of class discussion and as a teaching tool and is not intended as a source of data or otherwise. This publication may not be reproduced without the permission of Josef Mittlemann A BROW NR OUWN VNEI VRESRISTI TYY C S ES T U D Y A B N IU C AA SE S T U D Y F ASLPL R2 0I 0N4 G 2 0 0 5 19 Copyright © 2004-5 by Professor Josef Mittlemann, Brown University. This case was originally written by Paul Lenehan and Caitlin Mehner under the supervision of Professor Josef Mittlemann and Hannah Rodriguez Farrar. It has been revised and modified by Professor Josef Mittlemann with assitance from Natalie Schmid. This case was written for the purpose of class discussion and as a teaching tool and is not intended as a source of data or otherwise. This publication may not be reproduced without the permission of Josef Mittlemann A BROW NR OUWN VNEI VRESRISTI TYY C S ES T U D Y A B N IU C AA SE S T U D Y F ASLPL R2 0I 0N4 G 2 0 0 5 Data source: Nestlé Purina Tidy Cats Marketing Division, Chris Padgett, 20 March 2004 Exhibit 8 Tidy Cat Sales by Retailer Types Types Examples Percent Sales Grocery Stores Stop ‘n Shop, Shaws 50% Mass Merchandisers Wal-Mart, Target 35% Wholesale Clubs Sam’s, BJ’s 5% Pet Specialty Stores Petsmart, Petco 10% Total 100% Data source: Chris Padgett, Marketing Director of Tidy Cats, 23 March 2004 20 Copyright © 2004-5 by Professor Josef Mittlemann, Brown University. This case was originally written by Paul Lenehan and Caitlin Mehner under the supervision of Professor Josef Mittlemann and Hannah Rodriguez Farrar. It has been revised and modified by Professor Josef Mittlemann with assitance from Natalie Schmid. This case was written for the purpose of class discussion and as a teaching tool and is not intended as a source of data or otherwise. This publication may not be reproduced without the permission of Josef Mittlemann