Homework 1

advertisement

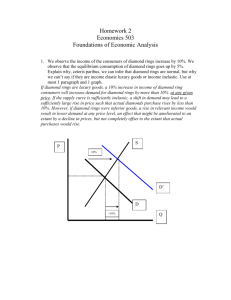

Homework 1 Economics 503 Foundations of Economic Analysis Assigned: Session 2 Due: Session 4 1. Using the demand and supply diagrams (one for each market), show what short-run changes in price and quantity would be expected in the following markets if chemists develop a new cheaper method for making jet plane fuel. Each graph should contain the original and new demand and supply curve, and the original and new equilibrium prices and quantities. For each market, write one sentence explaining why each curve shifts or does not shift. a. The market for air travel. Producers can provide any amount of air travel at a lower price. The supply curve shifts down. . S P S' P* P** D Q* Q** Q b. The market for rail travel. Rail travel is a substitute for air travel. As prices of air travel fall. P S P* P** D' D Q Q** Q* c. The market for hotel rooms at an island resort Hotel rooms at an island resort are complements. S P P** P* D' D Q* Q** Q 2. Suppose that the demand curve for copper were given by a log-linear demand function for copper q D 2.75 .03 p and the supply curve were given by a log-linear supply function q S 2.64 .05 p where q D ln(Q D ) , q S ln(Q S ) and p ln( P) where Q is measured in millions of tons and P is measured in thousands of US dollars. Solve for the equilibrium price and quantity level in the copper market. Suppose that the supply shifts out by 6%, q S 2.70 .05 p and demand shifts out by 5%, q D 2.80 .03 p ; solve for the new equilibrium price level. Use the mid-point method to calculate the % change in the price. q D 2.75 .03 p* 2.64 .05 p* q S .11 2.75 2.64 .05 p * .03 p* .08 p * p* 11 1.75 8 q* 2.64 .05 p* 2.64 .55 / 8 2.70875 Solve for the level of P* and Q*, using Excel Equilbrium p 1.375 q P 3.955077 Q 2.70875 15.0105 Originally, a-c = .11. Then, a-c = .1, so Δa-Δc =-.01. Since, p* expect the change in equilibrium price level to be p* so that p* ac , so we should bd a c , given that b = .03 and d = .08 bd a c 12.5 a c 12.5 .01 .125 or approximately -12.5%. So, .08 solve for q D 2.8 .03 p* 2.7 .05 p* q S p . Use Excel to get P = P .1 .08 p * p* 10 1.25 8 = 3.955077 to P1 =3.490343 , so that %P = ( P1 P0 ) 3.490343 3.955077 100% 100% ( P0 P1 ) 3.490343 3.955077 2 2 -.46473 100% .124837 100% 12.4837% 3.72271 1.25 3.490343 , so P goes from P0 3. The accompanying table shows the average daily quantity of postcards sold to tourists at the airport during each half of 2006 and 2007. Originally, the postcards sold at HK$4 each. However, they were raised to $5 on July 1st, 2006 then raised to $6 on July 1st 2007. The Airport Authority assumes that the average income of an airport traveler in 2006 was HK$200,000. They estimate the average income was HK$300,000 in 2007. Assuming that no other factors affecting the demand for postcards changed (i.e. ceteris parabis) calculate the price elasticity of demand as prices changes from $4 to $5 and the price elasticity as prices change from $5 to $6. In both cases, use the mid point method. Calculate the income elasticity of postcards using the midpoint method. 2006 4000 3000 P=4 P=5 P=6 (Q0 Q1 ) Own price elasticity of demand (4000 3000) When P0 = 4. (5 4) (4000 3500) When P0 = 5. (6 5) ( P1 P0 ) (300000 200000) ( P0 P1 ) 1000 1 7000 7 9 1.286 7 1 1 9 9 (5 4) (4000 3500) 500 (5 6) Income1 Income0 (4000 3000) 4000 3500 (Q0 Q1 ) (4000 3000) Q1D Q0D Income Elasticity 2007 1 7500 15 11 0.7333 15 1 1 11 11 Q1D Q0D when Income0 is 200,000 Income1 Income0 (4000 3000) (300000 200000) 1000 1 7 5 0.714 7 100000 1 5 500000 7000 4. The following is a demand table for oil as well as a supply table. Calculate the equilibrium price in a range of $10. Assume the cross-price elasticity of demand of oil with respect to the price of coal is 1.5. Is coal a substitute or a complement to oil? Assume that the price of coal increases by 10%. Calculate the new demand schedule for oil (you do not need to use the midpoint method) Calculate the new equilibrium. P Quantity Supplied Quantity Demanded 60 80,059.86 83,033.06 70 81,303.55 81,762.92 80 82,396.49 80,678.38 90 83,372.72 79,733.70 100 84,255.78 78,898.04 110 85,062.66 78,149.63 120 85,806.03 77,472.59 130 86,495.60 76,854.95 140 87,138.99 76,287.50 150 87,742.26 75,762.98 The equilibrium is between 70 and 80 dollars per barrel. The increase in the price of coal shifts the demand for oil out by 15%. This means that coal and oil are substitutes. Multiply the demand curve at every price level by 1.15. At the new demand curve, if the price is 140, there is excess demand; if the price is 150, there is excess supply. This means that the price goes to a new equilibrium somewhere between 140 and 150. P Quantity Supplied Quantity Demanded Quantity Demanded' 60 80,059.86 83,033.06 70 81,303.55 81,762.92 80 82,396.49 80,678.38 90 83,372.72 79,733.70 100 84,255.78 78,898.04 110 85,062.66 78,149.63 120 85,806.03 77,472.59 130 86,495.60 76,854.95 140 87,138.99 76,287.50 95488.02456 94027.35724 92780.14249 91693.76024 90732.74161 89872.07425 89093.47721 88383.19533 87730.62641 150 87,742.26 75,762.98 87127.43083 5. On January 1, 2011, you open up the newspaper and see the 1 year interest rate on US dollar lending is .1264% ( i = .001264). On the same day, you find 1 year interest rates on Japanese Yen, Australian dollars and the Euro. You also see the current spot exchange rate with the US dollar for those three currencies reported as number of currency units per US$. Use domestic and foreign interest rates, and the current spot rate to calculate the market’s expectation of the exchange rate on December 31, 2011. Spot Interest Forex Rate Rate US$ 0.13% Japan Yen 0.79% 89.490 Aus. $ 4.91% 1.1332729 Euro 0.12% 0.683527 St 1FORECAST (1 i) St 1FORECAST St St (1 i F ) Since the Japanese Yen has a higher interest rate than the US dollar, the Yen is expected to drop in value (i.e. the price of US dollars in terms of Yen goes from 89.49 to 90.086). The Australian dollar has a higher interest rate than the US, so the Aus$ is expected to depreciate. The Euro Interest rate is slightly lower to that on the dollar and so the currencies are expected to remain stable in relative value wit the Euro very slightly appreciating. Uncovered interest parity says (1 i) (1 i F ) Interest Rate US$ 0.13% Japan Yen 0.79% Aus. $ 4.91% Euro 0.12% Spot Forex Rate Future Forex Rate 89.490 90.08648 1.133273 1.187416 0.683527 0.68351 i iF 0.0013 0.0079 0.0012638 0.0491 0.0012638 0.0012 0.0012638 6. Speculators, both foreign and domestic, believe that domestic interest rates will fall next year. Draw a graph of the foreign exchange market to show what effect this will have on the forex rate today. S 2 S 1 D' D FX The low future interest rates will lead to a weak exchange rate in the future. This will make the domestic currency less attractive today, reducing demand for US dollars at the same time that foreign investors will reduce the supply. The exchange rate will depreciate